GILD Forecast: Gilead Sciences Has Short Term Potential, But The Long Term Is Worrisome

This article was written by Grant Goldstein, a Financial Analyst at I Know First

“The past cannot be changed. The future is yet in your power.”

(Source: Pixabay)

(Source: Pixabay)

GILD Stock Forecast

Highlights

- Gilead Q1 Misses Expecations

- Gilead is Undervalued

- Bearish Long Term Forecast

Gilead Sciences, Inc. is a bio-pharmaceutical company that discovers, develops, and commercializes medicine for unmet health needs. Incorporated on June 22, 1987, the company has products for the treatment of HIV/AIDS, liver diseases, cancer, inflammatory and respiratory diseases, and cardiovascular conditions. Some of their products include Atripla, Cayston, and Tybost. The company currently operates in over 30 countries.

Gilead’s Disappointing Q1 2018

Gilead Sciences’ Q1 2018 was not something to be proud of. Revenue decreased by 21.78%, missing Zacks Consensus Estimate by 310 million. The company stated that their new drug Biktarvy only had six weeks of sales in Q1 and that they fully expect sales to rise substantially next quarter, raising revenue. Expenses for the year were down 8%. However, this is mostly due to last years purchase of Priority Review.

The company missed their EPS target set by Zacks by 10.84%, decreasing to $1.48. The company’s gross profit margin was 80.33, which is lower than the industry’s average of 80.54. The company stated that this was inline with their expectations and they fully expect to increase earnings by the end of the fiscal year.

HIV and HBV product sales increased by 1.9% to $3.3 billion. Gilead’s sale numbers were not as high as the company expected since the availability of generic drug variants increased in the United States. But in total, product sales were down by 59%. The company blames an increasingly more competitive environment for this drastic decline. For example, HCV product sales were down $2.6 billion and the sale of their drug Harvoni dipped a whopping 74.7%. The company stated in their Q1 earnings call that they anticipate the sale and price of HCV products to even out by Q2.

Gilead declared a dividend of 0.57 cents per share of common stock to be received on June 28th. Throughout the quarter, the company paid $252 million in dividends.

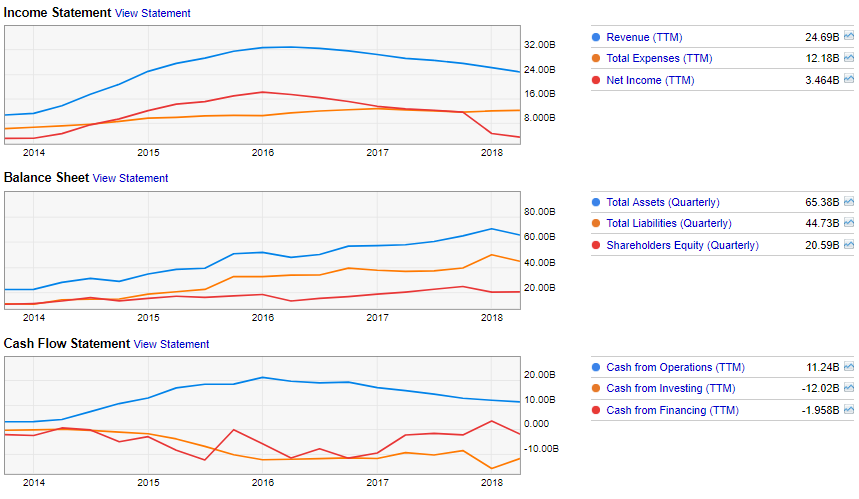

Financial Statements (Source: YCharts)

Financial Statements (Source: YCharts)

Following Q1 earnings, stock price dipped by 7.8%.

Technical Analysis

Looking at the MACD, we can see a bullish outlook as there was a signal line crossover on July 3rd. Also, there was a zero crossover on July 7th, a sign of a bullish outbreak.

MACD (Source: NASDAQ)

MACD (Source: NASDAQ)

The RSI for GILD is above $70, a bearish sign showing that momentum will soon shift downward.

RSI (Source: YCharts)

RSI (Source: YCharts)

Looking at the stocks moving averages (MA), GILD is above both the 50 day short term and 200 day long-term MA, a bullish sign. However, the 200 day MA is over the 50 day, a bearish sign. This is suggesting that GILD could be a good short term purchase, while it’s best to stay away from holding for the long term.

