Quick Win by the Algorithm: Shutterfly Therapeutics Stock Price Soars After Acquisition of Lifetouch

Quick Win by the Algorithm

Shutterfly (NASDAQ:SFLY) is an American Internet-based image publishing service based in Redwood City, California. Shutterfly’s flagship product is its photo book line. The company was founded in 1999 and is currently led by Christopher North.

Throughout the first week of February, 2018, Shutterfly experienced a significant share price increase, reaching a 48.34% gain over a one-month period. The spike began on the 31st of January, when SFLY unveiled a new acquisition in its fourth quarter results. Investor sentiment immediately increased as Shutterfly acquired Lifetouch which offers a myriad of opportunities and potential to make Shutterfly’s ecosystem more sustainable and solid. Both companies were struggling individually, however, combined are a perfect fit with substantial synergies.

“Shutterfly and Lifetouch, two undisputed leaders in their respective industries, are both built around the mission of helping customers share life’s joy through photos,” said Christopher North, President & Chief Executive Officer of Shutterfly. “The two companies are uniquely well suited for one another, with similar target customers as well as complementary manufacturing capabilities. Most exciting of all is the potential to bring together Lifetouch’s unique access to millions of families who value high-quality photographic portraits with Shutterfly’s cloud photo management, product breadth, and product creation capabilities. Together, the two companies will accelerate each other’s respective strategies, driving shareholder value through consumer growth and significant incremental profits and cash flow. We’re excited to welcome the Lifetouch team to the Shutterfly family.”

With the acquisition, Shutterfly is able to double its revenue base to $2.1 billion and can additionally realize cost synergies due to the complementary nature of operations. Furthermore, Lifetouch has a customer base of over 10 million households and adds a million kindergarten households each year, serving over 50,000 schools. Cross-selling personalized photo products throughout the milestones of school children will provide an excellent opportunity for Shutterfly to increase its orders. Without the acquisition, the marketing would have required millions of dollars to reach that market.

The acquisition of Lifetouch has resulted in a significant spike, highlights Shutterfly’s long term growth prospects and common mission – “to leverage technology to better serve our customers” (Michael Meek, CEO of Lifetouch).

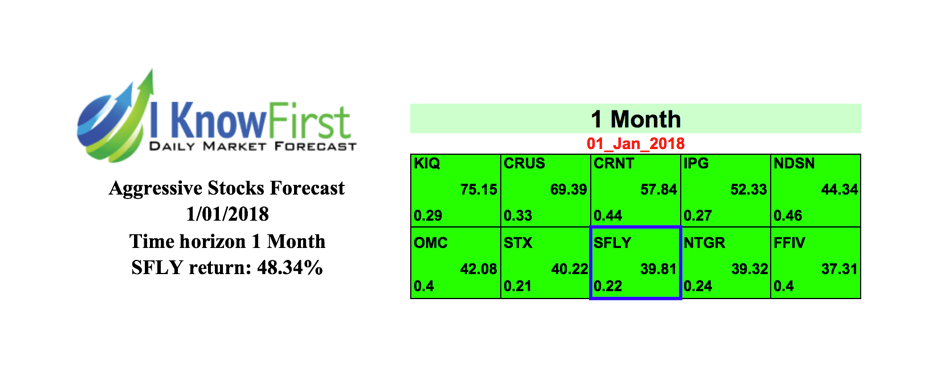

On January 1st, 2018, I Know First issued a bullish one month forecast for Shutterfly, Inc. (Nasdaq:SFLY) The forecast illustrated a signal of 39.81 and a predictability of 0.22. In accordance with the forecast, SLFY’s stock returned 48.34% over this period, highlighting another quick win by the I Know First algorithm.

Current I Know First subscribers received this bullish SFLY forecast on January 1st, 2018.

How to read the I Know First Forecast

Disclaimer

Before making any trading decisions, consult the latest forecast as the algorithm updates predictions daily. You can use the algorithm for intra-day trading. The predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.