NVDA Stock Forecast: New GPU Generation, Robotics – Next Growth Drivers

The article was written by Hieu Nguyen, a Financial Analyst at I Know First.

The article was written by Hieu Nguyen, a Financial Analyst at I Know First.

NVDA Stock Forecast

” The future car is going to have an enormous amount of computational ability, we imagine the number of displays in your car will grow very rapidly.” – Jen-Hsun Huang, CEO of Nvidia

Summary:

- Strong Q1 Earnings may continue in Q2 2018.

- Next GPU Generation – What to expect on August 20th?

- AI and Robotics: New growth drivers for NVIDIA

- Updated DCF model still recommends BUY on NVDA

(Source: Wikimedia Commons)

NVIDIA Corporation is the market leader in the graphics processing unit (GPU) industry. NVIDIA’s GPUs is used to solve many complex issues in computer science including gaming, professional visualization, datacenter, and automotive. The main revenue of NVIDIA comes from gaming GPU, which contributes for more than 56% of the revenue and has increased by more than 35% per year over the last 5 years. However, the most remarkable segment is datacenter, which has grown more than 130% per year in 2 years. Along with the booming in Artificial Intelligence (AI) in general and Deep learning in particular, NVIDIA’s datacenter segment also witnessed strong growth. NVIDIA’s GPUs have speeded up the training process by 10 to 75 times, reducing the data training time significantly. As a result, currently, NVIDIA has partnered with many giant corporations worldwide including Amazon, Baidu, Facebook, IBM, and Microsoft. In automotive segment, NVIDIA also partners with Tesla, one of the market leaders in self-driving cars.

Strong Q1 Earnings may continue in Q2 2018

As we mentioned in the last article about NVDA, the company earning has reached to a new level in Q1 2018. Digging deeper in the company 10Q, we can realize that the main driver for the growth is the gaming segment. In fact, the Gaming segment shot up by nearly 68% quarter over quarter in Q1 2018. The second strong segment, datacenter, also contributed to the overall growth by its 72% growth rate. Its two segments brought the total revenue from $1.94 billion to $3.21 billion.

The gross profit margin jumped up significantly in Q1 2018. However, I expect this growth rate not to be maintained by the company. Despite of the fact that the company is still dominating in all of its market, the GPM only increased 1.25% year over year in the past 5 years. In the next 5 years, I expect the Datacenter and Gaming segments to increase at a double-digit growth rate. The main drivers will be discussed in the following paragraphs.

Next GPU Generation – What to expect on August 20th?

According to Nvidia, the company plans to hold a GeForce event at Gamescom on August 20th. The company also mentioned that it may reveal some surprises in this event. Undoubtedly, all we should expect is a new GPU. Recently, CEO Jensen Huang said that the next GeForce GPU Generation will be “a long time from now”. However, based on several images that has been leaked on Baidu, the new GPU will be released soon. We can expect the new graphics card to support 16GP GDDR6 memory. Moreover, it will also have a 10-phase VRM thanks to 6+8 pin power connectors.

On August 20th, Nvidia also scheduled a talk named” NVIDIA’s Next Generation Mainstream GPU” at Hot Chips. Nvidia’s GeForce GTX 1180 may include 3,584 CUDA cores with the clock speed 1.6 and 1.8GHz. With the new configuration, the card may be able to play many latest games at 4K resolution. I expect this new GPU generation to boost the continuing growth of Gaming segment. As Acer and Asus’s latest monitors include 144Hz refresh rates, HDR, as well as Nvidia’s G-sync support, players need to purchase such a powerful GPU to take advantages of these features.

These two events will kick off at noon on August 20th. After these event, I Know First will release a new article analyzing the features of the new GPU generation as well as the outlook of this product.

AI and Robotics: New growth drivers for NVIDIA

Our last premium article by Kwon Sok has deeply analyzed how Nvidia can take advantage of the AI industry growth. In this article, I will continue to talk about Nvidia’s plan on applying AI on Robotics as well as autonomous car.

According to the International Fedration of Robotics (IFR), the global sales of industrial robots in 2017 increased by 31%. The unit sales of industrial robots grew from more than 294 thousand in 2016 to around 387 thousand in 2017. Robotics improve not only efficiency, cost effectiveness, but also flexibility to change. The number of unit sales is estimated to reach 3 million in the end of 2020. As the capabilities of robots highly depend on its ability to observe the environment and take action, AI can significantly boost the productivity of a robot.

Nvidia has earlier launched its complete platform for developers to build AI application on many type of robotic hardware. The platform uses the power of deep learning to rise the power for robotics industry. Nvidia Jetson Xavier is proved to save about 10 times the energy and perform at 20 times better than its two preceding generations, TX1 and TX2. With six kinds of processors, Jetson Xavier is able to support dozens of algorithms simultaneously in real-time application.