(Source: Yahoo Finance)

(Source: Yahoo Finance)

Valuing GILD

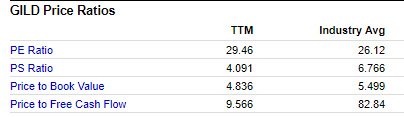

The company has a PE (TTM) ratio of 29.46, which is higher than the industry average of 26.12. The higher ratio of GILD tells that investors have high expectations for upcoming earnings.

GILD’s PS ratio is lower than the industry average by 2.675, a substantial difference. Indeed this is a sign that the companies price is low compared to revenue per share, a bullish sign signaling large value.

The company’s price to book value is 0.663 lower than the industry’s P/B. Investors are paying too little for the assets GILD possesses; stock price should be higher than it currently is due to the balance sheet holding higher value than stockholders are paying compared to related stocks.

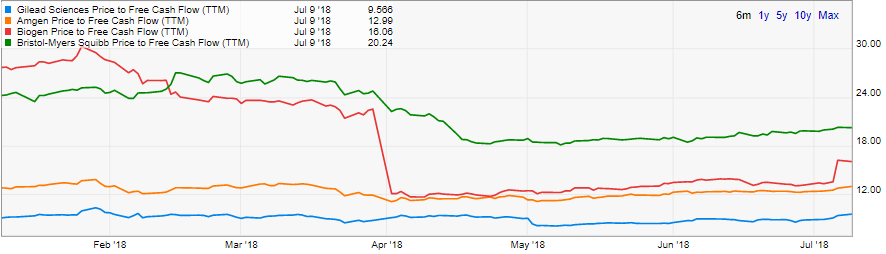

GILD’s price to free cash flow is astronomically low compared to the industry: 9.566 compared to 82.84. A low ratio is very desirable and is something investors who are seeking value look for.

Free Cash Flow (Source: YCharts)

Free Cash Flow (Source: YCharts)

Finally, the EV to EBITDA of Gilead Sciences is almost half that of the industry average. The company is currently being valued at too low of a price compared to their EBITDA.

Price Ratios (Source: YCharts)

Price Ratios (Source: YCharts)

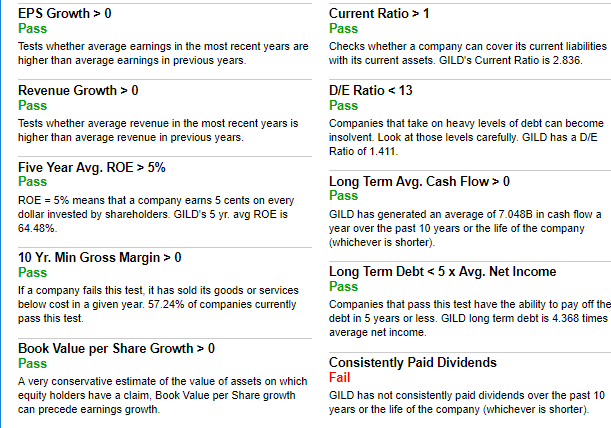

YCharts’ fundamental score examines which companies outperform the S&P 500. Passing over a score of 7 means that the stock is one of the best long-term performers. GILD has a score of 9.

Fundamentals (Source: YCharts)

Fundamentals (Source: YCharts)

Gilead News

On June 4, Gilead Science announced a large managerial change: Andrew Dickinson will be promoted to Executive Vice President, Corporate Development and Strategy. With Andrew at this executive position, the company could see a turn around from past business practices. Gilead CEO stated, “Andy has brought to Gilead vision, creativity and leadership, fundamentally changing the way that we assess and execute acquisitions and partnerships as an organization”. Investors were satisfied with the management switch as stock price increased by 2.96%.

On June 5, Gilead announced they were partnering with Hookipa to develop therapeutics for HIV and Hepatitis B. The two companies will jointly research the diseases and Hookipa will manufacture the arenavirus-based vectors for Gilead.

On June 29, the European Medicines Agency’s Committee for Medicine Products for Human Use (CHMP) issued a positive view for Gilead’s Yescarta, a treatment for patients with relapsed B-Cell lymphoma. Now, the drug recommendation is being viewed by the European Commission. If successful, the drug would be able to receive approval in 28 EU countries; the approval would be profitable for the company as it would cover a large landscape for an unmet field.

The company is hoping that their liver disease treatments will drive future growth. NASH, or Non-alcoholic Steatohepatitis, is projected to be a $35 billion business by 2020. Gilead is making strides to enter this business, as are various large drug makers. Their STELLAR 3 and STELLAR 4 are two ongoing phase 3 trials, which have been completed ahead of schedule. The company believes that they will be able to complete the regulatory approval by the end of 2019.

Gilead’s drug Filgotinib, which is in Phase 3, is expected to complete its study any day now. The drug is for the treatment of Rheumatoid Arthritis, a disorder that around 1.3 million Americans have. If the drug results come back as positive, GILD will skyrocket. The drug is expected to bring in annual sales of more than $3 billion.

SWOT Analysis

Strengths:

- Drugs in Phase 2 and 3

- New Management

- Desirable Treatments

Weaknesses

- Large competition

- Slipping drug prices

Opportunities:

- Approval of Yescarta

- Positive results for Filgotinib

- Approval of Phase 3 drugs

- Treatment for NASH

- Stabilized treatment prices

Threats

- GlaxoSmithKline

- Pfizer

- Adverum

- Failure of drug testing

Read the article above for more information

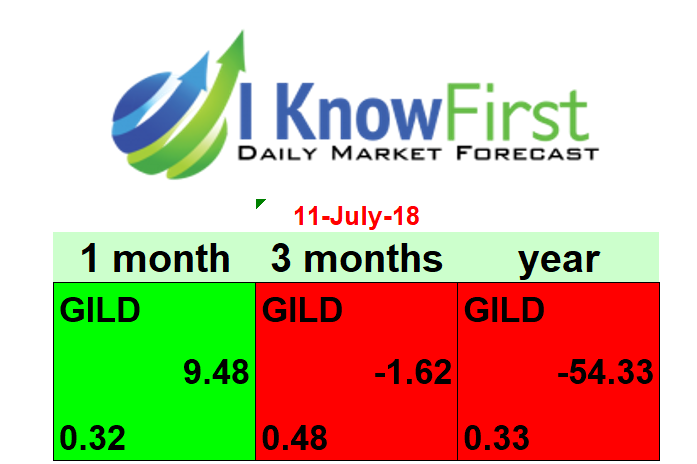

I Know First Algorithm Bearish GILD Forecast

I Know First has a bearish one year forecast for GILD. The Algorithm gives GILD a one year signal of -54.33 and a strong predictability of 0.33, as it does not have faith in the long term outlook of the stock. However, the Algorithm is in the green for the short term one month, meaning it predicts positive Q2 results.

Conclusion

I give GILD a bullish 1 month buy and a bearish long term outlook. With Q2 coming on July 25, there is a lot that can go right for the company. With the slated report of Filgotinib right around the corner, stock price may be boosted significantly, that is, if results are positive. Also, if Gilead is correct about HCV products stabilizing by Q2, the company would see an increase in revenue, potentially beating expectations. One of the great things about GILD is that it possess great value, as seen by examining their financial ratios. Finally, with the stock price soaring above the 50 day moving average, it is clear that the short term is bullish for GILD. So, buying right now and holding to Q2 will likely see a substantial hike.

However, I am bearish for the long term for a couple reasons. For one, examining the moving average shows that the 200 MA is creeping up closer and closer to the stock price, demonstrating a bearish long-term expectation. With this in mind, the RSI is showing a decrease in momentum for the stock. With ever growing competition, it is difficult to tell the amount of market share that Gilead will have in a year, a brutal realization. Finally, and most importantly, investors are anticipating high results for NASH treatment. However, this market is flooded with big pharma companies competing for treatment. So, with such a high competition and the possibility of treatment failure, it is unwise to suspect Gilead to be a leader in this market.

I Know First Algorithm is an agreement with my forecast.

Past I Know First Algorithm Success with GILD

On August 2, 2017, I Know First Algorithm gave a very bullish forecast for GILD. The Algorithm gave GILD a signal of 230.46 and a predictability of 0.71. The stock gained 8.6% since this forecast.

This bullish forecast for GILD was sent to the current I Know First subscribers on August 2, 2017.

This bullish forecast for GILD was sent to the current I Know First subscribers on August 2, 2017.

To subscribe today click here.