ASML Stock Forecast: A Monopoly with Higher Upside

This ASML Stock Forecast article was written by Meiru Zhong – Financial Analyst at I Know First.

Highlights

- The increased sales of EUV and DUV were mainly driven by the strong demand of chipmakers due to digital transformation and chip shortage.

- ASML is a monopoly on the manufacturing of EUV lithography machines and it has a strong pricing power that the price per EUV had increased by 22% to €176.1 million from 2020 to 2022.

- ASML has a strong competitive position in the semiconductor industry, with low threats of rivals, new entrants, and substitutes, and low bargaining power of customers and suppliers. It has over 90% market share of the lithography market and 100% share of the EUV market.

- EUV 0.55 NA, the next generation of the EUV system and promising engine of revenue growth, is expected to ship to customers for R&D purposes at the end of 2023 and support high-volume manufacturing by 2025.

- DCF Values ASML at $696, an upside potential of 4% compared with the stock price of $666.04 on September 6, 2023

Overview

ASML Holding N.V. (Advanced Semiconductor Material Lithography or ASML) is a Dutch multinational company, selling photolithography machines for the production of computer chips. According to FitchRating, ASML has over 90% market share of the lithography market and 100% share of the EUV (extreme ultraviolet lithography) market. Its monopoly position in the EUV lithography market has made it earn €21.17 billion in revenue and €5.62 billion in net income by the end of 2022. Its gross margin was 51.3%, operating margin was 32.5%, and net margin was 28.1% in Q2 2023. Headquartered in Veldhoven, Netherlands, and founded in 1984, ASML has a global team of over 39,000 FTEs, and its main business operations are in EMEA (Europe, Middle East, and Africa), North America, and Asia.

Soared Net Sales Bring a Brighter Future

What chipmakers want is the reduction of energy, cost, and time required for electronic computations by shrinking transistors on microchips. To achieve this goal, lithography is the key to producing tiny microchips in large volumes. As a leader in the semiconductor industry, ASML provides key products and services including Lithography systems (Extreme ultraviolet, or EUV, and Deep ultraviolet, or DUV), Metrology and inspection systems, Computational lithography, Lithography process and control software solutions, Refurbishment, and Customer support. The company generates revenue from volume purchase agreements, which include sales of systems, system-related options, warranties, and so on, other lithography solutions, and customer services.

Advanced Technology Drives Revenue Growth

According to its 2022 Annual Report based on US GAAP, ASML had disaggregated the net system sales per technology and per end-use. The following tables show the trend of units, price per unit, and net sales for each technology in the last 3 years. The increased total net sales were fueled by a strong demand from customers from all industries. For example, the net sales of EUV grew by 12% in 2022 compared with the previous year, because of the NXE:3600D system value proposition. The increased sales volume of DUV, including ArFi, KrF, ArF dry, and I-line, was driven by digital transformation and chip shortage.

Each product and service generated a quite stable percentage of total net sales, with EUV dominating at around 46%, followed by DUV at 50% (including ArFi, KrF, ArF dry, and I-line), and Metrology & Inspection at 4% in 2022. The sales volume of each technology has maintained a stable or rising trend, while the unit price has been increasing all the time.

In terms of EUV, the most complex and advanced machine in producing chips, its price per unit has increased by 22% from 2020 to 2022, while that for ArFi was 12%, ArF dry was 15%, KrF was 11%, I-line was 9%, and Metrology & Inspection was 19%. It’s apparent that ASML has a strong pricing ability in the lithography market, especially in the EUV segment, thanks to its state-of-the-art technology and the most innovative research teams. Since EUV lithography now defines the performance of the most advanced systems on Earth, from Apple’s iPhone to servers in data centers, the demand for EUV is perpetuating.

Strategic Layout on Product and Capacity

ASML has a highly differentiated product and service portfolio to cater to the needs of customers to enable affordable shrink. For example, the current EUV 0.33 NA installed base produced more than 111 million wafers in 2022, compared with 59 million wafers generated last year. To maintain the company’s competitiveness, ASML has a strategic layout for its product development.

