In the News: AI-Powered Stock Market Predictions Report by i24 News TV Channel

This stock market predictions TV report coverage is written by the I Know First Research Team.

This stock market predictions TV report coverage is written by the I Know First Research Team.Stock Market Predictions by AI

Israel is home to one of the most buzzing hi-tech and entrepreneurship ecosystems in the world. Major world companies establish their R&D presence on this soil which has significant footprint on the economy and people. The list of companies is endless and is growing dynamically each year with both new startups either attracting attention of the established US industry giants coming here to acquire new tech and boost their competitive positions, and new Israeli start-ups which make their ways to NASDAQ listing. However, one Israeli startup stands out of the mainstream and is boasting that its self-learning artificial intelligence algorithm can uncover the best investment opportunities and beat the market.

“… an Israeli startup is boasting that its self-learning artificial intelligence algorithm can uncover the best investment opportunities and beat the market…”

Israel Business Weekly, i24 News Channel

In mid November 2019 I Know First, a Tel Aviv based AI stock forecasting company let i24 News TV channel into its offices to shoot a story for the broadcast and cover the latest developments on the proprietary AI algorithm that generates stock market predictions developed by the company.

The main subjects of the discussion were the concepts and mechanics behind the predictive algorithm and its application in real-life scenarios, enriched by the recent performance evaluations results. Ben Rubin also discussed how the accuracy of the algorithm is compared against human financial advisers in terms of market forecasting accuracy – hit ratio.

“Hit ratio of the regular investment houses could be around 50%-60%, and with our AI algorithm we succeeded in reaching 67%-75% in some investment universes”

Ben Rubin, Head of Advisory at I Know First

Yaron Golgher, CEO of I Know First, provided significant insights into the current company advancements into its technology and future prospects for upcoming products for wide range of potential clients.

Israeli #fintech company, @i_Know_First, has a one-of-a-kind self learning artificial intelligence program that is able to uncover the best investment opportunities. #IsraelBusinessWeekly — https://t.co/vZVSe4PNFc pic.twitter.com/1ydyGon8Qt

— i24NEWS English (@i24NEWS_EN) December 1, 2019

I Know First Stock Forecast AI Algorithm

So how does this work, you may ask, and can I do the same? Yes for the latter – that is as easy as finding a reliable broker and subscribing to I Know First forecasts here – but the former question begs a more in-depth discussion.

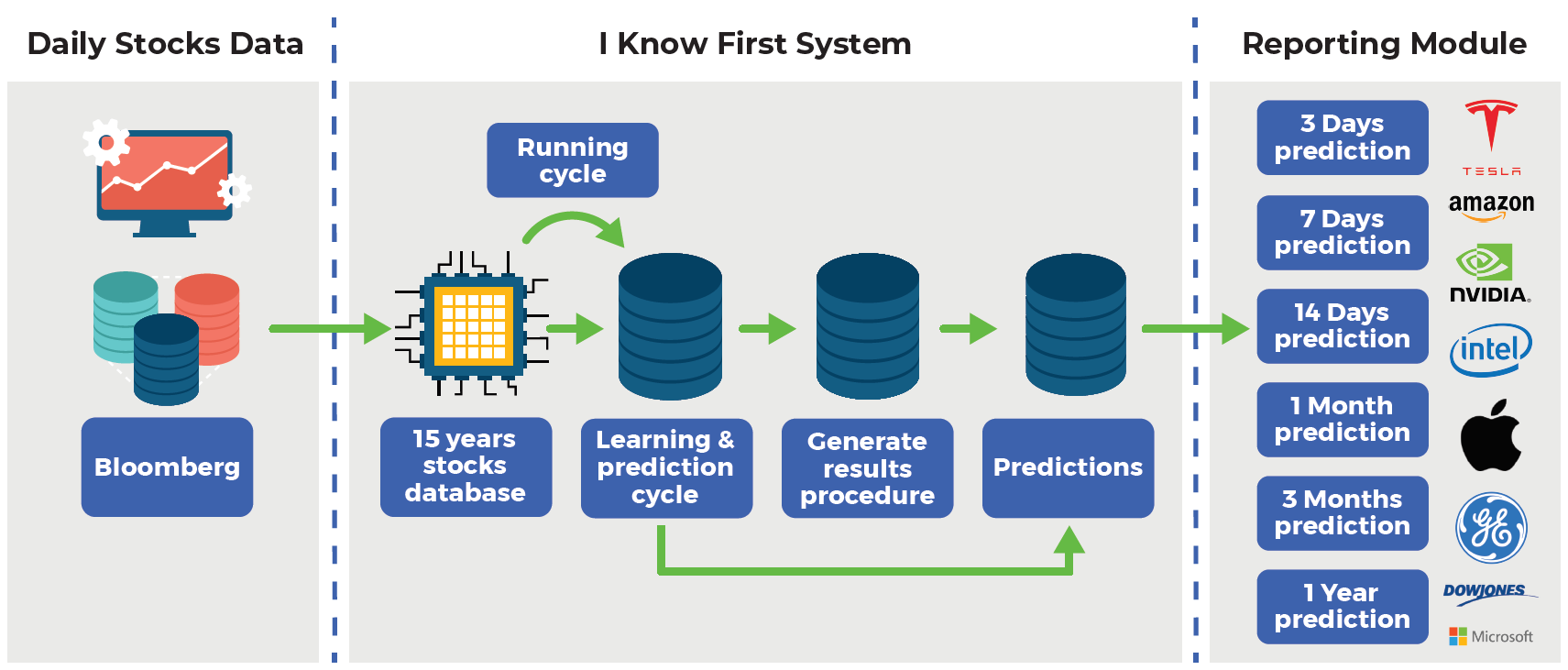

As noted in the report, the I Know First stock forecast AI Algorithm was trained on a data set covering 15 years of trading. What this means is that the machine was processing market data and looking for patterns and trends in it, effectively learning to model the markets and their behavior. Then, processing the fresh market data, it fine-tuned its own models, keeping track of its own successes and failures. This was achieved by incorporating elements of genetic programming in its design. Such an approach also ensures that the stock forecast algorithm attunes itself to any market conditions.

The deep learning-based algorithm currently delivers forecasts for over 10,500 financial instruments, including stocks, indices and ETFs. Deep learning is a term that refers to a special subgroup of algorithms known as neural networks. A neural network approximates the way the human brain works through advanced maths. It is comprised of layers of nodes, or weights, that transform the input to generate an output. Deep neural networks normally have multiple hidden layers between input and output layers, which means that the data goes through more transformations along the way.

Each stock forecast is delivered as an easily interpretable heatmap with two numeric indicators: signal and predictability. Signal works as a relative measure for the estimated difference between the current price of the asset and the price that the algorithm assesses to be fair. A strong positive signal means the asset is expected to rise, while a strong negative one is a promise of a decline. Predictability shows how precisely the AI algorithm has been predicting this asset before. This metric is an adaptation of the Pearson correlation coefficient, ranging from -1 to 1, and is calculated as the correlation between earlier forecasts and actual price movements, weighted to give the more recent forecasts more importance. Any value of P above zero indicates a positive predictability, the higher the better

The AI also draws on chaos theory to account for market volatility. Its forecasts cover time horizons ranging from 3 to 365 days, which makes it suitable both for speculative trading and long-term investment. In a string of recent evaluations like this one, it demonstrated an accuracy of around 60% for 3-day predictions, rising up to 80-90% for 3-month forecasts, which is more than enough to generate consistent profits.