BKNG Stock Forecast: Constructing a Fundament for Future Growth in the Fragility Time

![]() This BKNG Stock Forecast article was written by Adi Raved

– Financial Analyst at I Know First.

This BKNG Stock Forecast article was written by Adi Raved

– Financial Analyst at I Know First.

Highlights

- BKNG has dropped by 12.2 % since November 9, 2021

- BKNG’s Operating Margin is 17.2%, higher than 86.50% of the companies in the Travel & Leisure industry

- BKNG actively expands its business by internal projects and making deals with other companies to get advantages in the industry recovering time

Overview of Booking Holdings Incorporated

Booking Holdings Incorporated provides travel and restaurant online reservation and related services worldwide. Those services are provided to consumers and local partners in more than 220 countries and territories through six primary consumer-facing brands: Booking.com, Priceline, Agoda, Rentalcars.com, KAYAK and OpenTable, as well as through a network of subsidiary brands including Rocketmiles, Fareharbor, HotelsCombined, Cheapflights and Momondo. According to their website, their goal is to make it easier for everyone to experience the world.

The company was formerly known as The Priceline Group Inc. and changed its name to Booking Holdings Inc. in February 2018. Booking Holdings Inc. was founded in 1997 and is headquartered in Norwalk, Connecticut (based on yahoo finance). Since last November, Booking Holdings Incorporated (NASDAQ: BKNG) has roared up 50.91% over this 1-year period.

Arise from the Ashes

(Source: soundcloud.com)

The ongoing outbreak of coronavirus, COVID-19, as well as subsequent outbreaks driven by new variants of the virus, and the resulting economic conditions and government restrictions have resulted in a material decrease in consumer spending on leisure and tourism services. Consequently, the pandemic has resulted in an unprecedented decline in travel and restaurant activities and consumer demand for related services as compared to 2019 levels.

It is important to take into consideration that the company’s financial results and prospects are almost entirely dependent on the sale of travel-related services. Many governments around the world continue to implement a variety of measures to reduce the spread of COVID-19, including travel restrictions, bans and advisories, and additional restrictions on businesses as part of re-opening plans. These government mandates have had a significant adverse effect on many of the customers on whom the Company’s business relies, including hotels and airlines, as well as the Company’s workforce, operations and consumers. BKNG’s revenue significantly increased by 77% in 3Q2021 compared with 3Q2020 and was 93% of the revenue level in 2019. It is worth noting that the share of merchants in the revenue structure increased in 2021 compared to 2019, rising from 25% in 2019’s third quartile to 35% in 2021’s third quartile.

Rental Car Days and Room Nights shows a positive dynamic in 2021 with a growth rate of 44% for both groups in 3Q2021 compared with 3Q2020, still less than in 3Q2019. Today BKNG is developing a flight platform on Booking.com which will provide the ability to engage with flight bookers early in their travel journey and allow an opportunity to cross-sell accommodation and other services to these bookers. The sales in the airline segment in 3Q2021 significantly exceed the level in 3Q2019 that primarily driven by strength at Priceline and by Booking.com’s flight offering. While Booking’s flight product is staying in the early stage over 25% of Booking’s flight bookers are entirely new customers. There is a seasonality factor in BKNG business and it is reasonable to expect decreasing in the company business activity in 4Q2021.

(Figure 2 – Services Provide from 1Q19 to 3Q21)

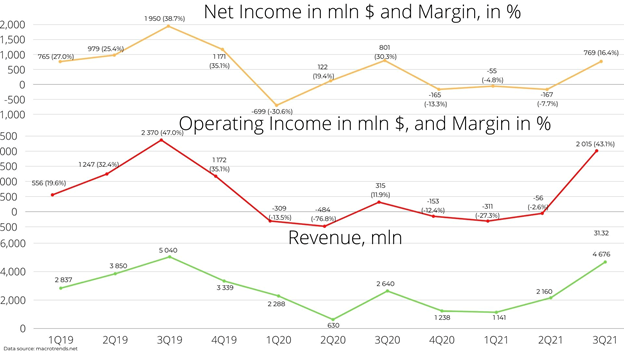

BKNG’s operating activity has significantly improved in 3Q2021, so operating income increased by 6.4 times compared with 3Q2020 and was 85% of the level in 3Q2019. Despite incising in operating income, the net income is $769 mln that less by $32 mln than in 3Q2020. It should be noted that the net income in 3Q2021 includes 1 billion dollars pre-tax unrealized loss on equity investments, primarily related to investment in Meituan as well as income tax expense of $199 million, while non-operating income got of $520 mln in 3Q2020. To cover more share of potential clients during the tourism sector recovering, the company’s marketing expenses are $1 378 mln. in 3Q2021 that higher by $647 mln than in 3Q2020, and compare with the level in 3Q2019 when the marketing expenses was $1 415 mln.

