Northrop Grumman Stock Forecast: On the Rebound

The article was written by Whitney Su, a Financial Analyst at I Know First.

“With a continued emphasis on performance, we are sharpening our focus on operational efficiency and agility to bring the power of our portfolio to solve our customers’ rapidly evolving needs.”

Kathy Warden, CEO, Northrop Grumman, Inc.

Summary

- Northrop Grumman is currently priced at $325.25. Northrop Grumman stock has been on an upward trend since reaching a low of $235.24 in December 2018.

- Escalating tensions in the Persian Gulf allow defense sector companies like Northrop Grumman to upgrade military equipment.

- Northrop Grumman is consistently looking to the future of warfare, currently working on a $200 million contracted partnership with Raytheon on hypersonic technology.

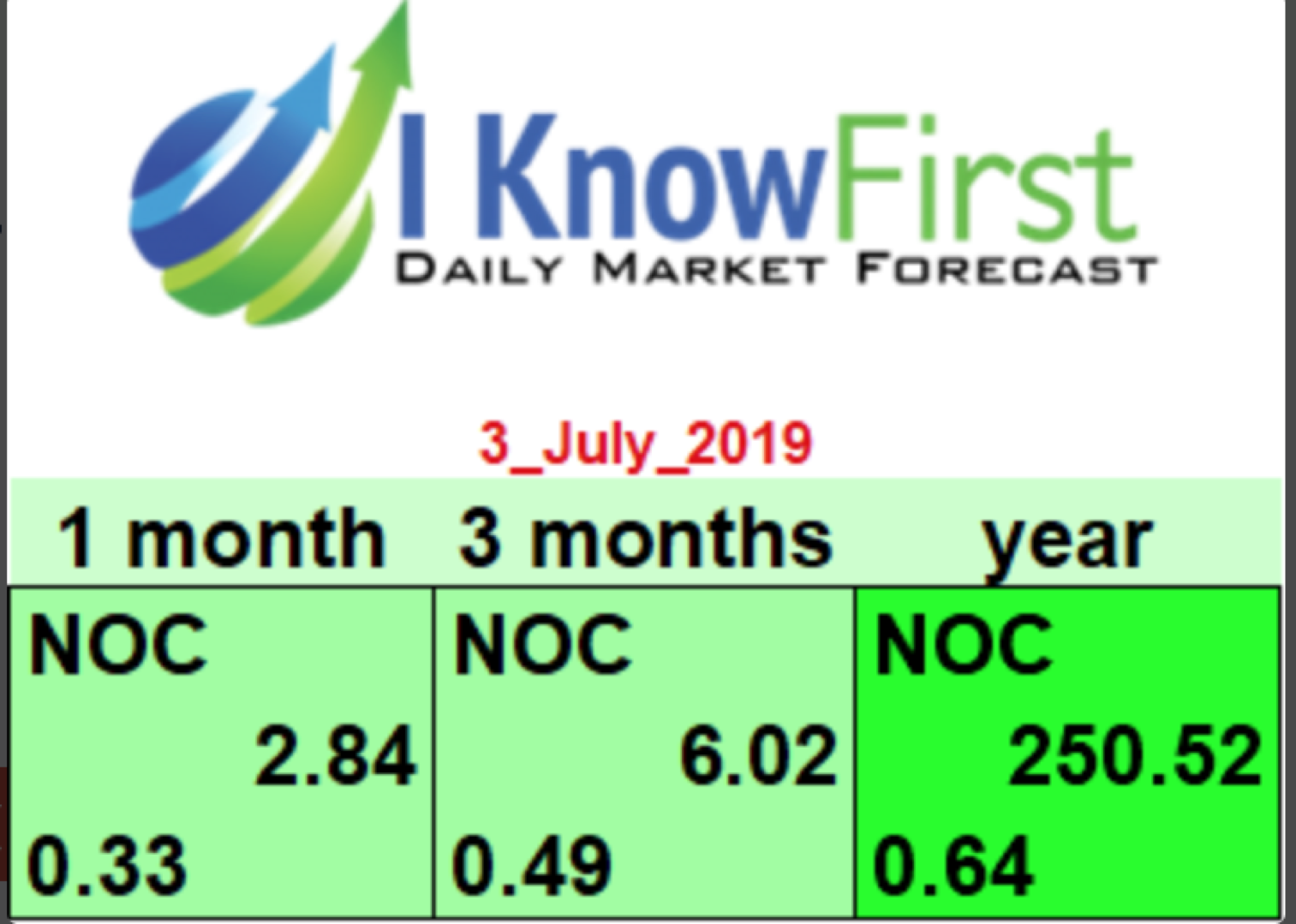

- Current bullish I Know First long-term forecast for Northrop Grumman.

Company Background

Northrop Grumman Corporation is an American global aerospace and defense technology company. It is one of the world’s largest weapons manufacturers and military technology providers, employing over 85,000 workers and boasting an annual revenue of over $30 billion. The company is divided into four main sectors: 1) Aerospace Systems 2) Innovation Systems 3)Mission Systems, and 4) Technology Services.

Northrop Grumman’s competitors are primarily other ‘big names’ in the defense and aerospace industry, including the likes of Lockheed Martin, Boeing, and Raytheon. Despite claims that Lockheed Martin is awarded more military contracts (especially since the ‘buzz’ lately that Lockheed Martin is partaking in a $34 billion defense deal with the Pentagon to provide 478 new F-35 fighter jets), Northrop Grumman remains crucial to US military endeavors. Critics of Northrop Grumman commonly compare Northrop Grumman’s YF-23 line to Lockheed Martin’s F-35, pointing out F-35s ‘superiority’ because of its designated, widespread use in the US military. Yet, this comparison is flawed: F-35 and YF-23 are widely different programs (joint strike fighter vs. advanced tactical fighter). It is worth noting that when it comes to bombers, Northrop Grumman dominates. The U.S. Air Force plans to spend as much as $5.9 billion over the next five years to begin buying Northrop Grumman’s B-21 stealth bombers. Northrop Grumman is a leading global security company providing innovative systems, products and solutions in autonomous systems, cyber, C4ISR, space, strike, and logistics and modernization to customers worldwide.

