NVDA Stock Prediction: Why Nvidia Can Hit $280 Soon

This NVDA stock prediction article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

This NVDA stock prediction article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- Nvidia still touts the best-performing graphic cards.

- Performance not price tags is the top priority of PC gamers when it comes to graphic cards.

- This fact should convince investors that Nvidia will continue to enjoy over 65% market share in discreet graphic cards.

- The very low $4.99 monthly fee of GeForce Now makes it the best cloud gaming service. It could kill Google Stadia.

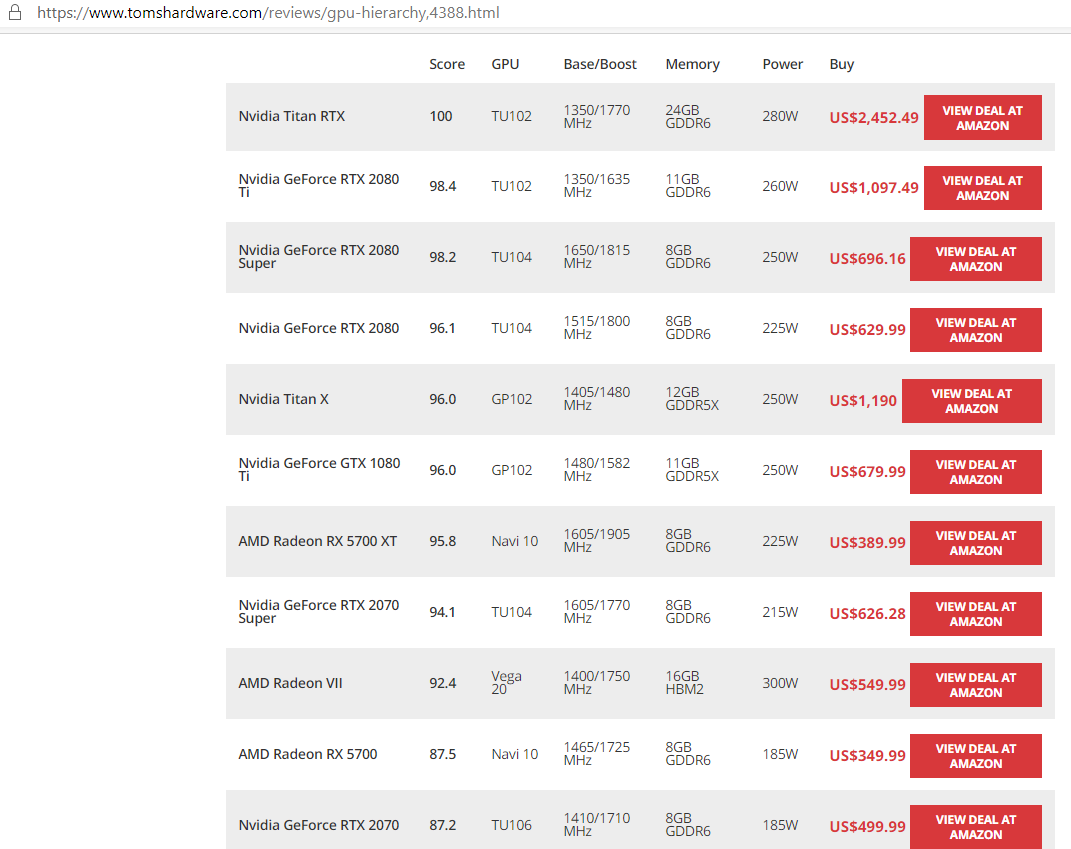

Tom’s Hardware did comprehensive real-world tests of graphics cards last week. It should please Nvidia (NVDA) shareholders to know that GeForce-brands graphics cards were again proven (by Tom’s Hardware) to be best for gaming. This will help Nvidia protect its over 65% market share in graphics cards or add-in boards. Remaining the top vendor of graphics cards protects Nvidia’s $1.66 billion quarterly revenue from its Gaming division.

