CCL Stock Prediction: Long Way to Recovery but Brightness is Ahead

The stock prediction article was written by Tianyue Yu, Analyst at I Know First, Master’s candidate at Brandeis University.

The stock prediction article was written by Tianyue Yu, Analyst at I Know First, Master’s candidate at Brandeis University.

Summary

- Costa and AIDA fleet resumption spurred market confidence

- CCL remains well-positioned to win the post-pandemic market

- Stock is currently traded at fair value but the bull case shows upside till $46

Good News, But Still Long Way to Recovery

Carnival Corporation stock (CCL) was strongly hit by the COVID-19 outbreak. Same as other “beach” stock, CCL lost more than half of its market value in February and March. However, after the Centers for Disease Control and Prevention (CDC) finally lifted its over 6 months no sail order for the cruise industry and replaced it with a new conditional sail order, the bull CCL stock forecast pushed up stock price 66% in November. Although this eased regulation brought some confidence to the cruise industry, nothing changed significantly to boost the revenue or operation results of CCL since the pandemic situation is still deteriorating in North America and Europe.

Cruise industry performance is highly dependent on COVID-19 recovery speed, nevertheless, it will be one of the slowest sub-sectors to rebound. The prerequisites of cruise lines back to normal include international travel resumption, ports reopen, and the return of consumer confidence. These recovery difficulties will finally boil down to two points: When will Carnival plan to sail again and when will the pandemic crisis become history.

For the first question, in November, CCL announced that the company canceled all US-based fleets through early 2021. This policy slows down the revenue recovery since more than 50% of the revenue comes from services in North America. After the CDC lifted the no sail regulation, CCL restarted part of the guest cruise operation of Costa and AIDA cruise lines with sailing in Italy, Canary Island, and the western Mediterranean. I expect that the revenue contribution from these fleets will be limited since the consumer confidence in the euro area and the EU remains low in November.

For the second question, we had some good news on the vaccine development and authorization. However, cruise travel requires the vaccine to be widely distributed. Based on the number of the available doses in major vaccine production companies, I estimated that by the end of 2021 the industry can expect to have a broad vaccinated passenger base to cover the operation region. Since the vaccine news and the shift in sailing policy have largely been priced in by the market, the CCL stock forecast will not have dramatic change until 2022.

Great Resilience in the Recession to Embrace the Brightness

COVID-19 is definitely a tough pill to swallow for cruise lines. Because there is no revenue to collect, CCL and its peer group all have been through cash burn and issuing new debt and stock to maintain the liquidity. CCL filed to sell $1.5 billion stock on November 10, hurting the stock price on that day. As the Q3 report disclosed, CCL’s long-term debt doubled since November 2019, leaving the company a large number of debt obligations to pay off in the future. This debt volume also will lead to a big gap between revenue recovery and EPS rebound. Even after the company sales gradually back to the pre-pandemic level, the mounting interest rate will become a big burden on EPS increase. Despite the negative impact of stock issuance and debt raising, these emergency actions play an important role to keep the company afloat and put CCL in a better liquidity position than the peer group.

Based on the great resistance in the pandemic situation, I predict that CCL will outperform other cruise companies after the industry recovered from the recession. Before the pandemic, CCL’s business accounts for the top share of the cruise passengers and cruise sector revenue. CCL also has a better global market footprint (46%) than Royal Caribbean Cruises (26%) and Norwegian Cruise Line (11%). Given the situation that the US struggles most under the pandemic, a better global presence will help with a quicker recovery speed.

Also, the updates on booking in the CCL Q3 report indicate a predictable inspiring performance in the post-pandemic world. As 10Q reported, cumulative advanced bookings for the second half of 2021 capacity currently available for sale are at the higher end of the historical range and similar to where booking positions were in 2018 for the second half of 2019. The ticket pricing remains relatively strong and decreases by mid-single digits versus the second half of 2019. In contrast, the RCL Q3 report implied a slow capacity ramp. Reflected on the stock market, CCL stock price gained the greatest growth in the past year among the direct peer group.

Stock is Currently Traded at Fair Value but CCL Stock Forecast will Ramp Up Quickly

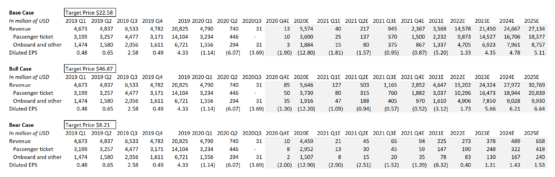

After factoring in the change of new debt and new shares outstanding, I build a DCF model under three cases to forecast CCL stock price. In the base case, I expect that CCL will recover to full capacity (capacity in FY 2019) in FY 2023, and costs and expenses will change accordingly.

In the bull case, my assumption is the recovery will speed up and pricing power will back to the pre-pandemic level. In the bear case, I assume that sailing in FY 2021 will remain closed generally.

As the valuation results show, under the base case, CCL stock is currently traded at fair value based on the market’s estimation of cruise sector resumption speed. However, the bull case indicates great upside. If we refer to the tourism recovery after the pandemic in China, we will notice the industry bounced back very quickly. Therefore, as time goes by, when the market sees the sign of promising recovery from the COVID-19 recession when the consumer confidence level builds up again, we can expect prompt growth of tourism industry business and CCL stock market value.

Final Thoughts on CCL Stock Forecast

As an unfavorable stock under the pandemic, CCL suffered from low valuation because its business is closely related to the uncertainty of COVID-19 recovery condition. However, we can be sure that the brightness of the CCL stock forecast is ahead. In the last month, positive news of vaccine and sailing policy pushed up the stock price by more than 70%, despite the increasing cases of COVID-19 around the US and Europe area, indicating that the market has faith in the strong consumer demand after the pandemic.

I believe that long-term sustainable price growth will depend on the gradual reopen of cruise lines and in the short-term positive news will be main the driver of the stock price. My positive prediction for the CCL stock is backed by the algorithm forecast results from I Know First. Once the market witnessed the indication of revenue bounce back in the financial report, CCL stock will experience a big increase even beyond the pre-pandemic level.

Past Success With CCL Stock Forecast

I Know First has been bullish with its CCL in the past. On December 5, 2020, the I Know First algorithm issued a bullish forecast for CCL stock price and recommended CCL as one of the top stocks to buy after the pandemic past. The AI-driven CCL stock forecast was successful on a fourteen-day horizon resulting in around a 30% gain since the forecast date. See the chart below.

In addition, on November 9, 2020, the I Know First algorithm recommended CCL as one of the best Robinhood trades stocks to buy. The AI-driven CCL stock prediction was successful on a three-day horizon resulting in more than 35% gain since the forecast date. See the chart below.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.