NVDA Stock Forecast: Will the Company Powering OpenAI Keep Up the Pace?

![]() This NVDA Stock Forecast article was written by Milana Papadopoulou – Financial Analyst at I Know First.

This NVDA Stock Forecast article was written by Milana Papadopoulou – Financial Analyst at I Know First.

Highlights

- NVIDIA’s shares soared nearly 260% in one year.

- The company posted record earnings in Q2 2023 and is expected to top that in Q3.

- However, DCF and comparable companies’ analysis suggests that the company may be overvalued.

Foundation for AI Revolution

NVDA Stock Forecast: NVIDIA has had an incredibly fruitful year, fueled by the AI craze that pushed their stock up more than 250% in a year. This made them the most successful benefactor of the post-Chat-GPT market. Although the standard deviation of returns is significantly higher than that of the competitors and the average in the wider industry, the Sharpe Ratio, measuring risk-adjusted returns, comes out at 2.9. This is a positive indicator. The stock was trading in the $300s until the 24th of May. Then there was the highest single day jump in price , bringing it into the 400s. The leap resulted from strong sales forecasts and a wave of AI-focused investments in late spring-early summer. Figure 1 shows the growth in competitors’ stocks over 52 weeks, with NVIDIA highlighted in orange.

(Figure 1: 52 week stock chart )

In the last decade, NVIDIA benefited greatly from prioritizing GPU research over CPUs, dominating gaming industry. Substantial revenue came from graphic chips used in professional visualization.

In 2023, GPUs surged in demand for their efficiency in AI and ML, becoming vital in AI. These chips and platforms are now prevalent in global data centers and cloud computing, leading Datacenter sales to exceed Gaming, contributing over 50% of Q2 2023 revenues.

Next week, Q3 earnings release is expected to see datacenter-related sales grow.

The automotive sector, a growing revenue stream, was praised by the CEO for adopting new technologies.

NVIDIA’s ratio analysis highlights strong operational performance with high margins, conservative risk approach, ample liquidity, and minimal default risk. Both gross profit and net income surpass peers, indicating efficient resource allocation and organized cost management.

Considering the DCF model assumptions, the earnings per share is expected to increase over the next 10 years. Assuming constant number of shares.

The Liquidity Ratios also leave no ground for concern about the fiscal responsibilty of the firm. With ample cash reserves and low interest costs, the company’s financials improved in the high-interest-rate climate last year

