Gold Price Prediction: Investment in Gold in Fragile Macroeconomic Environment

This “Gold price prediction: investment in gold in fragile macroeconomic environment” article was written by Zhou He – Financial Analyst at I Know First.

Highlights

- Gold has always been regarded as a safe haven investment product.

- The trend of the US dollar and gold show a seesaw trend.

- The real rate determines the opportunity cost and holding cost of gold.

Overview

Gold is one of the commodities with the most vital financial attributes, and it is also an irreplaceable risk-hedging tool. It has a high value and is an independent resource that is not restricted to any country or trade market. Therefore, investing in gold can often help investors avoid problems that may arise in the economic environment. The gold market is a global market. London and New York are home to the two largest gold trading markets in the world. The operation of the gold market is similar to other investment markets and the stock market. Buying and selling happen every day, and prices are affected by economic conditions within the market. Like other market resources, the cost of gold is determined by supply and demand as well as by financial conditions. People often stockpile gold in times of economic inflation, political strife, and war.

Five Factors Affecting the Gold Market

Gold has always been regarded as a safe haven investment product. One of the reasons is that during the period of war and political turmoil, the demand for gold increased, which will stimulate the rise of gold prices. Specifically, during a period of war and political turmoil, economic development will be greatly restricted, and any local currency may depreciate due to inflation. At this time, the importance of gold will be brought into full play. Because gold has recognized characteristics and is an internationally recognized trading medium, at this moment, people will turn their targets to gold. The rush to buy gold will inevitably lead to a rise in the price of gold. Right now, the risk aversion caused by the conflict between Russia and Ukraine still exists, which leads to people’s risk aversion. In the brewing stage before the war, gold prices generally rose due to risk aversion. In the stage of war conflict, when the situation becomes clear, the price of gold will weaken.

The trend of the US dollar is one of the important factors affecting the fluctuation of gold prices. The trend of the US dollar and gold show a seesaw trend, which can also be called a negative correlation. But both are the world’s “hard currency” and are internationally recognized hedging products. The reason why the U.S. dollar and gold prices have such a relationship is that the gold market price is denominated in U.S. dollars. The appreciation of the U.S. dollar will cause the price of gold to fall, and the depreciation of the U.S. dollar will push the price of gold to rise. The strength of the U.S. dollar can have a very significant impact on the price of gold. The Fed raised interest rates again by 75 basis points recently, and in its latest statement, the Fed stated that it will now consider the impact of “cumulative tightening” and “monetary policy lag” on economic activity and inflation. Meanwhile, Fed Chairman Jerome Powell also said the “final level” of U.S. interest rates could be higher than previously thought, while also saying the window for a soft landing had “narrowed”. Of course, this round is expected to be 5%, and it may be slightly higher than 5%, but it is impossible to reach 7%- 8%, so the Fed’s interest rate hike is coming to an end, and the dollar may reach its peak in these few months, thus It began to fall back, providing some support for the rise of gold prices next year, at least in the second half of next year. Overall, under the expectation of an interest rate hike, the dollar strengthened, and the price of gold fell.

In the long run, the price of gold is ultimately determined on the basis of supply and demand. If the production of gold increases substantially and the demand does not increase effectively, the price of gold will drop due to too much supply. In terms of production, the latest statistics from the China Gold Association show that in the first three quarters of 2022, domestic raw gold production was 269.987 tons, an increase of 33.235 tons compared with the same period in 2021, a year-on-year increase of 14.04%. In addition, in the first three quarters of 2022, 86.362 tons of gold were produced from imported raw materials, a year-on-year increase of 9.70%. If this part of the gold production from imported raw materials is included, a total of 356.349 tons of gold were produced nationwide, a year-on-year increase of 12.95%. According to the “Global Gold Demand Trend Report” for the third quarter of 2022 released by the World Gold Council, global gold demand (excluding over-the-counter transactions) in the third quarter of 2022 increased by 28% year-on-year to 1,181 tons. Compared with the third quarter of 2021, it has increased by 10%. In terms of global demand, the strong growth was largely led by India, whose jewelry consumption rose 17% year-on-year to 146 tons. In the third quarter, Saudi Arabia’s gold jewelry consumption demand increased by 20% year-on-year, and the increase in the UAE reached 30% in the same period. On the other hand, with the increasing preference of Chinese consumers for gold jewelry and the relatively stable domestic gold price in the third quarter, China’s gold jewelry demand also saw a slight growth of 5% year-on-year. The strong performance in the third quarter has also brought total gold demand so far this year back to pre-epidemic levels; among them, although investment demand has shrunk significantly, consumer demand and central bank gold purchases have effectively improved the overall performance of gold. While the demand for gold consumption is stabilizing, the amount of gold purchased by the central bank has also increased significantly. It is estimated that the amount of gold purchased in the third quarter will approach a new record of 400 tons.

