Disney and Comcast’s Expensive, Never Ending Battle Over 21st Century Fox

This article was written by Grant Goldstein, a Financial Analyst at I Know First

“All our dreams can come true, if we have the courage to pursue them.”

-The Walt Disney Company

(Source: Wikimedia)

Highlights

- Disney and Comcast Bid for FOXA

- Why 21st Century Fox is so Desirable

- Bullish Forecast for FOXA

Twenty-First Century Fox, Inc. is a media and entertainment company. Incorporated on October 23rd, 2003, the company takes part in cable network programming, television, and filmed entertainment. With 28 broadcast television stations, the company operates in the United States, the United Kingdom, Continental Europe, Asia, and Latin America.

The Famed Acquisition War

Last year, The Walt Disney Company announced a bid to acquire 21st Century Fox for $52.4 billion in stock. To make this deal work, Disney said they would spin-off Fox Broadcasting network and stations to its shareholders, currently called “New Fox”. Upon completion of the deal, Disney would own numerous assets, such as 21st Century Fox’s film and television studios, stake in Hulu and Sky News, and, yes, ownership of The Simpsons. This deal would greatly stretch the Walt Disney Company’s footprint across the world since Sky operates in 23 million homes in the UK, Fox Network International in 170 countries, and Star India which is in more than 100 countries. FOXA price rose 7.5% and volume increased 154.86% following this news.

FOXA Price (Source: Yahoo Finance)

On June 13th, the second biggest broadcasting and cable company, Comcast, announced a $65 billion cash deal to acquire 21st Century Fox.

Comcast counter offered the Walt Disney Company and was looking to buy the same assets as Disney. The deal would provide a 19% premium to the value of Disney’s all stock offer.

Comcast stated in a letter to 21st Century, “Our new proposal offers 21CF shareholders $35.00 per share in cash and 100% of the shares of New Fox after giving effect to its proposed spinoff, providing superior and more certain value as compared to Disney’s all-stock offer.” Stock price jumped 7.7%.

FOXA Price (Source: Yahoo Finance)

Disney did not bat an eye at this counter offer. A week later, The Walt Disney Company responded by acquiring the same assets as before, but with a new $71.3 billion evaluation at $38 per share. Shareholders will get the choice to receive cash or stock, but Disney plans for it to be 50/50; Disney will pay 35.7 billion in cash and issue 343 million new shares to 21st Century Fox shareholders. Following the announcement, stock price increased by 7.5%.

FOXA Price (Source: Yahoo Finance)

FOXA Offerings (Source: Wall Street Journal)

Disney currently own a 30% stake in Hulu. Once this deal goes through, they will own 60%, making them the majority shareholders in the streaming service. Bob Iger, Disney’s CEO stated, “Hulu will allow us to greatly accelerate into [the TV streaming] space and become an even greater competitor to those already out there.” Since Disney already had a streaming service in the works, owning a majority of Hulu gives them millions of subscribers right from the get go.

Now the big question remains, will Comcast counteroffer a deal with Fox? If so, the evaluation would be higher than Disney’s $71.3 billion and stock price would gain substantially. With Fox giving shareholders till July 10th to vote, Comcast has a large window of time to formulate a deal. Fortunately for stockholders, Wall Street is betting that an offer will take place, as UBS analyst John Hodulik stated, “We believe another counteroffer from Comcast for Fox is likely”. FOXA price is increasing as investors are confident that a deal upsurging the current evaluation of $38 a share will happen. Analyst Michael Nathanson believes that Disney will respond to any counter offer from Comcast, positive news for any Fox shareholder.

Comparing Comcast and Disney

The main difference between the two deals is that Disney is offering cash and stock, while Comcast’s deal is strictly cash. Looking at the two companies, Comcast has $6.117 billion in cash, compared to Disney’s $4.195 billion. So, the important aspect here is that both companies are going to have to borrow a massive amount of money in order to cover the current evaluation of $71 billion. Comcast, if successful, would be taking on more than $85 billion in debt, increasing their debt to EBITDA ratio from 2.32 to up to 4.25, making them the second most indebted company. Moody’s stated that if Comcast were successful in this deal, it would more than likely downgrade their credit raiding. This is where Disney has a huge advantage. Disney currently has a debt to EBITDA ratio of 1.53, so they have much more room to leverage and, ultimately, they can keep the fight going to eventually win. Comcast has a lot more on the line if they continue to increase the bid, as over leveraging can be detrimental. Disney’s CFO stated “Given the strong cash flow profile of the combined company and our commitment to a strong balance sheet and commensurate credit ratings, we expect to reduce leverage by at least half a turn per year and to return to leverage levels consistent with a single-A credit rating by the end of fiscal 2021 assuming 39% ownership of Sky and by the end of fiscal 2022 assuming 100% ownership,”. Disney has also been working with regulators for months, helping their positioning in getting the deal done as soon as possible.