Financials

NOC stock is currently priced at 325.25, up over 32% since the start of the year. Northrop Grumman reported an annual revenue of $30.09 billion for 2018, a 15.73% increase from 2017, making 2018 the first year that revenue reached the $30 billion mark for NOC. The company currently has a price-earnings-ratio of 15.79, and this is below the average price-earnings ratio the S+P 500 (22.07), indicating that NOC is not overrated. Northrop Grumman’s ROE for the three months ending March 31, 2019 was 41.42%, with ROE being between upper-30s and mid-40s every quarter since 2016, which is very strong, given that the average return on equity in the S+P 500 was between 14 to 18 percent over the last 3 years. NOC earns a return on equity which is more than twice as high as the return on equity from the market.

Right now, NOC has a dividend yield of 1.63%, which is below the average of the S&P 500, which has an average of 2%. The dividend payout for NOC is $5.28, which has increased by nearly 200 percent since the May 2012 payout of $1.77. NOC expects strong cash flow in 2019 of $3.8 billion to $4.2 billion. NOC will continue its plan of share repurchases, planning for a total of approximately $750 million in repurchases this year. Such a buyback program is appreciated by investors, as it will lead to higher stock demand. There are also plans to retire about $500 million in debt in the third quarter of 2019.

Northrop Grumman saw a strong Q1 2019 performance across all sectors and adjusted guidance accordingly. Northrop Grumman Corporation reported first quarter 2019 sales increased 22 percent to $8.2 billion from $6.7 billion in the first quarter of 2018. NOC has set its revenue guidance to be $34 billion for 2019.Q1 year-over-year EPS increased 6% to $5.06. Q1 net awards amount to $12.3 billion, with backlog orders increasing as well year-over-year by 7% to $57.3 billion. As a result, EPS guidance was increased to between $18.90 and $19.30.