The next generation of the EUV system, EUV 0.55 NA, designed to enable multiple future nodes, is expected to ship to customers for R&D purposes at the end of 2023 and support high-volume manufacturing by 2025. Compared to 0.33 NA, it can help customers expand the shrinking roadmap and minimize double or triple patterning, resulting in lower patterning complexity, lower defect risk, and faster cycle time. In 2022, the company has received purchase orders from all existing EUV customers for the new product, which can produce 220 wafers per hour.

Moreover, considering the sophisticated macroeconomic and long-term demand, ASML announced in Press Release on November 10, 2022, that “the company planed to increase the annual capacity to 90 EUV and 600 DUV systems (2025-2026), while also ramping High-NA EUV capacity to 20 systems (2027-2028) in order to meet future demand and prepare for cyclicality”.

Leader of Semiconductor Industry

To measure ASML’s competitiveness in the semiconductor industry. The Five Forces model is used to deliver a detailed and organized analysis.

Low threats of new entrants:The required technology behind the lithography systems and services is demanding and capital used to do research and develop business is intensive.

- For the production of EUV, ASML spent more than two decades developing EUV technology and has invested billions in R&D and acquired Cymer, a light source maker, to accelerate the development. This is a high-end game and also a lucrative business attracting other companies to join. For example, Energetiq Technology Inc. announced in December 2022 that the company is creating a disparate business segment for EUV light source products. But the progress to make sure the technology is mature enough for commerce is painstaking and takes time. In the short term, like 5 years, the leading position of ASML in the EUV market is unshakable.

- While the production of DUV is less demanding than that of EUV but still requires advanced techniques and sufficient capital to start the business. Overall, there is a high level of barrier for entering lithography market.

Low threats from substitutes: In the current market, there are no known machines that can replace EUV machines, which stand for the state-of-the-art lithography technology.

Low/ Moderate threats of rivalry:

- In terms of EUV, ASML is the sole company that has provided advanced EUV lithography machines. It’s the monopoly in this niche market with a market share of 100%.

- In terms of DUV, this playing field is not monotonous and competition is moderate in both immersion and dry segments. For instance, Nikon worked in ‘wet’ immersion, and Canon in the low-cost part of dry machines.

Low bargaining power of suppliers: There is a greater number of suppliers providing raw materials and other products for manufacturing semiconductor equipment. Take ASML for example, the number of suppliers was around 5,000. Besides, to reduce the supply chain risk, ASML has acquired firms like SVG, Cymer, Berliner Glas Group, and other firms that provide materials. This action significantly reduces ASML’s level of dependence on suppliers.

Low bargaining power of customers: ASML sells machines to only five chipmakers, among which the biggest three are TSMC (Taiwan Semiconductor Manufacturing Co.), Samsung, and Intel, accounting for nearly 84% of the company’s business in 2021. Although the buyer concentration is very high, their bargaining power is actually low since they can’t find any substitutes in the EUV market and can only deal with ASML.

To sum up, ASML has a strong competitive position in semiconductor industry and has dominated in the sub-industry, lithography systems. Its uniqueness and specialization give it robust pricing power to maximize its profit margin. This advantage will be sustained for at least 10 years.

Better Profitability compared with Peers

ASML’s competitive position can also be seen by comparing profitability within the industry using GuruFocus. As one of the most profitable companies in the semiconductor industry, ASML has a net margin of 28.48%, better than 92.64% of companies in the industry, and an ROE of 82.17%, better than 99.04% of similar firms. The excellent performance reflects its robust products and services and also demonstrates strong pricing power in the market.

Positive Industry Outlook

According to Fitchratings, the semiconductor industry revenue is expected to reach at least $1 trillion by 2030, with a CAGR of over 9%. ASML’s market simulation model in Q2 2023 guided to reach annual revenue in 2025 between approximately €30 billion and €40 billion, with a gross margin between approximately 54% and 56%.

ASML Stock Forecast: DCF Values ASML at $696

The DCF analysis shows that ASML’s intrinsic, 1-year, and 2-year stock price should be around $696, $742, and $788 respectively, which is 4%, 11%, and 18% upside potential from the price of $666.04 on September 6, 2023. It’s clear that the ASML stock price is undervalued and is worth buying.

