Winning AVXL Stock Forecast: Life Changing Treatment Discoveries and M&A Expectations Add Value to Avanex

“We are looking forward, focusing on executing clinical trials using the inclusion of advanced genomic biomarkers into late-stage CNS precision medicine trials, including our Rett syndrome, Alzheimer’s disease and Parkinson’s disease dementia trials – all indications with high unmet need”

-Christopher U. Missling, PhD, President and Chief Executive Officer of Anavex.

Anavex Life Sciences Corp. (NASDAQ: AVXL) is a biopharmaceutical company focused on using genetic medicine to treat neurodegenerative and neurodevelopmental diseases, such as Alzheimer’s disease and Rett Syndrome. AVXL closed on May 25th at $2.72 and closed on June 4th at $3.78, a 38.97% increase in stock price. In comparison, the S&P 500 rose by .94% and the S&P 500 Healthcare Index increased by only .81% in that same time frame.

Anavex saw this huge rally in stock consumption due in part to their breakthrough in Alzheimer disease research. From Q1 to Q2 of 2018, Anavex increased their R&D by $551 thousand, resulting in new healthcare discoveries. During their May 2018 corporate presentation, AVXL released details on their drug, Anavex 2-73, which slows down Alzheimer’s, a huge breakthrough for medicine. Although the company is still experimenting heavily with this treatment, investors saw this as a promising sign for the biopharmaceutical company. The Department of State Health Services of Texas reported that around 5.7 million Americans have Alzheimer’s disease. So, if successful, the treatment created by Anavex Life Sciences could be extremely lucrative, which gives investors confidence in Anavex. Also, there is a lot of hope that their other drugs will soon have major breakthroughs. A million people have Parkinson’s and 1 out of every 10,000 females worldwide has Rett Syndrome so a breakthrough by Anavex would provide them with a niche market, giving them a competitive advantage over competitors.

Moreover, the stock price gained due to the expected increase of M&A for 2018. Pawl Rawlinson, Global Chair of Baker Mckenzie, stated that, “[Baker Mckenzie] forecast an increase in both M&A and IPO activity as deal makers and investors gain greater confidence in the business prospects of acquisition targets and newly-listed businesses.” In 2017, there was a total value of healthcare company acquisitions of $332 billion. Companies started merging with others to take over their R&D and get access to major drugs. For example Takeda recently took over Ariad pharmaceuticals. With new 2018 tax laws in the United States, companies have a lot more cash available that can be used to grow their business, whether that’s investments or acquisitions. Due to this, Oxford Economics forecasts that there will be $3.2 trillion in M&A this year alone. Investors are anticipating that an acquisition of Anavex could take place, causing stock price to go up even further.

Analyst Recommendation

According to Yahoo Finance analysts, AVXL is a buy and has been since March.

(Source: Yahoo Finance)

I Know First’s Algorithms Bullish Forecast Performance For AVXL:

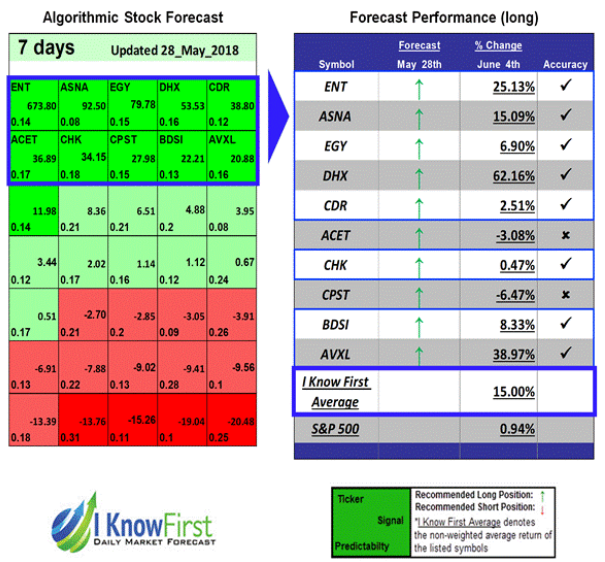

The I Know First algorithm gave AVXL a signal of 20.88 on May 28th with a predictability rating of .16 for the 7 day time horizon. Over this period, the stock gained 38.97%.

Current I Know First subscribers received this bullish AVXL one week forecast on May 28th, 2018.

To subscribe today click here.