Tesla Stock Forecast: Transforming the Future

This article was written by Talia Shakhnovsky, a Financial Analyst at I Know First.

Tesla Stock Forecast: Transforming the Future

“There is not a demand problem. Sales have far exceeded production…We have a decent shot at a record quarter on every level”

– Elon Musk, Tesla CEO at 6/11/2019 Annual Shareholder Meeting

Summary:

- Despite decreasing vehicle sales, global demand for electric vehicles is growing; Tesla is attempting to enter the global market by building a Gigafactory in China.

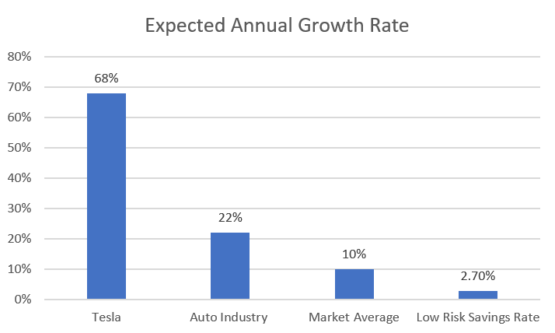

- From the first quarter of 2018 to the first quarter of 2019, Tesla’s revenue grew by 32.23%, surpassing automotive industry revenue (-1.61%). Tesla’s expected annual growth of 68% also exceeds the auto industry’s expected growth of 22%.

- At Tesla’s annual shareholder conference, CEO Elon Musk discussed continuing demand, Tesla’s acquisition of battery company Maxwell Technologies, and the new semi pickup truck among other developing technological advances like fully autonomous vehicles.

- Tesla’s financial statement supports a long term bullish outlook, with a potential June 2020 share-price of $333.

TESLA Logo – Source: Wikimedia

Current Automotive Market Trends Overview

The bull market of today is the longest period of uninterrupted gains in American history. While the Federal Reserve is unlikely to cut interest rates at the moment, it has signaled that it is open to cutting rates in the future, promoting further market growth. Tesla Inc (TSLA) is a member of the Consumer Cyclical sector, a category of stocks including the automotive industry that relies heavily on economic conditions and the business cycle. In periods of economic expansion, like nowadays, investors often recommend Consumer Cyclical stocks because risk in equities is low, so people can pursue an aggressive growth-oriented strategy.

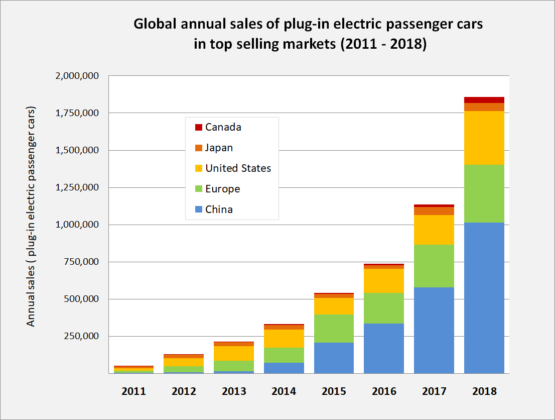

Global current events and trends indicate a positive future for Tesla. Even as the Chinese trade war continues, Tesla continues its bid for the world’s largest electric vehicle market – China. In 2018, China’s electric vehicle sales reached 1.2 million units, or 56% of the global market, of which only 24,000 were imports. Tesla is building a 210 acre Gigafactory in China with the capacity to manufacture 500,000 vehicles annually. By building in China’s ‘Free Trade Zone,’ Tesla does not need to partner with domestic producers, although it may still be subject to 15% tariffs. While global vehicle sales are contracting, demand for electric vehicles is growing due to government incentive programs, better performance, lower cost of ownership, improving infrastructure for electric vehicles like Tesla’s charging stations, and general support for energy efficiency initiatives.

Electric vehicle sales by region – Source: Wikimedia

Tesla Competitive Position Worldwide

Although the auto and truck manufacturer industry as a whole is struggling, Tesla has the potential for further and further growth. For instance, from the first quarter of 2018 to the first quarter of 2019, the industry’s revenue fell by 1.61% and the sector’s revenue fell by 2.02%, but Tesla’s revenue grew by 32.23%. Furthermore, Tesla’s expected annual growth rate is 68%, exceeding the low risk savings rate of 2.7%, the expected market average of 10%, and the auto industry’s expected annual growth of 22%.