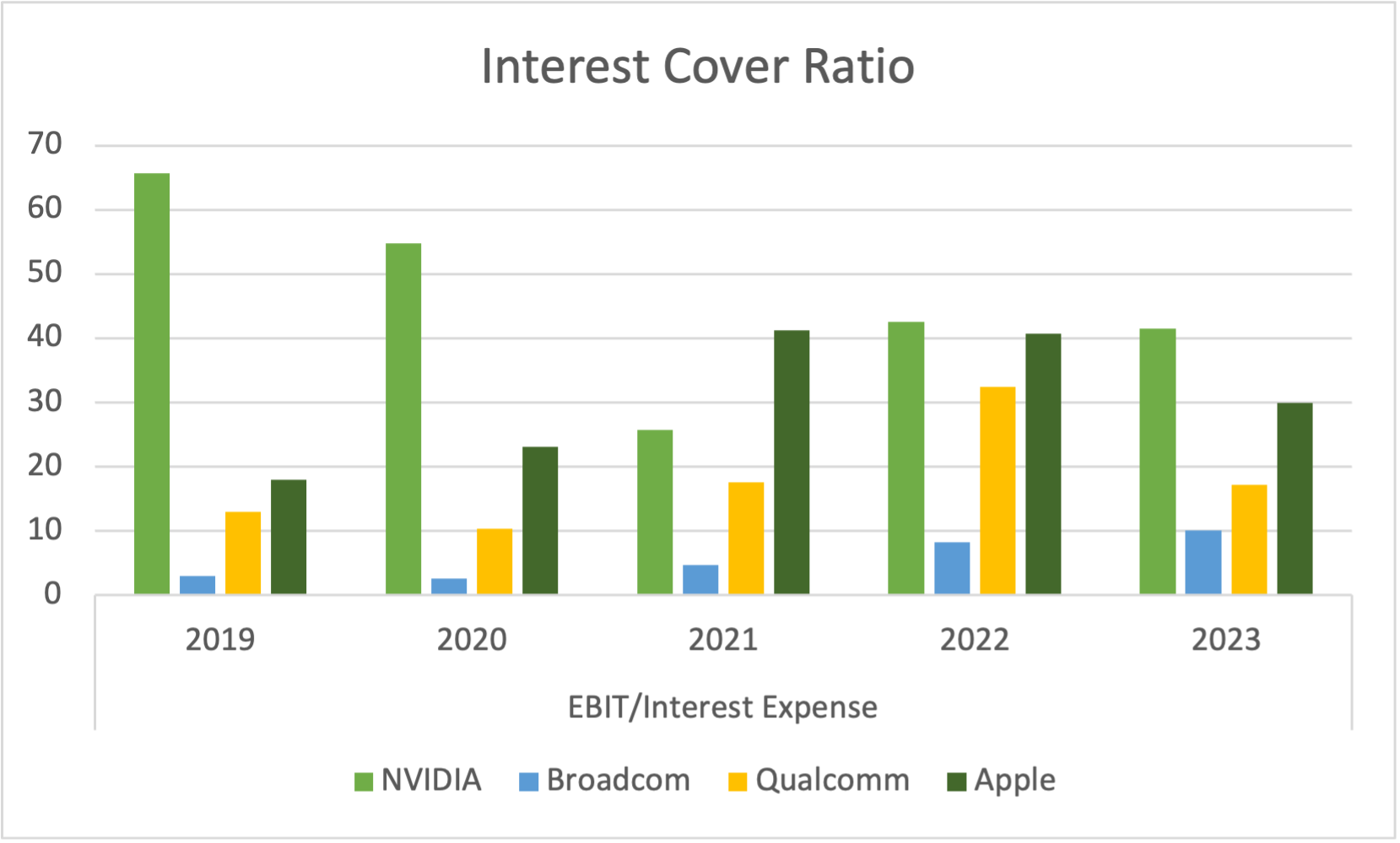

The interest coverage Ratio places NVIDIA ahead of all its peers as well as the industry averages. This indicates that they generate well over the needed liquidity from their operations than needed to service the interest on debt.

On the flip side, NVIDIA consistently underperformed peers in Return on Equity and Return on Capital for 5 years, signaling potential overvaluation. Capital injected recently might not yield proportional returns, and new contributions’ utility could be unsatisfactory. However, the firm outperformed the industry average.

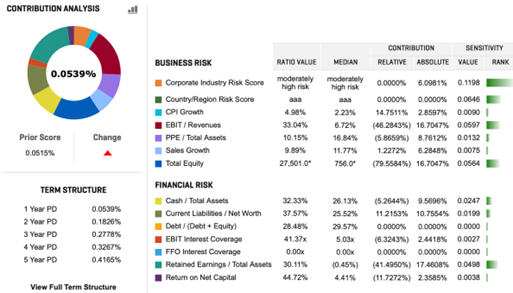

S&P rates the company’s debt as A- with fundamental probability of default within 1 year being 0.0519% as is summarized in the RiskGauge report below, sourced from CapitalIQ.

It’s among the industry’s lowest, indicating maturity and cautious capital budgeting. This provides access to affordable credit for expansion. It would be uncharacteristic for the firm to use debt for expansion. This would risk credit rating and effectiveness compared to invested capital.

Strategic Positioning for AI Dominance

In 2023, Artificial Intelligence made a significant shift from private discussions among tech professionals to becoming a common topic at lunch tables worldwide. And just like that NVIDIA became a “household name” in the financial industry, coming out as arguably the biggest winner.

The success can be attributed to years of persistent groundwork, which began with the CUDA chip. This endeavor may have seemed like a far-fetched failure at the time. Additionally, the risky acquisition of the struggling Mellanox in 2019 played a pivotal role. This move ensured that NVIDIA would power the world’s data centers and provide superior networking capabilities compared to its competitors. When AI started attracting investment, investment in datacenters-adjacent technology, being a vital element, followed.

(Jensen Huang, NVIDIA’s CEO)

What seems like a lucky bet by some, in reality, has been a consequence of years of meticulous planning and calculated risk taken by the management and the current CEO, Jensen Huang in particular. In a recent interview given by Huang to Acquired, he pointed out that “Our job as the CEOs is to look around the corners and anticipate where opportunity will arise in the future… I need to position the company to be standing under the tree so we can do a diving catch when the apple falls”. It is that kind of thinking that put Mr. Huang among the most respected faces in the worldwide tech industry. He is regarded by many as “the greatest CEO in all of tech” and boasts near 98% employee approval scores, which paved the way for talent acquisition as well as confidence in him as a leader when he bet on AI. He has been vocal about the importance of being in touch with recent research even in niche parts of the industry as well as facilitation of progress by cooperation between firms in the industry and claims to have hand delivered the first supercomputer to Open AI at their inception. It is that kind of thinking that made NVIDIA synonymous with Artificial Intelligence for many in the financial world not too closely familiar with the field in 2023.

Potential Implications of US-China Export Ban on the NVDA Stock Forecast

Despite blowout quarter results announced in October, the company is facing a challenge that could potentially stunt its growth for a while. 25% of the firm’s data center sales are in China, therefore, there are concerns regarding the effect of pending regulation on the business.

