BIDU Stock Forecast: Not Satisfied with Being Chinese Google

The article was written by Yutian Fang, a Financial Analyst at I Know First and Master of Science in Finance candidate at Brandeis International Business School

“AI is an enormous opportunity that will revolutionize the Internet and traditional industries. Baidu, in particular, is well positioned to lead the AI wave in China, with our unique combination of technology, data and talent. Our existing platform, including our search and newsfeed products, are enhanced by AI and enriched by our content and services ecosystem. We are thrilled by the opportunities that our existing platform has opened up and are excited to build the next generation of AI-enabled businesses.” – Robin Li, Chairman and CEO of Baidu

Source: bitrazzi.com

Source: bitrazzi.com

Summary

- Chinese google maintained its leadership far more by dominant market share

- AI platforms made significant contributions to the company’s revenue growth and brought more potential with extensive partnerships across industries

- iQIYI, of which Baidu is the major stockholder, grew rapidly with a user base quadruple Netflix’s and is seeking for more integration across platforms, and online and offline worlds

- Healthy operations and technical analysis supported my recommendation to regard it as a good buy in the long term

Stock price movement since our last analysis

Stock price movement since our last analysis

On June 14th, Baidu, Inc.(NASDAQ:BIDU) announced its comprehensive partnership with China Mobile in frontier areas such as artificial intelligence, big data and 5G. Besides leveraging their respective core strengths-China Mobile would offer data plans specifically for Baidu products and Baidu provides technical support for AI applications in telecommunications, the cooperation also included co-development of Baidu’s existing Apollo autonomous driving platform, building market for mobile-connected cars. As one step in its publicized plans to get “everyone on this planet” to use its AI systems, it foreshadowed Baidu’s future partnerships with 5G wireless, automakers and AI companies in the following years. The stock price reached to $272.97 on June 15th, with an increase of some 14% from the bottom following the announcement about Qi Lu, the recognized leading AI expert in the company, stepping down as COO.

Chinese Google remains leadership in search engine market despite missing the boat on mobile internet

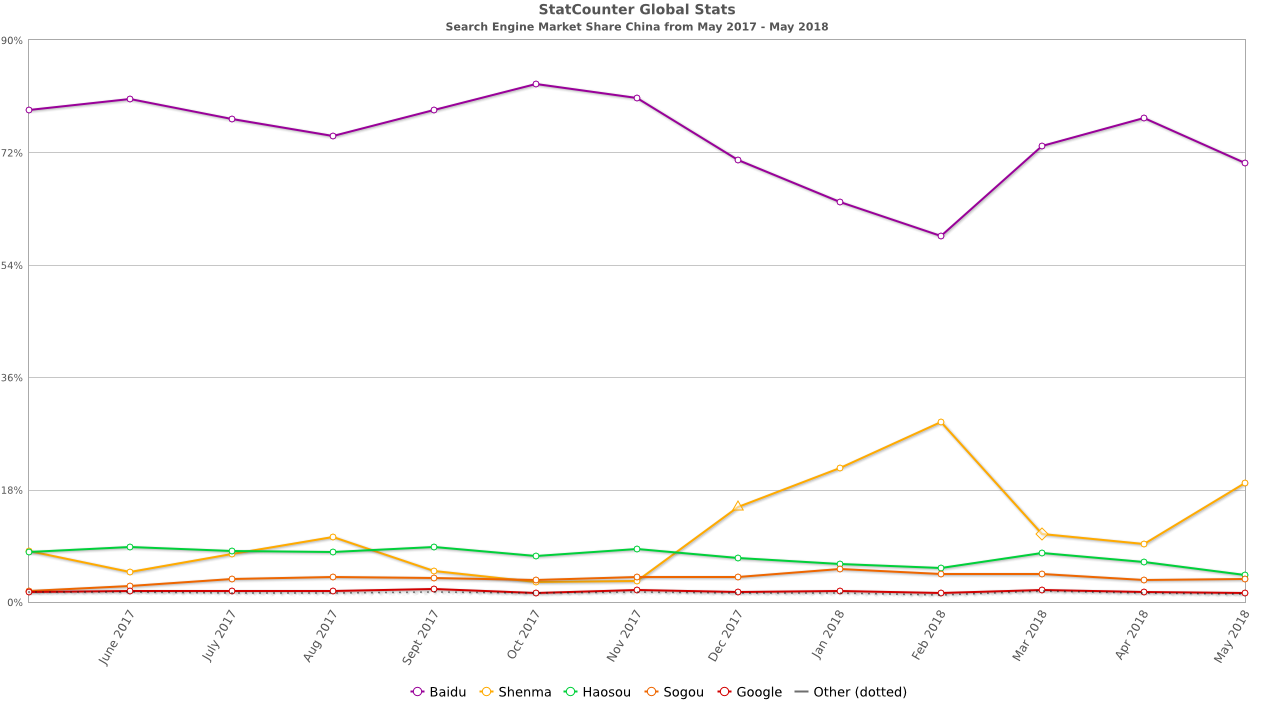

Search engine market share in China for the most recent year. Source: Statcounter.com