Moreover, on July 10th, Nvidia also announced its partnership with Bosch and Daimler (parent company of Mercedes-Benz) to help realize the dream of autonomous car. In fact, autonomous cars need to process a significant amount of data at a time. Due to the limitation of hardware, the computing process was not size-efficient as well as enery-efficient. However, now thanks to Nvidia’s Drive Pegasus with the back up of Drive Xavier and Drive Constellation, the dream of autonomous car has become real. According to Nvidia, the Drive Pegasus can perform more than 1 trillion operation with only 1 watt of power and 320 trillion operations in just 1 second.

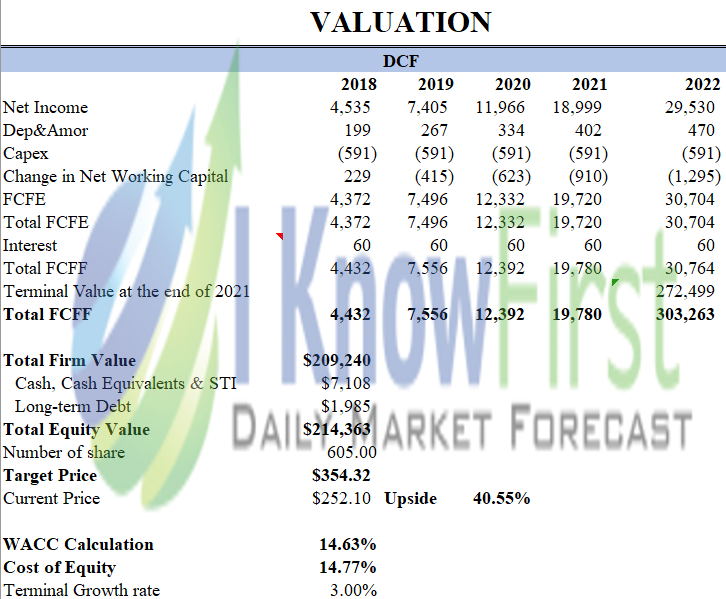

Updated DCF model still recommends BUY on NVDA

Our 5-year DCF analysis arrives the target price of $354.32 for NVDA, 40.55% upside from the current price. DCF model was constructed based on 3 main factors: top line and bottom line forecast, capital expeditures, and WACC. Since the main contributors for the total revenue is Gaming and Data center, the assumptions on these two segments are extremely important to value the stock price. I expect the Gaming segment to increase at 50% over the next 5 years thanks to the next GPU generation. On the same hand, I predict the Datacenter segment to growth at 80% in the same period of time. I am also conservative in my assumptions in GPM as I assume the growth rate of GPM to be 0.75% compared to 1.25% in the past 5 years

Conclusion

Nvidia still remains as a dominator in GPU industry. Thanks to the strong potential of AI application in real world, Nvidia keeps growing significantly over the last 3 years. In this August, Nvidia may release its next GPU generation with a lot of new features. Besides that, the company has partnered with Bosch and Daimler in autonomous car, a potential sector for Nvidia. Based on these drivers, I expect NVDA stock to keep its strong momentum in the next 1 year.

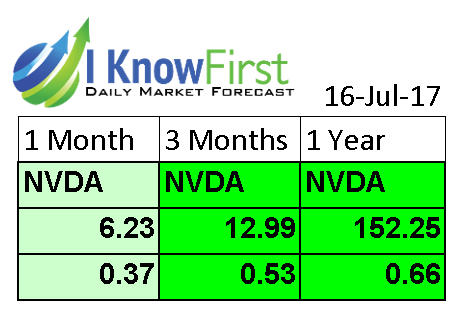

Current I Know First Forecast for Nvidia

My recommendation is supported by the forecast of I Know First. On August 3rd , 2018, I Know First issued a forecast for NVDA with a strong 1-year bullish signal of 487.74 and a predictability of 0.72. In addition, the signal gets better over time from 15.84 for 1 month to 487.74 for 1 year. The prediction totally agrees with the above arguments about the future of Nvidia.

Past I Know First Forecast Success with NVDA:

On July 16, 2017, I Know First published a premium article saying that it’s time to Buy NVDA’s Stock. I Know First has been bullish on NVDA’s stock on all of the three time horizons. We suggested that Gaming is still Nvidia’s biggest revenue and profit generator. Moreover, I Know First also suggested that the new Audi 8 2017 smart luxury car is prima facie evidence that Nvidia has a long-term winner in self-driving cars. In fact Nvidia stock price jumped up by 51.11% outperforming the benchmark by 37%. I Know First algorithm successfully predicted the movement of the NVDA stock price over all three period of time.

(Source: Yahoo Finance)

Current I Know First subscribers received this bullish NVDA forecast on July 16, 2017.

To subscribe today click here.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.