FL Stock Forecast: No “timeout” on the Rebound – Stock Price Jumps Following Q1 2018 Result

The article was written by Hieu Nguyen, a Financial Analyst at I Know First.

The article was written by Hieu Nguyen, a Financial Analyst at I Know First.

Foot Locker Stock Prediction

Summary:

- FL rockets with the rebound of Net Income and Gross profit margin.

- With Nike new platforms, Foot Locker is ready to jump.

- Amazon deal with Nike: Good News or Bad News?

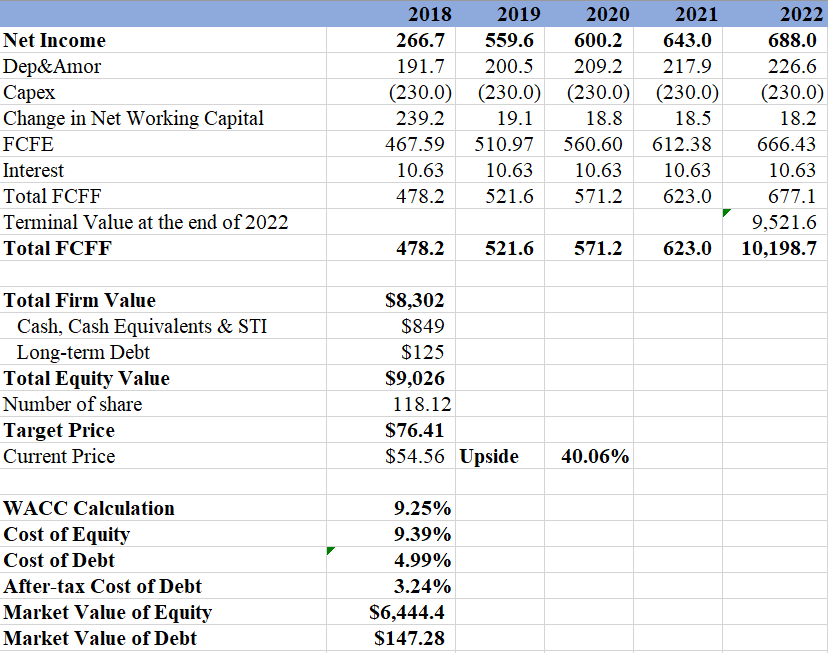

- DCF supports to stay long in FL at the target price around $76

(Source: Wikimedia Commons)

Company Background

Foot Locker (NYSE: FL) is the market leader in the athletic footwear and apparel store industry. As of 2018, the company has more than 3,300 stores in many countries and regions including the United States, Canada, Europe, Australia, and Asia Pacific. The revenue of Foot Locker comes from two major segments, athletic store and Direct-to-Customers. Under its athletic stores, Foot locker sells athletic footwear and apparels of selected brands under the banner of Footlocker, Kids Foot Locker, Lady Foot Locker, Champs Sports, Footaction, Runners Point, Sidestep and SIX:02. The Direct-to-Customers business sells the same items through the online channel footlocker.com and some affiliates like Eastbay. While Athletic store business accounts for 87% of the total revenue, the Direct-to-Customers generates the other 13%.

Foot Locker’s business model mainly focuses on selecting a handful of athletic footwear and apparel from several major suppliers, such as Nike, Adidas, and Under Armour and sell them under one roof. As a result, the company revenue is driven by the quality of its portfolio as well as its ability to get the best items from the suppliers. Its tag line also reflects this idea “If it’s here, it’s approved”

(Source: Wikimedia Commons)

Stock price rockets with the rebound of Net Income and Gross profit margin

On May 25, Foot Locker has announced its Q1 2018 results that exceeded market expectation. Following that, the stock price jumped up by 20.16%, closing at $55.74.

The revenue has finally come back to trend, after three consecutive quarters of decrease. Sales increased by 1.2% to $2,025 million this quarter, compared to $2,001 in Q1 2017, mainly because of the effect of foreign exchange rate fluctuations. Despite of the increase in total revenue, the comparable-store sales decreased by 2.8%, suggesting that FL is still struggling with its sales strategy. On the same hand, both net income and gross profit margin also brought good news for investors. Although the net income decreased by 8.33% y/y, it was clearly a recovery from the loss in Q4 2017. On the same line, gross profit margin increased to 32.9% from 31.4% in Q4 2018.

