Facebook FB Stock Forecast: Buy on the dip

- Facebook stock has gone nowhere since early 2018

- The inevitable controversies over data protection and safety of information on the platform have brought about a buying opportunity

- FB stock forecast – buy on the dip

- Facebook earnings continue to impress and add to its cash war chest

- Despite the enormous size of its network already, Facebook has fantastic revenue growth prospects

- I Know First Algorithm is currently bullish on Facebook

Facebook (FB Stock) does not need an introduction. It is the ubiquitous social network and has no competitors if one compares Facebook’s active user base to other social networks. Although the stock has almost quintupled since the IPO, when it comes to valuation, Facebook has become a victim of its own success. Thanks to hyped-up regulatory concerns which will not have a transformative impact on the business, medium to long term investors can take advantage of a buying opportunity and secure great growth for great value.

Despite all the regulatory concerns, controversies and the ‘delete facebook campaign’, revenue in the most recently reported quarter was $15.1 billion, growing by 26% over the year and beating expectations, as did adjusted earnings per share. Adjusted operating margin stands at 42% of revenue, above the 36% expected. Despite the dominance of the platform, total daily active users still grew by 8%. Facebook delivered $22bn in net income to shareholder in 2018.

When we talk about Facebook users we are talking about users on the original Facebook platform itself, along with its owned platforms Instagram, Wattsapp and Messenger. Facebook estimates that over two2 billion people use one of these products daily, and almost three billion use at least one of them monthly. That is almost ten times the population of the United States. If Facebook were a country, it would be by the far world’s most populous, by a factor of two. No other social network comes close to competing with Facebook.

Recently user time spent on the original Facebook platform is down, but this is being offset by huge growth in time spent on Instragram. Faceobok has all bases covered. Instagram and Whatsapp have been the source of much user growth. Facebook purchased Instagram in 2012 for $1bn and with it ensured domination of the younger demographic and fended off the threat being posed at the time by Snap.

Facebook purchased WhatsApp in 2014 for $19bn; at the time many could not fathom the valuation. But Mark Zuckerberg is visionary and in retrospect the move looks prescient. Whatsapp has become so dominant it is being blamed for the death of the text message/SMS, not to mention its impact on pay-for-voice-calls products such as Skype.

Facebook has no debt and a cash war chest

Facebook has great unit economics and unlike almost every other tech unicorn, was profitable at IPO time. Thanks to its profitability and the cash-generative nature of its business, Facebook keeps a war chest of cash and cash equivalents on hand, amounting to some $45bn. Facebook might choose to expand the size of its buyback program, and since it has no debt, it might even follow Apple’s lead and decide to borrow cheaply to finance buybacks.

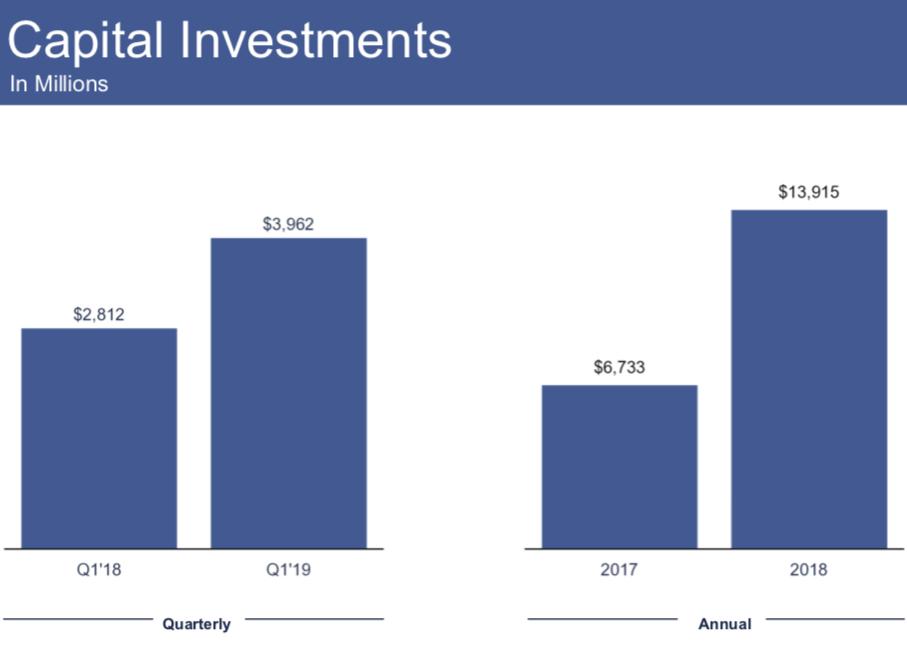

Source: Facebook 2019 Q1 Results

Its acquisition of WhatsApp shows the value of having resources on hand to stay ahead of any promising potential future competitors by acquiring them. The point is that Facebook’s valuation should not be adversely impacted by what might be perceived by some as capital inefficiency – both WhatsApp and Instagram are great companies that have underpinned continued user growth for the company, and one needs to be ready to pounce when the right acquisition target comes along.