EBITDA Ratio (Source: Bloomberg)

Another benefit to Disney’s deal is that the stock option gives a tax advantage over the all cash option from Comcast. The Murdoch family, who have 17% economic interest in 21st Century Fox, would have huge capital gains, meaning more taxes. Fox shareholders, if the current deal goes through, would own 19% of The Walt Disney Company, potentially more valuable than cash.

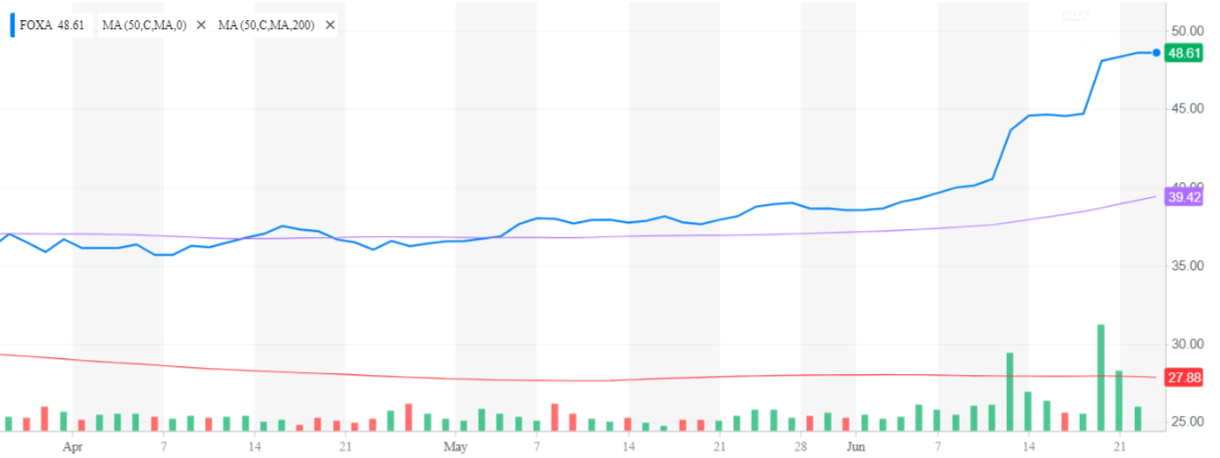

FOXA price is above both the 50 day short term and 200 day long term moving average (MA). This is a bullish sign and indicates FOXA is a buy. Also, the short term MA is above the long term MA, another bullish sign, further proving 21st Century Fox is a good buy and the price will continue to rise.

Moving Average Graph (Source: Yahoo Finance)

I Know First Bullish FOXA Forecast

I Know First Algorithm recognizes the 1 year potential for FOXA and assigns a bullish forecast. The algorithm gives FOXA a solid predictability of 0.7 and a powerful signal of 227.60.

Here is the explanation for how to read the I Know First Forecast and Heatmap.

Here is the explanation for how to read the I Know First Forecast and Heatmap.

Conclusion

I would give FOXA a buy rating. It’s in Comcast’s best interest to pursue a deal with FOXA and, if Disney successfully completes the deal, it would be a tremendous loss for the future of Comcast. The future deal would provide a higher appraisal of FOXA, causing the stock price to rise as more cash or stock options are in play. However, Disney won’t back down from this deal, due to their lust for both Hulu and Sky, along with their powerful leverage advantage. So, of course there will be a counteroffer from Disney, which will more than likely value the company, once again, higher than Comcast, increasing stock price. Now I don’t believe that Comcast will counteroffer after that, but if they do, it only benefits stockholders since stock rises an average of 7.6% each day a FOXA bid was announced. I think it’s fair to say that the Disney quote on top of this article, “All our dreams can come true, if we have the courage to pursue them.”, will quickly be proven to be true as this bidding war continues. Therefore, buying FOXA is at best a speculative risk, but I believe stock price will increase as the stakes are too high for Comcast not to counteroffer.

I Know First Algorithm FOXA Forecast coincides with my forecast for the future stock gains.

Past I Know First Success with FOXA

On November 7th, 2017, I Know First Algorithm issued a bullish forecast for FOXA, with 14 day signal of 20.32 and predictability of 0.28 FOXA gained 12.50% during that 14 day forecast.

This bullish prediction was sent to the current I Know First Subscribers on November 7th, 2017

To subscribe today click here.