The DCF model is built based on the following assumptions:

- The risk-free rate is 3.0% according to the average US 10-year zero coupon bond in the last five years. The risk premium 5.5% comes from the average market risk premium in the U.S. from Statista.

- Beta 1.14 is calculated based on the slope of the change of monthly ASML stock price and S&P500 price from 2018 to 2023.

- The cost of debt is calculated as a weighted average interest expense of 1.13% and finance lease discount rate of 2.2%, concluding at 1.2%.

- The tax rate is the effective tax rate 15.0% derived from the 10-K 2022.

- The terminal growth rate is assumed at 5.0%.

Due to the uncertainties in the macroeconomic environment, it is difficult to accurately predict the impact of relevant risk factors such as epidemics and wars, and the assumption may not be valid. A sensitivity matrix is created to show the impacts on ASML’s intrinsic stock price by altering WACC (weighted average cost of capital) and terminal growth rate.

ASML Stock Forecast: Viewpoints from Analysts Community

Based on Yahoo Finance, there were 35 analysts presenting recommendation trends in the last 4 months, among which 10 recommended Strong Buy, 18 Buy, and 6 Hold. The recommendation rating is 2.4 between Buy and Hold. The average price target from 35 analysts is around $696.82 within the lowest $474.81 and the highest $863.37 price range.

From TIPRANKS, there are 2 Buys, 2 Holds, and 0 Sell from 4 analysts’ ratings in the last 3 months. The expected stock price is $785.67 within the lowest $772 and the highest $800 price range.

ASML Stock Forecast: Conclusion

I take a buy-side on ASML stock because the DCF target price is $696, a 4% upside difference from the current price. Although the uncertain macroeconomics might hinder the company’s business operations, the increased revenue growth is expected due to digital transformation and chip shortage. As a leader in semiconductor industry, ASML has a strong pricing power over EUV as it’s the only provider in this segment. The next generation of the EUV system, EUV 0.55 NA, is expected to ship to customers for R&D purposes at the end of 2023 and support high-volume manufacturing by 2025, which will be the sales growth engine in the near future. Thanks to its specialization and state-of-the-art technology in the niche market, I am very confident about the company’s operations and growth potential based on the current stock price.

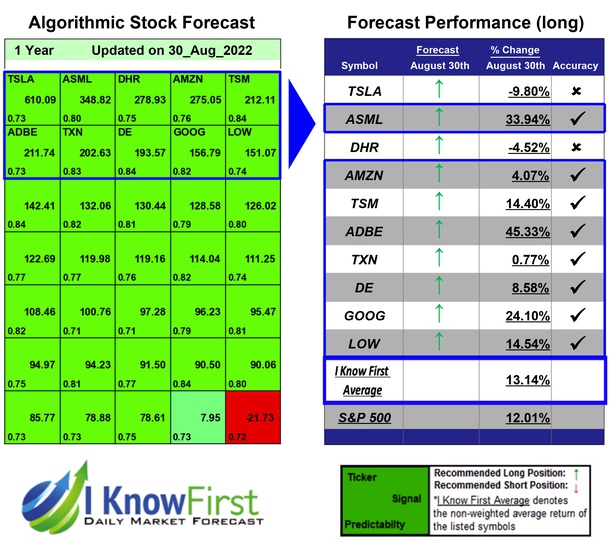

Worth noting is that the AI-driven stock selection by I Know First indicates a strong bullish signal for ASML stock on the one-year market trend predictions, aligning with my perspective. The light green for short-term forecasts suggests a mildly bullish stance, while the darker green represents a strong bullish signal for the one-year forecast.

Past Success with ASML Stock Forecast

I Know First has been bullish on the ASML stock forecast in the past. On August 30th, 2022 the I Know First algorithm issued a forecast for ASML stock price and recommended ASML as one of the best Megacap stocks to buy. The AI-driven ASML stock prediction was successful on a 1-year time horizon resulting in more than 33.94%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.