On the same hand, both net income and gross profit margin also brought good news for investors. Although the net income decreased by 8.33% y/y, it was clearly a recovery from the loss in Q4 2017. On the same line, gross profit margin increased to 32.9% from 31.4% in Q4 2018.

With Nike new platforms, Foot Locker is ready to jump

As Nike (NYSE: NKE) contributes to about 70% of the products sold, Foot Locker’s sales highly relies on the performance of Nike’s new products. Running segment continued to grow at single digit rate as Nike’s new innovative platforms, including Air Vapormax and Nike React, are still in form. Another segment that grew in Q1 2018 is Nike Tuned Air, the exclusive series for Foot Locker.

Recently, in Nike’s conference call, Nike has confirmed the ongoing momentum of its two new platforms: Air Vapormax and Nike React. “The Air Vapormax for example is delivering lightweight comfort with a distinct style and it quickly became the number one performance shoe above the $100 price point and we’re now scaling that platform into millions of pairs. Turning to Nike React, the consumer response has set new records for performance innovation launch.” Mark Parker – Chairman, President and CEO of Nike.

Moreover, the internet search also shows the reverse trend for Nike and Adidas. Over the last 4 years, Adidas had outperformed Nike in the number of search. However, since the end of 2017, the trend has inverted. We can now expect Nike to rebound, lifting Foot Locker up.

(Source: Yahoo Finance)

Amazon deal with Nike: Good News or Bad News?

Foot Locker has been considered one of the very few retailers that can survive the retail apocalypse. However, the company business was hugely threatened by the deal between Amazon and Nike, in which Nike will open an official shop on Amazon. Many may feel that the deal would destroy the direct-to-customer segment of Foot Locker, it may turn out to be the opposite.

After the deal, Nike will have more control on the selling narrative on Amazon. Currently, there are more than 72,000 of unlicensed third-party vendors that sell of Nike products on Amazon, but thanks to the deal, now Nike can stop them. Consequently, the deal has eliminated a lot of competitors for Foot Lockers.

On the other hand, Nike has always been good at market segmentation. With the elevated partnership with Foot Locker, Nike seems to try to sell the mid-range products via Amazon, leaving the high-end products to Foot Locker. The financial result of Foot Locker also proves this point. In 2017, the Direct-to-Customer segment of Foot Locker continued to grow at 8.5%, compared to 8.3% at 2016.

DCF supports to stay long in FL at the target price around $76

Our 5-year DCF analysis arrives the target price of $76.41 for Foot Locker. DCF model was constructed based on 3 main factors: top line and bottom line forecast, capital expenditures, and WACC. We tried to be conservative in our forecast both in sales and gross profit margin. In fact, the 2018 sales can reach to $7,800 million while the gross profit margin can be above 32.5%.

Current I Know First Algorithm Bullish Forecast for FL

Below is the latest forecast I Know First algorithm released as of today on May 31, 2018. I Know First provides a bullish signal for FL, which agrees with the discussion above.

Go here to read how to interpret this diagram.

Conclusion

Despite of a lot of difficulties, Foot Locker seems to continue to rebound. Following its impressive Q1 2018 result, the company has been trying to improve its sales strategy both in retailer stores and online. Foot Locker also received good news from it major partners, Nike, as Nike’s new platforms has been performing well and received positive feedback from its customers. Although the deal between Nike and Amazon may be a threat for Foot Locker, the Direct-to-customer segment still set a new record in sales in 2017.

Past I Know First Forecast Success with FL

I Know First Algorithm has successfully forecasted the movement of FL stock in the article on November 19th, 2017. For the 1-month and 3-month time frames, the forecast gave bullish signals of 822.82 and 522.44, and predictabilities of 0.36 and 0.42, respectively. Then, FL achieved 13.20% in 1 month and 21.22% in 3 months.

Current I Know First subscribers received this bullish FL forecast on November 19, 2017.

To subscribe today click here.

To subscribe today and receive exclusive AI-based algorithmic predictions, click here.