NXP Semiconductors Stock: Undervalued Apple Supplier for your Portfolio

The article was written by Ayush Singh Tip Ranks #4 Financial Blogger – Senior Analyst at I Know First.

The article was written by Ayush Singh Tip Ranks #4 Financial Blogger – Senior Analyst at I Know First.

NXP Semiconductors Stock

Apple suppliers like NXP Semiconductor have struggled over the last few months.

Apple suppliers like NXP Semiconductor have struggled over the last few months.- The risks of falling iPhone sales are blown out of proportion.

- NXP Semiconductor has a diversified business model that’ll offset the drop in iPhone sales.

- The growth and potential of connected cars make NXP Semiconductor undervalued.

- I Know First has a bullish view for NXPI stock movement for the mid and long term.

Due to the falling year over year sales of the iPhone 6S, Apple suppliers have taken a beating this year. Most Apple suppliers are down considerably from their 52-week high levels and NXP Semiconductors (NXPI) is no exception to it.

NXP Semiconductor is trading about 30% lower from its all-time highs and although the stock has struggled recently, it has fared better than many other peers. I think shares of NXP Semiconductor are undervalued, which is why I think investors should consider adding it to their potfolio.s

An amazing performance

NXP Semiconductors is the largest rival of STMicro. In 2015, the company had gone through a trifling drop of around 17 percent.

(Source: NXPI data by YCharts)

However, the company faced nearly the same headwinds which knocked down STMicro, but it grumbled up by acquiring opponent chipmaker Freescale previous year. By acquiring Freescale, the company became one of the biggest manufacturers of automotive electronics worldwide.

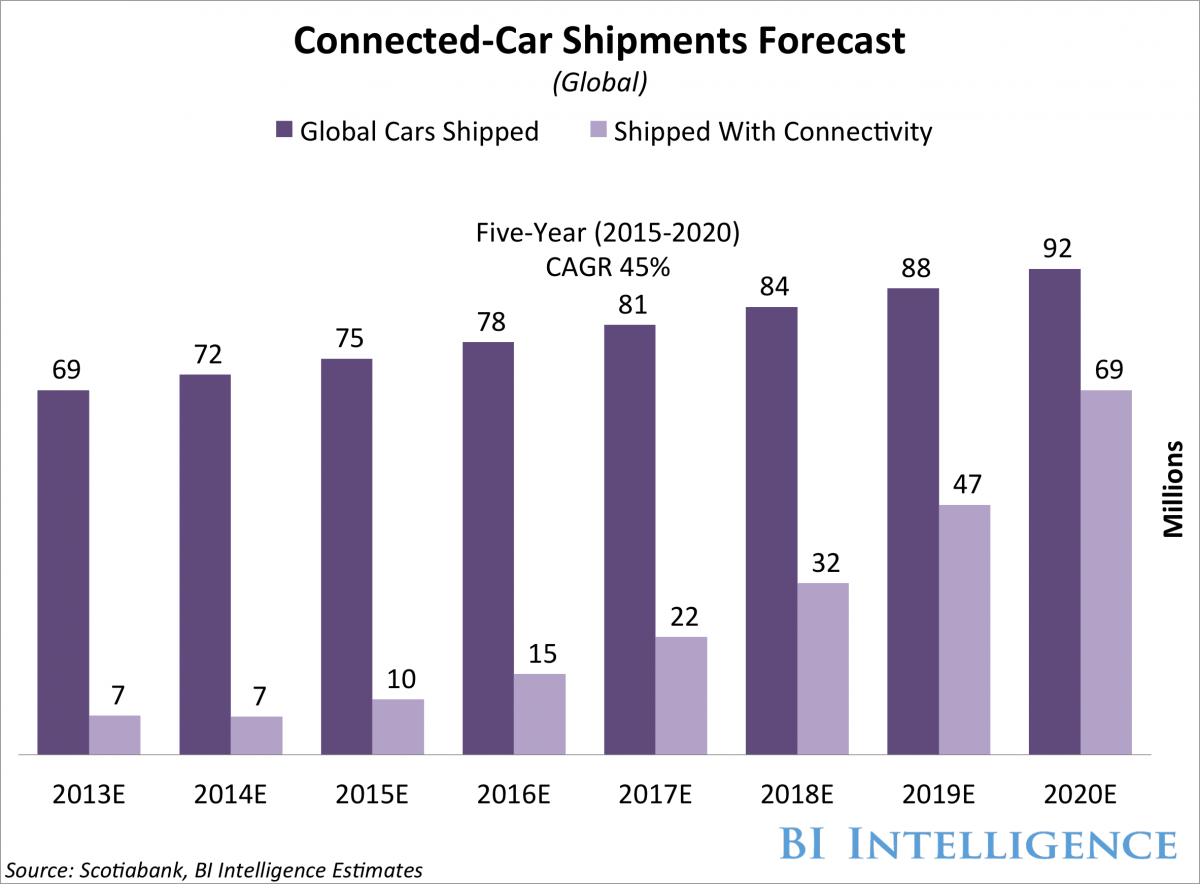

In 2015, the company’s automotive sales, including the first month of Freescale, surged 17 percent on a yearly basis and accounted for 22 percent of its revenue. The company still anticipates that percentage to reach approximately 36 percent throughout the first quarter this year, and it could turn into a major growth engine as sales of connected cars increases. Sales of protected interface and organization, high-performance assorted signal devices, and secure connected cars all displayed huge sales growth the previous year. Since sales of connected cars are expected to sky rocket in the future, I think NXP Semiconductor is currently undervalued.

(Source: Business Insider)

Just before closing NXP’s acquisition of Freescale, the company had projected all those sales to post y-o-y drops. Moreover, the joined company’s huge size could allow it to exploit economies of scale to destabilize less significant competitors like STMicro.

