AMD Stock Forecast: Overcoming Challenges and Embracing

This AMD Stock Forecast article was written by Meiru Zhong – Financial Analyst at I Know First.

Highlights

- AMD faced challenges in the first nine months of 2023, with lower sales of key processors and increased R&D investment, partially offset by positive contributions from Radeon GPU sales, product mix adjustments, and the inclusion of Xilinx.

- AMD’s strategic focus on high-performance and adaptive computing technology, reflected in a $4.4 billion investment in R&D for the nine months of 2023.

- AMD’s Q3 2023 highlighted a strong cash position of $5.8 billion for future stock buyback and a robust industry outperformance.

- DCF valued AMD at $143, a 6% upside potential compared to $135.47 on December 20, 2023.

Overview

Advanced Micro Devices, Inc. (AMD) is a leading American multinational company specializing in the production of computer processors and related technologies for both businesses and consumers. The Santa Clara-based company was founded in 1967 by Walter Jeremiah (“Jerry”) Sanders and seven other technology professionals and went public in 1972. The company operates through four reportable segments: Data Center, Client, Gaming, and Embedded. As of the end of 2022, AMD’s annual revenue was US$23.6 billion, an increase of 44%. However, the net profit saw a decrease of 58.23%, amounting to US$1.32 billion.

Revenue Rollercoaster: Path to Resilience

Since 2017, AMD’s revenue growth rate has been in two-digit mode, remaining above 20% and even reaching 68% in 2021, except for a drop in 2019 with only 4%. Then the increasing trend slowed a bit with a 44% increase in 2022, arriving at $23.6 billion. Although the number of annual sales was colossal and increased significantly, the net margin was small and the change was uncertain, jumping from 5% in 2019 to 26% in 2020 and gradually falling down to 6% in 2022. By the end of the third quarter of 2023, AMD’s sales were $16.5 billion and operating income was 0.59 billion, decreased by 8% and 96% for the nine months ended September 2023. Its sale in the third quarter was $5.8 billion, increased by 4.2% and operating income rose from -64 million to 224 million, a huge improvement compared to the first two quarters, indicating that AMD was robust and resilient in the turbulent market.

To understand the reasons behind the dramatic shift in revenue and net margin, let’s look at the updated reporting segments and analyze the sales engine. Basically, AMD now has four sections: Data Center, Client, Gaming, and Embedded.

- The Data Center market primarily includes server microprocessors (CPUs), graphics processing units(GPUs), data processing units(DPUs), Field Programmable Gate Arrays(FPGAs), and Adaptive System-on-Chip (SoC) products to address the computational and visual data processing needs in data centers. In the first nine months of 2023, the annual revenue for this sector, accounting for 18% of the total revenue, reached $4.2 billion. The figure decreased by 4% from the previous year, primarily due to lower sales of EPYC processors. Operating income also declined to $601 million, reflecting reduced revenue and increased investment in AI and product development. However, in the third quarter, the situation improved as EPYC processor sales rebounded, offsetting the earlier decline in adaptive SoC data center product sales.

- The Client segment, offering CPUs, APUs, and chipsets for personal computers, contributed 14% to the total revenue. In the nine months of 2023, it generated $3.2 billion, marking a 40% decrease from the previous year. This decline was attributed to a 19% reduction in average selling price and a 27% drop in unit shipments, driven by lower Ryzen processor sales in weaker PC markets. Operating income also shifted from positive to negative due to lower revenue. Conversely, the third quarter delivered strong results, with net revenue increasing by 42%, attributed to a 62% growth in Ryzen mobile processor shipments and improved PC market conditions. Operating income rebounded to $140 million, a significant improvement from the $26 million loss reported in the previous third quarter.

- The Gaming division, specializing in discrete GPUs, semi-custom SoC products, and development services, contributed $4.8 billion to the annual revenue for the first nine months of 2023, accounting for 21% of the total revenue. Despite a 6% decrease in sales, attributed to lower gaming graphics and semi-custom SoC product revenue, the division reported an increased operating income. This positive outcome was driven by higher sales of Radeon GPUs and improvements in product mix.

- The Embedded segment, encompassing embedded CPUs, GPUs, APUs, FPGAs, and Adaptive SoC products, generated an annual revenue of $4.3 billion, constituting 18% of total sales. This marked a 35% increase, largely propelled by the inclusion of embedded product revenue from Xilinx, Inc. Consequently, the operating income for the nine months of 2023 rose by 40% compared to the prior year period. However, in the third quarter, both revenue and income experienced a slight decline of about 5% and 3%, respectively. This drop was attributed to lower revenue in the communications market and increased R&D investment.

- The ‘All Other’ segment, not designated as a reportable segment, encompasses expenses and credits not allocated to the markets discussed above. Notably, a $3.4 billion loss was incurred, comprising $2.4 billion in acquisition-related expenses and $1.0 billion in employee stock-based compensation expenses.

In summary, AMD faced challenges in the first nine months of 2023, with lower sales of key processors and increased R&D investment. This was partially offset by positive contributions from Radeon GPU sales, product mix adjustments, and the inclusion of Xilinx. The downturn in Data Center, Client, and Gaming was offset by the growth in the Embedded market.

Nevertheless, the third quarter of 2023 showed improved profitability, as the amortization of intangible assets related to the Xilinx acquisition neared completion. This positions the company for better overall performance, especially in operating income, offering the potential for increased profits to be allocated to shareholders. Looking ahead, AMD’s consistent investment in R&D is expected to sustain its leadership in advanced technology, fostering long-term, sustainable profit growth.

