AMZN Stock Forecast: The Company that Continues Disruption

This AMZN stock forecast article was written by Nicole Shammay – Analyst at I Know First.

This AMZN stock forecast article was written by Nicole Shammay – Analyst at I Know First.

Summary

- The latest feature on the Amazon Shopping App, miniTV

- Companies acquiring Amazon businesses push capital up to $7 billion since 2020

- Amazon’s key numbers ensure various growth opportunities

- I project a target price of $4,400 on a year-horizon

Overview

Founded by Jeff Bezos, Amazon is an American multinational technology company primarily known for being the world’s largest online retailer and a prominent cloud services provider. The company has multiple websites, software development centers, customer service centers, and more. Amazon focuses on e-commerce, cloud computing, digital streaming, and AI. Along with Google and Apple, Amazon is one of the Big Five companies in the U.S and has long been known for its disruption of well-established industries.

A Free Video Streaming Service?

In mid-May, Amazon launched a new online feature, miniTV, presented on the shopping app. It is exclusively available to users in India as it attempts to compete with YouTube and act as a free streaming channel. miniTV includes several free web series, comedy videos, tech news, food, beauty, fashion, and more. It is essentially a free, ad-supported video streaming service available within the Amazon shopping app.

The main idea is to create a one-stop shop for customers wanting to shop for products, make payments, and watch free entertainment. The new feature will serve as massive competition for YouTube India’s 425 million monthly active user count. The fact that miniTV promises to offer “unlimited entertainment” for free and bring in content from popular YouTubers and not only popular YouTubers but also known channels is a game-changer. It will all be monetized through advertising. Also, with exclusives from popular YouTube creators, Amazon is enticing a large desired audience, rather than just one subset for the urban elite. Though other studios have attempted integrating video streaming into their apps, such as Paytm, Ola, and Zomato, they were unsuccessful. One alteration that Amazon is making to their new platform, which might push them forward compared to others that fell behind, is that Amazon partnered with leading studios and well-known comedians to create desirable content. Amazon might prove constructive due to its efforts to curate India-specific connect. Starting small with miniTV only in India can serve as a trial to assess whether or not customers will find it distracting while shopping.

miniTV seems promising, especially given the money they might make if successful. Because it will rank in revenue through advertising, it is advantageous to understand how much Amazon tends to make. International reports find Amazon’s US advertising revenues grew to $15.73 billion. This increased its market share from 7.8% to 10.3% in 2020. Thus, miniTV might enable Amazon to collect incremental advertising revenue.

The addition of miniTV has also enabled Amazon to be responsible for two video entertainment offerings – Prime Video and miniTV. However, there are a few key differences. miniTV is entirely free and does not require a separate app as Prime Video does. And, Prime Video requires payment in the form of a subscription to Amazon Prime, whereas miniTV will serve as a free service.

