Cisco Stock Forecast: Cisco Has Toppled Microsoft As The Global Leader in Collaboration

Cisco Stock Forecast: Cisco Has Toppled Microsoft As The Global Leader in Collaboration

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- Microsoft was the long-term leader in collaboration software which allows teams of employees to increase productivity via online cooperation/communication of ideas.

- However, the most recent report of Synergy Research convinced me that Cisco is now the race leader when it comes to collaboration software.

- Cisco taking the lead in collaboration software is a good reason to add this company to your long-term portfolio. Cisco is the king of on premise collaboration solutions.

- The future of enterprise productivity will get more increasingly dependent on collaboration software. However, Cisco will have to focus more on cloud-based solutions.

- I Know First has a buy signal for CSCO based on the stock’s one-year algorithmic market trend forecast.

Microsoft (MSFT) was the acknowledged leader in collaboration software in 2016. However, the most recent report of Synergy Research has proclaimed Cisco as the overall leader in global collaboration services. As of Q4 2017, Cisco has 13% of the total collaboration services market. Microsoft only had 12%. Cisco’s feat was thanks to its 26% market share in Premise-based collaboration.

CSCO is worth adding to your long-term portfolios. Cisco’s ascendance as the leader in the $10 billion/year collaboration software and services could be a stepping stone toward dominating it taking a bigger share of the $105 billion Software-as-a-Service industry.

Cisco’s big lead in premise-based or on premise collaboration products has even inspired it to release an on premise version of its popular hosted/cloud Webex products. By putting more emphasis on premise-based solutions, Cisco can offset the big lead of Microsoft on cloud collaboration services. Cisco only has 5% market share in cloud collaboration, while Microsoft has 8%.

Cisco Spark is now also Webex Teams. Webex is now Cisco’s unified brand push to differentiate it from Microsoft’s confusing array of collaboration tools. Cisco’s marketing effort is now laser-focused on Webex. This should simplify recruitment of potential customers. There is Cisco Webex Meetings for online video conferencing, Webex Teams for continuous teamwork, and Webex Devices for hardware tools that connect employees.

(Source: Cisco)

Webex Office Is Coming Soon?

The only missing link is for Cisco to come up with an equalizer to Microsoft Office 365. Online white boarding, file sharing, and video conferencing are still not enough for Cisco to complete its online collaboration strategy. Microsoft’s leadership in cloud collaboration is largely thanks to its Office 365 Suite.

Cisco shutdown Webex WebOffice five years ago because it could not compete with the document creation tools of Office 365. However, there’s a list of alternatives to Office 365. Buying SoftMaker Office and rebranding it to Webex Office completes the long-term Software-as-a-Service strategy of Cisco.

Unlike the ill-fated WebOffice, the on premise version of SoftMaker Office retails for $64.95. It uses the native DOCX, XLXS, and PPTX formats that Microsoft Office uses. It is therefore fully compatible with Office 365 native documents and users will have an easy learning curve to master the four software programs of SoftMaker.

(Source: SoftMaker)

The Android version of SoftMaker Office can also be easily ported to iOS to create a real cross-platform Webex Office suite. Mobile devices are important toward completing the total SaaS strategy of Cisco. Microsoft’s Productivity and Business Processes segment generates $8.95 billion in quarterly revenue thanks to the online collaborative features of Office 365.

Office productivity via teamwork is why Microsoft is currently the leader in Enterprise Software-as-a-Service. The enterprise SaaS market is generating $15 billion in quarterly revenue in 2017, or $40 billion a year. This is a larger opportunity than the $10 billion/year collaboration software industry.

Enterprise SaaS’ $40 billion a year contribution is the largest category in the $105.5 billion annual global SaaS industry.

