Google Stock Forecast: Why Google Will Lose Versus Oracle’s Java Copyright Infringement Case

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- I Know First has bearish algorithmic forecasts for Google’s stock. This could be due to its recent legal setback against Oracle.

- Oracle filed a copyright infringement case in 2010 against Google’s unlicensed use of Java APIs to develop its Android Operating System.

- The U.S. Court of Appeals has ruled that Oracle-owned Java APIs are copyright-protected. The case has been remanded to a California federal court to determine damages.

- This verdict is eerily similar to the recent ruling upholding Marvin Gaye family’s victorious copyright infringement case against Robin Thicke’s Blurred Lines.

- Unless the U.S. Supreme Court reverses this latest ruling, Google is now at risk of paying the $9.3 billion that Oracle wants in punitive damages.

Google (GOOGL) suffered the same fate of “Blurred Lines” songwriters Robin Thicke and Pharrell Williams. The U.S. Court of Appeals upheld the initial verdict that Mr. Thicke and Mr. Williams were guilty of illegally copying the “musical style” from the late Marvin Gaye’s “Got To Give It Up” song. Gaye’s family/descendants won a verdict $5.3 million in damages versus Robin Thicke and Pharrell Williams.

The two songs are very different in terms of audio quality, melody, and lyrics. However, the Court of Appeals still upheld the lower court’s decision that “musical style” or rhythm/vibe is subject to copyright protection. In similar fashion, the U.S. Court of Appeals has also ruled that Google has violated Oracle’s (ORCL) copyright when it used Java Application Programming Interface (API) codes to develop its Android Operating System software.

Use of open-sourced Java APIs for commercial purposes requires the permission of the copyright owner. Since 2008, Google failed to acquire the authorization and its now probably going to pay billions of dollars to Oracle.

This looming legal setback is likely one of the strong reasons why I Know First has very bearish market trend forecasts for GOOGL. It might be best to avoid going long on Google if you agree with my view that Oracle will win this legal battle.

When Defeat Is Imminent, Settle out of Court

Like the Gaye Family’s victory against Thicke and Williams, Oracle is now nearer to obtaining its demand of $9.3 billion from Google’s verbatim copying of 37 Java APIs in Android. The reality is Google could have written its own Java-derivative APIs but instead it chose to copy the original 37 APIs.

Google was rumored to only be willing to pay a maximum of $100 million in damages. However, the tens of billions of dollars that Google earned from mobile advertising on Android devices means Oracle will not easily back down from its $9.3 billion demand.

Google made almost $50 billion from global mobile advertising last year. Oracle wants a piece of the lucrative Android-related revenue stream. Oracle also wants a piece of the billions of dollars that Google made from its Android app store. The Google Play store generated $20.1 billion in sales last year. Google took 30% cut from purchases done through its Play App store.

Winning its copyright case against Google can help Oracle recover its $7.4 billion expense when it bought Sun Microsystems in 2009. Sun was the developer of the Java programming language. Financial Times reported today that Google plans to do a Supreme Court Appeal over its latest defeat in the Court of Appeals. However, the U.S. Supreme Court already declined in 2015 to hear the Oracle versus Google copyright case. It might be more prudent for Google to just negotiate for an out of court settlement. Thicke and Pharell only copied the musical style of Marvin Gaye and they were still found guilty.

Google copied thousands of code from Java APIs in its Android software. Its court defeat is imminent.

Just like the concept of “music style”, APIs were previously accepted as open source and subject to fair use for the past 30 years. Developers use APIs to create software interface that can be used on different devices without having to code different versions of the program.

Sun Microsystems offered Java for free and commercial licensing. However, Sun was not strict in implementing its Java IP. This is the reason why Google failed to properly license Java when it decided to release its commercial Android operating system in 2008. Google thought that verbatim copying of Java API codes is under the “Fair Use Doctrine.” Unfortunately, the fair use principle cannot apply to products that are meant for profiteering without the official permission of the intellectual/copyright owner.

Google was found guilty of infringing on the copyright over 37 Java APIs, Oracle-implemented rangecheck, and 8 decompiled security files.

Conclusion

Google’s quarterly revenue is $31 billion. It can afford paying the $9.3 billion demand of Oracle. However, the overall fee could have been much lower if only Google properly licensed Java APIs from Sun Microsystems in 2008. We can only hope that Oracle can be amenable to a lower out-of-court settlement payment. Negotiating payments retroactively is not going to be easy for Google.

Lastly, Google’s imminent defeat is also akin to The Verve’s copyright infringement defeat in their hit song Bittersweet Symphony. The Verve received permission to use a sample from a Rolling Stone-written instrumental music but it still got sued and lost. The Verve used the licensed sample beyond what was initially agreed upon.

Google probably avoided licensing Java APIs before 2010 because it did not want limitations imposed immediately while Android was still nascent.

Past I Know First Success With GOOGL

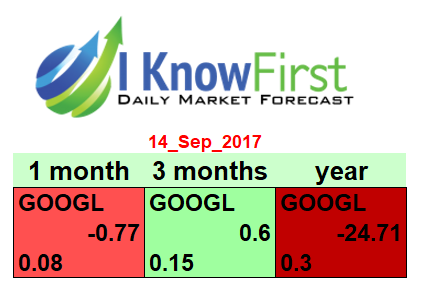

On September 14, 2017, I Know First published a premium article saying that it’s a hold time for Google’s stock . I Know First has been bullish on Google’s stock on 3 months time horizon. We suggested to hold it at that time and to wait until the performance of the stock improves. From the below graph one can see that on 3 month horizon the I Know First algorithm successfully predicted the movement of the GOOGL stock price which is rise by 20.89% outperforming the NASDAQ benchmark by some 8%.

(Source: Yahoo Finance)

This bullish forecast for GOOGL was sent to I Know First subscribers on September 14, 2017.

To subscribe today click here.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.