I Know First Reviews: November 26th

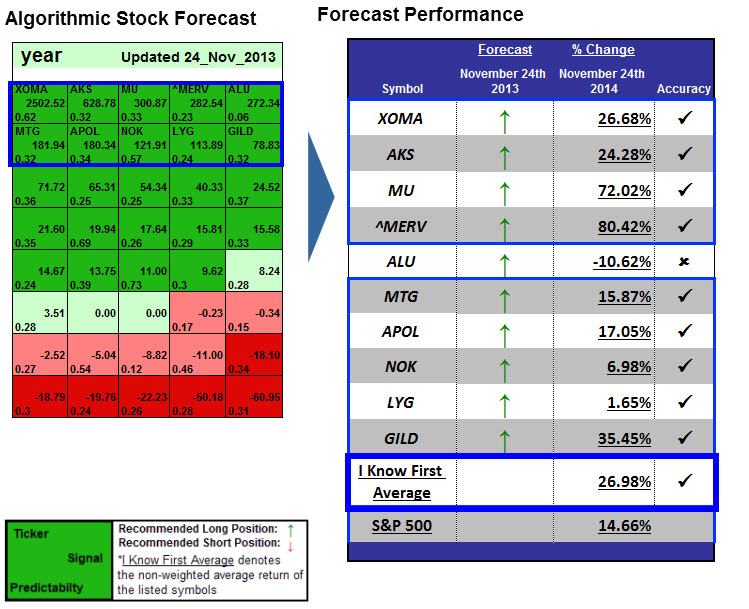

The stocks selected here are the top performing aggressive stocks from I Know First: Daily Market Forecast’s November 24th 2014. The Stock Forecast titled Quant Trading:26.98% Average Return in 1 Year. This forecast is part of the “Risk-Conscious” package, as one of I Know First’s quantitative investment solutions. The “I Know First Average” return was 26.98% versus a S&P500’s return of 14.66% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Signal (1 year): 2502.52

Predictability (1 year): 0.62

Return: 26.68%

XOMA Corporation (XOMA) is engaged in the discovery and development of antibody-based therapeutics. The Company’s lead drug candidate is gevokizumab (formerly XOMA 052), a humanized monoclonal allosteric modulating antibody designed to inhibit the pro-inflammatory cytokine interleukin-1 beta (IL-1 beta). The company had a signal of 2502.52 and a predictability of 0.62. In accordance with the algorithm prediction, the stock returned 26.68% in a one-year time horizon.XOMA Corp. was a big mover last session with its shares rising over 10% on the day. The move came on solid volume too with far more shares changing hands than in a normal session. This breaks the recent trend of the company as the stock is now trading above the volatile price range of $3.81 to $4.29 since Oct 31.

Signal (1 year): 628.78

Predictability (1 year): 0.32

Return: 24.28%

AK Steel Holding Corporation (AK Holding) is an integrated producer of flat-rolled carbon, stainless and electrical steels and tubular products through its wholly-owned subsidiary, AK Steel Corporation (AK Steel and, together with AK Holding, the Company). The Company’s operations consist primarily of nine steelmaking and finishing plants and tubular production facilities located in Indiana, Kentucky, Ohio and Pennsylvania. The company had a signal of 628.78 and a predictability of 0.32. In accordance with the algorithm prediction, the stock returned 24.28% in a one-year time horizon. AK Steel shares went up 7% to $6.57 in early market trading on July after the steel producer announced that the U.S. International Trade Commission had reached an affirmative 4-1 decision that imposed an antidumping order on steel imports from six different countries.

Signal (1 year): 300.87

Predictability (1 year): 0.33

Return: 72.02%

Micron Technology, Inc., is a global manufacturer and marketer of semiconductor devices, principally NAND Flash, DRAM and NOR Flash memory, as well as other memory technologies, packaging solutions and semiconductor systems for use in computing, consumer, networking, automotive, industrial, embedded and mobile products. In addition, the Company manufactures semiconductor components for CMOS images sensors and other semiconductor products. The company had a signal of 300.87 and a predictability of 0.33. In accordance with the algorithm prediction, the stock returned 72.02% in a one-year time horizon. Last Friday (November 21st), Nomura came out with a positive note on Micron and its competitor Intel Corporation (INTC) which has since lifted both stocks.

Signal (1 year): 282.54

Predictability (1 year): 0.23

Return: 80.42%

The Argentina Merval Index, a basket weighted index, is the market value of a stock portfolio, selected according to participation in the Buenos Aires Stock Exchange, number of transactions of the past 6 months and trading value. The index had a signal of 282.54 and a predictability of 0.23. In accordance with the algorithm prediction, the stock returned 80.42% in a one-year time horizon. Argentine stocks have been one of the world’s hottest investments this year, with the Mercado de Valores De Buenos Aires, or Merval, the country’s benchmark stock exchange, up 52% for 2014 and a whopping 136% in the past 12 months. One of the biggest reasons investors still like Argentina is that the country’s stock market remains exceptionally cheap compare to other indexes such as The S&P 500.

