FB Stock Forecast: Raise Your Bets On Facebook’s e-Commerce Push

The FB stock forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The FB stock forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary

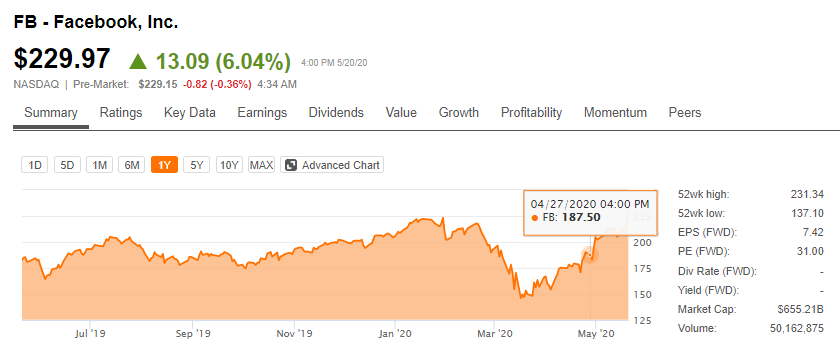

- The stock of Facebook has a price return of more than +22.6% since our April 27 buy recommendation. You can take your profits now.

- We still rate it FB as a buy. Yesterday’s launch of Facebook Shops is timely and necessary during this pandemic.

- Facebook Shops will allow companies/businesses to use their Facebook and Instagram profile accounts as full-blown online storefronts.

- Online shopping has surged because of COVID-19. Facebook can make extra bucks by helping people transform their businesses become more e-commerce friendly.

- Facebook continues to benefit from the tailwind created by COVID-19 quarantines. I have a one year FB stock forecast of $250.

I won’t fault you if you cash out your profits on Facebook (FB). This company’s stock has shot up +22.6% since our April 27 buy endorsement. We correctly predicted that the COVID-19 pandemic is boosting Facebook. FB soared as high as +10% after the company’s Q1 2020 earnings report last April 29. Pandemics are good for Facebook. Facebook’s Q1 revenue of $17.74 billion was almost 18% higher than Q1 2019’s revenue of $15 billion. Q1 2020’s net income of $4.902 billion is also double that of Q1 2019’s $2.429 billion. Facebook’s stock jumped another +6.04% yesterday because investors admire the recent launch of Facebook Shops.

Facebook Shops is also available for Instagram. This new feature will allow business owners to use their Facebook and Instagram accounts as full-blown online storefronts. People who visit their business profiles on Facebook and Instagram will be able to browse and instantly buy products.This enhanced approach to e-commerce is why Facebook deserves a one-year price target of $250. Aside from the increased ad views, Facebook Shops will also generate extra income via payments processing on product bought through Instagram and Facebook apps. Products for sale will also be cataloged on Facebook Search so that people who search for them can find and instantly buy them. Business owners who want higher rankings on product search results will likely pay Facebook for the privilege.

Business owners will have to pay fees on Instagram’s Checkout online shopping feature. Users do not have to pay any transaction fees on Facebook Pay. However, credit card issuers that are used through Facebook Pay aren’t freeloaders. Going forward, Facebook can also charge a small fee to business owners who will require a customer support backend and/or Loyalty Programs on their Facebook Shops storefronts. Facebook Shops is therefore an easy way for Facebook to generate more sales that are not related to advertising.

The Logic Behind Facebook Shops

Digital payments is an easy way for Facebook to diversify. The global pandemic is compelling people to do more online shopping. Increased online shopping also forces more people to use digital payments platforms more often. Yes, transaction fees on digital payments are minuscule. However, they could all up to sizeable amount when most of the planet’s citizens adopts digital payments. In the U.S., majority of people now use digital payments because they are forced to do more online shopping by COVID-19.

As per the chart below, more than 98% of Facebook’s revenue comes from advertising. By taking advantage of this pandemic,

Don’t Panic, Facebook’s Ad Business Is Pandemic-Resistant

Getting 98% of your revenue from advertising is not a bad thing. Facebook will always tout high-valuation ratios because of the massive advertising industry. In spite of the COVID-19 pandemic, eMarketer still believes global ad spend this year will increase by 7% to $691.7 billion. This estimate will grow to $865.12 billion by 2024.

FB is a strong buy because more companies will now spend more on digital ad placements. Out-of-home ads/signages and billboard advertising are not ideal because COVID-19 is forcing most people to stay at home and work from home. The inability of TV stations to provide targeted advertising is why Facebook and Instagram will still remain as the better choice for many savvy marketers.

The COVID-19 pandemic is not detrimental to Facebook and Instagram’s ad sales. In fact, Q1 ad spending on Facebook grew 19%. Ad placement sales at Instagram grew 39% in Q1 2020. The strong momentum of Facebook’s advertising business will keep padding up its already huge $60.289 billion cash reserve. Facebook’s free cash flow is also $23.18 billion. This company is not going to go bankrupt soon. It has too much money that Facebook might just buy other companies that will help it diversify.

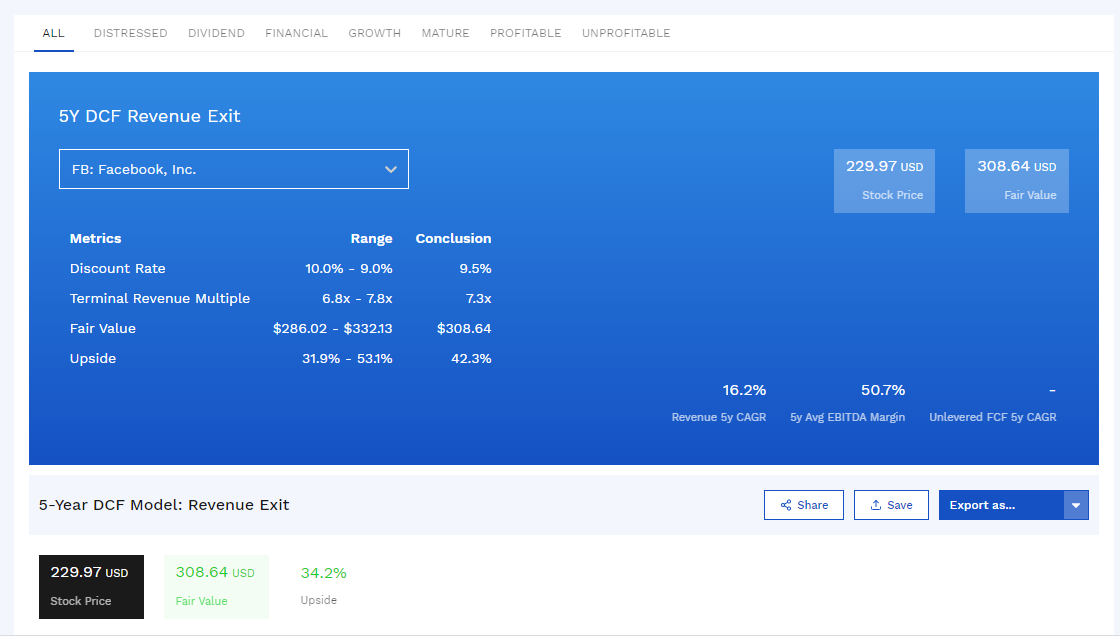

On the other hand, Facebook can remain heavily advertising-centric and it will still be a golden buy and hold forever investment. Using Finbox and its 5-year DCF Revenue Exit template, Facebook’s fair value is $308.64.

Conclusion

My $250 one year price target for FB stock forecast is feasible. The tailwind from this pandemic will only encourage advertisers to spend more on Facebook and Instagram’s ad platforms. They know very well that billions of people are stuck at home most of the day. The best way to market products and services are still via Facebook apps and Instagram.

Facebook only paid $1 billion for Instagram 8 years ago. Instagram made $20 billion in ad revenue last year. Instagram’s huge ad business is why you should buy more FB shares. Instagram is largely why it is outpacing the growth rate of other Technology sector companies. Facebook’s 40.27% 5-year revenue CAGR is higher than that of Amazon (AMZN) and Google (GOOGL).

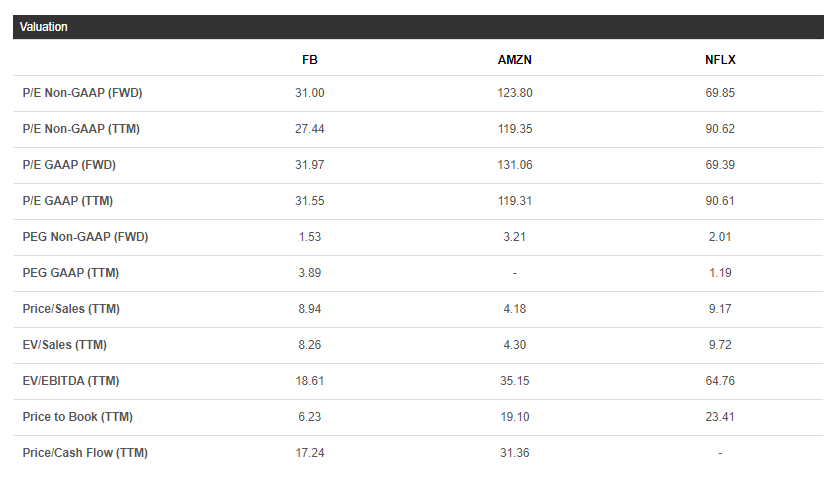

Facebook is growing faster than its sector peers. Facebook is the better growth stock we should own. Fortunately for us, we can still buy FB at lower valuation ratios than AMZN.

The obvious undervaluation of Facebook is likely why the predictive algorithm of I Know First gave FB a super bullish one year forecast score of 403.68. I Know First is highly confident that the market will keep pushing FB higher this year.

Past I Know First FB Stock Forecast Success

I Know First has been bullish on FB stock price in a past forecast. On April 26th, 2020, the I Know First algorithm issued a bullish forecast for FB stock. The algorithm successfully forecasted the movement of Facebook’s shares. In almost one month, Facebook’s shares have risen by 20.99% in line with the I Know First algorithm’s forecast. See the chart below.

Here at I Know First, our AI-based algorithm trading has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing daily stock market forecast, as well as gold predictions, euro to dollar forecast, and, in particular, Apple predictions. Also, we produce articles such as the sector rotating strategy. Today, we are producing daily forecasts for over 10,500 assets. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.