Lexmark Stock Price: Lenovo Could Be Behind Apex Technology’s Purchase of Lexmark

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Lexmark Stock Price

Summary:

- Printer maker Lexmark has received regulatory approval over merger with Apex Technology and PAG Asia Capital.

- The agreed purchase offer of Apex and PAG Asia is $40.50 per LXK share.

- Lenovo’s subsidiary Legend Capital is involved in this deal.

- Lexmark is one of the leaders in Gartner’s Magic Quadrant for Managed Print Services. Lenovo could use Lexmark as a stepping stone to enter the MPS industry.

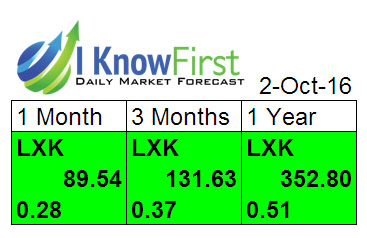

- Lexmark’s stock has buy signals from the market trend algorithmic forecasts of I Know First Research.

Lexmark now that it finally received regulatory approval from U.S. authorities over its proposed $3.6 billion merger with Apex Technology Co. Ltd. and PAG Asia Capital. Apex and PAG Asia are part of the consortium of Chinese firms which offered $40.50 per share to acquire Lexmark.

Hoarding some Lexmark shares could allow you to sell the shares above $45 to Apex Technology and PAG Asia later on. Lexmark’s stock will not immediately get delisted from the New York Stock Exchange. It will still take more time before the merger deal closes. I do not think that this acqui-merger deal will get completed before 2016 ends.

Going forward, I also believe that Lenovo (LNVGY) could become the final owner of Lexmark. Legend Capital Management Co, which is part of the consortium helping Apex Technology buy Lexmark, is a known subsidiary/partner of Lenovo. As per the terms of the deal Lexmark will continue to operate as an independent firm. However, I see Lenovo eventually taking a huge part in future operations of Lexmark.

(Source: Lexmark)

Lexmark is one of the recognized leaders in Gartner’s Magic Quadrant For Managed Print and Content Services. Lenovo could sure use a healthy printer business to offset a declining sales of its PC and mobile devices business segments. Lexmark’s esteemed position as a provider of Managed Print Services ((MPS)) could provide Lenovo with a new recurring revenue stream.

(Source: Gartner)

Lenovo, Not Apex, Could Benefit More From MPS

Apex Technology is just a designer/manufacturer of inkjet and laserjet cartridge chips for remanufacturers who offer cheaper alternatives to original ink/toners of printer firms like Lexmark. In short Apex technology helps third-party firms that hurt the sale of original inks and toners for printers made by Canon (CAJ) or Hewlett-Packard (HPQ).

Apex also builds and sell the Unismart cartridge chip resetting product that allows people to print more than the set maximum monthly page count on their printers. Apex is therefore a known nemesis of printer manufacturers like Lexmark, Canon, Epson, and Lexmark.

The merger deal with Apex Technology was approved by Lexmark management probably because they are tired fighting against third-party vendors of inks and toners. By joing forces with Apex Technology, Lexmark gets insurance that Apex will stop helping third-party firms that sell inks/toners for Lexmark printers.

Lexmark’s patents on inkjet and laser printers will now give Apex and Lenovo access to a strong portfolio of home/office printers and copiers. Lexmark could help China rely less on printers/copiers of Japanese firms like Canon (CAJ) Fuji Xerox, Minolta, Ricoh, and Kyocera.

The Lexmark-Apex Technology deal is also timely. The global market for portable printers like those used in homes and offices is still predicted to grow with a CAGR rate of 17.32% until 2020. Printers are the previous weakness of China. While Chinese firms can build competitive phones and computers, they have not yet produce a laser or inkjet printer that could compete with Canon or Epson’s products.

