Holiday Season, a Perfect Moment To Invest With AI

This article about investments in the holiday season was written by Gabriel Plat, a Financial Analyst at I Know First.

This article about investments in the holiday season was written by Gabriel Plat, a Financial Analyst at I Know First.

Summary

- Shopping increase dramatically during Black Friday and Cyber Monday, boosting retail and consumer sectors;

- Investments opportunities can also be seen in other areas such as airlines and hotel companies;

- Inflation and other concerns might affect investments and harm profit;

- The I Know First algorithm is the best way to mitigate investment risks.

Holiday or Investment Season?

The holiday season brings a mix of sensations to all of us. For some, it is a moment to enjoy the presence of your relatives. For others, having a nice Thanksgiving dinner is everything they were asking for. There are also those who enjoy this time of the year by traveling or by buying something on Black Friday to gift someone important for them.

But what if I tell you that the holiday season is also an excellent opportunity for your investments?

According to the National Retail Federation, approximately 186.4 million consumers shopped in 2020 during the Thanksgiving holiday. Even though this number is slightly inferior to 2019 (mostly because of the pandemic), it is still worth noting that online-only shoppers rose by 44% from those years.

(Figure 1: Thanksgiving Weekend Shoppers Over The Years)

These numbers, of course, have an impact on the stock market. A CNBC analysis found out that the top sector in this period between 2007 and 2017 has been retail. This is also observed in XRT, a grouping of retail stocks from the S&P 500. During the holiday season, XRT saw an average return of about 5%, while the index itself returned on average 3%.

Focus On These Assets

Between all investment opportunities for the holiday season, there are always the ones that stand out. But what are they and why they are good opportunities?

Retail stocks, of course, are a solid option to invest in. Days such as Black Friday and Cyber Monday boost sales across not only the United States but also other countries around the world. In other words, this could mean better results for stocks such as Apple (AAPL), Macy’s (M), Amazon (AMZN), Walmart (WMT), and others involved in the retail sector.

Plus, the consumer sector is also a strong investment opportunity. The sector, just like retail, tends to move positively during the holiday season. Stores such as Big 5 Sporting Goods (BGFV) and Michael Kors (CPRI) already saw their stocks generating positive returns in November and could be poised for even better results. The S&P 500 Consumer Discretionary Sector is also in a positive trend for the month of November.

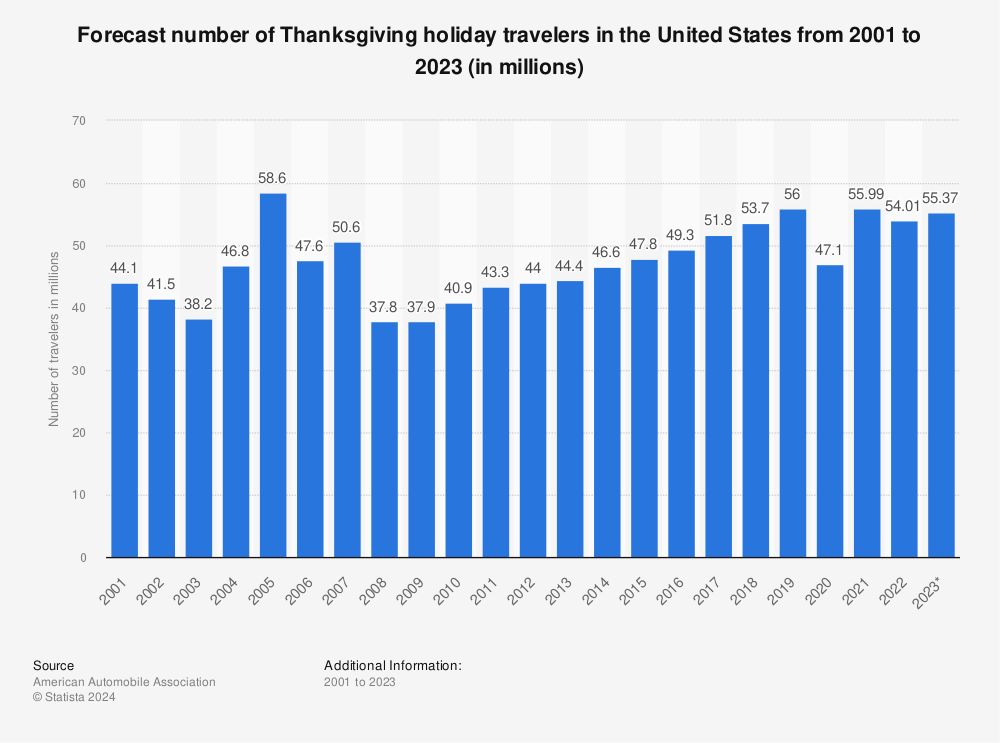

Find more statistics at Statista

(Figure 3: Thanksgiving Holiday Travelers in the United States Over The Years)