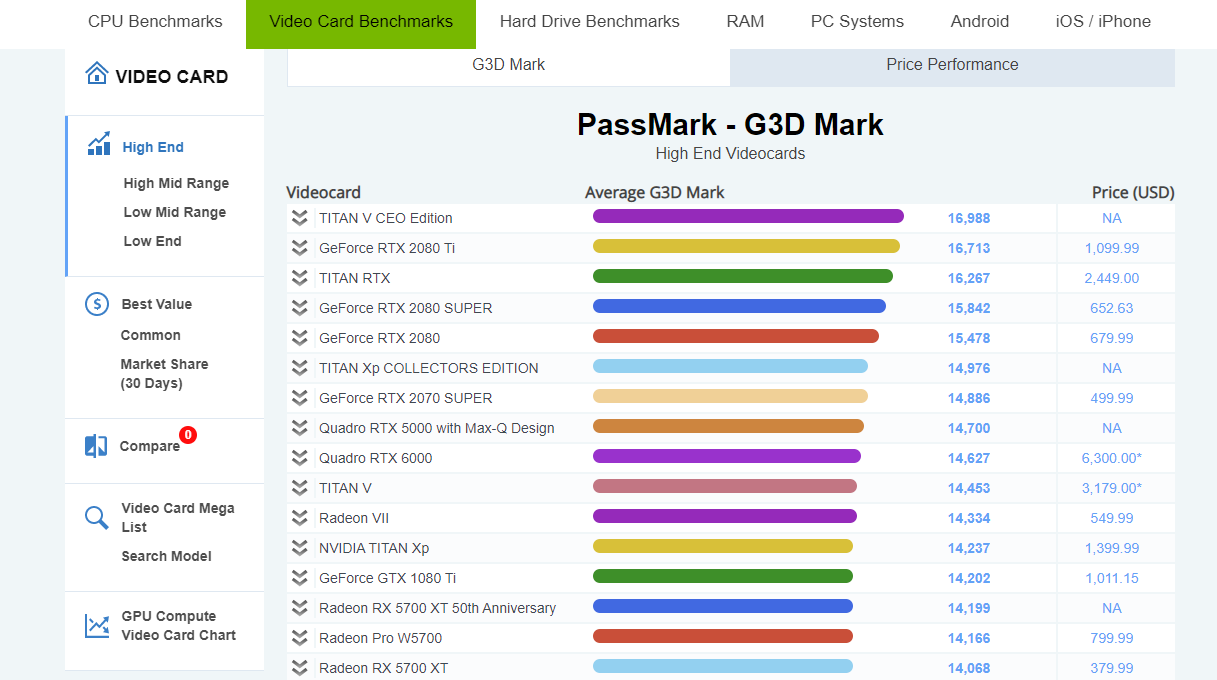

A check on PassMark also revealed that Nvidia’s products are truly the best PC gaming GPUs. Nvidia’s continued dominance of the GPU market makes it a safer long-term investment than Advanced Micro Devices (AMD).

Going forward, Nvidia’s has a great chance of hitting $280 within the next 12 months. Dozens of new PC games will get launched this year. Many of them will require at least new mid-range GPUs like the $499.99 GeForce RTX 2070 Super.

Most wise budget-conscious gamers will also still favor a Nvidia GPU when it comes to price/FPS performance. PCGamer.com tested and found out that the best bang for the buck value GPU this year is the $180 GTX 1650 Super. My fearless forecast is that selling the best high-end GPUs and entry-level GPUs insured Nvidia’s long-term profitability.

Why Dominance In Gaming GPUs Matter

PC gamers put performance as top criteria in their graphics cards purchases. Yes, Advanced Micro Devices’ (AMD) Navi graphics cards can retail at lower price tags. However, Nvidia will still continue to enjoy more than 65% market share.

AMD’s inability to disrupt the mid-range and high-end GPU markets is why Nvidia has higher gross and net income margins. As the chart below states, AMD’s measly 5.07% net income margin is far lower than Nvidia’s 24.07%.

The much better profitability of Nvidia should eventually lead to its stock having higher valuation before 2020 ends. It is inevitable that NVDA’s TTM GAAP P/E ratio of 64.63x will eventually average up with AMD’s very high TTM GAAP P/E of 165.77x. The most probable scenario is that 12 months from now NVDA will trade at around 70x GAAP P/E.