The US Department of Commerce announced on Tuesday that it planned to curb sales of advanced computer chips to China with a new legislation that is due to pass this week. This is a revision of last year’s legislation passed with the aim to cripple China’s progress in Artificial Intelligence in fear that they could use it against the interest of the United States and their allies. Last year the announcement of the initial legislation having passed led to a drop in NVIDIA’s share price. Back in October of 2022, however, the chips that fell under the export ban were mostly relating to gaming and NVIDIA’s sales of that kind made a negligible part of the firm’s income statement, it also banned the sale of the advanced A100 AI chips, but there were ways to go around the ban. Investors found reassurance in this, and the stock eventually rebounded as firms could utilize the numerous loopholes within the legislation. On the other hand, the revised legislation, as announced by the firm’s representative following the news, will exert an influence on the sales of A800 and H800 Chips, along with other gaming-related chips, potentially significantly affecting NVIDIA’s sales in the region This spread a sense of uncertainty in the market and affected the shares of NVIDIA as well as their competitors like Intel, AMD, and others. Despite the concerns, it is the analysts’ consensus that the sales figures for NVIDIA will continue growing rapidly at least until 2028, solidifying their dominance in the market.

NVDA Stock Forecast

The Discounted Cashflow Analysis places the incremental share price in the range between $228 and $419. The lower-end values are based on a 5-year accelerated growth, followed by a terminal growth rate of 3%, and the higher-end values are based on 10 years of 5 years of accelerated growth and 5 more years of growth gradually slowing down to 3%. The first 5 year-to-year growth rates are determined using analyst consensus from varying sources.

The WACC is calculated assuming a constant capital structure, the initial one being taken from the Annual report. (NVIDIA.com). The risk-free rate equals the 10-year US Treasury bond rate. The market risk premium is the average market risk premium for US companies in 2023. The figures used in the calculation of the free cash flows are from NVIDIA’s 10K report for February 2023. The terminal growth rate is the average US GDP growth rate. The tax rate is 21%, the US corporate tax rate. The 10-year accelerated growth projection seems to be the more likely case as the firm is still far from its mature state.

