Micron Technology Stock Forecast: NAND and DRAM Prices Maintained High

This article was written by Kwon Sok Oh, a Financial Analyst at I Know First.

MU Stock Forecast

(Source: Wikimedia Commons)

Micron Technology, Inc. (NASDAQ: MU), incorporated on April 6, 1984, is engaged in semiconductor systems. The Company’s portfolio of memory technologies, including dynamic random-access memory (DRAM), negative-AND (NAND) Flash and NOR Flash are the basis for solid-state drives, modules, multi-chip packages and other system solutions. Its business segments include Compute and Networking Business Unit (CNBU), which includes memory products sold into compute, networking, graphics and cloud server markets; Mobile Business Unit (MBU), which includes memory products sold into smartphone, tablet and other mobile-device markets; Storage Business Unit (SBU), which includes memory products sold into enterprise, client, cloud and removable storage markets, and SBU also includes products sold to Intel through its Intel/Micron Flash Technology (IMFT) joint venture, and Embedded Business Unit (EBU), which includes memory products sold into automotive, industrial, connected home and consumer electronics markets.

Summary

Micron Achieves Record Revenue for FQ3 2018

Average Sales Price for NAND Maintained

AI Applications are Driving DRAM Growth

DCF Model Suggests MU is Currently Underpriced

I Know First’s Algorithm Forecast is Bullish for MU in the Long Run

Micron Achieves Record Revenue for FQ3 2018

Micron Technology achieved record revenue for FQ3 2018. Mobile Business Unit’s revenues increased by 12% quarter-over-quarter. Strong sales of mobile NAND drove this increase, nearly doubling quarter-over-quarter. Furthermore, compared to no TLC NAND sold during FQ3 2017, 85% of Managed NAND bytes were low-cost TLC NAND during FQ3 2018. Micron Technology expects continuous demand for its mobile solutions due to the increase of memory and storage content per phone, and it is planning to meet these demands through various new products, including the 1Y nanometer DDR4 memory and 64-layer TLC UFS and eMCP Managed NAND solutions.

The high demand from data centers is driving sales of Micron Technology’s DRAM and NAND products whose total revenues increased 87% year-over-year. Moreover, revenue from cloud computing was also strong, rising by 33% and 24% quarter-over-quarter for DRAM and NAND, respectively. Cloud capital expenditure is projected to reach $50 billion and $108 billion in 2018 and 2021, respectively, maintaining high demand for Micron Technology’s products.

(Source: Wikimedia Commons)

Embedded Business Unit also enjoyed record revenue for all market segments, due to high growth in home and industrial automation, IoT, and drones. A 64-layer 3D NAND surveillance-grade microSD card is expected to be deployed in the near future, allowing AI capabilities to be implemented to edge devices.

(Source: Pixabay)

SSD sales also achieved a company record, increasing 37% year-over-year. Micron Technology began major production and shipments of its 64-layer 3D NAND enterprise SATA SSD, and it also shipped the world’s first QLC-based SSD. This QLC SSD is built on Micron Technology’s 64-layer 3D NAND by using the world’s first terabit NAND die in the SSD industry. Micron technology expects its lower cost and high tech SSD solutions will take more of HDD market shares in the future.

Micron Technology has been negotiating the commercial terms of its 3D XPoint technology development partnership with Intel. 3D XPoint technology is expected to create a type of memory and storage that provides functions in the middle of DRAM and NAND flash.

Average Sales Price for NAND Maintained

The recent over supply of NAND has driven prices down, and consequently, Micron Technology’s largest competitors have experienced significant drops in average selling prices for NAND. However, Micron is not experiencing this difficulty with its NAND segment due to concentrating on higher value solutions. Furthermore, multichip packages that have both NAND and DRAM have higher average selling prices, and Micron Technology managed to double sales in this market quarter-over-quarter. Finally, Micron Technology also showed record high SSD sales. The combination of all of these positive factors maintained average selling prices for Micron Technology’s NAND.

Quarterly Market Share Held by NAND Flash Memory Manufacturers Worldwide

(Source: Statista)

Moreover, Micron Technology is increasing its 64-layer technology NAND production and is preparing its 96-layer technology, which is expected to be implemented during the second half of this year. Both technologies are expected to provide further cost reduction.

AI Applications are Driving DRAM Growth

AI applications are driving growth in the data center and in the edge device market, which is in turn driving growth for the DRAM market. Recent trends in AI development are requiring more and more DRAM for high level performance. Moreover, smartphones are requiring more rigorous DRAM capacities due to the implementation of AR, VR, and AI, not to mention high resolution cameras also driving DRAM demand. Excellent memory is needed for data centers, mobile, graphics, and automotive applications in order to deliver higher value for end market applications, and Micron Technology’s DRAM will enjoy a long-term healthy market.

