Apple Stock Forecast: Why Apple Will Dominate In Video Games-As-A-Service

This Apple stock forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

This Apple stock forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- The low $4.99 monthly subscription fee is why Apple Arcade, not Google Stadia, will eventually dominate in Video-Games-As-A-Service.

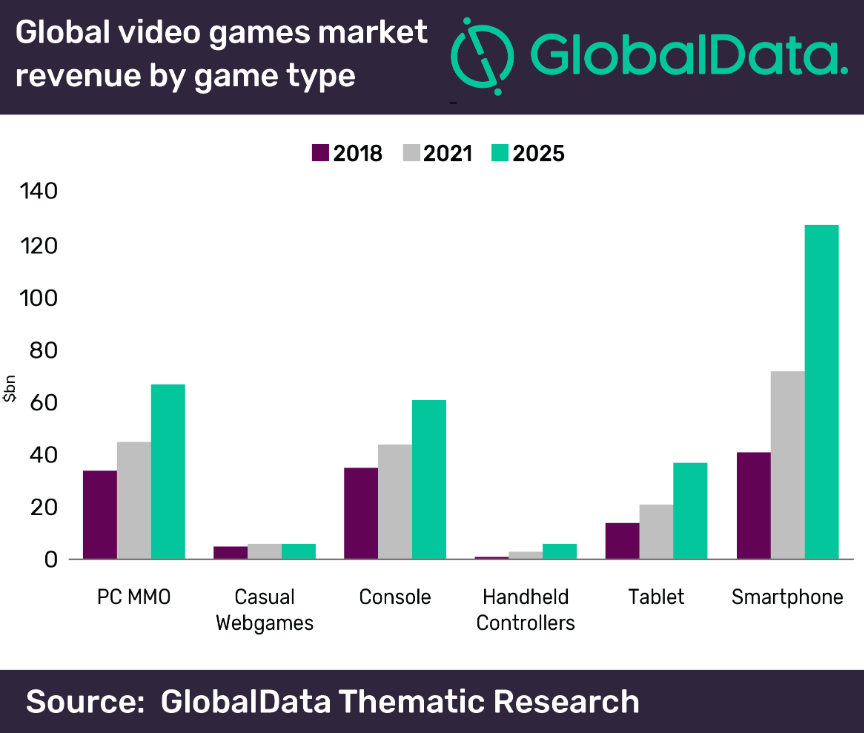

- Apple’s big bet on subscription-only video games is well in-tune with GlobalData’s projection that the global video games industry can grow to $300 billion by 2025.

- Parents and players alike will eventually appreciate that the stigma of in-app purchases just got eliminated by Apple Arcade.

- Most iOS developers will initially be lukewarm to the idea of zero in-app purchases for their games. However, many of them will eventually warm up to Apple Arcade.

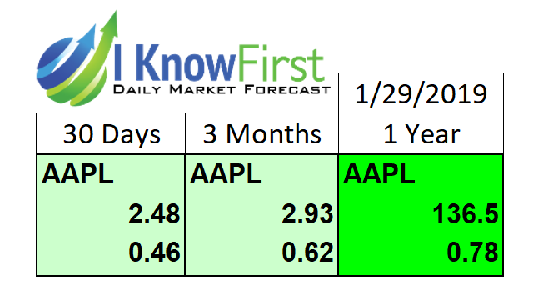

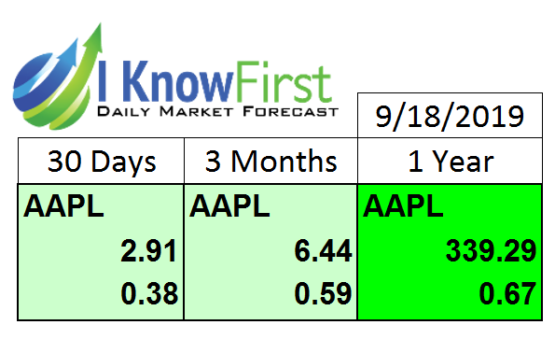

- Apple stock has a bullish one-year algorithmic forecast score of +339.29. I Know First has a great 0.67 predictability score on AAPL’s one-year market trend.

As a long-time video games aficionado, I am highly confident that Apple (AAPL) will eventually become the leader in Video-Games-As-A-Service (VGaaS). The dirt-cheap $4.99 monthly subscription fee of Apple Arcade makes it super attractive to hardcore and casual gamers.

The low asking price of Apple Arcade is likely because it will available in more than 150 countries. It means even gamers in developing countries like the Philippines can afford Apple Arcade. Apple Arcade will go live in the Philippines on September 20 and I will likely be among the first subscribers.

