HPQ Stock Forecast: Why You Should Hold HP Inc Stock

Summary

- The COVID-19 pandemic is obviously a tailwind for most companies. HP Inc. is obviously go to trade sideways below $20 for a long time.

- HP Inc. will report its Q2 2020 earnings later today. Our HPQ stock forecast most likely predicts a drop even with an EPS and revenue beat.

- The -12.3% decline in Q1 was due to the COVID-19 global pandemic. This was because of shuttered Chinese factories during February-March period.

- PC sales will still suffer year-over-year declines for most of this year. Many companies are retrenching employees instead of adopting work-from-home.

- The COVID-19 pandemic is also a big headwind for HP’s printing business.

Xerox (XRX) was forced to cancel its $34 billion takeover bid for HP, Inc. (HPQ) due to COVID-19 pandemic. This global pandemic is also the reason why HPQ will have a hard time delivering my $28 price target. COVID-19 is why HPQ will likely trade below $20 for most of 2020. The 12.3% drop in global PC shipments in Q1 is why most investors will continue to shun HPQ. HP Inc will do its Q2 FY20 earnings later today. Our HPQ stock forecast most likely predicts a drop in price even if HP reports a beat on EPS and revenue estimates. Consensus EPS estimate is $0.45 (-15.1% Y/Y) and revenue estimate is $12.73 billion (-9.1% Y/Y).

HPQ now has 30-day price return of +13.73% but it still has YTD return of -16.98%. We are all underwater on HPQ and we must hold our breath until for a long time. Seeking Alpha’s Quant Rating system and Wall Street analysts are both neutral on HPQ.

The predictive AI of I Know First has a bullish one-year HPQ stock forecast. It might be prudent to hold on to our beaten-down HPQ shares. Perhaps one year from now, the prediction of I Know First will let us exit HP Inc. with a decent profit. I would like to take a bow and quit my HPQ position without capital loss.

The chance of HPQ hitting $30 is remote. However, we can console ourselves that we are holding on to HPQ because it is an excellent dividend giver. HPQ’s forward yield of 4.13% is good enough to be more than just beer money. HP Inc. has managed to post a 5-year CAGR of 18.28% in its dividend payments. HP is big enough that it could afford to grow its dividend payments again for the next nine years.

We can also just wait for the stock to appreciate from the management’s promise that they will do $16 billion in share buybacks within the next three years. Since HPQ is clearly undervalued right now, it might be profitable for cash-rich investors to buy more HPQ stock before the company starts making big share buybacks.

HPQ is Very Affordable Right Now

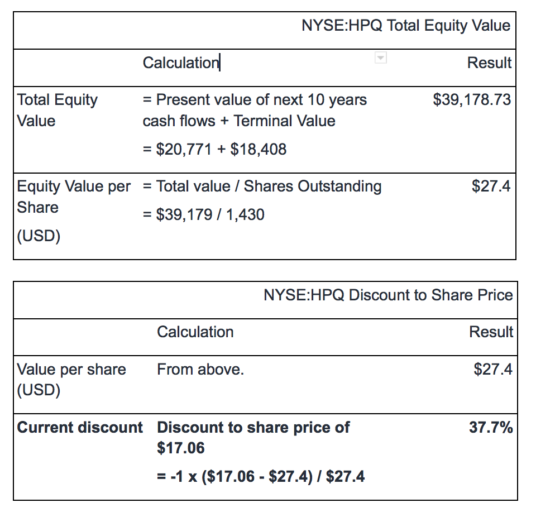

I used the 2 Stage Free Cash Flow to Equity DCF valuation model of SimplyWall.st to guesstimate a fair value for the stock and to predict our HPQ stock forecast. I used a discount rate (cost of equity) of 9.4% and perpetual growth rate of 2.2%.

Discounted Cash Flow Calculation for NYSE:HPQ using 2 Stage Free Cash Flow to Equity

The calculations below outline how an intrinsic value for HP is arrived at by discounting future cash flows to their present value using the 2 stage method. We use analyst’s estimates of cash flows going forward 5 years for the 1st stage, the 2nd stage assumes the company grows at a stable rate into perpetuity. The levered free cash flow for the next 10 years were based on HPQ’s past performance numbers. I came up with a fair value of $27.4 for HPQ.

I cross-referenced this $27.4 with a 10-year EBITDA EXIT DCF model of Finbox.io. I came up with a lower fair value calculation of $24.37 for HPQ. The discount rate range was 8% to 9%.

DCF forward valuation is ripe with assumed projections but it gives us a reason to hold on to our HPQ shares. There’s no vaccine for COVID-19 coming soon and many more people in the world will lose their jobs. Many more companies will close or go bankrupt. The new normal of living with COVID-19 means the PC and printing segments of HPQ will post year-over-year declines this year. This downward trend might even continue until the end of 2021.

Conclusion

I cannot give a buy rating for HPQ when there is an ongoing pandemic. HPQ computers and printer products do not have the mythical appeal of a Tesla (TSLA) car. HPQ will remain undervalued for this year and beyond. I know that the boost in video gaming activities will not be enough to reverse the weakness in PC sales. I also know that global billboard and out-of-home advertising is severely affected by COVID-19 quarantines and travel restrictions. Investors will remain neutral on HPQ if its commercial printing business remains under the dark cloud of COVID-19.

Do not believe Technavio’s chart below that global outdoor or out-of-home advertising will grow 4.4% this year. My takeaway is that this niche market (wherein HP commercial printers are very dependent) will suffer a decline of up to 15 to 25% this year. In the United States, the outdoor advertising business suffered a 51% decline in March/April.

The best thing to do now is sit on the fence and shout that HPQ is undervalued when compared to its technology sector peers. By releasing this good propaganda for HP Inc., some deep-value investors might start buying HPQ hand-over-fist. Pointing out the cheap valuation ratios of HP Inc is more believable than arguing that the PC and printing industries will recover from COVID-19. Going forward, it might be beneficial to its shareholders if HP Inc management sells the company to Tesla. Maybe investors will go bat-crazy bullish on HPQ if it starts selling lithium ion battery-equipped computers and printers. It’s a great advertising copy to market a laptop that doesn’t need to get recharged after 50 hours of heavy usage.

Our HPQ stock forecast renders the stock with a neutral rating due to its bearish monthly technical indicators and moving averages. If you are daring enough, shorting HPQ before its earnings report today could turn out profitable. The technical analysis chart below is prima facie evidence that the stock market is very pessimistic on HPQ. The emotions of the market do not give damn if a stock is undervalued or undervalued. It does what it does according to its whims.

Past I Know First Success with HPQ Stock Forecast

I Know First has been bullish on HP Inc. stock in the past. On November 17, 2019, the I Know First algorithm issued a bullish prediction for HPQ stock price. The algorithm successfully forecasted the movement of the HPQ stock price for the 3 months time horizon. HPQ’s shares rose by 10.85% in line with the I Know First algorithm’s forecast. See chart below.

This bullish HPQ stock price prediction was sent to the current I Know First subscribers on November 17, 2019.

At I Know First, our AI-based stock algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing predictions like artificial intelligence stocks under $10. Additionally, we provide gold price predictions today and Forex market outlook being published at currency-predictions.com, and, in particular, Apple stock news. Today, we are producing daily forecasts for over 10,500 assets. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.