Strategic Investments for Market Leadership

As outlined in the 10K report, AMD is strategically concentrating on high-performance and adaptive computing technology, software, and product leadership. In pursuit of this objective, the company is dedicated to investing in advanced technology. By the third quarter of 2023, AMD had allocated $1.5 billion in a three-month period, reflecting an 18% growth from the preceding period, and a total of $4.4 billion for the first nine months, representing a 20% increase compared to the prior year period. These investments primarily supported AI development through increased headcount and the acquisition of additional equipment and property.

During the third quarter of 2023, there was a wide array of new products introduced to the market:

- New AMD graphics cards, the Radeon PRO W7600 and W7500, cater to mainstream professional tasks.

- The Radeon RX 7800 XT and RX 7700 XT offer high-performance gaming at 1440p resolution, supported by AMD FidelityFX™ Super Resolution 3 for enhanced gaming experiences.

- AMD EPYC™ 8004 Series processors with “Zen 4c” cores enable energy-efficient platforms for hardware providers.

- The AMD Kria™ K24 SOM and KD240 Drives Starter Kit enhance adaptive System-on-Modules (SOMs) for cost-sensitive industrial and commercial edge applications.

- The AMD Alveo™ UL3524 accelerator card is a fintech accelerator providing ultra-low latency for nanosecond-speed electronic trading applications.

The introduction of new products did enrich the product mix, contributing to a more comprehensive and varied portfolio. This strategy not only enhances the overall offering but also boosts the company’s competitive advantage in the market. By constantly innovating and expanding its product range, AMD is better positioned to meet the evolving needs and preferences of its customers.

$5.8 Billion for Future Buyback and Industry Outperformance

As of the end of Q3 2023, AMD’s cash and short-term investments totaled $5.8 billion, slightly down from $5.9 billion in 2022. The company returned $752 million to shareholders through stock repurchases. Additionally, with an approved repurchase program for up to $12 billion buyback of common stock, $5.8 billion remains available for future repurchases as of September 2023.

What’s more, AMD outperformed 60% of peers in the semiconductor industry by the third quarter of 2023. Its gross margin was 45.01%, better than 78.14% of similar companies. With a Debt to EBITDA ratio of 0.71, AMD has a strong earnings capacity to pay back its debt obligations. There are no financial or bankruptcy risks in the short term, which is a good signal for investors.

DCF Values AMD at $143

The DCF analysis shows that AMD’s intrinsic, 1-year, and 2-year stock price should be around $143, $156, and $168respectively, which is 6%, 15%, and 24% upside potential from the price of $135.47 on Dec. 20, 2023. It’s clear that the AMD stock price is undervalued and is worth buying.

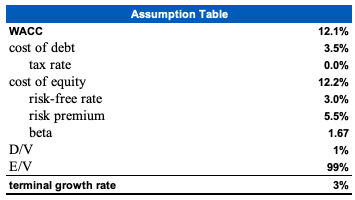

The DCF model is built based on the following assumptions:

- The risk-free rate is 3.0% according to the average of the US 10-year zero coupon bond from 2018 to 2023. The risk premium of 5.5% comes from the average market risk premium in the U.S. from Statista.

- Beta 1.67 is calculated based on the slope of the change of monthly AMD stock price and S&P500 price from 2018 to 2023.

- The cost of debt is calculated as a weighted average interest expense of 3.26% and operating lease discount rate of 3.83%, concluding at 3.50%.

- The tax rate is the 0% derived from the 10-K 2022.

- The terminal growth rate is assumed at 3.0%.

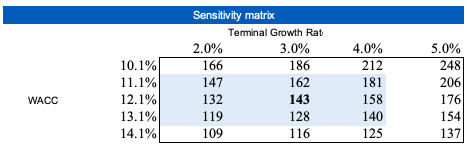

Due to the uncertainties in the macroeconomic environment, it is difficult to accurately predict the impact of relevant risk factors such as epidemics and wars, and the assumption may not be valid. A sensitivity matrix is created to show the impacts on AMD’s intrinsic stock price by altering WACC (weighted average cost of capital) and terminal growth rate.

Viewpoints from Analysts Community

Based on Yahoo Finance, there were 31 analysts presenting recommendation trends in Dec 2023, among which 5 recommended Strong Buy, 6 Buy, 15 Hold, and 4 Underperform. The recommendation rating is 1.9 between Strong Buy and Buy. The average price target from 39 analysts is around $133.18, with a low of $60 and a high of $200.

From TIPRANKS, there are 26 Buys, 8 Holds, and 0 Sell from 34 analysts’ ratings in the last 3 months. The expected stock price is $132.41 within the lowest $98 and the highest $165 price range.

AMD Stock Forecast: Conclusion

I take a buy-side on AMD stock because the DCF target price is $143, a 6% upside difference from the current price. Despite challenges in the weak PC market and turbulent macroeconomics in 2023, AMD demonstrated improved financial performance in the third quarter, highlighting its resilience and commitment to innovation for sustainable growth. The allocation of $5.8 billion for future stock buybacks reflects management’s confidence in the company’s business operation. Good news from internal management and exterior operation both drove the company’s values up.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the AMD stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success with AMD Stock Forecast

I Know First has been bullish on the AMD stock forecast in the past. On December 23, 2022 the I Know First algorithm issued a forecast for AMD stock price and recommended AMD as one of the best computer stocks to buy. The AI-driven AMD stock prediction was successful on a 1-year time horizon resulting in more than 118.60%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.