Consensus forecasts that the company will show 57 percent sales growth and 8 percent sales growth in 2016 and 2017 respectively. Throughout the approaching five years, the company’s yearly earnings are predicted to surge 25 percent yearly. Although NXP Semiconductor does not pay a dividend, the company spent $474 million on buybacks previous year. Heavy spending on buybacks indicates that the company’s management also believes that shares are undervalued.

Well Positioned

Due to NXP’s acquisition of Freescale Semiconductor, the company has been able to become one of the largest semiconductor supplier companies in the world, comprising leadership positions in both the broad-based microcontroller as well as in the automotive semiconductor markets.

NXP Semiconductor is also a prominent supplier of the NFC chips, mainly used to allow mobile payment systems such as Android Pay and Apple Pay, as well as the company, strives in a variety of other areas, providing it a diverse customer base.

In the case of automotive semiconductor segment, NXP’s merger with Freescale accounts to be a big bet, and the long-run tendencies are working in the company’s favor. Nowadays, cars are becoming more connected, and though a mass-market self-driving car is not so far, growing penetration of progressive driver assistance features can drive the company’s growth even without considerable growth in yearly auto sales.

NXP Semiconductor shares declined in 2015, as general semiconductor weakness has pulled down the company’s results. On the other hand, it is significant to keep in mind that the company operates in a cyclical industry, and though the company managed an operating margin of more than 30 percent the previous year, average profitability will probably be flat moving onward.

However, NXP Semiconductor holds a robust position on the board and the automotive semiconductor sector, the company is well positioned to grow well over the next decade.

Still working very slow

It is true that the merger with Freescale adds a lot of muscular bulk to the company’s already athletic frame. In 2016, total sales are projected to reach $10 billion, a surge of $3.9 billion as compared to the sales in 2015.

However, the merger would not be all that takes NXP Semiconductor to a great height. There is some similarity between Freescale’s and NXP Semiconductors’ operations, and the company also had to unburden some operations to a Chinese investor so as to meet regulatory antitrust necessities.

Apart from this, the top-line estimate for the approaching quarter of 2016 is $2.2 billion, a 50 percent surge in NXP Semiconductors’ individual sales in the year-ago quarter, but 17 percent lower than the total sales of Freescale and NXP in that quarter.

Also, the merger was supposed to create $40 billion enterprise value and presently stands at $34 billion. Therefore, it clearly indicates that the company is putting a lot of efforts to reach the mark.

According to TipRanks, both bloggers and analysts alike think that NXP Semiconductor will be able to reach that mark. All the 8 analysts covering NXP Semiconductor think that the stock is a buy and have an average price target of over $105, which represents a hefty 30% upside potential from current levels.

As for bloggers, 24 out of the 25 bloggers who have covered the stock recently are bullish. Given the strong bullish sentiment, I think it’s highly likely that shares of NXP Semiconductor will move higher in the near future.

Conclusion

I believe investors are not appreciating NXP Semiconductors diversified business model and are being overly paranoid about moderately declining iPhone sales. The company has a dominating presence in other sectors, which is why I think it will be able to survive this downturn, making it a good pick.

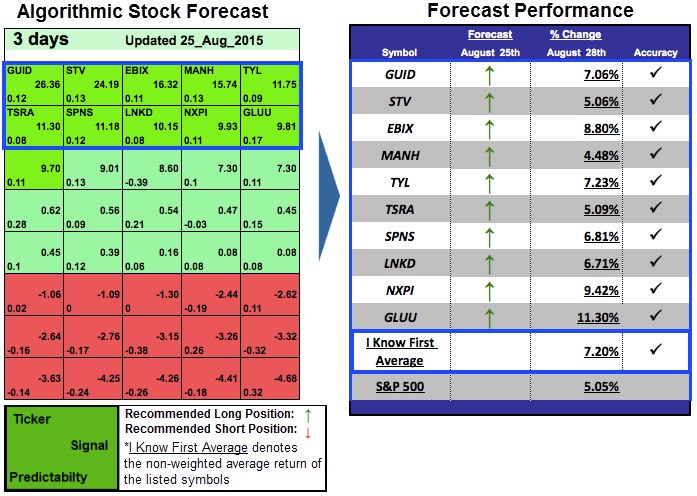

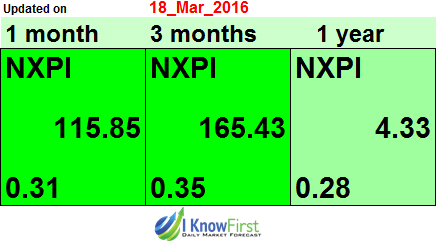

My bullish outlook is echoed by algorithmic forecasts of I Know First. I Know First uses an advanced state of the art algorithm based on artificial intelligence and machine learning to foresee market performance for more than 3,000 markets including stock forecasts, world indices, commodities, interest rates, ETFs, and currencies. The algorithm generates a forecast with a signal and a predictability indicator. The signal is the number at the center of the box. The predictability is the figure at the bottom of the box. At the top, a particular asset is identified. This format is standardized across all forecasts. The middle number indicates strength and direction, not a price target or percentage gain/loss. The bottom figure, the predictability, signifies a confidence level.

As you can see from the image above, the green 115.85, 165.43 and 4.33 forecasts for the respective time period indicate that I Know First’s algorithm expects NXPI to continue moving higher in the short as well as the long-term.

In the past, I Know First has predicted correctly the bullish signal for NXPI stock movement, like in this forecast from August 25th, 2015. NXPI had a bullish signal of 9.93 and predictability of 0.11 managing to bring high returns of 9.42% in just 3 days.