Quick Win by the Algorithm: Insider’s Purchasing BOC A Commonality

Quick Win by the Algorithm

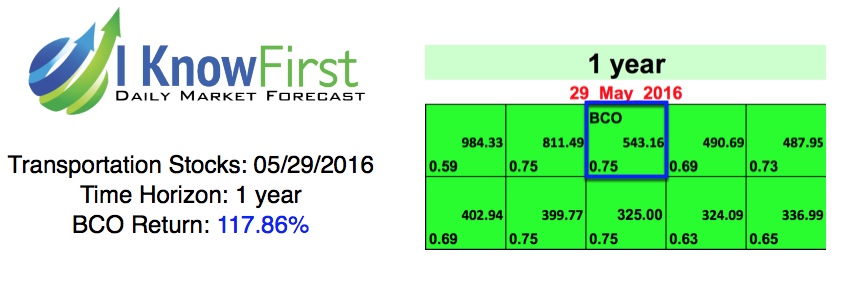

On May 29th, 2016, the I Know First algorithm issued a bullish forecast for The Brink’s Company (BCO). BCO had a signal of 543.16 and a predictability of 0.75. As a result, in accordance with the forecast, the company’s stock increased by 117.86% in a year, showing a quick win by the algorithm.

The Brinks Company (BCO) provides secure transportation, cash management services, and other security-related services worldwide. The company offers cash-in transit services such as armoured vehicle transportation of valuables. These include, automated teller machine (ATM) services, such as cash replenishment, cash optimisation, ATM remote monitoring, service call dispatching, and installation services. It also provides transportation of valuable commodities such as diamonds, jewelry, precious metals, securities, currency, high-tech devices, electronics and pharmaceuticals. In addition, the company offers payment services, including bill payment processing and mobile phone top-up services. As well as commercial security system services, such as security system design and installation of alarms, motion detectors, cameras, biometrics and locks.

Brink’s Company (BCO) has a one year low of $26.86 and a one year high of $63.85. After the release of its FY17 earning guidance report, things are looking promising for BCO. A Thomson Reuters consensus, estimated an earnings per share (EPS) of $2.50, the company topped that, reporting an EPS guidance of $2.55-2.65. BCO also beat the consensus revenue estimate, reporting revenue guidance of $3 billion. Today, June 1st, 2017, the firm is set to pay a recently disclosed quarterly dividend to any shareholders on record as of May 18th. A dividend of $0.15 per share, representing a $0.60 annualised dividend and a yield of 0.97% is what’s expected. This quarterly dividend, is a boost from the previous quarterly of $0.10. The current payout ratio for BCO is 58.82%

Interesting to note, is other happenings within Brink’s Company. In the last couple of months, Douglas A. Pertz, a senior, acquired $1,558,500.00 worth of shares, at an average cost of $51.95 per. Translating to 30,000 of the company’s stock. Another insider in Thomas Colan, sold 935 shares at $62.30, equating to a total transaction of $58,250.50. Insiders currently own 11.29% of Brink’s Company stocks.

This bullish forecast on BOC was sent to current I Know First subscribers on May 29, 2016.

Before making any trading decisions, consult the latest forecast as the algorithm updates predictions daily. You can use the algorithm for intra-day trading. The predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.