Furthermore, even though the market price for DRAM has been decreasing, demand from cloud service and edge devices, coupled with demand from AI and data center as mentioned above, has been exerting upward pressure on Micron Technology’s DRAM prices. Other various sources of demand for Micron Technology’s DRAM include mobile, graphics, gaming, and crypto currency, and these sources of demand along with demand from AI, data center, cloud service, and edge devices will contribute to maintaining DRAM prices for Micron Technology.

Quarterly Market Share of the DRAM Chip Market Worldwide

(Source: Statista)

Finally, Micron Technology is starting to ramp up its 1X technology for DRAM into production, which will continue to provide cost benefits for Micron Technology.

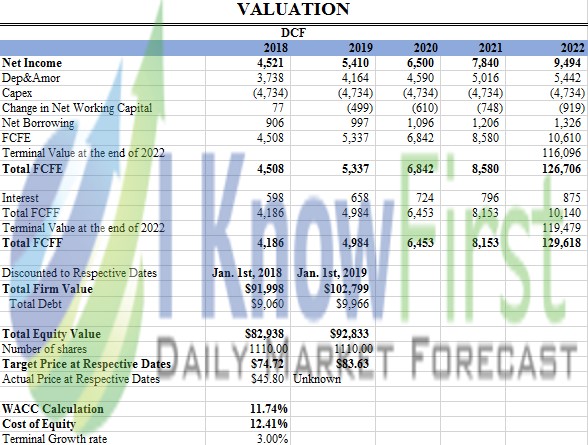

DCF Model Suggests MU is Currently Underpriced

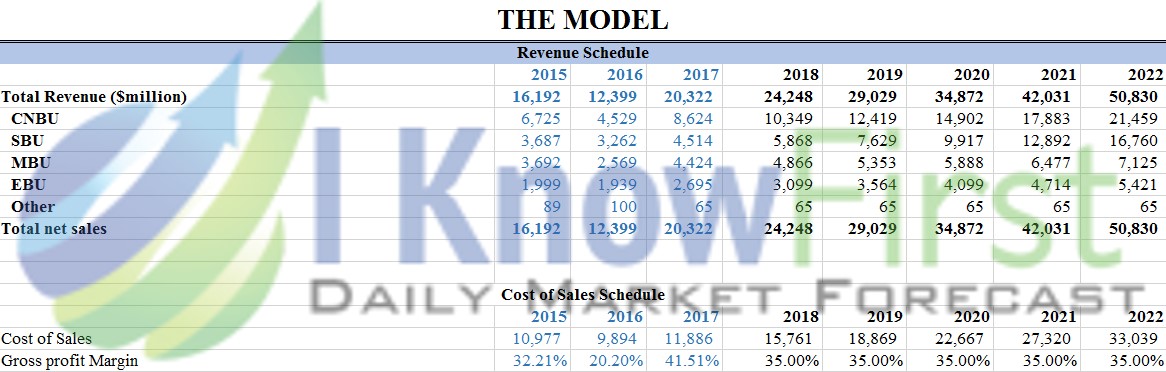

Inferring from the 5-year DCF analysis, the target price of MU for January 1st, 2019 $83.63, which is a 58.36% upside from the current price of $52.81 (August 3rd, 2018). The main assumptions made were a constant growth of the CNBU segment (20%), the SBU segment (30%), the MBU segment (10%), and the EBU segment (15%). We can clearly see that CNBU and SBU are the main sources of revenue for MU due to high demand from the cloud service, edge device, data center, and AI industry, and these segments are projected to be the primary sources of revenue in the future too.

I Know First Forecast is Bullish for MU in the Long Run

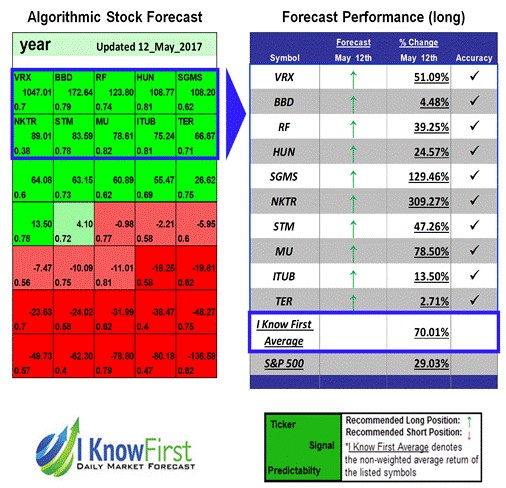

I Know First’s algorithm has very bullish forecasts for the 1-month, 3-month, and 1-year time frames, all with predictability ratings of over 0.5. The forecasts for longer time horizons have stronger signals and predictabilities, further supporting the long-term bullish stance of I Know First’s algorithm.

Past I Know First’s Success with MU

On May 12th, 2017, I Know First’s algorithm made a bullish 1-year forecast for MU. The signal strength was 78.61, and it had a high predictability rating of 0.82. As shown below, Micron Technology’s stock price has risen roughly 70.01% for a time period of one year until May 12th, 2018, further iterating the success of I Know First’s algorithm.

Current I Know First subscribers received this bullish MU forecast on August 15th, 2017.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

To subscribe today click here.