Hedge Funds Performance: Did the Hedge Fund Industry Pass the Test of Market Uncertainty in 2021?

This “Hedge Funds Performance: Did the Hedge Fund Industry Pass the Test of Market Uncertainty in 2021” article was written by Sergey Okun – Senior Financial Analyst at I Know First, Ph.D. in Economics.

Highlights:

- Despite the fact that 2021 was a year of high macroeconomic uncertainty and market volatility, the S&P 500 rose by 27% with a consistent uptrend dynamic during the whole year.

- The S&P 500 significantly overperformed HFRI Fund Weighted Composite Index by 16.7% in 2021.

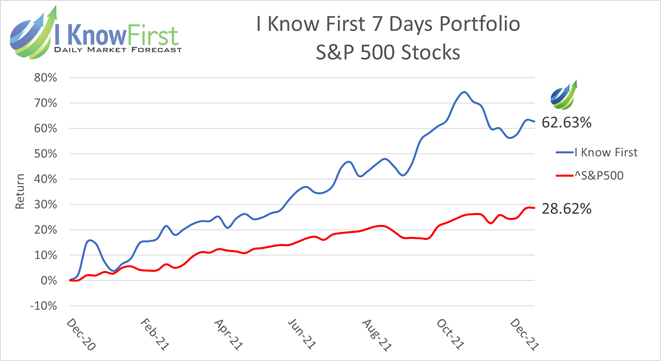

- The I Know First S&P 500 portfolio beat the S&P 500 by 56.56% in 2021.

The previous 2021 was an exciting period in terms of uncertainty, growth, and macroeconomic expectations. The global economy started 2021 in lockdown and in uncertainty about the future. The introduction of the vaccine in the first quarter of 2021 helped to restore the stable functioning of the economic system and created additional optimism in the stock market, which was also facilitated by government support. Moreover, discussions about reducing government support and increasing interest rates in order to combat expected inflation began in the second quarter of 2021. However, the presidential elections in the US, and the lack of consensus on reducing government support between the FED and Biden’s administration, forced the FED to postpone finding a solution to the inflation problem for the future.

The emergence of the Delta variant, in March of 2021, showed that the global economy had already adapted to the realities of the pandemic and could react quickly to the current situation. Undoubtedly, the emergence of the Omicron variant at the end of November 2021 increased volatility in the financial market and introduced discussions about the danger of the new variant and the probability of putting the global economy in a new lockdown. Despite the changes in the macroeconomic environment and significant stocks volatility, the S&P 500 increased by 27% with a consistent uptrend dynamic during the whole year.

(Figure 2: The VIX dynamic in 2021)

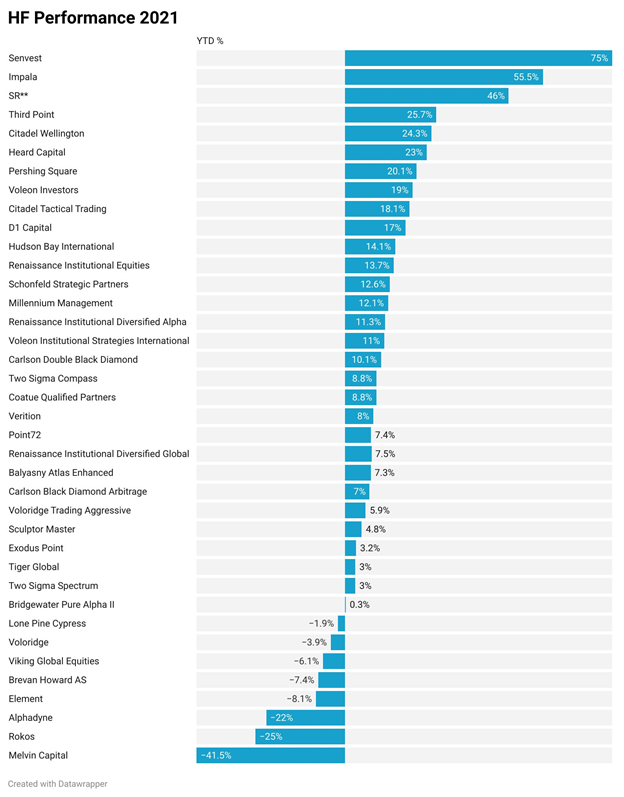

However, not all investors could fully gain from the S&P500 growth in 2021. HRF’s benchmark HFRI Fund Weighted Composite Index, an equal-weighted index of the largest hedge funds that report to the HFR Database, rose by 10.3% in 2021, which is the third-best performance since 2009. According to @wallstreetpro only 3 hedge funds outperformed the S&P500 in 2021.

Of course, there are a lot of individual factors which could have had an impact on hedge fund returns, but there is a factor which has changed the landscape in the daily trading activity. The formation of a group of memo investors, and cases of GameStop Corp. and AMC Entertainment Holdings Inc., have forced institutional investors to review their investment approaches. According to a survey by Bloomberg Intelligence, some 85% of hedge funds and 42% of asset managers are now tracking retail-trading message boards. Moreover, JPMorgan Chase & Co. presented a new data product with information on which securities individual investors are likely buying and selling, as well as which sectors and stocks are being talked about on social media. About 50 clients, including some of the largest asset and quant managers, are testing the product, the bank says. JPMorgan equity traders are also using it to help manage their own risk. Senvest, which is at the top of the performance list, actively gained from memo stocks in 2021. However, there were funds which took short positions in memo stocks, as Melvin, and finally recorded losses.

