DAR Stock Forecast: A Rising Star In The Bioenergy

This DAR Stock Forecast article was written by Zhou He

– Financial Analyst at I Know First.

Highlights

- DAR’s share price has surged more than 20% in recent years.

- The ROE of the company is 20.96% that higher than 86.95 of the companies in the Industry.

- The Piotroski F-Score provides a positive outlook for DAR’s stocks.

Overview

Darling Ingredients Inc. (NYSE: DAR) develops and produces sustainable ingredients for customers in the pharmaceutical, food, pet food, fuel, and fertilizer industries. The company collects and converts animal by-products into raw materials, including gelatin, fat, protein, pet food ingredients, fertilizers, and other specialty products. In addition, the company recycles used cooking oil and bakery residues and converts them into feed and fuel feedstocks. The company has three main business segments: Feed ingredients (the source of most of its revenue), Food ingredients, and Fuel ingredients. The company provides grease isolation services to food businesses and sells a variety of equipment for collecting and transporting edible oils.

Unaffected by the environment and sustainable development

Combining cutting-edge renewable fuels with an established feed segment, the company is growing rapidly in the renewable diesel segment, thanks to its feedstock/manufacturing advantages primarily from its base business. With new renewable diesel projects coming online, there is a lot of focus on feedstock availability. Providing raw material supplies will drive more tremendous success later.

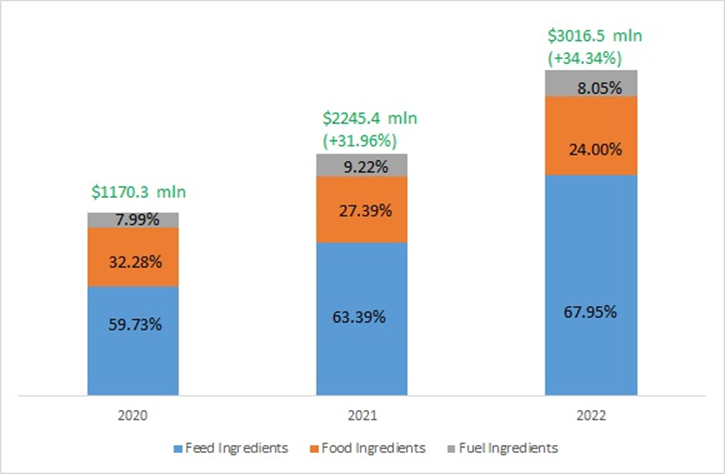

Comparison of revenue for three ingredients based on three years (2020-2022). We can see that the revenue each year is growing. The total profit in 2021 will increase by 31.96% compared to 2020. The total profit in 2022 will increase by 34.34% compared to 2021. Among them, the main growth comes from Feed Ingredients. A total of 8.22% growth over the three years. It can also be seen in the chart that the Feed Ingredients area accounts for a large proportion. What amazes me is that much of the economy has struggled or even stalled under the impact of Covid-19. However, DAR continues to develop in its own field, and it gets better results every year, and its benefits are gradually increasing.

(Figure 1 – The Revenue Structure, Six Months Ended on July 2 for 2020 – 2022)

Darling Ingredients actively expands its business by acquisitions. On May 2, 2022, the company purchased all shares of Valley Proteins. It is expected that this deal will strengthen the company’s underlying business and expand its ability to provide additional carbon-intensive feedstocks to drive the growing demand for renewable diesel. Furthermore, on February 25, 2022, DAR’s wholly owned international subsidiary acquired the entire stake in the Belgian digester, organic and industrial waste treatment company Group Op de Beeck, which is now included in the company fuel components segment. Group Op de Beeckone of the leading organic waste and industrial by-product processing companies in Belgium. Not only is this acquisition a perfect fit for Darling’s growing presence in European sustainable energy production, but it progresses the company’s development of bio-digestion.

The potential problems DAR is facing now could be affected by inflation. In order to curb the high inflation in the United States, the Federal Reserve has raised interest rates four times in a row and raised interest rates twice in a row by 75 basis points from June to July, with a total of 150 basis points. Due to the drop in international crude oil prices, the growth rate of CPI and PPI has slowed down. There is a possibility of continuing to raise interest rates by 75 basis points in September after a report from the Bureau of Labor Statistics showed that CPI increased by 8.3% over the prior year and 0.1% over the prior month when the market had expected an 8.1% increase in inflation over last year and a decline of 0.1% over the prior month.

