MXIM Stock Price Forecast: Buy It Now, Before the Greatest M&A Deal of 2020

This MXIM stock price forecast was written by Jessica Kremer – Analyst at I Know First.

This MXIM stock price forecast was written by Jessica Kremer – Analyst at I Know First.

Summary

- Maxim Integrated holds healthy financials, prompting my future price target for MXIM stock to be $73, making this stock a buy.

- MXIM has been producing innovative technology in the healthcare space, with smaller and faster optical sensors and microcontrollers.

- The recent $21 billion acquisition of Maxim to Analog Devices will provide both shareholders with impressive gains, and the combined company will possess a large portion of the market space.

Maxim Integrated is a technology company that designs, manufactures, and sells analog and mixed signal integrated circuits. Their products span multiple industries, from automotive to healthcare. Currently, MXIM stock is up, trading around $70. Over the past quarter, MXIM shares have increased 38.88%. In the last year, MXIM stock gained 13.66%, as stated by Yahoo Finance.

MXIM’s Healthy Financials

Maxim Integrated released their 2020 Q3 results in late April, exhibiting impressive growth during the quarter. Despite the pandemic affecting their test operations, Maxim was able to earn a revenue of nearly 562 million, as mentioned in their press release. Additionally, although their total cash was $1.7 billion, down $97 million from the prior quarter. However, their operating cash flow was $210 million, up from $207 million in the Q3 of 2019. Since the release of these results, the stock price has increased, demonstrating investors confidence in the company.

Furthermore, Maxim’s profitability is impressive relative to the sector. Their gross profit margin, coming in at 64.77%, illustrates their production efficiency and ability to maximize profits. Relative to their industry, MXIM has a high gross profit margin, and investors expect it to maintain this efficiency. Additionally, MXIM’s ROE comes in at 49.65%, much larger than their industry average at 2.59%. This demonstrates the company’s efficiency in utilizing shareholder equity.

Finally, Maxim’s balance sheet is healthy, with their short term and long term liabilities being covered by their short term assets of $2.3 billion. As can be seen above, the company consistently holds more equity and cash than debt, demonstrating their ability to repay the debt. All in all, the company’s healthy financials set the stage for continued growth, strengthening my buy verdict.

Maxim’s Previous Successful Products

Although the company produces technology for multiple industries, they have recently produced innovative technology for the healthcare industry. On July 8, 2020, the company announced the industry’s thinnest dual-photodetector optical sensor solution for wearable health and fitness products. This simplified design “offers designers of advanced wearable products the ability to achieve a 45 percent thinner optical design versus a discrete approach.” Additionally, the module measures vital signs to the most rigorous medical standards, granting designers more time to develop market-differentiating features. All in all, Maxim estimates that this will save designers up to six months in designing more efficient and functional products.

Additionally, Maxim announced the ultra-reliable arm cortex microcontroller on June 22. This innovative design includes the industry’s lowest power consumption and smallest size for sensor applications. Some key advantages of this technology include the high reliability, with ECC-protected flash and SRAM prevent bit flips for higher uptime. It is also the world’s smallest microcontroller with the lowest power consumption. The recent developments in technology exhibits the company’s dedication to innovation, furthering my buy option.

Successful Future Outlook: Maxim’s Merger With Analog Devices

On July 13, 2020, Analog Devices announced its acquisition of Maxim Integrated, a $68 billion dollar company, for nearly $21 billion. This merger, one of the largest in the semiconductor industry, will grant Maxim stockholders “0.630 of a share of ADI common stock for each share of Maxim common stock they hold at the closing of the transaction.” At closing, Maxim investors will own about 31% of the combined company. As a result of this announcement, MXIM stock rose, and this momentum strongly impacts my buy verdict.

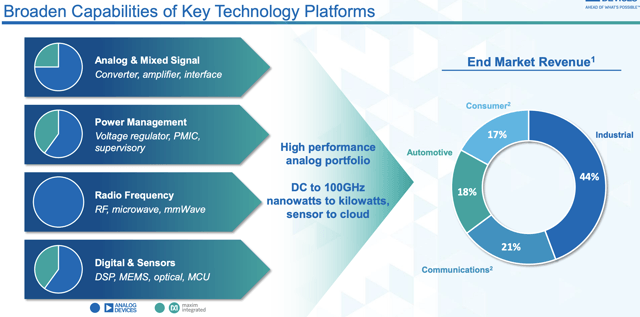

The merger of these two companies will provide both stockholders with impressive returns. Analog’s press release stated that “Maxim’s strength in the automotive and data center markets, combined with ADI’s strength across the broad industrial, communications and digital healthcare markets are highly complementary and aligned with key secular growth trends.” Additionally, the merger of the two companies will enhance the expertise and breadth of engineering capabilities, combining 10,000 engineers and approximately $1.5 billion in annual research and development funds. It will also grant the combined company a large share of the $60 billion dollar industry. All in all, this merger will allow the combined company to offer their 125,000 customers more complete solutions.

Furthermore, as can be seen above, MXIM holds healthy valuation ratios. In particular, Maxim’s P/E ratio is high, demonstrating investor’s optimism in its future growth. Analog Devices (ADI) also holds a high P/E ratio, and with the merger of these two companies, their ability to grow in the future only increases.

Conclusion

Maxim Integrated is a largely successful company, generating impressive revenues and continuously improving their already innovative technology. With the recent M&A deal with Analog Devices, Maxim will only have more resources to continue to thrive and bring in profits for their shareholders. I have also set my price target to $73, largely due to this merger. Additionally, my buy verdict is strongly supported by I Know First’s bullish forecast. Our algorithm grants MXIM stock a score of 79.35, with the predictability of 0.69, indicating expected future returns.

I Know First’s Past Success with MXIM Stock Price

I Know First was successful with MXIM stock price forecast. On July 12, 2020, the I Know First algorithm issued a bullish 7 day MXIM stock forecast, with the algorithm successfully forecasting the stock’s movement. After the 7 days, MXIM shares rose by 11.36%, in line with our forecast.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.