Google Stock Forecast: Why Google Should Compete More With Adobe In SaaS

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Google Stock Forecast: Google vs. Adobe in SaaS

Summary:

- Formerly just a software developer of creative/design/content creation software, Adobe has branched out to digital marketing/advertising.

- Adobe is now encroaching on the digital advertising business of Google. It’s time Google lashes back and start competing with Creative Cloud.

- Google bought photography-related software companies Picasa and Nik Software. It is time Google buys rival software developers that can compete with Adobe Creative Cloud.

- Buying creative/design software products and making them subscription-only could help Google compete better in Software-as-a-Service. G Suite is not enough anymore for Google to take the lead in SaaS.

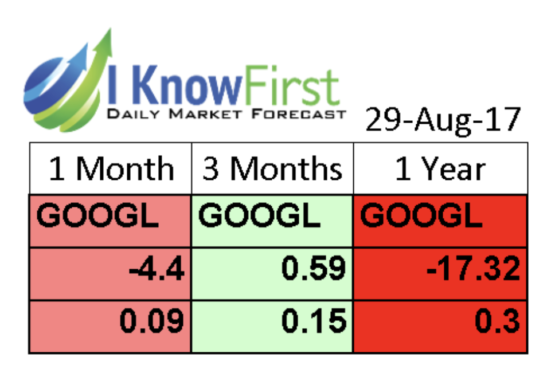

- Google’s current inability to do better in enterprise SaaS is maybe why I Know First has negative algorithmic forecasts for its stock.

I am long Alphabet (GOOGL, GOOG). However, I am not going to rate it as a buy right now. Google remains overly-dependent on its advertising business. Sad but true, Google’s cheaper subscription rates for G Suite wasn’t still enough to let it catch-up with Microsoft (MSFT) and Adobe (ADBE) in the enterprise Software-as-a-Service (SaaS) market.

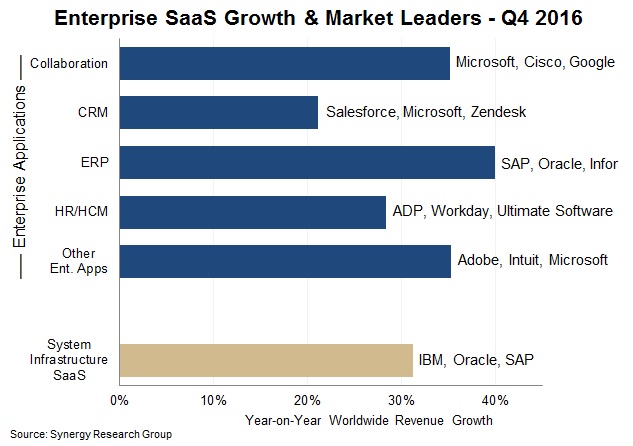

Google is only no.3 in Collaborative SaaS, and it isn’t yet a factor in Other Productivity Enterprise SaaS where Adobe and Intuit (INTU) reigns supreme. Intuit is a leader in SaaS because of its subscription-only bookkeeping and accounting software.

Google’s future in SaaS might be better if it branches out of its Collaborative G Suite alternative to Microsoft’s Office/Office 365. I want it to go after the lucrative Creative Cloud subscription service of Adobe. Like how G Suite now competes with Office 365, Google’s SaaS strategy needs a monthly subscription service for creative/design professionals that are too dependent on Adobe Photoshop, Illustrator, Lightroom, InDesign, Premiere, and After Effects.

Google Can Succeed Where Others Failed

Autodesk (ADSK) and Microsoft (MSFT) tried before but failed to break Adobe’s monopoly on commercial design software. Adobe can get away with $19.99/month for Illustrator CC (vector illustration) or InDesign CC (DTP/Layout) because there’s no serious competition for those programs.

Adobe’s monopoly on design/creative software is why its valuation is much higher than that of Microsoft, Intuit, and Google. Investors love Adobe’s seemingly infinite reign as the provider of industry-standard creative/design software. Adobe’s Creative Cloud software products are necessary tools for creating advertisements, information, entertainment, and productivity.

Google only has 3 million businesses subscribing to its G Suite product. Adobe touts more than 10 million subscribers to its Creative Cloud products. There’s obviously money to be made by creating a Creative Suite or C Suite for Google G Suite customers. Like G Suite, C Suite will again be more affordable than Adobe’s Creative Cloud subscription service.

Attracting 3 million customers to its own subscription-only creative/design software suite will likely be more lucrative for Google. Unlike document-creation software like Google Docs, photo or video editing software can be rented out at $9.99 per month/per user.

Why Compete With Adobe?

Earning $500 million/year from renting out software that competes with Adobe Creative Cloud is not going to move the needle for GOOG. However, the prestige of successfully competing against Adobe will probably inspire investors to give a higher valuation for GOOG. The significantly higher Price/Sales valuation of ADBE compared to GOOG (9.37 vs. 6.28) is clear bias for Adobe’s appraised superior software business.