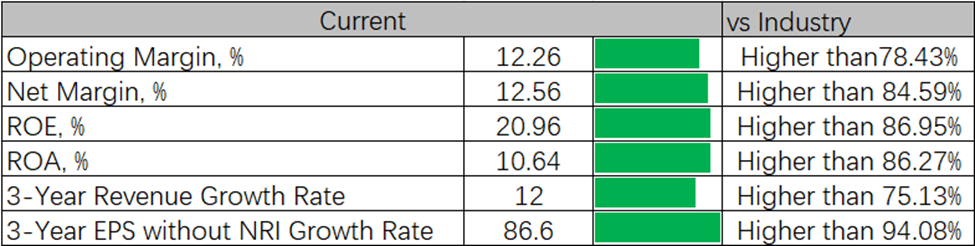

Let us look at DAR’s performance across the Consumer Packaged Goods Industry. According to GuruFocus, DAR is one of the most profitable companies in the industry. DAR’s ROE of 20.96 is better than 86.95% of companies in the industry. The Net Margin of 12.56% is higher than 84.59% of companies in the industry. The Operating Margin of 12.26% is higher than 78.43% of companies in the industry. The highest one is EPS without NRI Growth Rate higher than 94.08% of companies in the industry.

(Figure 2: DAR vs consumer packaged goods industry in TTM)

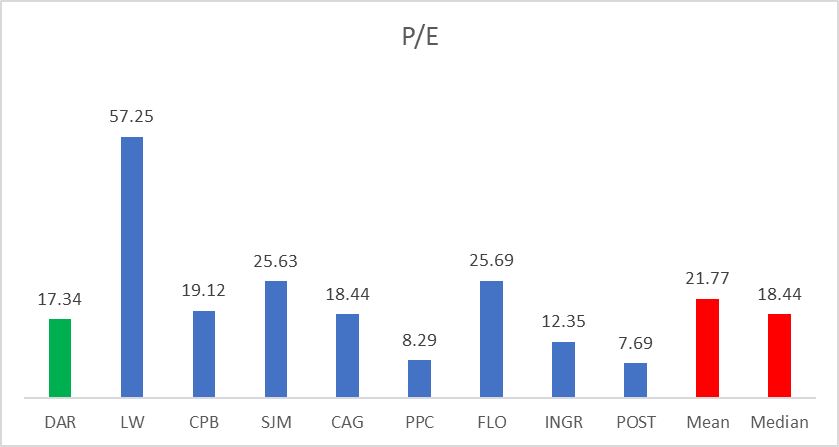

Let’s look at the next comparable companies: LW, CPB, SIM, CAG, and PPC. According to Figure 3, DAR’s P/E ratio is lower than Average and Median values across comparable companies.

(Figure 3: P/E Ratio)

Let’s look at the company credit test and financial positions.

The Altman Z-score, which determines the result of a credit test, stays near the bored of the Grey and Safe zones. At the same time, DAR looks interesting in terms of the Piotroski F-Score. Piotroski F-score is a number between 0 and 9 used to assess the soundness of a company’s financial position. A score of 7 may indicate that the company’s stock is undervalued and can be interpreted by investors as a good signal to buy the stock.

The Yahoo Finance coverage for the company is performed by 8 analysts for DAR Stock Forecast: 3 and 4 of them take Strong Buy and Buy positions, while the other one takes the Hold position. The analysts’ community puts the average target price for the stock at $99.54 while it is traded at $73.22.

DAR Stock Forecast: Conclusion

DAR is a buy stock with a positive revenue growth outlook. DAR’s financials and growth prospects show its potential to outperform the market. Surging food demand and innovations in food processing technology are expected to drive the market over the next few years. Dietary shifts in both developed and developing countries, including the growing prominence of health-conscious eating, are also expected to drive growth. DAR looks promising in the context of its Piotroski F-Score and price ratios.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the DAR stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

To subscribe today click here.

Please note-for trading decisions and use the most recent forecast.