Due to falling demand, Moody’s downgraded the auto industry outlook from stable to negative. The electric vehicle market, however, is on the rise. Based on McKinsey’s forecast, electric vehicle producers could quadruple annual sales by 2020, led by China’s demand. Electric vehicles are gaining industry importance as government incentives and tax breaks for energy efficiency become more and more prominent. Although Tesla’s traditional competitors like BMW, Ford, and GM, are beginning to produce electric cars, Tesla is the global leader.

Expected Annual Growth Rate for Tesla vs Auto Industry, Market Average, and Low Risk Savings Rate

Data Source: Simply Wall Street

Tesla’s Business Growth Review

Tesla, now an industry standard in electric vehicles, was founded in 2003 and despite continuous net losses, it has forged a path of research, development, and growth. Tesla is an American multinational corporation which designs electric vehicles, lithium-ion batteries, and solar panels. Tesla’s vision: to make affordable electric cars, reaching global consumers. Elon Musk is Tesla’s CEO and an innovative entrepreneur, but also one of unfulfilled promises. He is highly distrusted by Wall Street for often erratic behavior and untrue statements. For instance, just this week after an argument over not giving credit for a piece of art he shared on Twitter, Musk tweeted “Just deleted my Twitter account” on his still active Twitter account.

At Tesla’s annual shareholder conference, which took place on Tuesday, June 11th, Elon Musk offered a positive outlook for Tesla’s future and Tesla as the future, claiming that “If you buy a gasoline car that is not self-driving, it’s like riding a horse and using a flip phone.” Wall Street analysts have questioned demand for Tesla’s cars in 2019, but Musk explained, “There is not a demand problem. Absolutely not.” He highlighted that Tesla was still finding new customers, with 90% of orders coming from customers who do not hold reservations and with sales exceeding production. Further, a leaked staff email illustrates that Tesla has a chance of reaching record deliveries this quarter. At this shareholder meeting, Musk also discussed Tesla’s recent acquisition of battery company Maxwell Technologies. This acquisition will make scaling up production of lithium-ion battery cells cheaper and easier, which Musk earlier cited as the biggest obstacle to Tesla’s growth. Musk also discussed Tesla’s forthcoming “cyber-punk” pickup truck, which will start at less than $50,000 and be more functional that a Ford F-150, according to Musk’s claims. Throughout the meeting, Musk also mentioned Tesla’s new insurance, new solar roof tiles, and an upcoming roll-out of the “Advanced Summon” feature which allows Tesla owners to call their cars to them.

Musk further discussed upcoming technological advances and Tesla’s level of growth. He asserted that Tesla would soon have a 400-mile range car. He also maintained that Tesla drivers will be able to use self-driving features sometime next year: “Every car made since October 2016 is capable for full autonomy with replacement of the computer alone.” While Tesla still needs regulatory approval, the technological capability exists. Finally, Musk justified Tesla’s lack of profitability because of its level of growth. Tesla made as many cars last year as in their entire history and is on track to grow its “fleet” by 60-80% this year. With that growth level, Musk declares that Tesla can still be cash-flow positive.

Tesla’s Gigafactories were not deeply discussed during the shareholder meeting but are crucial for potential investors to note. The Nevada Gigafactory, which will be the world’s largest building once completed, will drive down battery production costs because of its density and energy efficiency. As mentioned before, Tesla’s new Gigafactory in Shanghai will allow Tesla to tap into the large Chinese market for electric vehicles with lowered production, lowered distribution costs, and by removing the need to pair with domestic Chinese producers. Tesla has also announced plans for a Gigafactory in Europe, although the location is still unknown.

Tesla’s Nevada Gigafactory – Source: Wikimedia

Tesla’s Financial Position Analysis

Finally, Tesla’s financials illustrate why Tesla is likely to be a bullish long term investment. Tesla’s model 3 is the best-selling US car by revenue. Furthermore, Tesla’s quarterly and annual revenue has been growing: Tesla’s revenue for the quarter ending March 31st, 2019 was $4.54B, a 33.23% year to year increase and Tesla’s annual revenue for ending March 31st, 2019 was $22.594B, an 81.17% year to year increase. Tesla’s profit is growing as well, with Tesla’s gross profit for the quarter ending March 31st, 2019 at $0.556B or a 23.92% year to year increase and Tesla’s gross profit for the year ending March 31st, 2019 at $4.151B or a 106.42% year to year increase. Next, Tesla’s cash flow from operating activities reached $2.097B as of December 31st, 2018 compared to -$60.654 million a year before. While Tesla’s net income is still negative at -$1,062,582 as of December 31st, 2018, it is also increasing compared to a net income of -$2,240,578 as of December 31st, 2017. Tesla’s long-term debt is decreasing, reaching $8,460,873 on December 31st, 2018 compared to $9,486,248 on December 31st, 2017. Long-term debts are loans and liabilities which are due within more than a year of when they are created. A high debt burden leaves a company with little room to operate, because money must go to paying off interest on the debt. Tesla’s ability to reduce its long term debt highlights that it has enough cash flow to pursue research, development, and expansion while still reducing debt. Over the past 5 years, the level of debt compared to net worth has been reduced from 241.5% to 190.4%. Over the period from December 31st, 2017 to December 31st, 2018, it is also important to note that Tesla’s inventory turnover ratio increased from 4.213 to 5.5948. Inventory turnover indicates the number of times a company sells and replaces its stock of goods over a time period. The inventory ratio is the cost of goods sold divided by the average inventory over the same time period. An increasing inventory turnover like Tesla’s means that a company is selling goods quickly and that demand for the product exists. By December 31st, 2018, Tesla’s inventory turnover ratio had passed the industry average of 5.49, showcasing that Tesla is selling goods faster than its competitors.

Many investment management companies support a bullish forecast for Tesla including CIBC which issued a $437 price target on Tesla shares on January 31st, 2019 and Jefferies Financial Group which set a $450 price target on Tesla shares on the same day. Recently on May 31st, JMP Securities set a $369 price target on Tesla shares, explaining that “more Model 3s were registered in April and May than during all of the first quarter.”

US Passenger Car Sales in Q3 2018 – Source: electrek

Conclusion: Tesla Valuation

Tesla is currently trading at $224.74 per share and has been trading strongly for the past couple of weeks but is down over the course of the year from a high of $369.09 per share. Considering Tesla’s dominance in the growing market for electric vehicles, Tesla is a good investment for the long run. CEO Elon Musk is optimistic about Tesla’s future, and especially Tesla’s demand: “I think it’s basically financially insane to buy anything except an electric car that is upgradeable to autonomy.”

At a share price of $224.74 and .173B outstanding shares, Tesla’s current value is $38.89B. Musk predicts more than 1 million Tesla vehicles will be produced by 2021, and plans to target 3 million vehicles annually by 2023. Musk’s forecast appears feasible, with Tesla’s production already tripling from 120,000 vehicles in 2014. In 2016, Tesla’s production target was 500,000 vehicles and Tesla traded at roughly $200 per share. If Tesla reaches roughly double the output by 2021 (Musk’s outlook) and issues no change in price, its value may double as well, so double the share price is possible. This prediction assumes demand for Tesla’s will continue to exceed supply, according to Musk’s statements at the 2019 shareholder meeting. $400 is an ambitious target for 2021 because it takes Musk’s forecast for granted, but is also a reasonable number in the context of Tesla’s upcoming growth with new Gigafactories, expansion into global markets, more efficient batteries, and new vehicles. Assuming relatively constant growth, Tesla may be two thirds of the way to this share price by June 2020, or at a price of roughly $333. Thus, I predict Tesla is stepping into a future of growth with an expected June 2020 share price of $333, in accordance with I Know First’s bullish forecast.

Current I Know First Forecast

I Know First’s machine learning algorithm has a positive outlook for TSLA. The stock is bullish over the 1 month, 3 months and 1-year horizons. For the 1-year horizon, the signal is strongest at 212.465 with a predictability indicator of .52.

Past I Know First Success

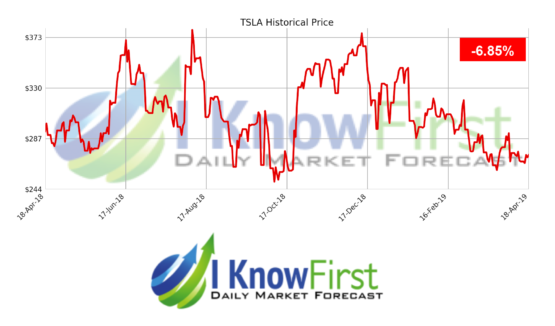

On April 18, 2018 I Know First published a bearish forecast for TSLA. Since then, the stock price has fallen from 308.4 to 231.05, highlighting another success of I Know First’s algorithm.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.