CPRI Stock Forecast: Strong Top-Line and Margin Growth Forecasts

![]() This CPRI Stock Forecast article was written by Opher Joseph – Financial Analyst, I Know First.

This CPRI Stock Forecast article was written by Opher Joseph – Financial Analyst, I Know First.

Highlights

- The market growth forecasts depict a favorable return with targets of $6.83 per share for the current fiscal year.

- CPRI grew revenue by 25% year-over-year, nudged adjusted gross margins up to 63.7%, and increased earnings per share by 170% year-over-year to $1.02.

- Return on Equity (ROE) of 32.76% and Return on Capital Employed (ROCE) of 17.05% better than 76.32% of the companies in its industry.

- The company has announced to buy back $1 billion worth of shares to maximize shareholder returns.

Overview

Capri Holdings Ltd. operates as a global fashion luxury group. It engages in the design and distribution of sportswear, accessories, footwear, branded women’s apparel and accessories, and men’s apparel. The firm operates through the following segments: Versace, Jimmy Choo, and Michael Kors. The Versace segment sells Versace luxury ready-to-wear, accessories, footwear, and home furnishings through directly operated Versace boutiques. The Jimmy Choo segment sells Jimmy Choo luxury goods to end clients through directly operated Jimmy Choo stores. The Michael Kors segment sells Michael Kors products through four primary Michael Kors retail store formats: Collection, Lifestyle, outlet stores, and e-commerce. The company was founded by Michael David Kors in1981 and is headquartered in London, the United Kingdom. The company was formerly known as Michael Kors Holdings Limited and changed its name to Capri Holdings Limited in December 2018.

CPRI Gaining Momentum from Growing Profitability and Positive Growth Forecasts

CPRI is gaining momentum by finally returning to profitability. It posted strong financial results for the fiscal year ended 2022 beating market estimates and thus has been on the radar of prospective investors. The market growth forecasts also depict a favorable return with targets of 6.83 per share for the current fiscal year. Capri expects revenue of approximately $5.95 billion for fiscal 2023, with earnings of roughly $6.85 per share, with the consensus predicted being $6.08 billion and $6.57, respectively. In addition, gross margin is estimated to be about flat compared to fiscal 2022, with higher transportation and input costs being the deterrent.

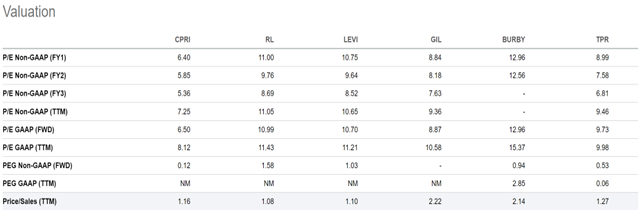

The company reported $1.02 earnings per share for the quarter, beating the consensus estimate of $0.82 by $0.20. The business had revenue of $1.49 billion during the quarter, compared to analysts’ expectations of $1.41 billion. Capri had a net margin of 14.54% and a return on equity of 36.48%. The firm’s revenue for the quarter was up 24.6% compared to the same quarter last year. During the same quarter in the prior year, the company posted $0.38 EPS. In terms of the fourth quarter, Capri grew revenue by 25% year-over-year, nudged adjusted gross margins up to 63.7%, and increased earnings per share 170% year-over-year to $1.02. Given these revenue growth numbers and the ongoing price drop due to market conditions, CPRI trades at cheap valuations. The price-to-earnings-growth (PEG) ratio of just 0.2 and a PEG ratio of under 1 is widely accepted to mean that a stock is inexpensive.

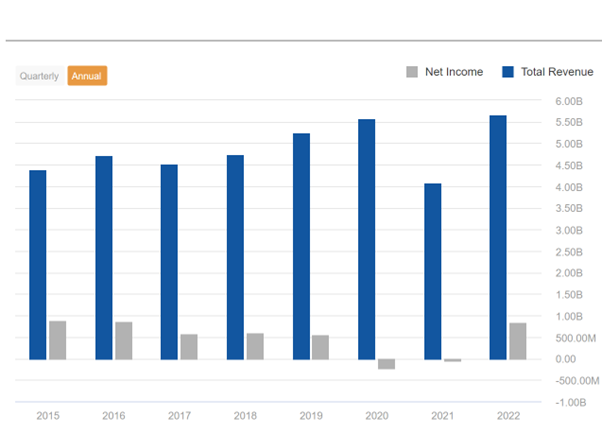

CPRI maintains strong margins with higher revenues. CPRI has had a revenue growth rate of 2.4% over the last 3 years while increasing its Free Cash Flow per share (FCF) by 3.8% in the same period. It has an impressive Return on Equity (ROE) of 32.76% and Return on Capital Employed (ROCE) of 17.05% better than 76.32% of the companies in its industry.

The Cash to Debt ratio of the company is 0.06% and the Debt to Equity ratio is 1.19. The company is not generating enough operating cash flows to cover its debt and interest outflows, however, this situation is improving with its increasing profitability. CPRI has a low debt to EBITDA ratio of only 0.83 and despite having net debt, it received more in interest over the last twelve months than it had to pay. CPRI grew its EBIT by 134% over twelve months with an increased free cash flow from operations to 83% of its EBIT to improve its interest coverage. While Capri does not pay a dividend, it shareholders’ returns via share buybacks. It repurchased $300 million of shares during the fourth quarter. In addition, Capri just announced a massive share repurchase authorization of $1 billion, which equates to nearly 15% of the company’s current market capitalization.

CPRI also looks attractive in terms of the Piotroski F-Score. Piotroski F-score is a number between 0 and 9 that is used to assess the soundness of a company’s financial position. A score of 8 indicates that the company’s stock is undervalued and can be interpreted by investors as a good signal to buy the stock. The Altman Z-score is the result of a credit test that measures the likelihood of a publicly owned manufacturing company going bankrupt, it is at a grey level for CPRI given its leverage and interest coverage levels, as shown in the above image.

Conclusion

CPRI has certainly impressed recently with its positive run and positive earnings growth momentum. It is therefore on the radar of the market of growth stocks to look out for. With effective debt management and an upward market outlook, CPRI is an attractive prospect to look forward to expecting to reach its 52-week high levels again. Given the current scenario of high inflation and other economic and political challenges in the market, it would be advisable not to buy on dips and to wait out till the market stabilizes and the stock starts recovering. I expect a return of more than 20% from current levels with the stock crossing the $55 price mark at least.

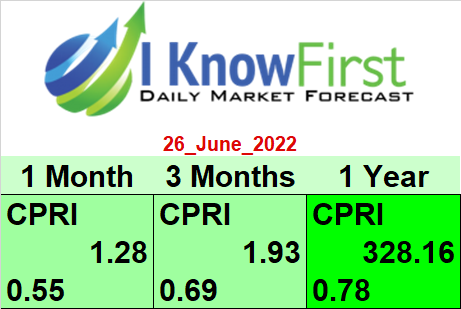

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the LPX stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success with CPRI Stock Forecast

I Know First has been bullish on the CPRI stock forecast in the past. On February 2nd, 2022 the I Know First algorithm issued a forecast for CPRI stock price and recommended CPRI as one of the best stocks to buy. The AI-driven CPRI stock prediction was successful on a 1-month time horizon resulting in more than 12.51%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.