All Eyes on Iran

As tensions rise in the Persian Gulf, several defense sector stocks may play to the current climate. This past month of June, in particular, saw many notable confrontations involving Iran. First, there was the attack on two oil tankers from Japan and Norway in the Strait of Hormuz on 13 June 2019 that the US claims was coordinated by Iran. Then on 20 June 2019, there was the shooting of the US RQ-4A Global Hawk drone (manufactured by Northrop Grumman) by the Iranian Revolutionary Guard that reportedly cost the Department of Defense $222 million per unit. The US claims it was in international airspace whereas Iran claims that it was over Iranian territory. Tensions between the two countries have escalated as of late, with President Trump having threatened to declare war.

The nervous atmosphere given the current situation in the Gulf region lends itself to Northrop Grumman products being in high demand. Yesterday, 2 July 2019, Northrop Grumman received a $104 million award for updating UH-1Y, AH-1Z and UH-60V mission computers. The contract covers delivery of production units, retrofit units and spare units for the Marine Corps, Defense Logistics Agency and the government of Bahrain under the Foreign Military Sales Act.

Signing of a $958 Million Deal

On 7 June 2019 Northrop Grumman was awarded a $958-million-dollar contract for 30 new multi-mission, Ground/Air Task Oriented radars by the US Marine Corps Unlike other radar systems used in the military, Ground/Air Task Oriented Radars (G/ATOR) combines the capabilities previously provided by five different legacy radars, greatly enhancing the Marine Corps’ ability to perform various air defense and counter-fire functions. “Fiscal [year] 2019 procurement funds (Marine Corps) in the amount of $194,748,327 will be obligated at the time of award and will not expire at the end of the current fiscal year,” the official announcement reads. The work is expected to be completed by January 2025.

Northrop Grumman and Raytheon Team Up

Northrop Grumman remains at the forefront of modern warfare technology and focused on innovation, recently announcing its partnership with Raytheon as part of the $200 million Hypersonic Air-breathing Weapon Concept (HAWC) program by the US Air Force and DARPA. This program will bring Raytheon and Northrop together to “develop, produce, and integrate scramjet combusters built by Northrop into Raytheon’s hypersonic tactical missiles.” The reasoning behind this partnership is that using a scramjet will allow hypersonic vehicles to have higher sustained speeds, shorter flight times, and increased weapon survivability. The US military is eager to develop hypersonic technology as doing so would allow for aircraft to travel over five times the speed of sound, rendering enemy defense systems essentially useless. It would alter warfare completely, with China and Russia also funding programs to develop hypersonic technology. “The Raytheon/Northrop Grumman team is quickly developing air-breathing hypersonic weapons to keep our nation ahead of the threat,” says Thomas Bussing, Raytheon Advanced Missile Systems vice president.

Conclusion

NOC stock has rebounded from its low of 235.24 in December and is currently priced at 325.25. Aerospace and defense sector stocks, in general, have experienced an upward surge, consistently beating the return on the S&P 500 this year to date. With tensions escalating in the Persian Gulf region as of late and the US military (and other militaries around the world) looking to take advantage of the latest military technology, major defense companies such as Northrop Grumman have received huge government-backed contracts and awards to upgrade equipment. The inflow of orders will increase NOC overall revenue for the year, with Northrop projecting a revenue of $34.0 billion for the year, up from $30.09 billion in 2018. With this increase in revenue, we can expect increases in earnings-per-share as well. In 2018, EPS for NOC stock came in at $18.49. For 2019, increased overall projected revenue combined with the company’s aggressive share buyback program of $750 million worth of shares is likely to bring Northrop Grumman EPS to a range of 19.25 to 19.7, with a consensus forecast of 19.41. This is in good consensus with the bullish long-term I Know First forecast.

Financial analysts at Yahoo Finance currently give Northrop Grumman stock a buy rating.

Current Bullish I Know First Forecast for Northrop Grumman Stock

The I Know First machine learning algorithm currently has a positive outlook for NOC stock. The stock is bullish over the 1 month, 3 months and a year horizon. It is most bullish for the 1-year period with a signal of 250.52 and predictability indicator of 0.64.

How to interpret this diagram.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.