Conclusion

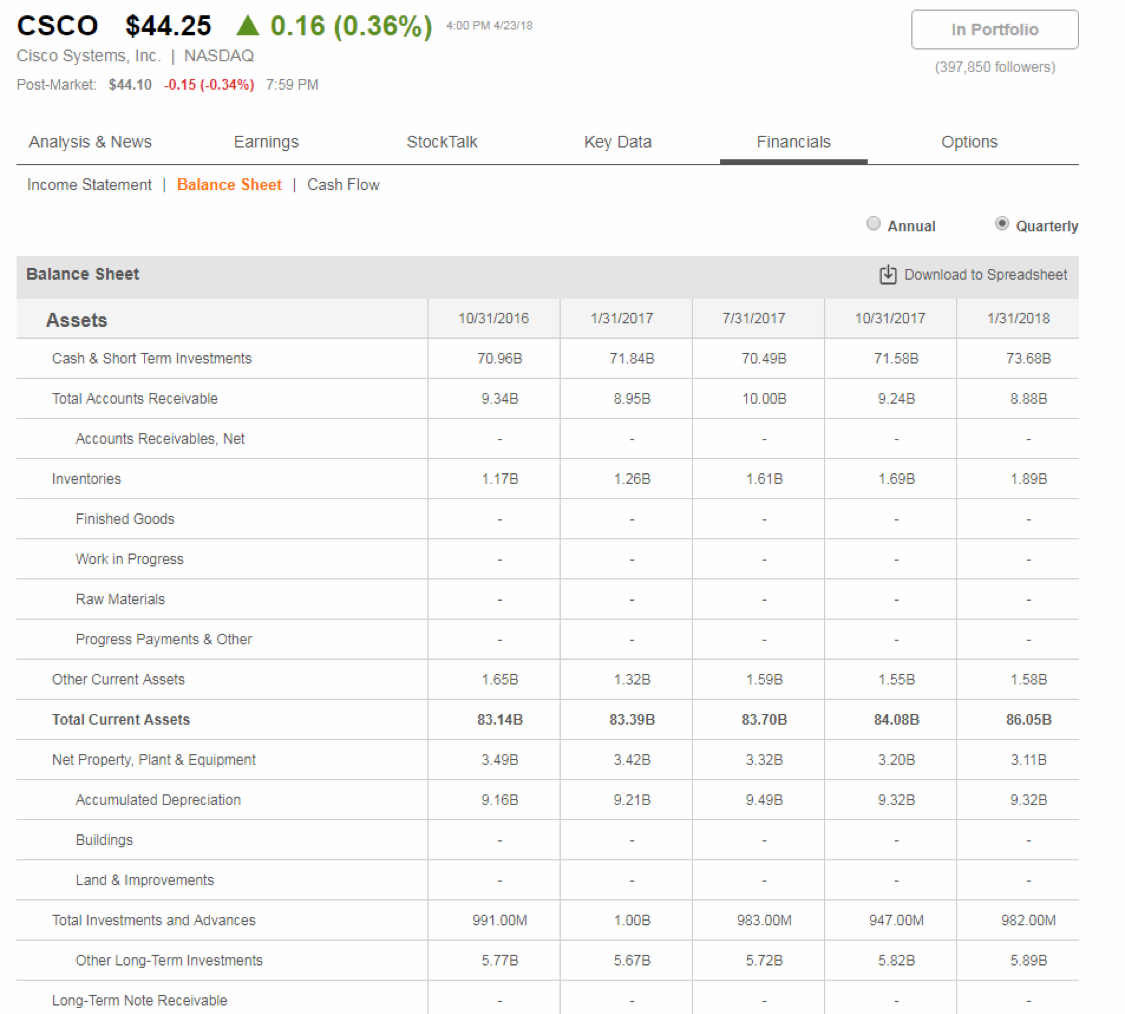

Cisco has enough cash reserves to fund more mergers and acquisitions. As of January 31, 2018, Cisco has more than $73 billion in cash and short-term investments. Cisco’s free cash flow is $3.85 billion. Cisco can easily acquire companies that which could all help make Cisco a mini-Microsoft.