A period of high volatility and macroeconomic uncertainty creates great opportunities in the market. However, at the same time, an investor has to stay calm to correctly analyze the current market situation in an environment of ambiguous information, and make correct investment decisions. One of the ways is to delegate the task of determining profitable investment opportunities to AI free from human-derived assumptions. Moreover, I Know First AI has proven to be an effective tool in recognizing investment opportunities in memo stocks. I Know First provides investment solutions for hedge funds with a competitive advantage utilizing our advanced self-learning algorithm. We provide an individual approach for our clients and help them in the process of stock selections based on their needs and preferences. Please visit our website for more details. I Know First has used algorithmic outputs from the S&P500 Stocks package and from the S&P100 Stock package to provide an investment strategy for institutional investors.

The investment strategy that was recommended to institutional investors by I Know First based on the S&P500 Stocks package and the S&P100 Stocks package accumulated a return of 85.18% and 62.63% which exceeded the S&P 500 return by 56.56% and 34.01%, respectively. Moreover, I Know First AI consistently beat the S&P500 and S&P100 during the whole 2021 year.

I Know First Algorithm – Seeking the Key & Generating Stock Market Forecast

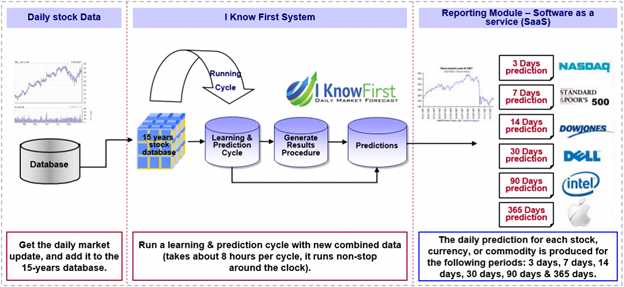

The I Know First predictive algorithm is a successful attempt to discover the rules of the market that enable us to make accurate stock market forecasts. Taking advantage of artificial intelligence and machine learning and using insights of chaos theory and self-similarity (the fractals), the algorithmic system is able to predict the behavior of over 10,500 markets. The key principle of the algorithm lays in the fact that a stock’s price is a function of many factors interacting non-linearly. Therefore, it is advantageous to use elements of artificial neural networks and genetic algorithms. How does it work? At first, an analysis of inputs is performed, ranking them according to their significance in predicting the target stock price. Then multiple models are created and tested utilizing 15 years of historical data. Only the best-performing models are kept while the rest are rejected. Models are refined every day, as new data becomes available. As the algorithm is purely empirical and self-learning, there is no human bias in the models and the market forecast system adapts to the new reality every day while still following general historical rules.

Hedge Funds Performance: Conclusion

The previous year was a year of unfulfilled hopes with a vaccine development at the beginning and with a threat of a new economic lockdown for the reason of Omicron at the end of the year. Introducing memo investors as a new class player on the market and where they took opposition opposite to some hedge funds, had a tremendous effect on some stocks, and resulted in losses suffered by institutional investors. Hedge Fund Industry showed the unconvincing result in 2021 with the return of HFRI Fund Weighted Composite Index of 10% versus the S&P 500 index return of 27%. At the same time, I Know First AI proved its efficiency of predicting memo stocks, and the I Know First S&P 500 and S&P100 strategies provided a significant return of 85.18% and 62,63%, which exceeded the S&P 500 return by 56.56% and 34.01%, respectively.

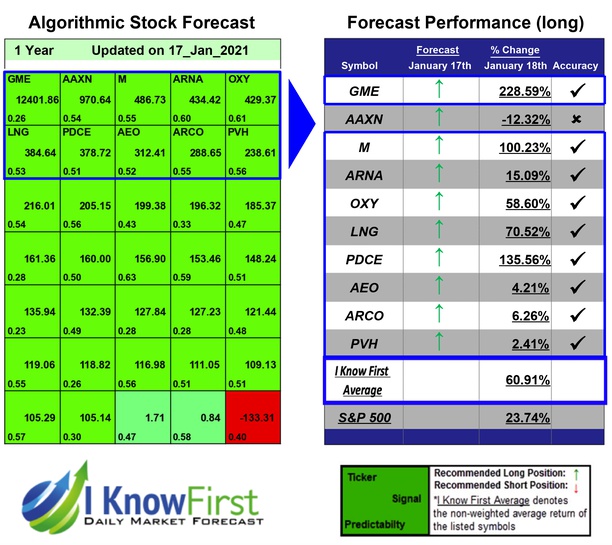

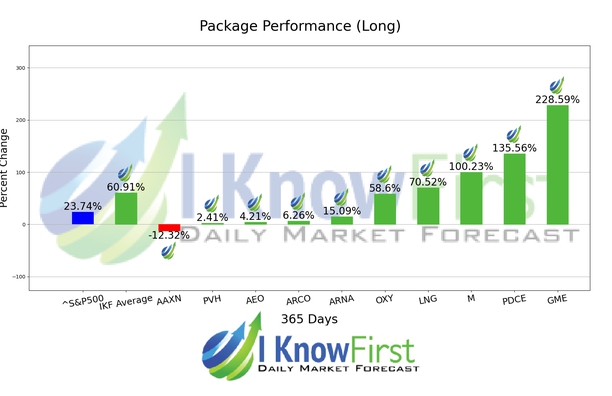

I Know First has developed the Hedge Fund Forecast Package to help our client to determine the most promising stocks picking by hedge funds managers. This Hedge Fund package had correctly predicted 9 out of 10 stock movements for the period of January 17th, 2021 – January 18th, 2022. GME was the highest-earning trade with a return of 228.59% in 1 Year. PDCE and M saw outstanding returns of 135.56% and 100.23%. The package’s overall average return was 60.91%, providing investors with a 37.17% premium over the S&P 500’s return of 23.74% during the same period.

To subscribe today click here.

To learn more about I Know First and the solutions we offer, visit our website