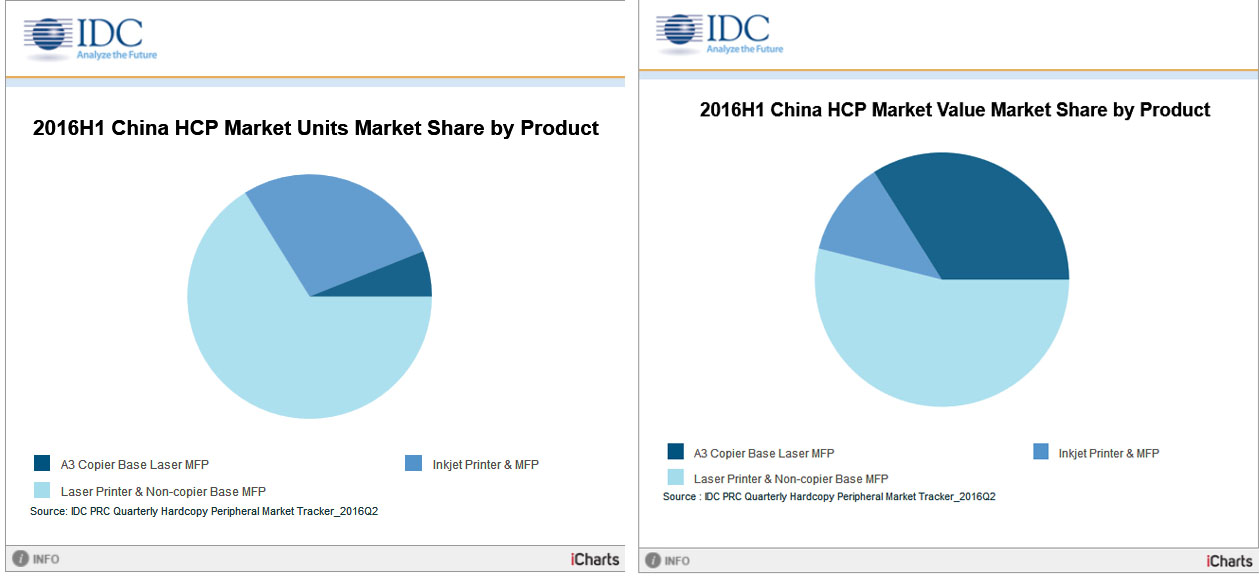

Japanese firms dominate the printer industry of China right now. Lenovo will likely use the Lexmark products to try and break the grip of Canon, Ricoh, and Fuji Xerox over the lucrative A3 (11”x17”) laser copier/printer market in China.

(Source: IDC)

Lexmark will supply the printers and the original inks and toners. Apex/Lenovo will try to package them as part of their Managed Print Services in China and in Asia. Lenovo can use Lexmark’s reputation and leadership position in Managed Print Services to try becoming a player in China’s MPS industry. Once it gains a foothold in China, Lenovo can then expand to other countries.

The global MPS industry is predicted to grow to a $94.97 billion/year business by year 2024. MPS revenue will enjoy a CAGR of 14.8% until 2024. Unlike the declining sales of PCs, printers and printing are still growing opportunities that Lenovo could profit from.

Conclusion

Apex Technology will continue to help third-party ink vendors. However, it will likely stop offering remanufactured cartridges and chips for Lexmark-branded printers. Apex Technology will only help the firms that sell compatible ink and toner cartridges for competing printers made by Epson, Brother, HP, and Canon.

Lexmark will likely gain more business inside China after the deal with Apex Technology is completed. Chinese government agencies and business entities will most likely put Lexmark on the top of their list when it comes to printing. Anti-Japanese feelings will gradually diminish the appeal of printers and copiers made by Canon, Epson, Brother, and Fuji Xerox.

Lexmark’s stock received favorable market trend algorithmic forecasts from I Know First. LXK’s price is unlikely to go below $40 again. Rather, statistical probabilities favor the future scenario that LXK going higher than $41 price.