Of course competition regulators have now caught up and a buy-out of an already popular platform like WhatsApp may not be as easy. But Instragram had only thirty million users when Facebook speculatively ‘snatched it out of its cradle.’ So anti-trust issues are not an impediment to future growth if Facebook continues to successfully identify the most promising early stage start-ups. It’s cash war-chest allows it to throw enough darts to do so, in many areas, including artificial intelligence and virtual reality.

Facebook’s abundant resources also allow it to deal as effectively as possible with the inevitable regulatory challenges that it will continue to face given its outright dominance in connecting people and delivering them news and information.

Facebook’s balance sheet is an often-overlooked margin of safety, a catalyst for another exciting acquisition, or alternatively more earnings growth via buybacks.

Victim of own success

In 2018 regulatory concerns overshadowed the earning power and growth prospects of the company. 2018 started with the Cambridge Analytica scandal and the ‘Delete Facebook’ campaign encouraged by Whatsapp co-founder Brian Action, and ended with the EU readying a multi-billion-dollar fine for breaching data protection, all topped off with the December Fed-inspired stock market meltdown.

In March 2018 Mark Zuckerberg had to testify in front of congress on issues ranging from Facebook’s impact on elections, fake news, to data protection and privacy, and questions of harvesting of users data, as well as important political questions about how to balance on the one hand the spreading of violent, hateful and extremist views, and on the other hand protect free speech.

The dominance of Facebook means that such political and regulatory scrutiny is probably inevitable. Facebook is so dominant and globalised that Mark Zuckerberg himself recently called for more regulation. Co-founder Chris Hughes recently demanded the break-up of Facebook:

“Mark’s influence is staggering, far beyond that of anyone else in the private sector or in government. He controls three core communications platforms – Facebook, Instagram and WhatsApp – that billions of people use every day,” Hughes wrote.

“The most problematic aspect of Facebook’s power is Mark’s unilateral control over speech. There is no precedent for his ability to monitor, organize and even censor the conversations of 2 billion people,” Hughes wrote.

“We are a nation with a tradition of reining in monopolies, no matter how well intentioned the leaders of these companies may be. Mark’s power is unprecedented and un-American.”

Source: Facebook Co-Founder Chris Hughes Op-Ed: New York Times: May 9, 2019

Zuckerberg argues that Facebook needs to be kept in-tact for it to have any hope of maintaining adequate levels of resources to address the safety issues that arise from data privacy, and spreading of hate speech, fake news and other dangerous and false information.. But if Facebook was broken up, existing shareholders may realise even greater value as the uncontaminated value of higher growth businesses like Instragram and Whatsapp can be independently valued by the market.

Many users wanted to leave the Facebook family of products following the Cambridge Analytica scandal. But they had nowhere to go! The more regulation that is proposed for the industry, the more difficult it will be for competitors to innovate and emerge to challenge the dominance of the existing social media platforms.

Facebook is so globalised and large, that in order for regulation to be truly impactful for its operation, globalised internet regulations would need to be implemented. Since sovereign states always have conflicting interests, any sort of globalised regulation would be necessarily self-regulating in nature, probably designed by Facebook itself, and therefore not dramatically adverse to its operations.

Regulation may impact impact the viability of some advertising revenue streams and temporarily compress margins as capital investments are made to improve user safety , but the overall internet ad market is still growing rapidly, and Facebook has other opportunities for further monetization to more than offset these losses – more on this in the next sections.

The Regulatory overhang on valuation –

The performance of the stock in 2018 and its subsequent rebound shows that many investors are spooked by the inevitable political and regulatory controversies that a behemoth such as Facebook will attract, and fail to focus on the underlying business. T

The result of the annus horribilis that was 2018 is that the stock still offers good value – despite the run up in the stock along with the rest of big tech since Christmas 2018 when the Fed did a U-turn on its hiking path.

On the basis of commonly referenced valuation ratios including Price to Sales, P/E, Price to Cash Flow and EV/EBITDA, comparing these ratios now to their average level over the time since Facebook listed – Facebook is on sale – at a discount of up to 50% if you take the P/E ratio.

A DCF valuation of Facebook, with a terminal growth rate of 3%, required return of 10% and free cash flow assumed to increase 20% over the next six years, decreasing to below 15% thereafter, yields an implied stock value today of $237. If anything these input assumptions are conservative overall, for example the required rate of return given the secular low interest rate environment globally and given Facebook’s leading position in one of the fastest growing industries in the world.

There is a lot of runway for growth in the rest of the world

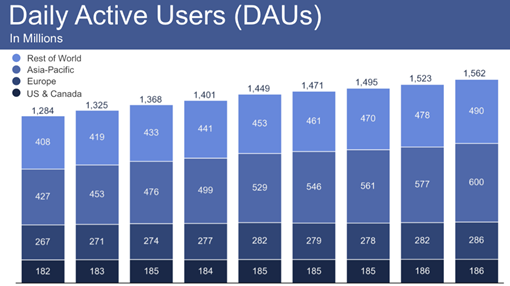

Source: Facebook 2019 Q1 Results

Despite the dominance of the platform, total daily active users still grew by 8%. Since Facebook’s user base is already so large, growth in the user base cannot be expected to keep driving growth prospects and valuation. Rather, one needs to focus attention on the revenue generated per user.

Facebook generates $2.78 revenue per user in Asia-Pacific and $1.89 per user in the rest of the world. Compare that to $30.12 per user in US & Canada. As incomes across developing world converge with developed markets such as US & Canada, Facebook’s revenue per user across all markets should converge with its developed markets. In line with the distribution of the globe’s population, the number of Facebook users in the rest of the world and Asia Pacific well exceeds that of US & Canada and Europe, so the revenue growth from income convergence in these developing markets will be even more impactful for Facebook.

S

Many monetization opportunities for all countries

Proposed data privacy regulations means that some of Facebook’s targeted advertising revenue will be impacted, and also (possibly temporary) margin compression will result due to capital investment to ensure improved safety for users’ data and the safety of the information distributed by users on the platform.

There is also the impact of large tech outfits besides Google, for example Amazon, expanding their advertising business. But since Facebook has by the largest network of users, only competitors as large as Amazon could have any hope of having any impact on the ad pricing power of Facebook.

Importantly when it comes to considering the impact of large competitors such as Amazon, there is also the overall growth of the internet ad market to consider, which some analysts believe could double from its current $350bn size in just five years. As streaming becomes ever more popular and households cord cut, the growth of online ads continues apace as previously newspaper and now ever more television advertising migrates to the internet.

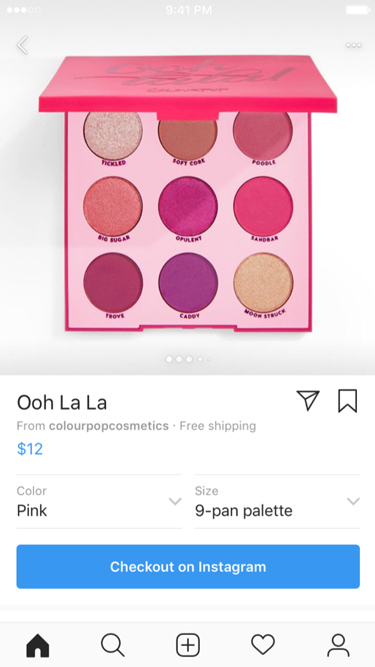

In addition to runway for growth in revenue per user in developing markets already outlined, in in all countries, there are still monetization opportunities – for Whatsapp in particular, as well as Facebook and Instagram. Facebook is investigating dating and business services, including payments through its recent deal with Paypal to bring in-app purchasing ability to Instagram.

Of course Facebook has to be mindful about the extent to which it attempts to monetize Whatsapp, lest its use become less wide-spread. However the size of the user base means that Facebook will be able to monetize the product in subtle ways (it is already doing so with a Whatsapp-for-business product) without detrimentally impacting the user experience for the vast majority of users. There are many levels that Facebook can still pull to increase revenue from existing users without detrimentally impacting their user experience to the extent that they leave the platform or spend much less time on it. Facebook’s strategy so far has to attract as many users as possible, and it is now transitioning to a greater focus on monetization of these users.

Final Thoughts

Facebook’s dominance and pricing power is underpinned by the network effect. Facebook and its subsidiaries have many multiples times more users than any other social media platform-if users want to leave they don’t really have anywhere else to go. Facebook’s cash-war chest is arguably under-valued by the market. Even if Facebook had to make no further acquisitions, it still has great revenue growth prospects ahead via increasing revenue per user and many monetization opportunities across its platforms.

Fifteen years after the company’s founding, the inevitable controversies over data protection and safety of information on the platform have come to a head and brought about a heavy discount in the price of the stock and a good buying opportunity for medium to long-term investors. If Facebook were broken up, like co-founder Chris Hughes is calling for, existing shareholders may realise even greater value.

I Know First Algorithm is currently bullish on Facebook

My bullish endorsement for Facebook is backed by the positive algorithmic forecasts from I Know First. The 1 month, 3-month and 12-month algorithmic forecasts for FB are all positive. The underlying future trend for the FB Stock Forecast is that this stock is likely to go up in price.

How to interpret this diagram

Past I Know First success with FB

I Know First has been bullish on Facebook’s shares in past forecasts. On 29 January, 2019, the I Know First algorithm issued a bullish article on Facebook with the one month, three month and one year forecasts for FB all bullish. The algorithm successfully forecasted the movement of the FB share. Over the next four months, FB shares rose by 28.51% in line with the I Know First algorithm’s forecasts.

Current I Know First subscribers received this bullish FB article on January 29, 2019.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.