Search engine market share in China for the most recent year. Source: Statcounter.com

As the leading Chinese language Internet search provider, Baidu had remained its dominant market share of nearly 80% for years until the end of last year. The striking disruption came from Shenma, which is a mobile search engine formed by Chinese browser-maker UCWeb in a joint venture with Alibaba and attained a penetration rate of over 15% in total browser market by its stance in app and book search and more importantly, its integration with Alibaba products. However, market share was not the only one factor that helped Baidu remain its leadership. Other contributors included Baidu’s marketing strategy and innovation.

“There are 18 formats on Baidu. Not just side links but videos and images, and we can also work with feeds, product listings, whatever works best for the industry vertical. We also have some mobile-specific formats, such as a three-image carousel for example,” said Linda Lin, general manager of Baidu.

It also cooperated with Forward3D, a global digital marketing agency to advertise Western brands to Chinese customers to meet the demand brought by Chinese people’s increasing spending power and new spending habits. To help its customers better match users’ favorites and boost their operating efficiency, it introduced deep neutral network (DNN) technology into its click-through rate (CTR) estimation and started using reinforcement learning in its Phoenix Nest online marketing system.

Two AI platforms become pillars for the potential growth

Baidu had invested 1.6 billion RMB ($250 milion) in R&D of AI In 2016 and 2 billion RMB in 2017, which made up for 15-20 percent of total search revenues and ranked it biggest investments in AI across all Chinese companies. Currently, it has two mature AI platforms and many of the deriving applications have already been or will soon be put into market use.

Apollo version 2.0. Source: cnet.com

Apollo version 2.0. Source: cnet.com

Apollo autonomous driving platform was established on partnership with 50 automotive companies. On Aril 19th, Apollo 2.5 has been released just four months after 2.0. The newest version added new highway-driving capabilities and chopped down barriers to fast, efficient development by making advancements in camera-based perception, real-time relative mapping, high-speed planning and control, and developing other efficient tools. It also announced to launch the Apollo Automotive Cybersecurity Lab that would work to enhance safety in mobility. It is expected that with Apollo 2.5, much more will be possible in months ahead. These developments would be accelerated by its partnerships with BYD and other 99 companies including automakers, components suppliers, mobility service providers, software platforms, etc. This year, Baidu’s first autonomous car-a small SUV-will be released yet it’s not prepared for use on public roads.

Source: dueros.baidu.com

Source: dueros.baidu.com

Xiaodu Soundbox. Source: chinamoneynetwork.com

Xiaodu Soundbox. Source: chinamoneynetwork.com

The other platform is DuerOS, a native language interaction platform that allows users command and communicate with smart devices. Hardware devices that are transferable to DuerOS platform have a vast coverage of household appliance, robot, wearable devices, automobile, etc., bringing about partnerships with companies like hardware manufacturers, chip makers, content providers and more. On June 11th, a month after it launched Xiaodu Zaijia, a smart speaker with screens, Baidu released its latest product Xiaodu with discounted price of some $14, which empowered with artificial intelligence, is able to switch between two modes-“Child mode” and “Geek mode”, being more flexible and developed in voice recognition and communication and could be individualized after 30 days of use. Although facing fierce competition from other tech giants like Alibaba, Tencent and Jingdong, Baidu’s high accuracy voice recognition technology, along with its advanced microphone functionalities, echo cancellation, voice ‘wake-up’ and face recognition technologies would contribute to the ecosystem involving the whole supply chains of IoT business.

The Netflix of China grows at a breakneck pace

Since Spinning off from Baidu and going public on March 29th , iQIYI(NASDAQ: IQ) stock kept roaring from $15 to over $40, achieving an increase of 158% in one and half months. As reported in Baidu’s Q1 2018 earnings report, with an active user base that quadrupled that of Netflix, iQIYI generated revenue of 4.9 billion RMB with an increase of 57% year over year, all of its segments showing sold growths. It established partnership with Jingdong, enhancing customer services for both sides and successfully attracting over one million new users in the first week after the product released. More than being streaming service, on May 21st, iQIYI announced the launch of its first brick-and-mortar theaters, which featured mini-sized rooms, online movie library and world-class facilities, to expend the company’s reach to Chinese increasing moviegoers.

