Tesla Stock Forecast: Tesla Can Succeed Against The Chevrolet Bolt

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Tesla Stock Forecast

Summary

- The upcoming $37,500 Chevy Bolt from General Motors is not an

existential threat to Tesla.

existential threat to Tesla. - Discerning buyers will continue to favor the high-end Tesla Model S and Tesla Model X cars. The more expensive Model S still outsold the $30k all-electric Nissan Leaf in America last year.

- The Tesla Model 3’s scheduled launch for next year will give Tesla a mass-market equalizer to the Chevy Bolt.

The I Know First algorithm is bullish on Tesla in the long term.

The continuing success of Tesla (TSLA) is forcing established traditional car vendors to try and compete. General Motors (GM) unveiled its first-ever all electric Chevrolet Bolt product during last week’s CES event. Many pundits screamed that the Chevrolet Bolt could threaten Tesla’s growth prospects.

The doomsayers are saying that 200-mile range-capable Chevrolet Bolt could go on sale by the end of this year. This could allegedly kill the planned 2017 launch of Tesla’s mass-market Model 3. I, on the other hand, believe that General Motors’ Bolt will only enhance the future sales prospect of the Tesla Model 3.

The $35k Model 3 will likely tout the same luxury aesthetics of the Model S but with less powerful internal hardware/engine features. Yes, a $37k Chevrolet Bolt will find many buyers but it will likely fare no better than the $29k Nissan Leaf or the $42k BMW i3.

Tesla’s brand power as a new status quo symbol will help the Model 3 compete with the Chevy Bolt and any other mass-market electric vehicles. If cheaper rival EVs could really kill Tesla, the BMW i3 and Nissan Leaf would have done it last year.

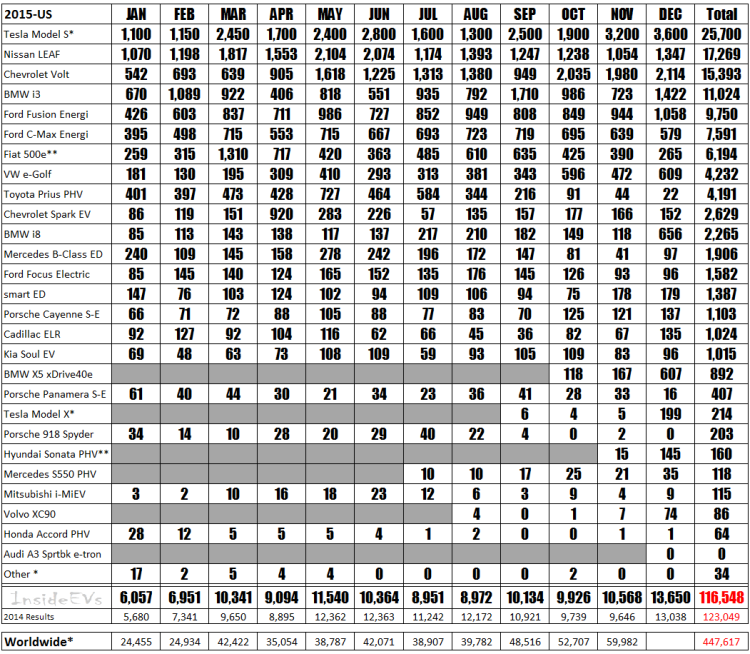

On the contrary, in spite of the much lower price tags of the Nissan Leaf and the BMW i3, the Model S continues to outsell both cars in America. As per the December 2015 report of Inside EV, the Tesla Model S sold more units every month last year than any other pure-electric cars.

(Source: Insideeevs.com)

The estimated total 2015 U.S. sales of the Model S is 25,700 – far higher than second-placed Nissan Leaf’s 17,269. The total global sales of Tesla last year was more than 50k units. This outstanding achievement is a testament to the global appeal of the luxury car Tesla Model S.

This goes to show that electric vehicle buyers are not necessarily going to do an en masse defection toward cheaper EV models. Brand power and the proven track record of Tesla will help it thrive against General Motors. I gladly predict that the Model S will likely sell more units in America than the Chevrolet Bolt will do in 2017.

General Motors is still a newbie when it comes to pure-electric cars. There would be hesitation among customers to fully trust the first generation Chevrolet Bolts. I doubt the Bolt could even hit 15k sales in its first year of commercial availability. The current hybrid Chevrolet Volt had an estimated sales of only 15.3k in 2015.