Now let’s take a look at some of the fundamental indicators of the company that will help us understand its current financial health and position in the market and industry. The key profitability indicators of the Booking Holdings Ins look much better than competitors in the Travel and Leisure industry and this is a serious positive factor for the company’s stocks.

According to GuruFocus, BKNG’s ROE of 7.66 is higher than 77% of companies in the Travel and Leisure industry. The Operating Margin of 17.2% is higher than 86.50% of companies in the industry. This can exhibit the company’s excellent profit generation ability. Moreover, according to Current and Quick Ratios, the company has enough financial resources to meet short-term obligations with its most liquid assets that are really valuable in today’s uncertain time.

(Figure 4 – BKNG vs Travel & Leisure Industry in TTM)

Let’s look at the next comparable companies: EXPE, CCL, RCL, NCLH, TNL, TRIP. Despite that BKNG has a high P/E Ratio of 265.14, only BKNG and TNL are generating profit, all others companies currently generate losses for their investors. It is more probable that the current high value of BKNG’s P/E Ratio indicates the expected income growth in the future than BKNG is overvalued.

The P/S ratio is 10.44. The average value among the comparable companies is 19.89. This lower P/S ratio indicates that BKNG is undervalued.

The Fundament for Growth in the Post-Pandemic Time

According to the Global Hotel and Other Travel Accommodation Market Report 2021, the market is expected to grow from $673.02 Billion in 2020 to $801.9 Billion in 2021 at a compound annual growth rate (CAGR) of 19.1%. The expected growth is mainly due to the companies rearranging their operations and recovering from the COVID-19 impact.

The improvement in BKNG’s trends in 2021’s third quarter, and so far in the fourth quarter, following the negative impact from the Delta variant, demonstrates the resilience of leisure travelers who are looking to travel when it is safe to do so, and restrictions are lifted. Moreover, as the global recovery continues, the company is strengthening its core accommodation business to support its long-term growth by aiming to create a superior booking experience and build stronger relationships. The workers continue to see pre-pandemic customers coming back and booking with Booking.com again, while also attracting new customers.

In addition, Glenn D. Fogel, Chief Executive Officer and Director of Booking Holdings Incorporated expressed confidence in BKNG’s ability to capture demand as the global recovery continues. Among other reasons, his confidence is based on the fact that Booking.com is making efforts to provide its customers a ‘connected trip experience’, a trip that is accompanied by direct contact with the company’s representatives via the app. He believes that this strategy will further enhance the strength of their core accommodations business and support the company’s continued growth. In the third quarter of 2021, they already surpassed 100 million monthly active app users for the first time, and they are working hard to encourage the recent growth of Booking.com’s app.

BKNG expands its business not only by internal sources in the pandemic time but also by acquiring other companies. BKNG announced to acquire hotel wholesaler Getaroom for $1.2 billion. BKNG plans to pair the Priceline Partnership Network, which powers numerous websites such as U.S. Armed Forces Travel behind the scenes, with Getaroom to create a new Strategic Partnerships business, Booking Holdings stated. Getaroom has more than 150 affiliate partners for its wholesale hotel business. When Getaroom was sold to private equity firm Court Square Capital in 2018, Getaroom did an estimated $1 billion in gross sales.

Nowadays the short-term perspective predominates in the BKNG stock price dynamic. Despite that BKNG reported a good result for 3Q2021, that beat market expectations, the BKNG stock price has dropped by 3.9% since the 3rd of November. Looking at the last closing price on the 19th of November, we notice that the price stays in the upward corridor, but during the last trading day, it attached the support line. Also, the price stays below the 50-days Moving Average (the green line) and gets the 100-days Moving Average (the yellow line) and 200-days Moving Averages (the red line), with a high trading volume.

I suppose that today the stock market pays more attention to expected worse financial results in 4Q2021 compared with 3Q2021 (that is not surprising) and the BKNG’s stock could go under the support line in the short-term perspective, but it also creates a promising point to open a long position for the long-term.

BKNG Stock Forecast: Conclusion

Despite the significant progress that has been made in the fight against COVID-19 for the last year, the pandemic continues to create uncertainty in the tourism sector. The uncertainty increases the volatility of BKNG’s stock. Today, the recovering time creates unique advantages that BKNG tries to leverage by realizing internal projects as “connected trip experience” and acquiring other companies to accelerate business expansion. I believe that BKNG is a buy stock because the company can construct a solid fundament for future growth under an unstable situation in the tourism industry.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the BKNG stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success with BKNG Stock Forecast

I Know First has been bullish on the BKNG stock forecast in the past. On September 17th, 2021 the I Know First algorithm issued a forecast for BKNG stock price and recommended BKNG as one of the best stocks to buy. The AI-driven BKNG stock prediction was successful on a 1-months time horizon resulting in more than 6.70%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.