Signal (1 year): 272.34

Predictability (1 year): 0.06

Return: – 10.62%

Alcatel Lucent SA is a France based company that proposes solutions used by service providers, businesses, and governments worldwide to offer voice, data, and video services to their own customers. It is also engaged in mobile, fixed, Internet Protocol (IP) and optics technologies, applications and services.

Signal (1 year): 181.94

Predictability (1 year): 0.32

Return: 15.87%

MGIC Investment Corporation (MGIC) is a holding company and through wholly owned subsidiaries is a private mortgage insurer in the United States. The company had a signal of 181.94 and a predictability of 0.32. In accordance with the algorithm prediction, the stock returned 15.87% in a one-year time horizon. Recently, MGIC Investment Corp. was upgraded by equities research analysts at Goldman Sachs from a “buy” rating to a “conviction-buy” rating in a research note issued to investors. As a consequence, it shares traded up 1.59%, hitting $9.265.

Signal (1 year): 180.34

Predictability (1 year): 0.34

Return: 17.05%

Apollo Education Group, Inc. offers educational programs and services, online and on-campus, at the undergraduate, master’s and doctoral level. The company had a signal of 180.34 and a predictability of 0.34. In accordance with the algorithm prediction, the stock returned 17.05% in a one-year time horizon. In November 25, 2014 in Las Vegas, Boys & Girls Clubs of America (BGCA) and University of Phoenix, a subsidiary of Apollo Education Group Inc ,have once again joined forces to deliver opportunities for individuals to pursue their career goals and better prepare for a successful future. This year, 30 full-tuition scholarships will be available to Boys & Girls Club professionals across the country who are seeking to build their skills and knowledge to become more effective leaders within their organizations. After this announcement, the company saw 1.67% increase in value from the previous closing price, Gaining 0.51 cents to move to a closing price of $30.81.

Signal (1 year): 121.91

Predictability (1 year): 0.57

Return: 6.98%

Nokia Corporation invests in technological devices. The Company is focused on three businesses: network infrastructure software, hardware and services, which it offers through Networks; location intelligence, which the Company provides through HERE, and advanced technology development and licensing, which the Company pursues through Technologie. The company had a signal of 121.91 and a predictability of 0.57. In accordance with the algorithm prediction, the stock returned 6.98% in a one-year time horizon. Nokia may have sold their phone business to Microsoft Corporation in September 2013, but it held on to its most valuable asset, its brand name. Worth around $3.2 billion, Nokia’s brand name is ranked 98th of the most valuable brand names worldwide. Sebastian Nyström, Head of Products at Nokia Technologies, confirmed that the company has new ideas for its brand such as the N1 Android tablet, which will bring the Nokia brand back into consumers’ hands.

Signal (1 year): 113.89

Predictability (1 year): 0.24

Return: 1.65%

Lloyds Banking Group plc, is a holding company. The Company is a financial services group providing a range of banking and financial services, primarily in the United Kingdom, to personal and corporate customers. The Company operates in four segments: Retail, Commercial Banking, Wealth, Asset Finance and International and Insurance. The company had a signal of 113.89 and a predictability of 0.24. In accordance with the algorithm prediction, the stock returned 1.65% in a one-year time horizon. Société Générale reissued their buy rating on shares of Lloyds Banking Group PLC (LON:LLOY) in a research report released last week. This statement contribute to the increment in Lloyds Banking Group shares (LYG).

Signal (1 year): 78.83

Predictability (1 year): 0.32

Return: 35.45%

Gilead Sciences, Inc. (Gilead) is a research-based biopharmaceutical company that discovers, develops and commercializes medicines. The company had a signal of 78.83 and a predictability of 0.32. In accordance with the algorithm prediction, the stock returned 35.45% in a one-year time horizon. Recently, Gilead purchased a priority review voucher for $125 million, which it may decide to use for its NASH (Nonalcoholic statohepatitis) drug, deterring the competition from Intercept. Given the high number of people afflicted with the disease, it is expected that by 2025, NASH will become the primary reason for liver transplant. According to Alethia Young, analyst at Deutsche Bank AG (USA), the market for NASH drugs will be around $35-40 million by 2025.

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article. Read More From I Know First Research:

- IBM Fundamental And Algorithmic Analysis: Will Big Blue Bring Big-Time Blues?

- Google Can Grow Forever, But Is It The Best Investment Right Now?

- BlackBerry Is A Risky Fruit: Making 232% In A Year Using Fundamental And Algorithmic Trading

- Coca Cola – Undervalued: Stock Valuation Using A 10-Year Cash Flow Projection And Algorithmic Analysis

- Tesla Motors – Summative And Algorithmic Evaluation