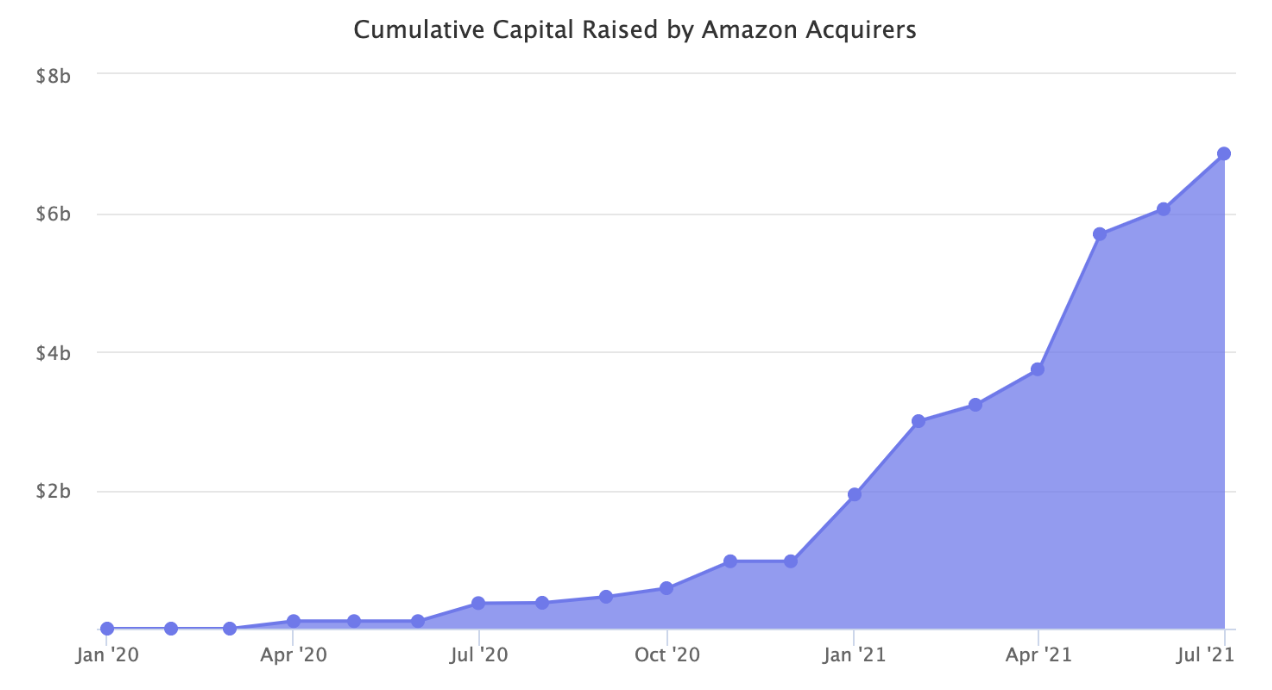

Amazon has become the pinpoint for sellers as one of their primary sources of distribution. Thrasio is a perfect example of this as it is the fastest-growing acquire of FBA businesses. It is also representative of Amazon’s current and expected future growth as it raised another $750 million at a valuation and acquired $1.5 million in revenue per day. The size of the opportunity generated by Amazon and its roll-ups could only allure more companies in and increase more sales revenue. Thus, as this distributor, Amazon also allows for intermediary companies such as Jungle Scout and Helium 10 to provide tools for growth based on demand, economics, and predictability of the marketplace. Amazon values its sellers and ensures that they are making money in the most effective way possible. By offering various resources and aid for successful transactions, Amazon is enticing in more business. The graph below shows that Amazon’s cumulative capital raised purely by acquirers is up-and-coming and proves how much companies depend on Amazon.

Amazon has single-handedly kept operations open for those companies which would not have survived without Amazon’s storage and shipment of their products. Amazon has perfectly utilized its expertise and resources to scale small businesses and operate them under one roof. It is not enough to say that Amazon is a disruptor in various enterprises, but the company has widened its portfolio, become even more lucrative, and has been able to grow its own business and enrich others simultaneously.

Amazon’s Healthy Financials

Amazon’s first-quarter revenue surged 44% year over year in 2021. It exceeded analysts’ estimations and percent changes in various services. Revenue in North America rose 40%, international revenue rose 60%, and AWS rose 32%. Net income expanded 224%, which increased EPS by 215%. These numbers crushed estimates by double, as shown below, and blew away investors.

Thus, looking ahead to the next quarter’s number being released next week, I expect Amazon’s revenue to increase. That being said, as we are coming down from the pandemic when consumers rushed to online shopping, I do not foresee as large of a difference.

Amazon excels because it invests in elements that are extreme growth drivers. It is an e-commerce business and a cloud computing service, advertising business, and more. That’s why Amazon is an excellent stock for the long term. Furthermore, their capital expenditures are well ahead of other big-tech companies, as shown below. This indicates that they are acting on their investments and are constantly aiming to enhance and improve the company. What is also interesting to note from the graph below is how much other companies have plateaued their investments. This reveals the drive Amazon has to infiltrate new industries and further capitalize on opportunities they believe they can prove success with. In other words, Amazon is clearly not resting its operations or its drive.

Conclusion

Amazon grew powerfully and unconstrained in 2020. With massive jumps in revenue, market share, net income, and EPS, alongside extreme capital investments with solid ideas, there is no reason Amazon should begin to level off shortly as they are committed to continuous growth. As they continue to infiltrate new markets, I am confident that Amazon will provide favorable results. So, I recommend the stock as a strong buy and set the price at $4,400.

Lastly, my bullish prediction for the AMZN stock is certainly supported by I Know First’s algorithmic forecast as shown above. With a strong one-year trend signal of 206.47, the forecast represents an optimistic indicator to buy as well as a confident increase in the stock price in one year’s time.

Past Success With AMZN Stock Forecast

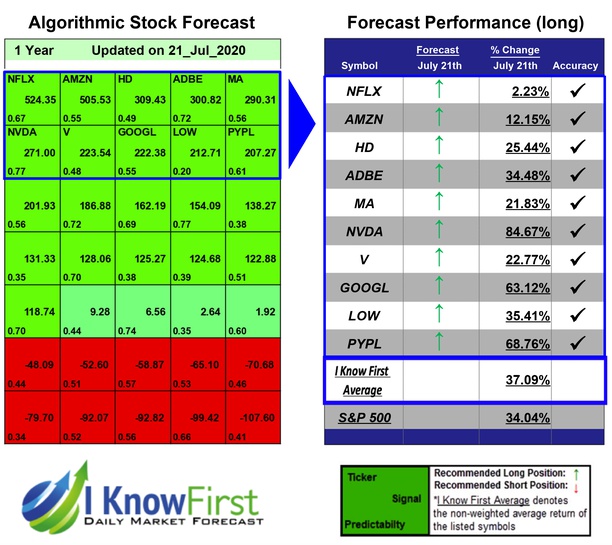

I Know First has been bullish on the AMZN stock forecast in the past. On July 21st, 2020 the I Know First algorithm issued a forecast for AMZN stock price and recommended AMZN as one of the best consumer stocks to buy. The AI-driven AMZN stock prediction was successful on a 1-year time horizon resulting in more than 12.15%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.