Tesla’s future is largely dependent only by its ability to improve its production capacity. The Chevrolet Bolt’s alleged commercial launch by end of 2016 is actually a motivating factor for Tesla to upgrade its production/delivery rate.

The Model 3 Will Accelerate Tesla’s Growth

A $35-$40k Model 3 from Tesla next year will also likely outsell the Chevrolet Bolt. It will be an easy choice for prospective buyers to select the mass-market electric vehicle from Tesla over similarly-priced cars from other manufacturers.

A more affordable Tesla car will be every American’s dream opportunity. The Model 3 is the first step toward Tesla’s 500k annual unit sales target. Once the Gigafactory is fully operational, Tesla could seriously ramp up the production of its mass-market electric vehicle.

As the pioneer in commercial electrical vehicle, Tesla will keep on producing innovative products that will keep it ahead of its rivals. Tesla’s current generation Model S is already semi-autonomous car that could park without physical control from a human driver.

The prospect of sub-$35k Tesla cars with autonomous/semi-autonomous features is a future killer idea for car buyers. Not only will they get an environment-friendly car, they will also be emancipated from the rigors of parallel parking and exhausting long-drives.

Conclusion

There is a strong possibility that Tesla’s stock price will rally above $250 once the company starts hitting the 100k annual car sales level. Buying TSLA now while it trades below $220 could prove to be a long-term winner. Another catalyst for a bull run could come when Elon Musk unveils the prototype of the Model 3 this coming March.

The Model S set the bar for what a luxury electric vehicle should be. The Tesla Model 3, not the Chevrolet Bolt, will again define what a mass-market electric vehicle should be.

Furthermore, I like the Personal Referral program of Tesla. I believe this word-of-mouth marketing strategy fortifies Tesla’s direct selling approach. The incentive-driven Personal Referral initiative allowed one person to refer 188 Tesla Model S sales within two months.

The prospect of 50k Tesla owners working hard to persuade their friends and relatives to also buy a Model S or Model 3 is a long-term tailwind.

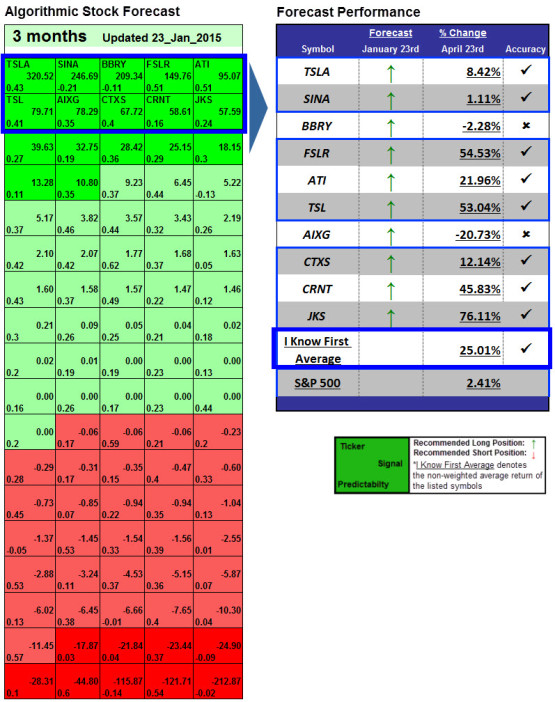

My buy rating for TSLA is again supported by the positive long-term algorithmic forecasts of I Know First algorithm.

I Know First utilizes an advanced algorithm based on artificial intelligence and machine learning to predict market performance for over 3,000 markets including stock forecasts, world indices, commodities, interest rates, ETFs, and currencies. The system follows the flow of money from one market into another.

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

The +32.08 one-year algorithmic forecast means market trend probability hints upside potential for TSLA.

Previously I Know First Predicted Tesla Stock Movement. In this stock forecast, We can observe that Tesla had a very strong signal of 320.52 and a predictability of 0.43 on Jan 23rd, 2015 and just three months later we saw Tesla’s return of 8.42% and the overall package of Tech stocks perform fantastically bringing 25.01% return to all investors that invested equally on the top 10 stocks from the 23rd of Jan 2015.

existential threat to Tesla.

existential threat to Tesla.