(Source: Seeking Alpha)

The chart above illustrating the rock-solid financials of Cisco is also a great reason to buy its stock. The decent free cash flow and deep cash reserves of Cisco are why it can afford to have a dividend yield of 2.98%. Cisco has consistently delivered dividend growth for the past seven years.

(Source: Dividend.com)

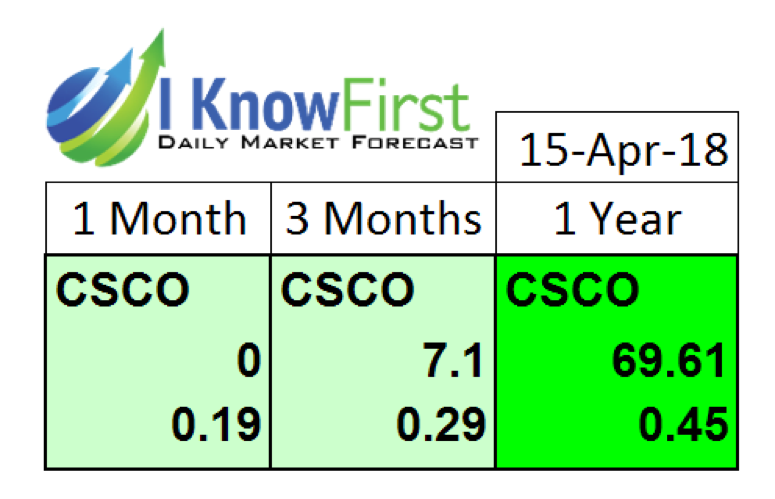

On April 15th, 2017, the I Know First algorithm gave bullish signals for Cisco Systems Inc. for the 1-Month, 3-Month, and 1-Year algorithmic market trends. The numbers located in the bottom right indicate predictability scores. Scores above 0.3 indicate excellent success in I Know First’s algorithm in correctly predicting the stock’s movements.

This bullish forecast for CSCO was sent to I Know First subscribers on April 15th, 2018.

Past I Know First Success with CSCO:

I Know First’s algorithm has made accurate predictions on CSCO in the past, such as its bullish article published on July 13th, 2017, where I documented that CSCO stock is relatively undervalued according to its peers. Cisco’s low valuation has resulted in it giving a dividend yield of 3.7%. Although Cisco is a slow-growth tech company; this mega-cap networking firm is likely to shrug off any downturn or recession. Also, as of the time of writing, Cisco had $62 billion in overseas cash. Therefore, CSCO has optimistic algorithmic trend forecasts from I Know First. The stock is unlikely to dip for a prolonged period this year. Bargain hunters looking to find cheap plays in the Technology sector should consider adding Cisco (CSCO). The world’s largest vendor of network switches is relatively undervalued compared to its peers in the Technology sector and Communications & Networking industry. Cisco’s P/E ratio of less than 16 was way lower than the average Technology sector’s 24.24.

Cisco’s positive one-year algorithmic market trend forecast score from I Know First fortifies my buy rating for CSCO.

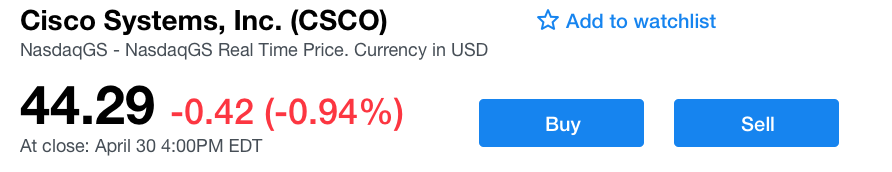

Over this period between July 17th and May 1st, CSCO stock outperformed the market by over 40%, demonstrating the success of the I Know First algorithm in predicting the performance of CSCO over this time horizon.

[Source: Yahoo Finance, May 1, 2018]

To subscribe today click here.

Further, analysis of monthly technical indicators and moving averages trends also support our buy recommendation for CSCO.

(Source: Investing.com)

To subscribe today click here.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.