GOOGL Stock Forecast: Unchallenged Leadership in Advertising Will Boost Google To $3,000

The GOOGL stock forecast was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- GOOGL’s stock price has shot up over +90% since my June 2020 buy recommendation.

- I am still rating GOOGL as a buy. Exuberant investors are already boosting GOOGL’s price even before it does its Q2 ER.

- The Delta and other current and upcoming COVID-19 variants will continue to boost the digital and mobile advertising business of Google.

- Learn-from-home and work-from-home are again the new normal because vaccinated people still get infected by new variants of the COVID-19 virus.

- Politicians are compelling telcos to put up 5G cellular towers even in rural impoverished towns. Increased 5G deployment and cheap 5G smartphones are a tailwind for Google.

Congratulations to all who heeded my June 2020 buy recommendation for Google (GOOGL) (GOOG). Back then GOOGL was trading below $1,400. Google’s stock is now trading above $2650. Enthusiastic, super-bullish investors are already buying GOOGL shares hand-over-fists during last Friday, July 23. They are betting big that the July 27 Q2 earnings report will again beat Wall Street expectations. This boundless optimism convinced me that GOOGL and GOOG will soon breach $3,000.

The Delta and other COVID-19 variants keep the pandemic tailwind strong for Google and other advertising companies. The persisting exuberance for Google is justified. Google has been doing big beats during this pandemic-boosted business climate. For the past four quarters, Google handily outperformed Wall Street’s EPS guesstimates. This 40% or more EPS surprise might happen again come July 27 Q2 ER.

GOOGL can skyrocket if the July 27 ER delivers a big beat on Q2 estimates ($56.04B revenue and $19.14 EPS).

GOOGL Stock Forecast: Join The Love Boat For Google

Yes, GOOGL already has a 1-year price performance of +64.13% but it is never too late to exploit the crazy, madly in-love emotion of most investors for Google right now. Emotion is the best dictator of stock market prices, not fundamentals or macro-economic factors. Momentum begets momentum.

Consistently beating the quarterly estimates has made growth-stock darling GOOGL a momentum investing opportunity. Joining the momentum bandwagon is justified because Google clearly enjoys a pandemic tailwind to all of its revenue streams.

Exploit the pattern of euphoria that investors have every time Google beat EPS estimates. The chart below clearly illustrates GOOGL makes notable upside movement post-ER. The herd mentality is worth exploiting for profit.

The upward momentum of Google is not endangered. There’s no near-term probable headwind that can prevent Google from beating the $56 billion estimate for Q2. Google’s Q1 2021 revenue was already $55.31.

The pandemic is only fortifying the No. 1 position of Google in digital advertising. Google also remains a near-monopoly on search with a 92.6% market share. YouTube is now also a near-monopoly that is why it can do $6.01 billion in quarterly revenue. YouTube’s ad-driven business model is almost catching up with the subscription-dependent business of Netflix (NLFX), which had a Q1 2021 revenue of $7.16 billion.

Investors are madly in love with Google because the advertising-driven business model is still very effective. The rise of ad-blocking browser extensions is not a headwind for Google.

GOOGL Stock Forecast: Cheap 5G Phones Plus Accelerating 5G Network Deployments

Aside from the continued growth driver from COVID-19 variants, the other catalysts are cheap 5G phones and accelerating the deployment of 5G networks. There are now more advertising eyeballs for Google’s YouTube ads, search engine ads, and mobile ads because are again stuck at home. They are enjoying YouTube bingeing using sub-$160 5G smartphones like the POCO M3 Pro 5G.

Google’s advertising-driven business benefits when politicians compel wireless carriers like Smart Communications to upgrade their cell sites to 5G even in a backward, sparsely-populated town like where I reside. Yes, a municipal councilor announced last July 4 on Facebook that her 2020-era legislation calling for Smart Communication to give us 5G was finally fulfilled. We can now enjoy full HD streaming YouTube and Netflix videos. Our town’s recently-installed 5G network can reach 111mbps download speed.

Google’s advertising prosperity also benefits because wireless carriers can now offer unlimited 7-day prepaid 5G data plans for just 299 pesos ($5.98). Smart’s 5G cell site tower is around 100 meters away from our house.

The proliferation of cheap 5G phones and affordable 5G unlimited data plans convinced me Google is close to achieving $65 billion/quarter sales. The lack of challengers to YouTube and Google Search can still help Google maintain its 18% revenue growth rate for many years to come.

The stay-at-home, learn-from-home, work-from-home government edicts due to the Delta variant are also going to boost Google Play App Store’s revenue. It is indeed safer to just play Android games at home. The more people playing mobile games, the more chances there are for them to do in-app purchases. Google’s app store generated $40 billion in sales last year. Thirty percent of that is Google’s commission.

Conclusion

My 1-year price target of $3,000 is higher than TipRanks’ Wall Street average of $2,834.74. However, my high 71% accuracy and +19.8% average return means I continue to outperform 95% of Wall Street analysts. Go long on GOOGL because its upward momentum is still going strong. Google is a safe growth-stock investment. This is because of its unchallenged leadership in the $657 billion/year global advertising business.

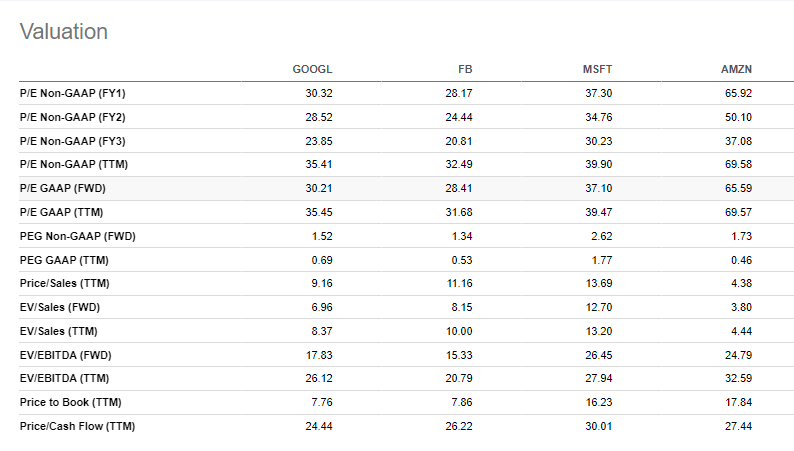

The inability of Amazon (AMZN), Facebook (FB), and Microsoft (MSFT) to compete against Google Search, Google Chrome, and Android OS makes GOOGL a strong buy. Cost-wise, buying GOOGL is affordable. Google’s stock still has a lower Forward P/E valuation than Microsoft and Amazon, 30.21 versus 37.10 and 65.69. Google is not vulnerable to software piracy like Microsoft is.

The predictive AI of I Know First is also very optimistic on the one-year market trend forecast of GOOGL. I Know First gave GOOGL a 1-year trend score of 193.66.

Past Success With GOOGL Stock Forecast

I Know First has been bullish on GOOGL’s shares in past forecasts. On our June 28, 2020 premium article, the I Know First algorithm issued a bullish GOOGL stock forecast. The algorithm successfully forecasted the movement of GOOGL’s shares on the 1 year time horizons. GOOGL’s shares rose by 79.86% in line with the I Know First algorithm’s forecast.

Here at I Know First, our AI-based stock forecast algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. The database used is 100% historical data free from human-derived assumptions and is constantly evolving with newly added data and adapting to changing market situations. Today, we are producing daily forecasts for over 10,500 assets such as forex forecasts, as well as gold predictions, while also providing the latest Apple stock news. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note – for trading decisions use the most recent forecast.