BZH Stock Forecast: A Promising Contender in Homebuilding

![]() This BZH Stock Forecast article was written by Zheman Zhong – Financial Analyst at I Know First.

This BZH Stock Forecast article was written by Zheman Zhong – Financial Analyst at I Know First.

Highlights

- BZH Stock Forecast indicates robust financial health backed by consistent revenue growth and strong liquidity metrics, making it a standout entity in the homebuilding industry.

- Despite some operational efficiency challenges, Beazer Homes net margin and return metrics significantly surpass industry medians, indicating effective capital and asset utilization, as well as profit retention.

- Beazer Homes Q3 fiscal 2023 financial performance presented a mixed bag, with impressive revenue growth but some areas like net income and backlog valuation requiring attention. However, the company’s financial position remains robust.

- Over the past decade, Beazer Homes USA, Inc. has demonstrated consistent revenue growth, with only one year of slight decline, indicating a solid financial foundation.

- Valuation metrics suggest a potential undervaluation of BZH stock, offering a potentially attractive entry point for investors. Its strong market presence and appealing valuation further establish it as an intriguing prospect within the homebuilding industry.

Overview

Beazer Homes USA, Inc.(BZH), founded in 1985, is one of the largest, financially robust homebuilders in the United States, with roots tracing back nine generations to England in the 1600s. The company operates in 13 states, constructing and selling a variety of single-family homes, townhomes, condos, and duets through commissioned sales counselors and independent brokers. Beazer Homes, known for their innovative and energy-efficient designs, provides value to customers through high-caliber construction practices and rigorous inspections, ensuring durable homes that stand the test of time. They prioritize locations near places that matter to their customers, creating more than just a house, but a community. The company also caters to the active adult market through its Gatherings communities, offering high-performance homes with an array of amenities. Beazer Homes underscore the importance of outstanding customer service, providing support to homeowners from the initial sale through to post-move-in care. They have a unique “Formula for Success” combining decentralized operations with a centrally-controlled conservative financial policy, aiming for financial flexibility and local responsiveness.

Beazer Homes Reveals Mixed Q3 2023 Results, Driven by Improved Sales and Higher Backlog Conversion

Beazer Homes USA, Inc. (BZH) released its financial results for Q3 2023 on July 27, revealing a combination of positive and challenging outcomes. Allan P. Merrill, the Chairman and CEO of the company, highlighted the positive aspects of the quarter, including a higher sales rate, increased backlog conversion, and reduced sales concessions.

The quarter saw substantial revenue growth, surpassing both the top and bottom-line predictions, which resulted in a significant 16% boost in the stock price, reflecting the market’s positive sentiment. BZH reported total revenue of approximately $572.54 million, an 8.7% increase YoY, beating estimates by an impressive $60.28 million. The major driver of this growth was the homebuilding revenue, which increased 9% YoY to $570.5 million, propelled by a 7.1% increase in home closings and a slight 1.8% rise in the average selling price.

However, there are some areas that warrant close attention. Beazer’s net income from continuing operations declined to $43.8 million, a 19.3% drop from $54.3 million in Q3 2022. Earnings per diluted share also fell from $1.76 to $1.42 YoY. Moreover, the backlog decreased by a significant 36.4%, indicating a potential future sales decline if standard conversion rates persist. This decrease, together with a 490 basis point reduction in the homebuilding gross margin, could signify impending challenges that might negatively impact the stock price if not addressed.

Yet, in the face of profit and backlog valuation challenges, Beazer Homes remains financially strong. The company closed the quarter with an unrestricted cash balance of $276.1 million and total liquidity of $541.1 million. Furthermore, despite the dip in earnings per share, the EPS still outperformed the market’s expectations, which might explain the recent surge in stock price.

In conclusion, Beazer Homes USA, Inc.’s (BZH) stock has potential for growth, backed by strong revenue performance and a solid financial footing.