Further, Google needs to hit Adobe where it hurts, Creative Cloud is its biggest revenue/income generator. Without aggression from Google, Adobe’s rise as a digital advertising leader could threaten Google’s core advertising business. Look at the chart below, Adobe now offers a platform-agnostic advertising service. It touts it can deliver customers a simple method to deliver ads for video, display, and search advertising on any format. From merely selling software to create advertisements and entertainment content, Adobe is now going after Google’s main advertising business.

(Source: Adobe)

Which Company To Buy To Hammer Creative Cloud With

Google can actually afford to buy controlling interest in Adobe because of its massive cash hoard. However, it doesn’t really need to do so because there are other much cheaper software companies with competent products that can hurt Creative Cloud if marketed properly.

As per Bloomberg, Google has more than $92 in cash. It can easily afford to buy all of Adobe’s smaller rivals like Corel Corp., Serif Software, Xara, and Magix.

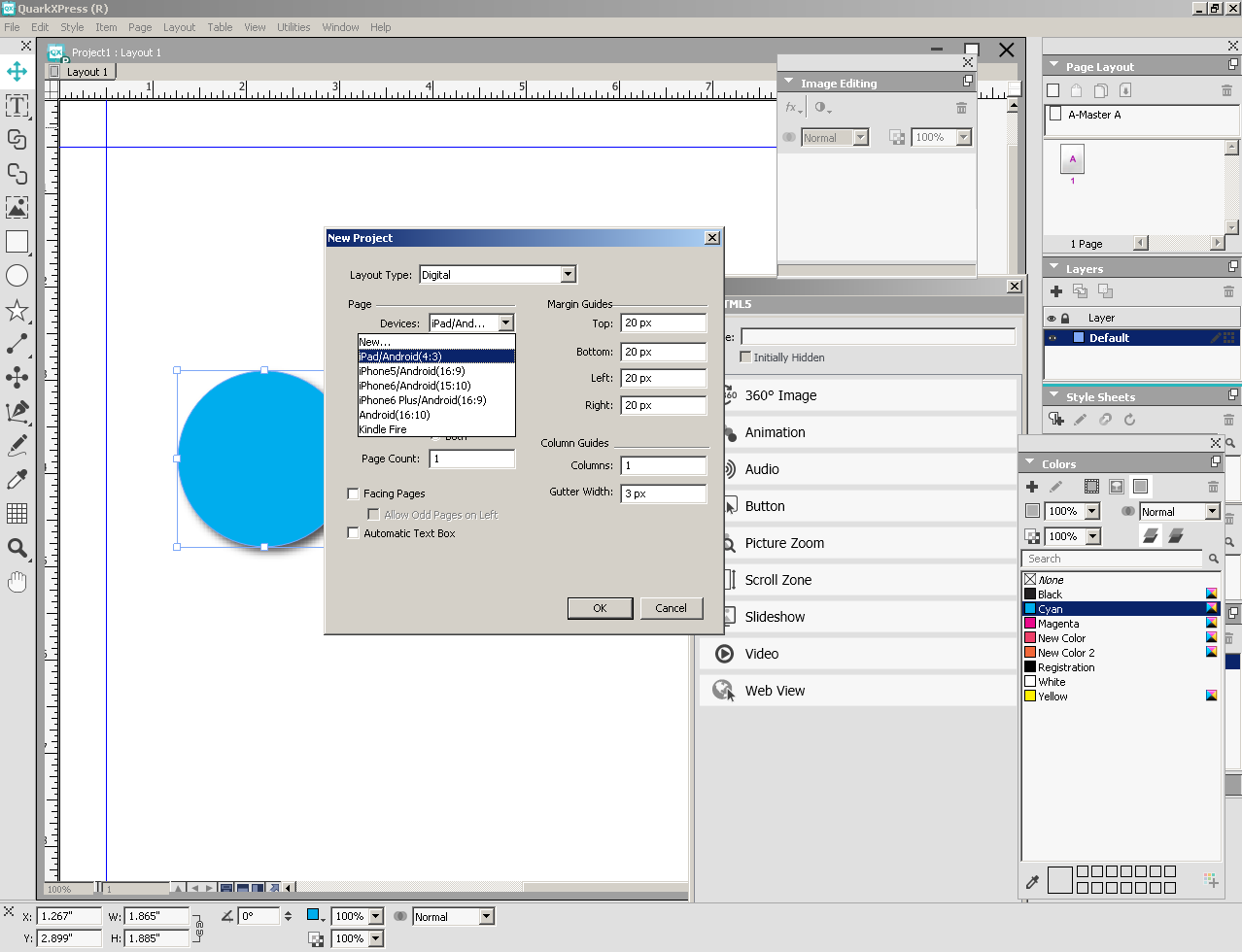

I don’t really care which companies Google should buy. I just want it to try competing against Adobe’s Creative Cloud. I love Photoshop but Adobe might get inspired better to improve its software products if there’s enough competition. Google has enough money and influence to properly market QuarkXPress to business customers and creative professionals. Adobe’s penchant for renting out separate software programs for $19.99 each is sometimes unfair.

