Buy Nike Stock: Fundamental, DCF, and Algorithmic Analysis

This article was written by David Berger, a Financial Analyst at I Know First

This article was written by David Berger, a Financial Analyst at I Know First

Nike: Fundamental, DCF, and Algorithmic Analysis

Summary:

- Fundamental analysis shows Nike will continue increasing revenue through Triple Double Project

- DCF analysis conservatively estimates NKE as underpriced in the stock market by about 3%

- I Know First’s algorithm projects NKE as a strong long-term buy

Nike, Inc. (NYSE: NKE) is an American apparel, footwear, equipment, accessory corporation. It is the world’s largest supplier of apparel and athletic shoes. Nike employs more than 44,000 people worldwide. The company is headquartered near Beaverton, Oregon and was founded in 1964.

Nike’s Triple Double

(Trevor Edwards, President of Nike Brand)

Nike has always been on the cutting edge of consumer sportswear. NKE is attempting to continue growth across the world with Consumer Direct Offense, fueled by Nike’s Triple Double strategy: 2X Innovation, 2X Speed and 2X Direct connections with consumers.

Firstly, to increase innovation, Nike plans on doubling new consumer platforms. Recently, Nike launched three new platforms: ZoomX, Air VaporMax and Nike React. These new product lines help Nike with its new focus on comfort and cushioning. Nike is also reducing its styles by 25 percent, allowing customers to know and understand its products and apparel.

Secondly, to double speed, NKE will cut product creation time in half. Nike is introducing its Express Lane, which updates and fulfills product orders based on consumer demand. Express Lane currently functions in North America and Western Europe, and China will get its own Express Lane by the end of the summer. China is one of the world’s largest sports markets, so NKE is planning on taking advantage. Michael Spillane the President of Categories and Product, will jumpstart this initiative. Spillane will focus on the sectors with the highest growth potential: Running, Basketball, Nike Sportswear, Men’s and Women’s Training, Global Football and Young Athletes.

Finally, to double direct connections with customers, Nike is creating Nike Direct, led by Heidi O’Neill, President of Nike Direct, and Adam Sussman, Chief Digital Officer. This branch will join Nike.com, Direct-to-Consumer retail, and Nike+ digital products. This connection will expand Nike’s global membership experience and combine physical and digital retail to serve consumers. For example, SNKRS Stash unlocks exclusive Nike and Jordan product using mobile geo-locations; and Shock Drop alerts for coveted sneakers that gives consumers notice of where and when to buy the sneakers.

Additionally, the changes will reduce 2 percent of the company’s global workforce. “Today we serve our athletes in a changing world: one that’s faster and more personal,” said Trevor Edwards, President of the Nike Brand. “This new structure aligns all of our teams toward our ultimate goal — to deliver innovation, at speed, through more direct connections.”

DCF Analysis Shows NKE is Undervalued

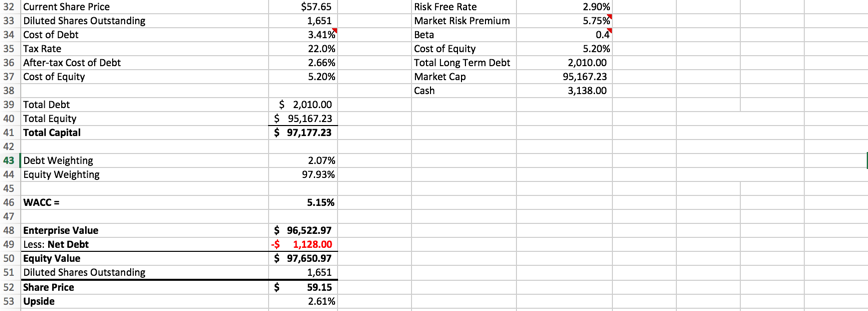

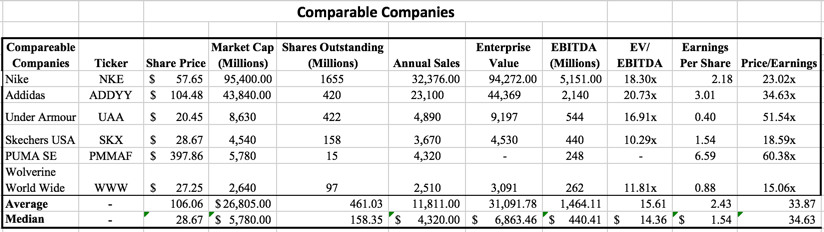

I used a discounted cash flow (DCF) model is used to yield a valuation and emphasize the company’s strong future outlook. Essentially, a DCF model suggests a current value of a company by projecting future cash flows within it. The sum of a company’s cash flows earned in the future, discounted back to the present, is one way to determine NKE’s future stock price. Historical data, combined with an annual outlook, provide a benchmark for evaluation. However, historical data does not fully suggest all future data. It should also be stressed that projections are discretionary, and there are often estimated inputs used in the process. That being said, carefully performed DCF can aid further consideration about Nike’s potential. Below is the full DCF model, along with a chart of comparable companies (notice that all numbers are in millions of dollars):

The fact that Nike looks underpriced through this analysis should give investors optimism. These are conservative growth figures, so this model represents a floor for Nike’s potential future stock price. Furthermore, the projected share price of $59.15 results in an upside 2.61% from the current share price. My DCF projection falls into line with other analyst predictions. Moreover, out of 35 analysts in June, 22 concluded NKE to be a buy.

(Source: Yahoo! Finance)

However, every investment involves risk. One inherit risk for investing in Nike is political volatility, mainly regarding trade agreements. While there is no imminent concern, if the United States were to heavily tax Asian countries, Nike’s distribution costs would significantly increase.

Algorithmic Analysis:

My bullish forecast for NKE in the long-run is echoed by the I Know First algorithmic forecast from July 19:

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.