BIDU Stock Forecast: Bet on Baidu’s Strong Earning Power

The BIDU stock forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The BIDU stock forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary

- Yes, Baidu’s stock is essentially dead money because of its 5-year total return of -49.30%. Baidu’s value will likely continue to diminish because of the new U.S. Senate bill.

- This handicap is ignored by the predictive AI of I Know First. BIDU still got a super bullish one-year forecast from I Know First. It must be due to BIDU’s strong earning power.

- The U.S. Senate bill requires US-listed Chinese stocks to be compliant with the standards of the Public Company Accounting Oversight Board.

- Chinese companies also need to declare they are not state-owned or controlled. Baidu can easily comply these two new requirements.

- I am in favor of Baidu’s rumored plan to delist from NASDAQ and transfer to Hong Kong. This could take time but it might boost the valuation of Baidu.

The rising tension between the United States and China is why many Chinese companies’ stocks suffered price declines this week. Baidu (BIDU) saw its stock dipped -6.71% yesterday. Republican Pres. Trump was likely behind the new US Senate bill requiring US-listed Chinese companies to be compliant with the audit standards of the Public Company Accounting Oversight board. Failure to comply means publicly-traded Chinese stocks could be delisted from NYSE or NASDAQ. The Republican Party currently controls the US Senate.

The increasingly antagonistic tone of US rhetoric against China and Chinese companies is why Baidu’s stock now has a 5-year return of -49.30%. BIDU is essentially dead money or a dying stock.

Baidu is rumored to be considering to voluntarily delist from NASDAQ and register itself on the Hong Kong Stock Exchange. This will likely boost its stock valuation. You can buy BIDU now while it is cheap and hope that the US SEC administrators will allow Baidu to voluntarily delist from NASDAQ. Sad but true, American politicians and investors are biased against Baidu. This probability that BIDU will transfer from NASDAQ to HKSE is likely why the predictive AI of I Know First has a super bullish one-year forecast for BIDU.

The other obvious reason for I Know First’s high optimism is Baidu’s strong earning power. This company is obviously undervalued when you consider its very strong Cash from Operations metric. Baidu got a bullish Quant rating from Seeking Alpha mainly because of its strong Cash from Operations performance. BIDU touts a 5-year Cash from Operations average of $4.08 billion.

Being the long-running number one search engine company in China is why Baidu has strong earning power (or cash flow from operating activities).

BIDU Stock Forecast – Why BIDU Is Undervalued

The -49.30% 5-year return of BIDU pushed in to great-value territory. The Price to Free Cash Flow metric is a great way to determine if is a stock is undervalued or not. BIDU’S -49.30% decline in price for the past 5 years has pushed down its annual Price to Free Cash Flow valuation from as high as 43.05x to just 11.39x. The lower the Price to Free Cash flow ratio, the more BIDU is relatively undervalued.

Compared to its search engine peers Google (GOOG), Baidu has lower valuation ratios. The comparative chart below illustrates just how cheap BIDU is when compared to GOOG. This gross undervaluation reeks of bias by American investors. Sad but true, American investors still look down on Chinese companies. This is just bad because Baidu will continue to rule as China’s no. 1 search advertising company. Google has no plan to re-enter China or launch a censors-friendly search engine in China.

BIDU Still Rules China’s Search Advertising Business

Tencent’s (TCEHY) subsidiary, Sogou is a competent search engine company. However, Baidu will always be the no. 1 beneficiary of China’s fast-growing $34.525 billion/year search advertising industry. Yes, Sogou now leads in desktop search usage but Baidu still rules mobile search.

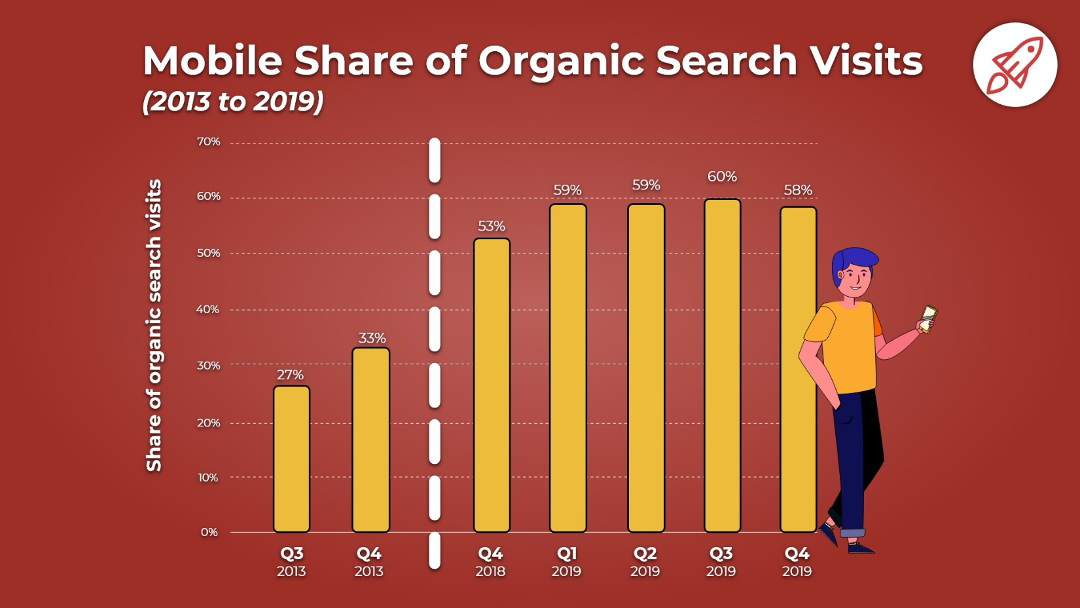

BIDU is a buy because it still boasts 85% market share in mobile search engine usage in China. Mobile devices now account for almost 60% of global organic search visits.

Conclusion

I used Finbox’s Earnings Power Value template to come up with a fair value of $142.58 for BIDU. My assumption is that BIDU has 38% upside potential. This fair value estimate is lower than the average one-year price target for BIDU at TipRanks, which is $146.79. Baidu is clearly a good-value bet we should make before the herd starts pushing BIDU higher.

I also tested the DCF forward fair valuation algorithm of SimplyWall.St. That site gives BIDU a fair value price of $210.28. SimplyWall.St uses a 2 Stage Free Cash Flow To Equity model in its fair value calculation. Like Finbox, DCF fair value calculation is from an AI making assumptions based on discounted future free cash flow performance of stocks.

Lastly, BIDU is a buy because it boasts a healthy balance sheet. Baidu’s total current liabilities is only $7.91 billion. This is notably lower than Baidu’s $20.57 billion position in total cash & short-term investments. Going forward, there is almost zero chance that Baidu will go bankrupt.

Past I Know First Success with BIDU Stock Forecast

On April 28th 2020, I Know First algorithm made a bullish BIDU stock forecast. As shown below, during the time period from April 28th, 2020 to May 24th, 2020, BIDU has already grown by 2.74%. This confirmed I Know First’s BIDU stock forecast.

Here at I Know First, our AI-based algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing daily stock predictions, as well as S&P 500 forecast, Forex forecast, Apple stock predictions and, in particular, Apple stock news. Today, we are producing daily stock market outlook for over 10,500 assets, including gold and commodities that are published on gold-prediction.com. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast