Intel Stock Forecast: Why Intel Deserves A Price Target Of $75

This Intel stock forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

This Intel stock forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- The consensus 12-month price target at TipRanks is only $67.02. This is likely due to incorrect anxiety over the corona-virus outbreak.

- You should go long INTC now because the corona-virus outbreak in China will help this stock reach $75 this year.

- All of Intel’s factories or x86 processor fabs are located outside of China. There won’t be any suspension in Intel’s production.

- It is fabless AMD that is suffering from the suspension of factories in China. A short supply in Ryzen processors will compel more PC vendors to go all-Intel.

I correctly predicted last October 31 that Intel’s (INTC) would breach $60 before 2019 ended. INTC’s closing price on October 31 was below $57. The stock is now trading above $67. My fearless forecast is that the corona-virus outbreak will not hinder INTC from beating its 52-week high of 69.29 (achieved last January 24).

A check on TipRanks revealed that Wall Street analysts have a consensus 12-month price target of only $67.02 for Intel’s stock. My takeaway is that INTC deserves a price target of $75. Going forward, I expect Intel get higher valuation ratios. Based on the peer comparison chart, INTC is still grossly undervalued.

Ryzen processors are excellent but the 14-nanometer x86 desktop PC processors are still a windfall for Intel. Unlike Advanced Micro Devices (AMD), Intel is very profitable (58.56% gross margin and 29.25% net income margin). The high margins are why Intel is a great dividend payer.

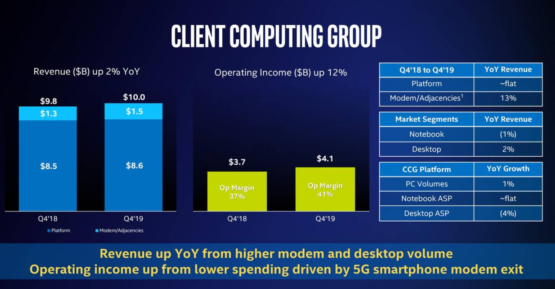

Q4 2019’s earnings report showed Intel can afford to lower the price tags of its desktop processors and still come up with an average operating margin of 41%.

Why Intel Is Headed Higher

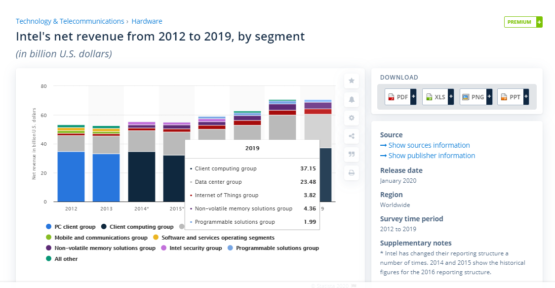

Lack of notable rivals in data center processors convinced me that Intel will wrap up FY 2020 with annual of EPS $5.0 or higher. Intel still dominates the data center and desktop markets for x86 processors. In my book, INTC deserves at least 15.5x Forward P/E GAAP valuation ratio.

My $5.0 EPS projection is reasonable. INTC’s bottom line is stronger going forward. Intel is no longer subsidizing/making smartphone chips and 4G/5G smartphone modems. Intel completed the sale of its smartphone modem business to Apple (AAPL) last December. The $1 billion cash that Apple paid would likely go to Intel’s efforts to accelerate its x86 processor production rate.

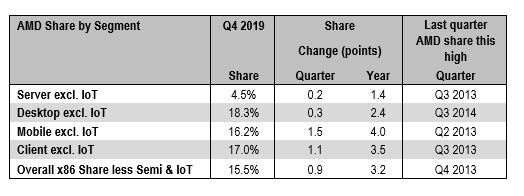

An EPS of $5.0 multiplied by 15.5 results in a forward P/E valuation price of $77.5 for Intel. I won’t be surprised if INTC breaches $80 before 2020 ends. Despite the high valuation of AMD, the fact remains that Intel still commands more than 95% of the server processor market and 81% of the PC processor business.

You know INTC is header for higher valuation just by looking at the chart below. Despite coming up with decent 7-nanometer Ryzen, AMD is not making any serious progress against Intel’s x86 processor business.

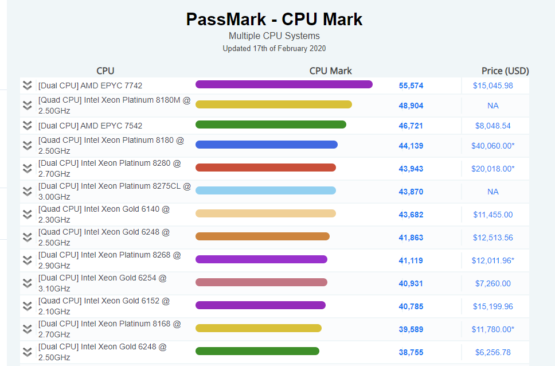

AMD now touts the fastest server processor with its EPYC 7742 product. Unfortunately, the 64-core EPYC 7742 is unlikely to help it gain 10% market in server processors anytime soon. Data center and server farm operators have optimized their software and ecosystem for Intel Xeon. It will be risky for them to migrate their apps to EPYC 7742. Most of them are likely waiting for Intel to come up with a new Xeon server chip that can eclipse EPYC 7742’s performance.

We can also dismiss the noise over Nuvia’s alleged challenge to Intel’s data center business. Nuvia is a start-up that is also using ARM-based processor designs for data centers. If Qualcomm (QCOM) failed with its ARM-based Centriq 2400 10-nanometer server processor, Nuvia is already DOA. The legacy Win32 and x86 architecture software code of most data center-based software means ARM-based chips will never threaten Intel’s $23.48 billion/year data center business.

Intel’s $2 billion purchase of Habana Labs last November further fortifies dominance in data center semiconductor. Habana Labs build Artificial Intelligence-based processors that can process various inferencing workloads. Habana’s Gaudi processor will help Intel compete against Nvidia’s (NVDA) best GPUs for deep learning tasks.

The Coronavirus Outbreak Will Help Intel Sell More x86 Processors

Going forward, Intel has a tailwind from China’s corona-virus outbreak. Yes, the Chinese government extended the Lunar New Year holiday in its effort to control the corona-virus outbreak. It means most factories are still closed. This has little or zero effect on Intel’s important production of x86 desktop and server processors.

Aside from its Dalian factory for 3DNAND and 3DPoint products, all of Intel’s fabs are located outside of China. Please study the chart below. Intel’s 10nm and 14nm fabs are located in the United States, Ireland, and Israel. All of them are capable of 24/7 factory operations.

TSMC’s factories in China are still suspended. Fabless Advanced Micro Devices relies on TSMC (TSMC) for Ryzen and Radeon production. It is a tailwind for Intel that AMD will likely suffer a slowed-down production of Ryzen processor. Delayed production on Ryzen means PC vendors will again source out their entry-level and flagship x86 processors mostly from Intel.

Consequently, Intel can charge higher for its processors this year. It knows competitive PC vendors like Lenovo (LNVGY) and HP, Inc. (HPQ) will be willing to pay anything just to have enough desktop and server processors.

Conclusion for Intel Stock Forecast

Production delay over AMD’s Ryzen and EPYC processors will help Intel sell more Xeon and 9th-generation and 10th-generation Core processors. Intel will also likely improve its margins when there’s short supply of AMD processors. Server builders and PC vendors have weaker bargaining power because Intel knows AMD cannot deliver enough Ryzen/EPYC processors on time this year.

Buy more shares of INTC because it has its own factories outside China. Unlike fabless AMD, Intel is not a hostage to China’s forced shutdown of factories due to coronavirus. This is likely why I Know First’s stock-predicting AI maintains bullish Intel stock forecast.

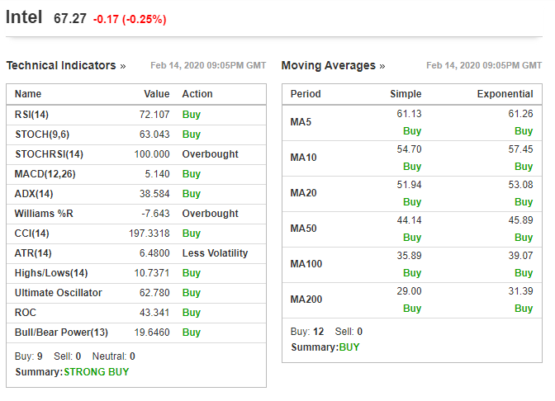

A check of important monthly/long-term technical indicators also reveal INTC is a buy right now.

Past Success With Intel Stock Forecast

On October 30th, the algorithm of I Know First provided bullish Intel stock market forecast. The algorithm successfully predicted the INTC stock movement on the 3 months time horizon. Intel’s shares rose by some 18% in line with the prediction:

Here at I Know First, one of the top fintech companies in the industry, our algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing daily stock predictions for 10,500 assets, including S&P 500 forecast, Euro to Dollar forecast, gold price forecast, world indices, and for individual stocks, such as Apple stock forecast, and stock market predictions for popular indices. Additionally, we provide the latest Apple stock news. Our stock forecasts generated by our algorithmic trading tool is used by institutional clients, as well as private investors and traders to identify the top stock picks in the market and exercise the traded faster than the other market players.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.