Sustainable Stocks: ESG Does Good Through Investing

![]() This sustainable stocks article was written by Milana Papadopoulou – Financial Analyst at I Know First.

This sustainable stocks article was written by Milana Papadopoulou – Financial Analyst at I Know First.

The Future is Sustainable

Sustainable Stocks: ESG has been one of the hottest topics in the financial industry in recent years. Daily financial digests were rare to avoid mentioning the movement, and some respectable magazines even created links to provide easy access to headlines on their landing pages. Themes of environmental, social, and government factors were heavily discussed during news episodes and were applauded by politicians. Bold claims emerged during the COVID-19 pandemic: “ESG Funds to outnumber conventional funds by 2025” – was the headline of a 2020 PwC report. With the amount of live interest and avid discussion, it is sometimes hard to determine the true potential of ESG investing and whether it is indeed “the future”.

Who Cares Wins

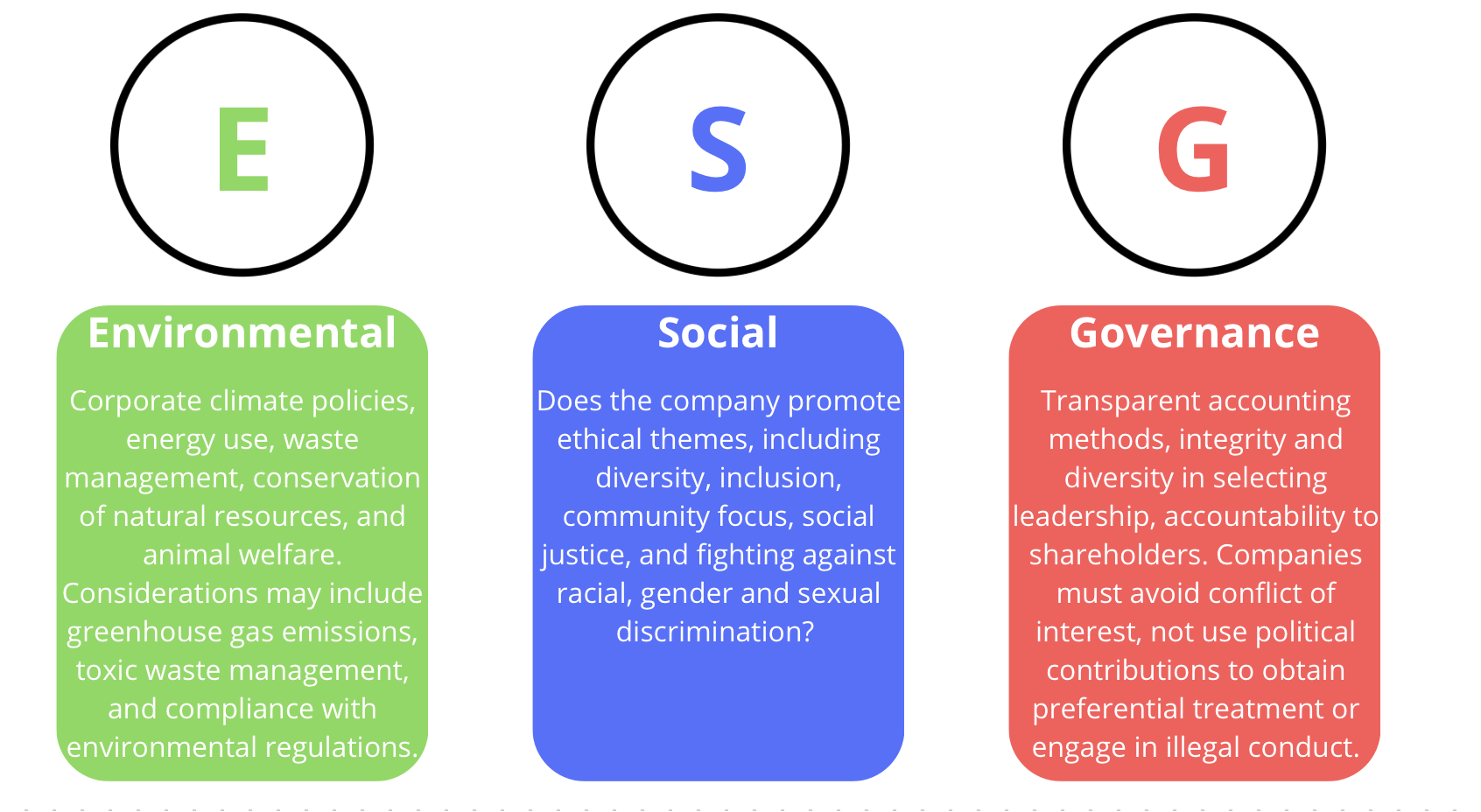

The term “ESG” was first used in a 2004 joint report by the United Nations and Swiss Federal Department of Foreign Affairs “Who Cares Wins, Connecting Financial Markets to a Changing World”. The report encourages the finance industry to include environmental, social and governance factors in asset management decision-making.

