The AI Renaissance: 5 Top AI Stocks To Consider

This article was written by Julia Masch, a Financial Analyst at I Know First.

“Given AI’s potential to impact a variety of sectors, we believe it is poised to become one of the most significant technological innovations of the modern era.”

-Alex Ashby, director of product development at Global X

Highlights

- How NVDA, MSFT, YEXT, PFE, and BIDU Are Utilizing AI

- What Technical Analysis Tells Us

- Top Stock Pick By I Know First Algorithm

Artificial Intelligence (AI) is taking over the world. The once fantastical idea of creating machine learning algorithms that adapt and correct for their mistakes has become a reality thanks to cheaper computer processing chips with more computing power. This technology is applicable in almost all facets of our daily lives. In our article about 5 AI Fintech Companies That You Should Know, we discussed how AI can be used in Fintech, one of our priorities here at I Know First. But there’s a myriad of other impacts this technology can be utilized for in sectors ranging from tech to big pharma. We’re in the midst of an AI Renaissance with more and more uses for the sophisticated technology to be used being brought into reality. Meanwhile, more and more companies are adapting AI and machine learning to improve their products or even to create new ones. With the expansion of this technology, the number of stocks with AI interests is growing exponentially and it is becoming harder to tell which AI stocks are worth a buy. So what are some of the top AI companies? Which one’s are the best?

Nvidia

It’s difficult to write an article about top AI stocks without including one of the companies that made the AI Renaissance possible with its GPU that can support the massive amount of computing power necessary for AI. Nvidia’s began as a company focused on creating these chips, but has expanded to become a powerhouse in the AI sector. Nvidia maintains almost ⅔ of the market share for GPUs and demand is only increasing as more people are using the chips for gaming and cryptocurrency mining.

More recently, Nvidia launched its first computer designed specifically for robotics, the Isaac robot platform. This technology will enable artificial intelligence to be applicable in an even greater range of products with new ways of simulation, training, and deployment for autonomous machines. On top of this, Nvidia had a phenomenal first quarter for the 2018 fiscal year that included stunning revenue growth and showcased the company’s outstanding financial health.

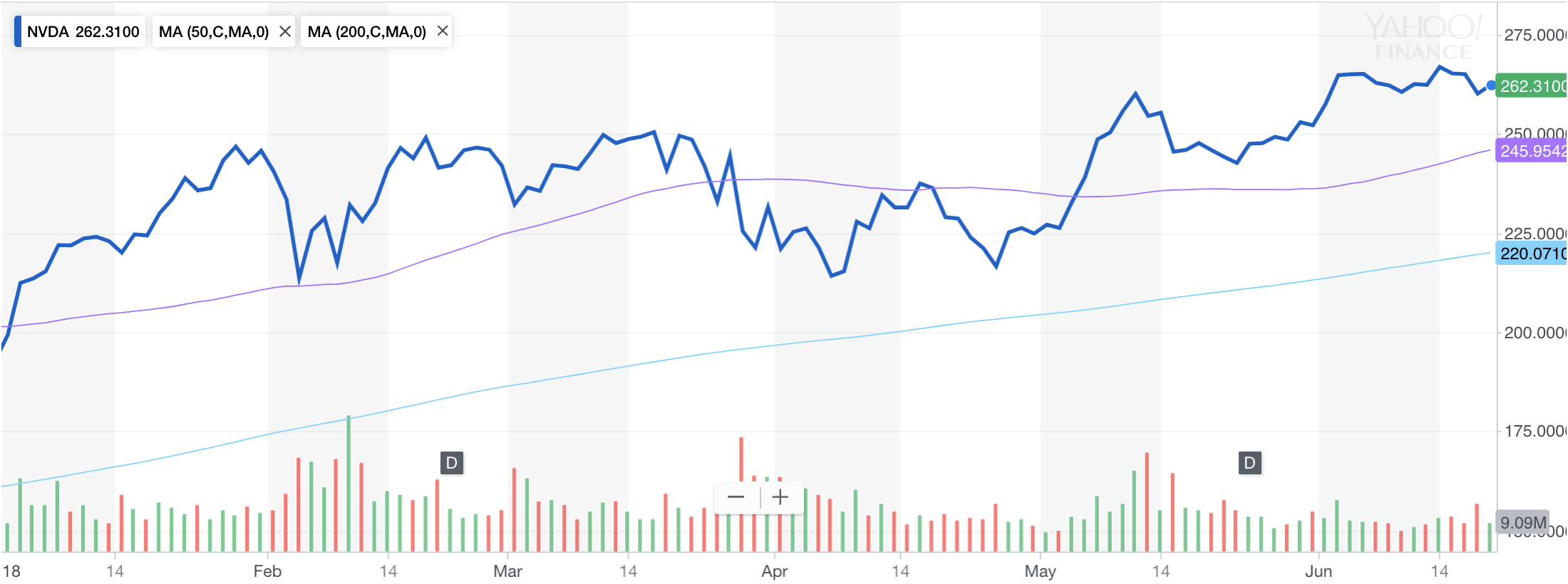

The technical analysis for Nvidia shows a bullish trend with the stock price greater than both the 50 day (purple) and the 200 day (light blue) moving averages (MA). In mid- May, the stock price surpassed the 50 day MA, further solidifying the bullish prediction for the AI company.

