AMD Stock Forecast: Delaying The High-End VEGA GPU to Next Year Is Good For AMD

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

AMD Stock Forecast

Summary:

- The budget-friendly Polaris GPUs are AMD’s best 14-nm video cards for this year.

- The high-end 14-nanometer Vega GPU is postponed from October this year to H1 2017.

- I agree with this postponement because it will give AMD more time to fine-tune its flagship video card products.

- AMD’s Radeon business will get a big boost from Apple’s refresh of the MacBook Pro and iMac.

- I Know First still has positive short-term and long-term algorithmic forecasts for AMD.

I am not worried about the alleged postponement of Advanced Micro Devices’ (AMD) flagship 14-nanometer Vega GPU. It was rumored before that Vega will see an October 2016. However, I prefer the H1 2017 release date because it will give AMD and its foundry partner more time to fine-tune Vega.

There’s only four months left for this year, there is no need to rush a flagship GPU this year. I am firm believer in not rushing important products like the Vega. AMD should already learn from the embarrassment over the PCIe-power draw of its first Polaris GPU prototypes. The Radeon people should re-double its efforts (and spend more time) on making sure the Vega GPU prototypes is error-free so that online review sites won’t complain about minor mistakes.

Selling a $500 Vega GPU with obvious mistakes is like handing bullets to the sell-side community that’s been shorting AMD. Thanks the internet, bad product reviews from online authors (like Mark Hibben of Seeking Alpha) are deadly weapons against a debt-laden, still recovering company like AMD.

AMD should focus more on marketing and promoting its sub-$200 Radeon RX 480, RX 470, and RX 460. A laser-focus on selling cheaper alternatives to Nvidia’s (NVDA) 16-nanometer Pascal GPUs will go a long way in helping AMD regain market share in discreet GPUs.

Benchmark scores already proved that the Virtual Reality-ready RX 480 is already competent with Nvidia’s Pascal 16-nanometer GTX 1070. My take is that an intentional delay in releasing the high-end Vega GPU is akin to hunger-marketing. AMD can just whet the appetite of its loyal fans by postponing the Vega GPU to next year. By the time Vega is ready to ship, die-hard haters of Nvidia’s flagship cards will go hand-over-fist line-up for it.

Market Share First Before Margins

I reiterate my view that AMD’s stock performance this year will rely largely on the company’s ability to compete with Nvidia on the discreet GPU market. Since Q2 2015, AMD has been steadily gaining back the lost market share in discreet or stand-alone video cards.

(Source: Jon Peddie Research)

(Source: Jon Peddie Research)

My view is that offering sub-$200 14-nanometer cards will encourage third-party GPU vendors like Sapphire, XFX, Asus, and others to strongly support the Polaris GPU products. While it is true that Nvidia’s $500+++ Pascal GPU has higher margins, I believe the total addressable market for $200 and below GPUs is much greater.

Nvidia can dominate in the Enthusiast segment of the discreet GPU market. AMD can position the sub-$200 Polaris GPU to the much bigger segments of the Performance and Mainstream market. Concentrating on customers who can only afford $200 video cards is an easy way for AMD to improve its market share to 40% or more.

(Source: Jon Peddie Research)

(Source: Jon Peddie Research)

AMD will not make a fat margin on the $149 Radeon RX460 but there’s still decent money to be made from large-volume shipments to third-party GPU vendors. Pricing is important to third-party vendors like Sapphire and XFX. Those firms makes most of their revenue from selling to the budget-conscious PC gamers.

The more third-party support that the Polaris GPUs receive, the better it is for AMD’s Radeon division. A huge boost on Radeon GPU revenue might help AMD’s stock post another 52-week high this year. AMD’s stock price is notably down from its $8 high. However, Apple’s (AAPL) upcoming October revamp of its MacBook and iMac products should inspire investors to rally around AMD once more.

We should expect AMD to get hefty Polaris GPU orders from Apple starting next month. The fortune of AMD for the next few months will get a boost from Apple. Apple is a monster mover of discreet GPUs because its iMac and MacBook has fanatic loyalists. On hindsight, Apple’s decision last year to go all-Radeon for its Mac computers is the reason why AMD starting regaining market share in discreet GPUs.