Adobe can actually combine the core features of Photoshop, Illustrator, and InDesign as a single software product but it refuses to do so because it’s more profitable. It might be time for Google to shake Adobe out of its complacency. It could be more profitable than G Suite.

On the other hand, I will already be satisfied if Google buys Adobe’s old nemesis, Quark Software, Inc. Quark will probably cost less than $300 million to buy. Corel will cost maybe $1 billion. Quark has enough mobile, cloud, and design software products to start chipping away at Creative Cloud.

(Source: Quark)

I am a creative professional engaged in photo/video editing and mobile UI design. I want Google to buy Quark because QuarkXpress 2017 is a superior all-in-one product for print/web/mobile design. It is the combined might of Illustrator CC and InDesign CC. It can do vector illustration, graphic design, desktop publishing lay-out, web/mobile wireframe, create HTML5 websites and iOS apps too.

Below is my copy of QuarkXPress 2017. I am a part-time freelance User Interface artist, I sometimes use QuarkXPress to do prototypes of mobile app for UpWork clients. It’s faster than using Photoshop and/or Illustrator for this kind of low-paying but deadline-imposed projects. I use Illustrator CC for complex game character/assets designs, but for simple cartoon-based game assets, QuarkXpress’ vector illustration tools are good enough.

(Source: Motek Moyen)

I also used QuarkXPress for template-based layouts of digital photo albums. It’s faster to do 42-pages wedding/birthday albums on it than using Photoshop CC. My point is that Google can easily rent out QuarkXpress for $19.99 a month and there will be many creative professionals and design firms who will gladly sign-up. QuarkXpress’ photo editing capabilities are more than enough for photographers who just want better pictures without using CPU/RAM-heavy Lightroom or Photoshop.

Conclusion

Buying design software companies is nothing new Google. It bought Photoshop plugin software maker Nik Software in 2012 and photo editor/manager Picasa in 2004. Google’s decision to give away its $150 Nik Software collection for free in 2016 indirectly hurt Adobe and its software partners. Google Nik’s rival plugin makers like On1 Software, ACDSee, and AlienSkin had no choice but to evolve from plugins to building their own full pledged photo editing software products. They now compete with Lightroom and Photoshop. AlienSkins Exposure X2 is a better, faster version of Adobe’s Lightroom. On1’s Photo Raw 2017.6 is also an excellent alternative to Lightroom. ACDSee’s Ultimate Photo Studio is a good alternative to Photoshop CC.

I am long GOOG but I Know First has negative algorithmic forecasts for Google. Investors are probably bored that Alphabet can’t seem to compete better in SaaS.

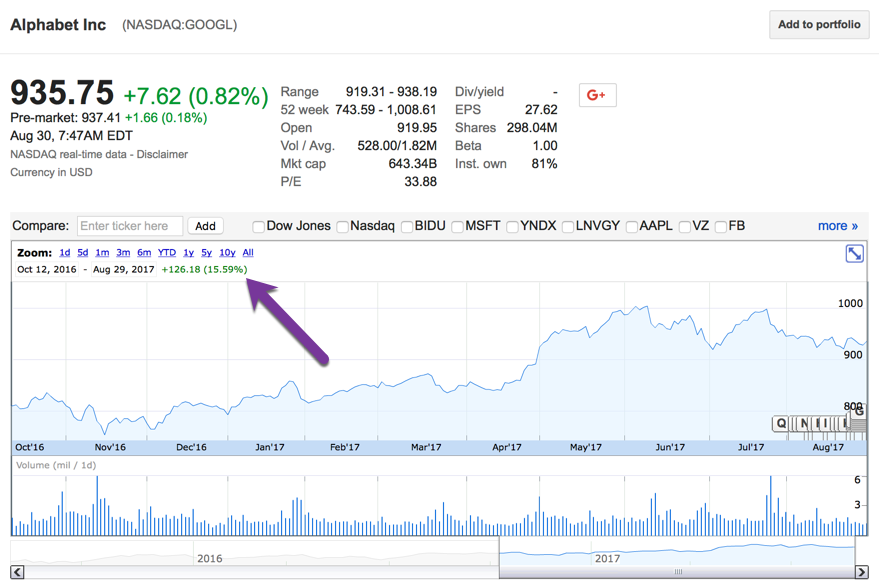

Past I Know First Forecast Success with GOOG

I Know First has been bullish on Google shares in past forecasts. On October 12, 2016, an I Know First Analyst wrote about Google. In the article, it said Alphabet entering the ‘Software as a Service’ (SaaS) space, as well as competing at the high-end market for smartphones with Apple and Samsung. Since then, Google shares have risen 15.59% in line with the I Know First algorithm’s forecast. See chart below.

(Source: Google Finance: GOOGL)

This bullish forecast for GOOGL was sent to I Know First subscribers on On October 12, 2016. To subscribe today click here.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.