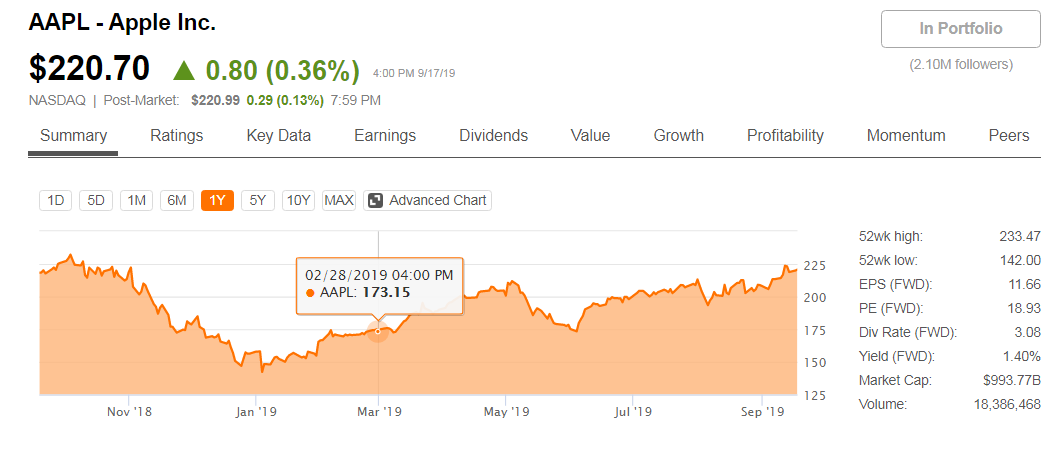

My last buy rating for AAPL was in February 28. The stock back then was trading at less than $174. I still rate AAPL as a buy at its current price $220.70. One year from now, AAPL could be trading at $240 to $250 price range. Apple Arcade is an obvious long-term tailwind for AAPL.

Google (GOOGL) has yet to announce a final official launch date for its Stadia subscription gaming service. Apple Arcade is already going live in more than 150 countries two days from now. The $4.99 monthly fee for Apple Arcade is a killer deal. Up to six family members can use a single Apple Arcade subscription on multiple Apple devices. The seamless device-to-device gaming on Apple Arcade means players can continue their progress when switching from an iPhone to an iPad, iPod Touch or Apple TV.

It is true that there is a much larger number of Android devices. Sorry Google Stadia but the early bird advantage went to Apple Arcade. Just like how it was with Netflix’s early bird move on paid TV/movies streaming, Apple Arcade is taking an early lead in subscription gaming.

Further, the usually affluent crowd of iPhone and iPad owners means more of them will likely subscribe to Apple Arcade’s bargain $4.99/month subscription fee. I am highly confident that Apple Arcade (like Netflix on streaming videos) can also attract more than 100 million subscribers.

The Future Value of Apple Arcade

Going forward, Apple Arcade has the potential to generate additional annual revenue of $5.98 billion. I also believe that one year or two years from now, Apple Arcade will offer more expensive monthly subscription fees. My $5.98 billion/year forward estimate therefore can still go much higher.

The affordability of Apple Arcade can help Apple become less reliant on iPhone hardware sales. Apple is still known as an iPhone sales-driven company. However, five years from now Apple will probably generate more revenue from its Services business segment. Its subscription services for music, streaming TV/movies, software services, and video games will potentially generate more than 50% of the company’s revenue by 2025.

In video games alone, Apple has the potential of generating $10 billion/year five years from now. Apple Arcade will probably responsible for half of that. The other half obviously will still come from its 30% commission on iTunes App Store in-app purchases. Most top-earning developers will probably remain in the in-app purchase monetization camp rather than join Apple Arcade.

My forward estimates are very realistic. GlobalData Thematic Research expects the global video games industry can become a $300 billion/year industry by 2025. This significant because Newzoo only estimates that global video games will only generate around $152.1 billion in 2019.

You should invest in Apple right now if you like the idea of the global video games growing more than three times in size by 2025. Unlike the slowing/stagnating smartphone and tablet businesses, the video games industry has always been in an upward trajectory.

This fact is why Apple is very bullish on video games. Apple Arcade is clue to just how hungry it is to have a bigger slice of the future $300 billion/year video games industry.

Conclusion

I firmly believe that Video-Games-As-A-Service will see major adoption by gamers. VGaaS gives more players and developers alike to get more from video games. The $4.99 Apple Arcade now gives Apple two sources of revenue from mobile video games. The 30% cut from iTunes app store in-app purchases will continue to flourish. I believe that many developers will continue to offer free-2-play iOS games because they like the lucrative in-app purchases and/or mobile advertising business.

Apple will likely initially attract mostly econd-tier game developers to join its Arcade subscription gaming. On the other hand, developers will eventually notice that most iOS gamers will probably switch to Apple Arcade. Paying a one-time monthly to access play more than 100 games is more cost-efficient than buying individual $0.99 to $4.99 iOS premium games.

Subscription gaming also eliminates the pay-to-win aspect of free-to-play games, which favors whales (big-spending players) who spend hundreds or thousands of dollars on in-game purchases. Apple Arcade is basically a gamer-friendly approach to mobile games. In the end, most developers and games publishers will realize the long-term advantage in joining Apple Arcade.

My buy rating for AAPL is greatly reinforced by its very bullish one-year algorithmic score from I Know First. The 339.29 forecast score for Apple stock is more attractive considering I Know First has a good predictability score of 0.67. I Know First has a great track record of correctly predicting the upward movement of AAPL’s one-year market trend pattern.

The monthly review of technical indicators and moving averages also favor going long on AAPL right now. I do not see any near-term headwinds that could force AAPL to drop below $200.

Past I Know First Success With Apple Stock Forecast

The Apple stock forecast above refers to a previous successful I Know First algorithm prediction that gave a bullish long term outlook for AAPL which was included in a premium article on why Apple would release a new Mac Mini this year. The prediction was bullish in both in short and long term with a 3-month signal of 2.93 and a predictability indicator of .62. The Algorithm correctly predicted Apple’s share trend.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.