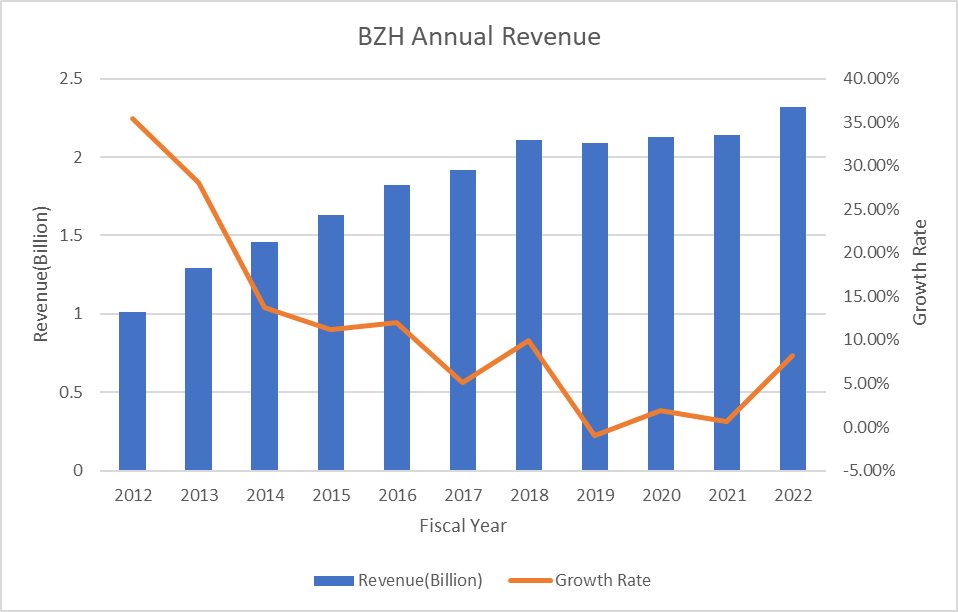

BZH Stock Forecast: Revenue Growth Steadily Over 10 Years

Beazer Homes (BZH) stock forecast relies heavily on its impressive revenue growth over the past decade. From 2012 to 2022, the BZH stock demonstrated a consistently increasing trend in annual revenue. This positive trajectory started with a significant 35.46% growth in 2012 and a further 28.03% upsurge in 2013. Over the next few years, BZH’s revenue growth remained healthy, albeit at a slower pace, eventually leading the revenue to hit $1.82 billion in 2016. A slowdown to 5.17% was witnessed in 2017, but the BZH stock bounced back with a 9.96% increase in 2018. A slight downturn of -0.92% occurred in 2019; however, BZH promptly returned to a growth trajectory in the ensuing years. While 2021 saw modest growth of 0.62%, the BZH stock bounced back strongly in 2022 with an 8.26% increase, reaching a revenue of $2.32 billion. With a decade of consistent growth, barring one year of minimal decline, Beazer Homes showcases a strong financial foundation. However, the fluctuating growth rates suggest potential volatility, possibly due to market oscillations or factors specific to BZH stock. Despite minor annual fluctuations, Beazer Homes USA, Inc. has displayed a consistent growth trend over this ten-year period, positively impacting the BZH stock forecast.

(Figure 1: BZH annual revenue and growth rate in 10 years)

The BZH Stock Price Demonstrates Impressive Growth in 2023

The BZH stock’s general trajectory over the past five years shows a steady incline, which is a positive indication as it signifies an increasing stock value. Nevertheless, the BZH stock also experienced periods of volatility, with several instances of fluctuation over time. This reflects the inherent volatility in the housing market.

It is important to note that a significant decline in the BZH stock price occurred in the first quarter of 2020. This could possibly be linked to the COVID-19 pandemic, which had a major impact on global financial markets. Despite this setback, the BZH stock price demonstrated resilience, with a steady recovery commencing in May 2020 and the price reaching $23.22 by January 2022.

Moreover, recent months in 2023 have seen a remarkable increase in the BZH stock price. The stock experienced a surge from $12.07 in July 2022 to $35.43 by August 2023. This upward trend could be attributed to several factors, including favorable market conditions, Beazer Homes USA’s solid financial performance, or an optimistic investor sentiment towards the real estate sector.

Overall, BZH stock forecast a positive trend in the future, sinceThe BZH stock has shown a consistent upward trend over the past five years, especially In 2023 BZH’s stock price saw a significant increase.

(Figure 2: BZH historical stock price)

BZH Stock Forecast: An Undervalued Gem in the Homebuilding Industry

In the realm of homebuilding industry forecasts, Beazer Homes USA, Inc. (BZH) is an underappreciated gem, according to GuruFocus. The BZH Stock Forecast presents a vibrant image of profitability and impressive liquidity measurements, setting it apart from many of its industry peers.

BZH’s gross margin of 20.65%, while respectable, falls slightly below the industry median of 22.73%. This situates it beneath 59.05% of its counterparts within the homebuilding and construction sector, signifying potential areas for enhancing cost efficiencies within its production processes. Similarly, its operating margin, at 9.41%, trails the industry median margin of 9.87%. These figures illuminate potential avenues for bolstering BZH’s operational effectiveness.

Nonetheless, BZH’s profitability ratios portray a compelling strength. With a net margin of 7.94%, the company exhibits a superior capacity to retain a substantial portion of its revenue as profit, outperforming 58.72% of its industry peers. Moreover, its return metrics, specifically Return on Invested Capital (ROIC) at 9.83%, Return on Equity (ROE) at 19.75%, and Return on Assets (ROA) at 8.44%, are significantly above the industry medians. This underscores BZH’s proficiency in utilizing capital and assets effectively, delivering robust returns to its stakeholders.

From a liquidity standpoint, BZH overshadows a majority of the industry. With a remarkably high current ratio of 10.13, coupled with sturdy quick and cash ratios of 1.69 and 1.34 respectively, BZH demonstrates a robust short-term financial position. These figures attest to BZH’s formidable ability to meet its near-term liabilities.

(Figure 3: BZH vs Homebuilding Industry Metrics)

Beazer Homes USA Inc. (BZH) occupies a pivotal place within the homebuilding industry, underpinned by a robust market capitalization that hovers around the $1.11 billion mark, making it one of the larger entities in its peer group. This substantial market footprint potentially offers strategic leverage, manifesting as economies of scale, competitive advantage, and the ability to shape industry trends, which smaller firms may lack.