Due to Nvidia’s persistent dominance in graphics cards, it makes sense to conclude that it had a very strong Christmas quarter performance. It is logical to expect that it will end fiscal year 2020 with $5.50 EPS. I won’t be surprised if NVDA will trade higher than $265 later this month after it reports is Q4 2020 numbers.

GeForce Now Will Not Hurt PC Graphic Cards Sales

There is a prevailing misconception that cloud gaming can hurt future sales of gaming hardware like graphics cards. My fearless forecast is that in spite of cloud gaming, sales of new GPUs and CPUs will continue to rise for many years to come. Cloud gaming will prosper only among people who cannot afford to buy decent discreet GPUs. The core PC gaming community (who always have the money to buy the best gaming hardware) are not the intended audience of GeForce Now.

GeForce Now’s low price-tag of $4.99/month is intended to attract casual gamers who want to experience the ultimate power of Turing RTX GPUs without immediately spending $500 or more for a graphics card. GeForce Now will also likely appeal to mobile gamers who can now try pricey premium PC games on their sub-$300 Android phones.

Going forward, I also believe GeForce Now’s compatibility with hundreds of PC games and lower subscription fee can eventually kill Alphabet’s (GOOGL) Stadia cloud gaming platform. Unlike Stadia, GeForce Now doesn’t force subscribers to buy new games from its own games store. GeForce Now works with the current games you own regardless where you bought them.

This open approach to cloud gaming means GeForce Now can attract 5 million or more paying customers before 2020 ends. Going forward, GeForce Now has the potential to generate $300 to $600 million in annual recurring revenue. It can even go to $1 billion/year by year 2025.

I do not think Alphabet will be able to catch up with GeForce Now’s library of compatible PC games. Since it owns the high-end Turing GPUs powering GeForce Now, Nvidia can always afford to offer lower monthly fees than Google Stadia or Shadow PC.

GeForce Now will emerge as the persistent leader in paid PC games streaming. The cloud gaming industry is growing at a CAGR of 30%. It will be worth $8 billion by 2025. Go long on NVDA if you want to ride the coming bonanza in cloud gaming.

Conclusion – NVDA Stock Prediction

The emerging leadership of Nvidia in cloud gaming complements its decades-long dominance of the on-premise PC gaming industry. These two tailwinds are enough reasons why Nvidia deserves a 12-month price target of $280.

My last buy recommendation for NVDA was last November when it was still trading below $217. I am now endorsing NVDA again as a buy while it still trades below $255.

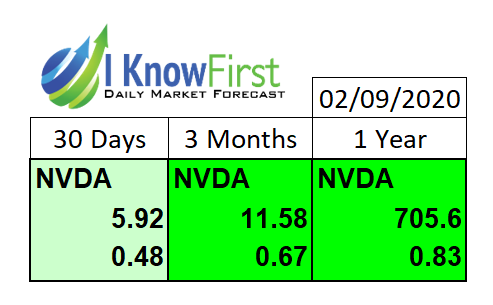

My optimism over NVDA is also due to its very high 1-year market trend forecast score of 705.6. I Know First’s stock-picking AI also has a very accurate 0.81 predictability score for NVDA’s one-year performance. It is a no-brainer that NVDA is a buy right now.

Past Successful NVDA Stock Prediction

I Know First has been bullish in respect of Nvidia stock forecast recently. On November 19, 2019, the I Know First algorithm issued bullish stock predictions for NVDA for long-term horizons. As we see today, the algorithm provided winning NVDA stock prediction – Nvidia stock price have hiked by some 18.5% in line with the I Know First quant trading forecast.

Here at I Know First, our algorithm has modeled and generated stock market outlook for some 10,500 assets worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing daily stock predictions for Stocks under 10 dollars and the S&P 500 stocks, currency forecast, gold price predictions, Apple stock forecast as well as latest Apple stock news coverage. Highly appreciated by institutional clients, as well as private investors and traders, it helps to identify the top stock picks in the market and exercise the traded faster than the other market players.

To subscribe today click here.

To learn more about I Know First and the solutions we offer, visit our website in the links below:

Please note-for trading decisions use the most recent forecast.