The willingness of AMD to sell budget-friendly Polaris GPUs meant it will continue to rule the Mac platform. The economic benefits of supplying GPUs to Macs is easy to estimate. Apple is capable of selling 4-5 million Mac computers per quarter. Assuming 0.5 million of which has discreet GPUs, we can calculate the potential revenue contribution of Apple to Radeon’s fortune.

500,000 units x average selling price of $50 = $250 million. A quarter-of-a-billion business from Apple is nothing to sneeze at. I believe the GPU business from Apple contributes more than the custom CPU/GPU business from Xbox One. ]

Conclusion

I reiterate my Buy rating for AMD. The decision to postpone the commercial launch of Vega is a good example that the management team is learning from its mistakes. The brouhaha over the RX 480 PCIe-power draw was a PR disaster that AMD is unlikely to repeat with Vega.

My July 3 article’s buy recommendation would have been very profitable for you if you followed my advice. A +47% gain from AMD in less than 7 weeks is beastly smart.

(Source: Google Finance)

(Source: Google Finance)

My long recommendation for AMD is again supported by positive algorithmic forecasts from I Know First. This stock is not going to drop or linger below $7. The market trend signals from I Know First are too favorable for both the 3-months and 1-year algorithmic forecasts of AMD.

Past I Know First Forecast Successes with AMD

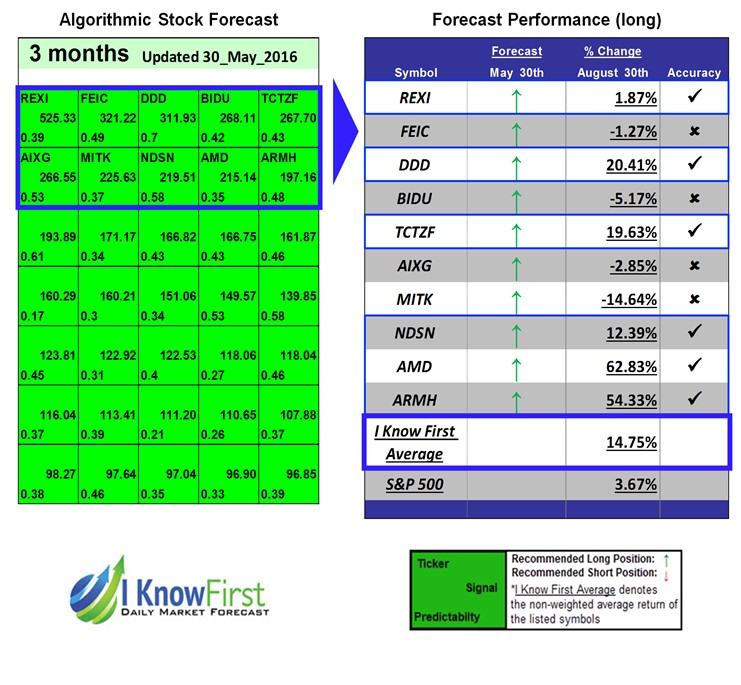

I Know First has been bullish on AMD in the past, as shown below. In past forecasts, such as the one dated on May 30th, the I Know First algorithm correctly predicted a price increase for AMD stocks in a 3-month time period. The return on AMD during the course of 3 months had been 62.83%, providing investors a premium over the SP500’s average return of 3.67%, during the same period. AMD had a signal strength of 215.14, and a predictability indicator of 0.35. This forecast was a part of the Tech Stocks package, and the algorithm had predicted 6 out of 10 stocks correctly, with an average return of 14.75%.

The forecast is color-coded, where green indicates a bullish signal while red indicates a bearish signal. Brighter greens signify that the algorithm is very bullish as it does at the top of this forecast. The signal is the number flush right in the middle of the box and the predicted direction (not a specific number or target price) for that asset, while the predictability is the historical correlation between the prediction and the actual market movements. Thus, the signal represents the forecasted strength of the prediction, while the predictability represents the level of confidence.

This bullish forecast for AMD was sent to current I Know First subscribers on May 30, 2016.