Since the report, ESG investment has expanded significantly. In 2020, about $35 trillion in assets were being managed following ESG principles, as the Global Sustainability Investment Alliance outlined. ESG investing has existed informally since the 1960s. Some investors would exclude companies engaging in business activities they deemed immoral from their portfolios. At the time, investors would shun away from firms facilitating the apartheid regime in South Africa. They further expanded the ideology towards tobacco companies and arms manufacturers.

Looking Outwards

ESG has moved centre-stage within the global investment arena in recent years. It is one of several approaches to investing that are as concerned with the impact on people and the environment as they are with potential financial returns.

The Effective Altruism movement is one of the vehicles that drove awareness and interest in ESG. It has spread the ideas of ESG investment, especially for younger people, as the movement has a strong presence in elite schools in the UK and the US. EA calls members to do good rationally, one of which is investing in socially beneficial causes. The idea has been further spread by Dustin Moskovitz, the co-founder of Facebook, who has been an influential advocate for socially beneficial investing and avid supporter of the notion that companies need to “look outwards”, i.e. thinking about social causes.

In 2020, Larry Fink of BlackRock, the most significant financial firm, stated that a fundamental shift in capitalism was underway to which companies and investors needed to respond if they wished to prosper.

Sustainable Stocks: Investment Trends

ESG investors are increasingly influencing large institutional investors such as public pension funds. According to a report from the US SIF Foundation, investors held $17.1 trillion in assets chosen according to ESG principles in 2020, from $12 trillion just two years earlier. ESG-specific mutual funds and ETFs also reached a record $400b in Assets Under Management in 2021, up 33% from the year before.

The number of financial products that can allow an investor to gain exposure to ESG is climbing rapidly. An individual investor can opt for ETFs that aggregate the performance of companies that generally follow ESG principles or pick a more tailored approach and select indices that track specific “causes”. One example is the FTSE4Good Index Series: it offers indices that track emerging market ESG companies, ESG companies based on location or those with historically low variance.

Sustainable Stocks: Behind the Smoke and Mirrors.

ESG, however, does not always have an upside, and investors still need to exercise caution. First, ESG companies may often overstate or hide specific facts, essentially “greenwashing” themselves. Legislative agencies worldwide are working to set more explicit rules for what is considered satisfactory for each factor. EU rules implemented in 2020, for example, force asset managers to disclose detailed information about the sustainability of their funds. France has been the most prominent advocate in the bloc after an enquiry revealed funds promoting themselves as pure ESG when it was only a minor part of their portfolios.

In 2021, ESG investing was again criticised when BlackRock’s former Chief Investment Officer for Sustainable Investments called it “a dangerous placebo”. He called out funds that promoted ESG investing to collect higher fees. According to data from FactSet published by the Wall Street Journal, ESG funds had an average fee of 0.2% at the end of 2020, whereas other more standard baskets of stocks had fees of 0.14%. Mr. Fancy claimed that ESG investments overstate their impact and that market-led solutions distract from government-led ones.

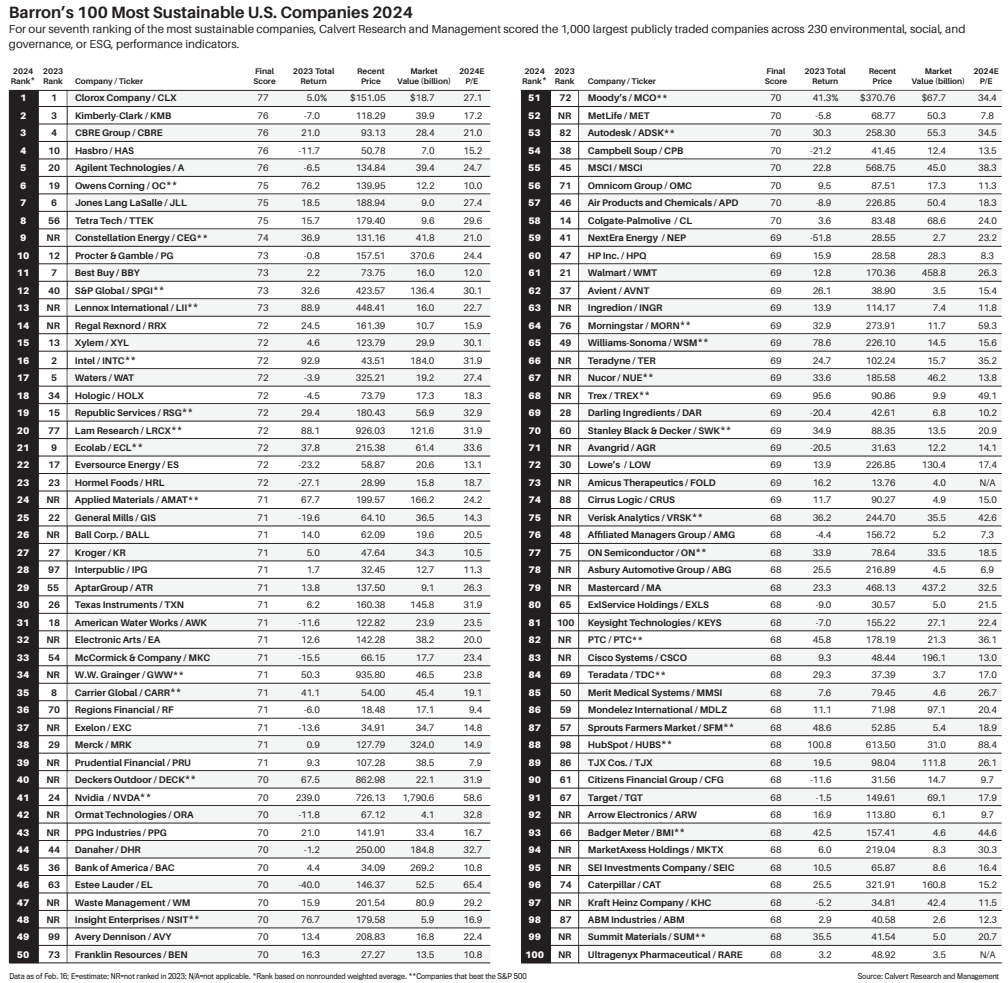

Moreover, the subjective nature of measuring ESG may mean that a company fulfils specific criteria and needs to catch up on others. This leaves fund managers with the difficult choice of which stocks to include in a portfolio and which ones to omit. Below, we can notice the Barron’s rating of the most sustainable U.S. Companies in 2024.

Sustainable Stocks: Does Make Managers More Responsible?

Despite being often criticised for “greenwashing” and “performative activism,” ESG investing has moral and financial benefits. For instance, it encourages investors and fund managers to scrutinise companies more when choosing investments. The additional analysis associated with ESG measures means that an investor or fund is more likely to be exposed to better-managed companies.

Experienced fund managers like Abrdn share that ESG popularity can positively affect corporate management and portfolios. Companies that consider ESG issues are likely to find opportunities more quickly. Therefore, despite constraining themselves in one way, they open themselves up in others, which may allow them to outperform in the long term.

Sustainable Stocks: Lack of Analysis

The uncertainty surrounding ESG investing and its criteria has slightly turned the tide. According to data from Calastone, ESG funds were hit by the worst monthly outflows on record in May 2023, with UK investors pulling 304 million GBP from such strategies. This was only the second time in five years that investors had been net sellers of such funds.

Also, it is worth remembering that ESG investing is susceptible to the same human factors as elsewhere, such as fear and greed. High cash inflows and a lack of awareness mean that individual stocks popular with ESG investors may be overvalued and under-analyzed.

Silver Lining

As discussed previously, the world of ESG investing can take time to navigate. ESG stocks have yielded lower average returns than the S&P 500 in previous years. However, this can be partly explained by a large chunk of S&P 500’s spectacular returns last year due to the performance of the “Magnificent Seven” – Apple, Microsoft, Amazon.com, Nvidia, Meta, Tesla and Alphabet. However, it is not only moral considerations that need to drive an investor to ESG stocks. They are an instrument for getting exposure to innovative and responsible firms. If selected cautiously, ESG stocks can yield significant returns while contributing to those “doing good”.

Sustainable Stocks: Sustainable Investing with I Know First

I Know First provides predictions for the Sustainable and Responsible stock market based on the AI algorithm for six horizons: 3-day, 7-day, 14-day, 1-month, 3-months, and 1-year. I Know First has constructed Sustainable packages that cover Sustainable and Responsible Companies. Below, we can observe the performance of the prediction of the Sustainable and Responsible stock packages which were sent to our clients (you can access our forecast packages here).

Package Name: Sustainable and Responsible Companies

Recommended Positions: Long

Forecast Length: 14 Days (2/27/24 – 3/12/24)

I Know First Average: 3.44%

During the 14 Days forecasted period several picks in the Sustainable and Responsible Companies Package saw significant returns. The algorithm has correctly predicted 10 out of 10 returns. The top-performing prediction in this forecast was TGT, which registered a return of 11.6%. DECK and WSM also performed well for this time horizon with returns of 5.24% and 4.93%, respectively. The package’s overall average return was 3.44%, providing investors with a 1.35% premium over the S&P 500’s return of 2.09% during the same period.

Using algorithmic forecasts to manage your portfolio with ESG in mind could help enhance portfolio performance, verify investors’ analysis, and act on market opportunities faster.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.