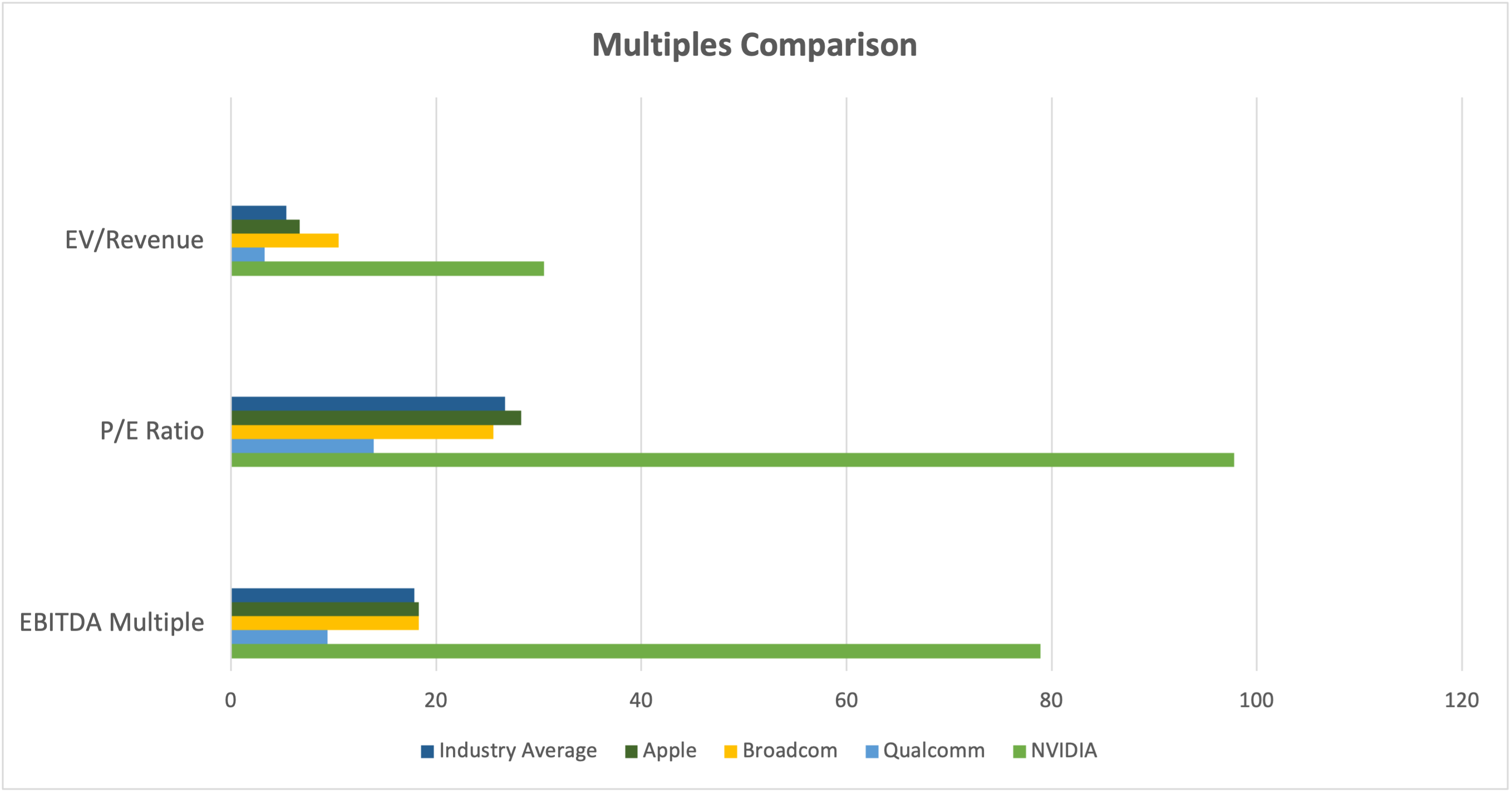

We have taken Apple, Qualcomm, and Broadcom as peers in the comparable companies’ analysis, as they closely match in size and impact within the fabless industry. Fabless is a turn referring to companies like NVIDIA that design and market semiconductors while outsourcing the fabrication to a specialized manufacturer called a semiconductor foundry. We have also incorporated the industry average multiples. The comparable companies’ analysis reveals that NVIDIA’s stock is currently trading at significantly higher multiples even for the tech industry relative to its peers, which makes it an unattractive investment. The analysis places the true share price even lower than the DCF model, at $70-$111, depending on the operating metric.

Such a high valuation, however, could also mean that the multiples at which the stock is trading currently reflect the notion that NVIDIA has not reached a mature state and that the market sees the value currently trading at to be the intrinsic potential value. Higher multiples also indicate that NVIDIA could finance acquisitions with its own shares in the future.

The football field summary represents the valuation based on different methods. It is summarized below. The green line marks the current share price as of 27/10/2023.

It shows that the company is likely currently overvalued relative to its operational metrics as well as compared to its main peers as well as other firms in the industry. The true value of an NVDA share is likely to be closer to the figure forecasted by the DCF analysis as it stands now, and the stock is worth holding or waiting until it declines slightly in order to present a buying opportunity. As government officials continue warning of a looming recession and the boom in AI investing likely to subside in 2024 as well as more competitors catching up to speed and releasing their own AI-compatible chips, NVIDIA will need to keep up the pace to defend its title as “the hottest stock”. It is unlikely that the firm will see the growth of the magnitude it saw in 2023 even with great management, high operational efficiency, and the “head start” it had. Due to the velocity of development in the semiconductor industry, it is rather easy for firms to see themselves behind quickly, so the firm will need to continue lining up strategic acquisitions and releasing new products. However, some investors viewed the $25 billion share repurchase plan as a warning sign that the firm might be running out of suitable investment options. Conversely, others regarded it as a positive notion, believing that the firm sees the stock as currently undervalued.

NVDA Stock Forecast: Conclusion

NVIDIA’s management has shown a consistently solid vision, and it is likely that the Return on Capital figure will improve. The company will continue to bring innovation to the tech world and prosperity to its investors in the long run. Nonetheless, in the short term, the stock price may be too high and may not be worth buying at the current price. If the stock experiences a slight decline in the coming weeks, however, it is likely to become an opportunity to buy.

It is worth paying attention that the stock-picking AI of I Know First has a high long signal on the one-year market trend forecasts taking the opposite position to my prediction. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

NVDA Stock Forecast: Previous Analyst-Algorithm discourse

Despite the Valuation analysis suggesting a bearish view on the NVDA stock forecast, it is possible that it will not come true. The I Know First Algorithm confidently places the stock in the «buy category» with a very strong signal and high possibility of the outcome. You can read the algorithmic forecast here.

This is not the first time when the I Know First analysts’ estimates have been drastically different from the algorithm. In August of 2021 the analysis written by Motek Moyen Research, who is Seeking Alpha’s #2 analyst in technology was also firmly bearish on the stock. At the time of the article release, NVDA stock was trading around the $200 mark. The algorithm was predicting upside potential. NVDA did, in fact, briefly decline later that year only to shoot right back up and more than double as of November 2023.

Past Success with NVDA Stock Forecast

I Know First has been bullish on the NVDA stock forecast in the past. On November 6th, 2022 the I Know First algorithm issued a forecast for NVDA stock price and recommended NVDA as one of the best Mega Cap stocks to buy. The AI-driven NVDA stock prediction was successful on a 1-year time horizon resulting in more than 223.19%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.