Financials demonstrate significant revenue growth and operating health

Baidu’s quarterly revenues in most recent five years. Source: amigobulls.com

Baidu’s quarterly revenues in most recent five years. Source: amigobulls.com

Baidu’s total revenues for the most recent quarter were RMB 20.9 billion ($3.33 billion), increasing 31% year over year. Operating income was RMB 4.6 billion ($728 million), increasing 128% year over year. Operating margin reached 22%, compared to 13% for the same period in the prior year. The company’s net income for the fiscal year of 2017 was 18,288 million ($2,810 million), growing up 57.7% from the prior year. According to Simply Wall St’s analysis model, even though Baidu’s past earnings growth exceeded the US Internet industry average, its future annual earnings growth is expected to be 14.8%, which is slightly below the expected industry average. According to the most recent data, the company’s ROE was 16%, compared to the industry average of 12.8%, demonstrating a good management efficiency. Meanwhile, the company’s ROA is 8%, a little higher than the industry average of 7.4% and its debt level has reduced in the past 5 years and now the Cash Flow-to-Debt Ratio is about 65%.

Technical analysis and analysts recommendations

It was not until Baidu released its strong financial data for Q1 2018 that the stock price broke out the channel after the second confirmation of the support level. The new ceiling has been raised to a level higher than $280 but without support of increasing volume. The price dropped down to a bottom due to the announcement that Qi Lu stepped down as COO, whom was regarded as the leading expert in Baidu’s core business and made investors concerned about the company’s AI strategy after seeing a series of high-profile AI experts left company since the start of last year, where the nervousness has been shown by the high trading volume. The stock price is showing recovery and probably further uptrend as the trading volume increased a little when compared to the past levels.

Source: StockTA.com

Source: StockTA.com

Currently, Baidu’s PE ratio is 26.3%, falling between the average levels of US market and Internet industry. Since the potentials for further revenue growth have not manifested yet and market tended to have doubts on the actual return brought by its vast investments in new fields, the stock seems overvalued in terms of price/earnings to growth ratio.

Source: Nasdaq.com

Source: Nasdaq.com

Analysts monitoring this stock tended to have the consensus that they were positive on the stock performance for the following months. All 13 analysts gave a recommendation to hold or buy with a split of half to half.

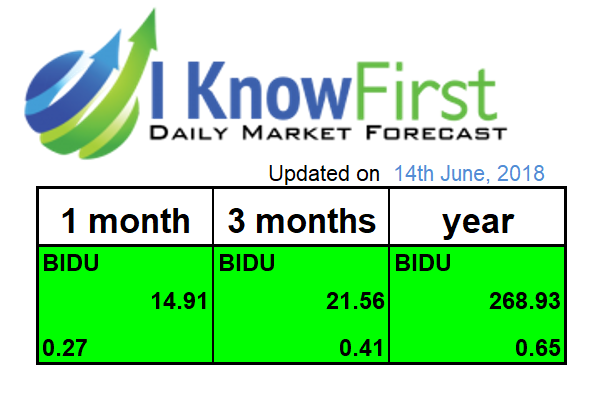

Current I Know First Algorithm Forecast for BIDU

In I Know First Algorithm forecast dated on June 14th, 2018, the signals for all three time frames were positive-signals for one month, 3 months and a year is 14.91, 21.56 and 268.93. The predictabilities also showed an increasing trend as the forecasting period becomes longer. In particular, I Know First’s forecast for one year got a predictability as high as 0.65. Combined with a very high signal, it suggested that BIDU be a strong buy if it matched investors’ desired investment time frame.

Go here to read how to interpret this diagram.

Past I Know First Forecast Success with BIDU

On September 26th , 2016, I Know First Algorithm gave very strong forecast on Baidu. The signals for 1 month, 3 months and 1 year are as high as 86.83, 153.56 and 356.69 respectively. We believed that BIDU is a good buy for long-term investment since it would benefit from China’s rapidly growing digital advertising industry and the relatively low PE ratio also proved the potential.

Stock price movement since I Know First past forecast

Stock price movement since I Know First past forecast

As seen in the graph of the stock’s actual movement, in the period that covered our forecasting, the stock price rose by 43.30%, which echoed our previous analysis and I Know First Algorithms’ Forecast.

Current I Know First subscribers received this BIDU forecast on September 26th , 2016. To subscribe today, click here.

Conclusion

The Chinese Google still remains dominant competitiveness in the search engine market thanks to its efforts put in innovation and advanced marketing strategy. BIDU’s focus in establishing AI ecosystem has made achievements by partnerships with companies across manufacturing, auto and technology industry and helps the company penetrate further into IoT and self-driving car business. According to the most recent quarterly report, some AI applications have created market value and made significant contributions to the total revenue growth, while some are still in labs or on the way to market use. Some investors held consecutive view on the company’s AI strategy when considering that, fierce competition from other tech giants may exert pressure on its market share and earnings, along with the fact that several top AI executives left the company. Based on our financial and technical analysis, I take the long position as the company enjoys healthy operation and the stock has potential to enter into an ascending channel in the long term, which is also supported by the current I Know First bullish forecast for BIDU.