From Gurufocus, BZH’s profitability, while not leading the pack, remains competitive, occupying the sixth rank among its peers. This indicates a robust ability to generate earnings vis-à-vis its revenue, cost structure, and equity base. It’s worth highlighting that its market cap significantly overshadows that of firms boasting a higher profitability rank, signaling that BZH’s impact and presence in the market are far-reaching.

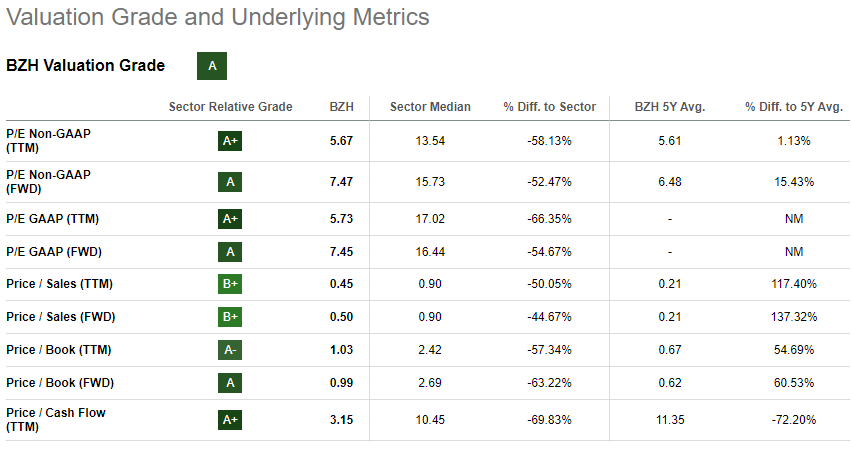

In terms of valuation, BZH presents an enticing profile. It trades at lower P/E ratios (both on a Non-GAAP and GAAP basis) compared to the industry’s median and average, implying that its stock may be undervalued relative to its earnings potential. This potentially provides investors with an attractive entry point for investment.

Furthermore, BZH’s Price-to-Book, Price-to-Sales, and Price-to-Cash Flow ratios all underscore potential undervaluation. These ratios trail below the industry median and average, suggesting that the market may not be fully pricing in the value of BZH’s assets, sales, and cash flows.

(Figure 4: Comparable Valuation Metrics)

(Figure 5: Valuation grade and underlying metrics)

In summary, Beazer Homes USA Inc., highlighted in our BZH Stock Forecast, manifests a noteworthy mix of robust financial health, admirable liquidity, and outstanding profitability ratios. This separates it from numerous competitors within the homebuilding industry. With its significant market footprint and enticing valuation metrics, BZH makes a compelling case in the stock forecast. The company’s strong operational outcomes and financial signs suggest its potential to deliver notable value for its shareholders for a long duration.

Conclusion

In sum, Beazer Homes USA, Inc. (BZH) offers a promising investment proposition, supported by strong financial performance, consistent revenue growth, and sound financial health. Despite a few hurdles, BZH’s strategic positioning and operational efficiencies suggest its capability to navigate potential challenges and maintain its growth trajectory. At present, the company’s significant market presence, undervalued stock, and strong financial indicators make it an enticing prospect for potential investors. The positive trend of the BZH stock signals market confidence in Beazer Homes, indicating promising future prospects.

Worth noting is that the AI-driven stock selection by I Know First indicates a strong bullish signal for BZH stock on the one-year market trend predictions, aligning with my perspective. The light green for short-term forecasts suggests a mildly bullish stance, while the darker green represents a strong bullish signal for the one-year forecast.

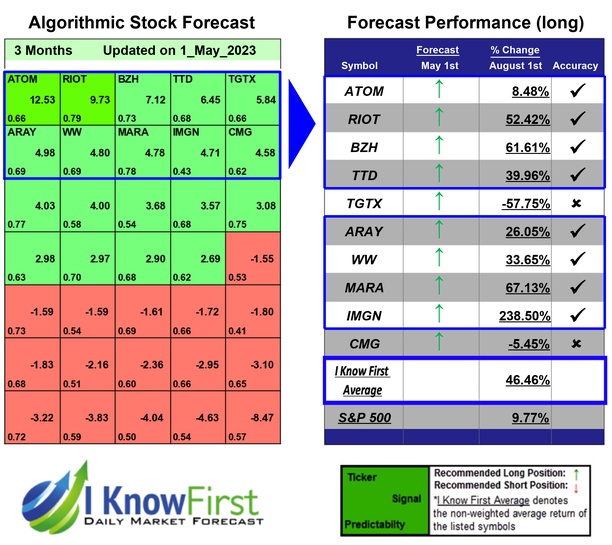

Past Success With The BZH Stock Forecast

I Know First has been bullish on the BZH stock forecast in the past. On May 1st, 2023 the I Know First algorithm issued a forecast for BZH stock price and recommended BZH as one of the best option stocks to buy. The AI-driven BZH stock prediction was successful on a 3-month time horizon resulting in profits of more than 61.61%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.