Microsoft

Microsoft has always been a force to be reckoned with, but even more so as it has begun to recognize the importance of AI. In 2017, the company officially listed AI as a top priority and has made the transition from a company focusing on a mobile and cloud based company to a vision of an intelligent cloud that is infused with AI. Since then, the company has become one of the leaders in AI and recently partnered with Amazon to create open source AI software for developers. In doing so, Microsoft is further opening the door to the world of AI and introducing a new world of applications for the technology.

Microsoft’s 50 day MA is well above the 200 day Ma, showing consistent growth for the company over recent months. Additionally, after dipping below the 50 day MA in April, MSFT has pulled ahead once again and it now greater representing a bullish trend for Microsoft.

Yext

Like Microsoft, Yext wants to bring AI solutions to more companies such as banks, restaurants, doctor’s offices, and more. Yext is a digital knowledge management platform that uses AI to take the large amounts of data available about a company and create an output it in a digestible format. This allows companies to control their brand image online in nearly real-time leading to better brand engagement, traffic, and sales. The company is relatively new to the stock market, only going public in April 2017. Recently, the company has teamed up with Yelp to better support enterprise businesses on top of releasing 15 new knowledge assistant skills.

Yext stock price has been above the 50 day and 200 day MA since mid April indicating a bullish momentum. More recently, in early may the 50 day MA also crossed above the 200 day MA further solidifying this upswing momentum for YEXT.

Pfizer

Pfizer is one of many pharmaceutical companies that is beginning to take advantage of AI to detect disease as well as to create targeted approaches to curing diseases. Billions of dollars are spent by pharmaceutical companies every single year on research and development of new drugs. Recently, companies have begun putting some of this money on creating AI that will help hone in on potential cures for disease or have the ability to detect disease. Pfizer’s R&D total was above $7.5 million in 2017 and 2018.

Additionally, in December 2016, Pfizer became one of the first organizations utilizing IBM’s supercomputer Watson for drug discovery. The collaboration used a cloud-based platform to target cancer therapies and find out the most effective treatments.

According to technical analysis, Pfizer has a bullish forecast with the stock price above the 50 and 200 day MAs and a very recent crossover of the 50 day MA and 200 day MA.

Baidu

Baidu may be last, but it is certainly not the least. The US is not the only country that is taking advantage of AI: China has set a goal to be the world’s leader in AI by 2030. Many companies are working on incorporating AI for their products and clients (some are even talking to I Know First about implementing our algorithm for their services). Baidu, a Chinese search engine, is leading the way. In 2014, the company founded a Big Data Lab focusing on machine learning, core search technologies, and finding uses for big data. Like Google, Baidu sees potential in the data it receives from searches and wants to convert this into useful information for consumers and companies. Thanks to China’s huge population, Baidu has an almost unparalleled amount of data it can use and may be one of the first companies to use AI to provide insights on global markets.

In February, the Chinese government gave Baidu approval for a state-backed engineering laboratory geared towards deep learning applications. Baidu now employs over 1,000 people in their AI group. On top of this, Baidu is still aggressively expanding its AI unit with new hires, investments, partnerships, and acquisitions. Recently, the company acquired Revn Tech, a start up developing AI platforms for smart homes, and so Baidu may soon join the smart home market.

Baidu recently had a golden cross in which there was an intersection of stock price, 50 day MA, and 200 day MA with BIDU coming out on top, followed by the 50 day MA, then 200 day MA which indicates an upswing in the stock.

Conclusion

After reading through all of these company descriptions and seeing all of these bullish technical analyses, you may be wondering which one is the best to invest in? Unfortunately, there’s no single answer and it depends what you want in your portfolio. If you want to invest in an AI giant, then Nvidia’s your answer. If you already have a lot of AI stocks, a dip into the pharmaceutical market through Pfizer is best for you. If you’re not scared of a potential trade war with China, Baidu is a solid stock. If you still can’t make a decision, perhaps an ETF focused on AI stocks such as the Global X Future Analytics Tech (AIQ) fund, which is comprised of companies leading AI as well as companies that benefit from it, is best for you. Overall, the AI market is bullish for many of the stocks in it because of the enormous potential of AI. Smart homes, autonomous vehicles, and more are being developed and there’s still so much more to come from the future of AI.

Top Stock Pick By I Know First AI Algorithm

While all of the aforementioned stocks are solid buys right now, currently, the I Know First algorithm has the strongest prediction for Baidu with a signal of 146.66 and predictability of 0.68 for the long term 1 year period. It is no surprise the company has such a bullish forecast with such a strong focus on AI and backing from the Chinese government, the company has far to go.

How to read the I Know First Forecast and Heatmap

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.