Why not think outside the box? Data shown above indicates that travelers in the Thanksgiving holidays were increasing yearly until the pandemic burst. Since the pandemic is in a much better situation than it was a year ago, we can expect an increase from these numbers in 2021. With that being said, the traveling sector can be another investment opportunity.

Flight companies come first when we think about traveling. American Airlines (AAL) can enjoy this period since it is the biggest airline company in the U.S., but so do Southwest Airlines (LUV), a company focused on domestic travel.

Of course, the hotel sector should not be forgotten. For example, we can highlight hotel companies such as Wyndham (WH) and Mariott (MAR) but also companies linked to it such as Booking.com (BKNG). And why not Air BNB (ABNB)? Even though it is not linked to the hotel industry, it plays a similar role when it comes to hosting a place for travelers.

Investment Life is Not Always A Bowl Of Cherries

Even though investments seem promising for this time of the year, there are always traps for us to avoid.

For the United States, there are real concerns about the inflation expectations for the near future. I wrote an article about it back in October and since there it is showing no signs that may slow down. A recent survey from the New York FED shows that Americans expect a 5.4% inflation one year from now. The worries about an inflation increase hereafter can affect sales in the holiday season.

The inflation impact would be seen heavily in the indexes. Even though they are having positive returns recently, the future could be plagued if this problem can not be solved quickly. While the main indexes such as the S&P 500 and Nasdaq seem less risky, betting in a long term may not be the best idea at the moment.

AI Is Always Here To Help You

If you are willing to take advantage of this investment opportunity, we can make it even better for you. The I Know First algorithm is the perfect solution to boost our clients’ portfolios.

By using machine learning and over 15 years of stock database, the algorithm provides outlooks for different stocks in different time horizons, for both short and long positions. The results over the years prove that our artificial intelligence is able to beat indexes consistently, no matter the assets or the time horizon invested.

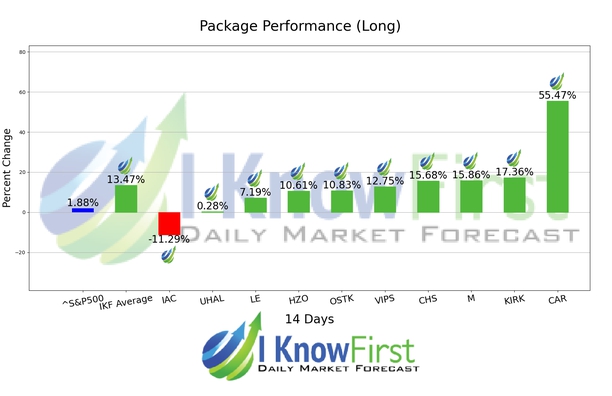

Let’s take the Retail Stocks package as an example.

Between October 29th and November 13th, the algorithm had successfully predicted 9 out of 10 movements. The 13.47% package overall yield implied a market premium of 11.59% versus the S&P 500’s return of 1.88%. That is, our clients could enjoy a return over six times the index had!

We could also see results equally impressive in other time horizons, such as one month, and in other packages such as the Consumer Stocks.

Conclusion

The holiday season always comes with investment opportunities. Between Thanksgiving and Cyber Monday, several sectors see an increase in their sales. This, of course, also has an impact on the stock market. For example, retail companies and the tourism sector as a whole can benefit from the holiday.

Even though it may look like a bowl of cherries, there are traps we should avoid when investing at the moment. The best way to escape from them is to enjoy the I Know First algorithm. Using machine learning, our artificial intelligence is able to predict stock movements and signal the best investment opportunities. In other words, it is the perfect tool to decrease the investment risk without losing the opportunity to profit!

To subscribe today click here.

To learn more about I Know First and the solutions we offer, visit our website at the links below: