PDSB Stock Forecast: Growing Pipeline Brings Results Driving Target Price To $20

This PDSB stock forecast article was written by Nicole Shammay – Analyst at I Know First.

This PDSB stock forecast article was written by Nicole Shammay – Analyst at I Know First.

Highlights:

- PDSB releases interim data for a clinical study revealing 67% tumor reduction

- Announcement of Oncology Research and Development Day

- PDS Biotechnology deserves a one-year target price range of $17 to $20

Overview

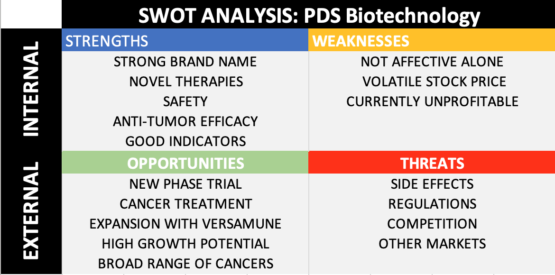

PDS Biotechnology Corporation (Nasdaq: PDSB) is a clinical-stage biopharmaceutical company. They are known for developing novel cancer therapies and infectious disease vaccines based on the Company’s proprietary Versamune T-cell activating technology for in vivo uptake. They create immuno-oncology therapies to treat various early and late-stage cancers such as head and neck, prostate, breast, cervical, and anal cancers. PDSB supplies aid to patients worldwide.

Interim Data for PDS0101 Showed Major Tumor Reduction

On June 3, 2021, PDS Biotechnology Corporation announced that they would be expanding to Phase 2 of the VERSATILE-002 clinical study for patients whose head and neck cancer has returned or spread. Patients who have enrolled would be given two drugs administered by PDSB, the first being PSD0101 and KEYTRUDA – an approved drug. The VERSATILE-002 study examines the effectiveness of combining both drugs rather than simply using KEYTRUDA by itself. PDBS also said that there is no placebo given during the trial.

Though analyses of immune responses and other immune correlates are ongoing, there are exciting highlights from the presentations which ensure a strong future. From the first abstract, PDBS revealed 83% (5 out of 6) patients showed a 30% reduction in tumor size. 100% (6/6) patients are still alive eight months after the diagnosis when the average is noted at 7-11 months. One patient showed a complete response with no evidence of active disease. With the new abstract, the trial added 12 HPV16-positive patients. 58% of the patients saw a tumor reduction. They also achieved a 67% tumor reduction among all of the HPV16-positive cancer patients. These results strongly encourage the evidence supporting a continuation of the trial. Effective tumor regression is most commonly done with chemotherapy and radiotherapy; however, PDBS might change that with PDS0101.

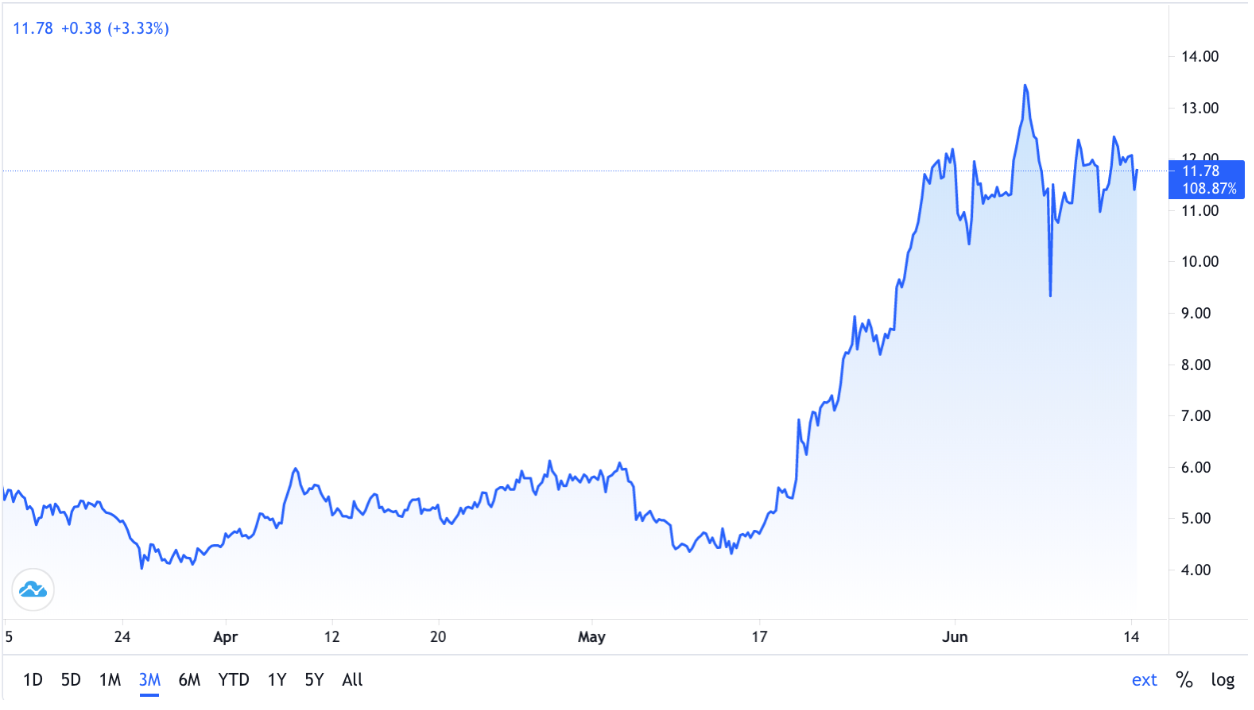

It is also important to note that on May 20, when PDSB released the abstract for the Phase 2 clinical study, their stock jumped $8 in one week. Shares were trending higher the day of the interim data release.

Oncology R&D Day Proves Confidence and Instills Certainty

On June 14, PDSB announced that they would be hosting an Oncology Research and Development Day for analysts, investors, and the scientific community to participate in on June 16th. The day has a full agenda and plans to focus mainly on the advancements within the clinical trial. They will also be hosting feature presentations from renowned doctors, CEOs, and professors who have studied an immense amount regarding cancer’s tumor immunology and biology. The presentation will also be made available to the public approximately 90 days after the webcast. The incredible advances the company has made paired with the public announcement of their research proves how confident they are in their study. No other company would publicize their efforts on an R&D day if they did not believe strongly in their work’s effectiveness and transformative properties. So no wonder the company wants to make such a presentation – they are expecting a big move for PDS Biotechnology shares, therefore strengthening the PDSB stock forecast.

Indicators Lead to a Buy Signal

As shown in the chart above, the PDSB stock price has been above the moving average for 200 days (the purple line) since the middle of last July. Therefore, signaling a strong change in the coming trend for the past year. The moving average for 50 days (the red line) also crossed over the moving average for 200 days at the end of July, indicating a shifting trend in the upwards direction. Because the short-term moving average crossed over the major long-term moving average in a positive direction, we can interpret this as signaling a definitive upward turn for the PDSB stock forecast because the short-term average is trending quicker than the long-term.

Lastly, the above Yahoo Finance analysts consensus presentation for PDSB shows that all four analysts took either a Buy or a Strong Buy position, which supports my opinion on the stock’s outlook.

High Growth Potential in 2021 Onwards

Given the recent advancements that PDSB has made and its significant results, I believe its stock price is projected to increase significantly. Many analysts agree upon the foreseeable stock growth in the near future in this case. One can see below the monthly growth over the last May peaking at 113.29%. Furthermore, the average negative stock price change is significantly less than the average positive stock growth. Therefore, I believe its growth will continue admirably as it keeps up with the trial and offer ultimate results.

A recent article on Nasdaq suggests the PDSB stock as a buy, with a 12-month upside of 10%. Zacks ranks PDSB as a #3 hold in the Medical – Biomedical and Genetics industry as well as in the bottom 22% of the Industry Rank. These numbers were not moving for 60 days, implying many analysts believe there could be a trade development.

Conclusion

I rate the PDSB stock as a buy based on the reasonable expectation that the stock price will grow further due to their powerful, safe, and versatile immunotherapies. As PDS Biotechnology develops the medication and provides effective results successfully, it’s reasonable to expect high growth in sales and revenue. This revenue growth leads me to expect a substantial increase in the strong price on a one year-horizon. Thus, I estimate the stock target price range to be between $17 and $20.

Finally, my bullish prediction for the PDSB stock is particularly supported by the algorithmic forecast shown above by I Know First. With a high one-year trend signal of 439.41, the forecast represents a secure trigger to buy as well as a positive increase in the stock price on a one-year horizon. Also, because the probability rating is so high as well at 66%, the forecast is strongly supportive and represents our ensured confidence.

Past Success With PDSB Stock Forecast

I Know First spotted an upward trend for the PDSB stock since mid-May. On June 16, 2021, the I Know First algorithm recommended PDSB as part of the Best Biotech Stocks Package. The AI-driven PDSB stock forecast proved successful on a one-month horizon resulting in a 111.45% gain since the original forecast date.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.