The purchasing power of a country’s currency is determined based on the price index. When a country’s prices are stable, the purchasing power of its currency is more stable, and vice versa. If inflation is severe, there is no guarantee for holding cash, and interest charges cannot keep up with the sharp rise in prices. People will buy gold because at this time the theoretical price of gold will rise with inflation. The higher the inflation in major western countries, the greater the demand for gold as a store of value, and the higher the world gold price. Among them, the inflation rate of the United States is the most likely to influence the change of gold. In 2022, under the influence of the epidemic and the high crude oil price, the global inflation rate is already astonishing, especially since the inflation rate of major western countries led by the United States will exceed 8.2% in 2022. In the second half of this year, the Federal Reserve raised interest rates decisively and aggressively, each time raising interest rates by as much as 75 basis points. The U.S. central bank has begun to try its best to slow down the inflation rate. Gold is still very attractive.

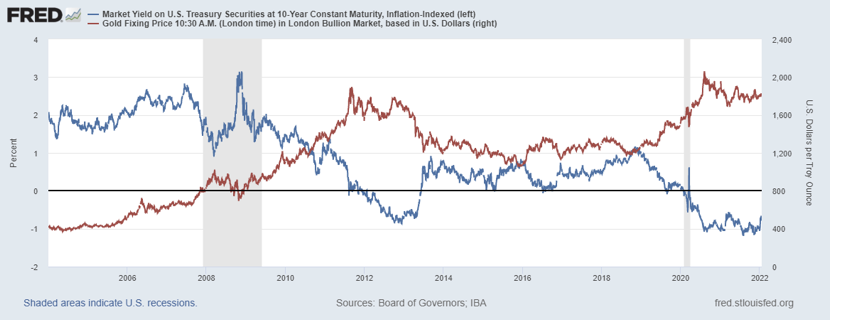

Interest rates are closely related to gold, and of course, this rate is the real rate. It determines the opportunity cost and holding cost of gold. Gold could fall as real interest rates rise. Because investing in gold will not earn interest, the profit of its investment depends entirely on the price rise. Therefore, when the interest rate is low, investing in gold will have certain benefits; but when the interest rate rises, it will be more attractive to charge interest. Interest-free gold The value of the investment will decline. Since the opportunity cost of gold investment is relatively high, it is better to put it in the bank to collect interest, which is more stable and reliable. Especially when the interest rate in the United States rises, the dollar will be absorbed in large quantities, and the price of gold is bound to suffer. During the pandemic, the Fed has engaged in quantitative easing, pushing real interest rates below -1%. However, since real interest rates bottomed out around the -1% level in 2020, gold prices have been in a downtrend zone. If the Fed continues quantitative tightening and raises interest rates to around 5% in 2023, real interest rates may turn positive in the near future. But gold is likely to retreat sharply from its current range.

Gold Price Prediction: Investing in Gold with I Know First

I Know First provides gold price prediction for Gold assets based on the AI algorithm for six horizons: 3-day, 7-day, 14-day, 1-month, 3-months, and 1-year. Below, we can observe the performance of the Gold prediction which was sent to our clients (you can access our forecast packages here). This Gold price prediction is part of the Commodities Package, one of I Know First’s algorithmic trading solutions. This package gives gold price prediction for Gold and other precious metals for the various forecasted time frames and includes our algorithmic outlook for:

- Gold ETF (GLD) direction

- Physical Gold (XAU) direction

- Silver (XAG) direction

Package Name: Gold Forecast

Forecast Length: 14 Days (11/9/2022 – 11/23/2022)

I Know First Average: 1.75%

Gold Price Prediction: Conclusion

Challenges in the global economic environment have had an impact on consumer gold demand this year. Most market demand has gradually benefited from the post-epidemic economic recovery, but we believe that a wide-ranging economic slowdown will also put pressure on consumer gold demand, especially as local gold prices in many markets have begun to rise significantly. But central banks’ gold-buying spree is expected to continue due to geopolitical tensions.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.