AMD Stock Forecast: Leading A New Era Of Tech

This article was written by Ari Herzog, a Financial Analyst at I Know First

This article was written by Ari Herzog, a Financial Analyst at I Know First

“We delivered solid first quarter results with significant gross margin expansion as Ryzen and EPYC processor and datacenter GPU revenue more than doubled year-over-year. We look forward to the upcoming launches of our next-generation 7nm PC, gaming and datacenter products which we expect to drive further market share gains and financial growth.”

Dr. Lisa Su, AMD president and CEO

Summary

- Current trade tensions and AMD’s uninspiring earnings report, which included an EPS value of $0.01 – a 75% decrease QoQ, drive my ‘wait-and-see’ short-term forecast

- Recently announced contracts with top tech companies show AMD’s continued rise in market share, up over 4% YoY, over the graphics processing sector

- How the markets respond as AMD approaches $30 per share will be a vital indicator of its short-term price direction

AMD Business Overview

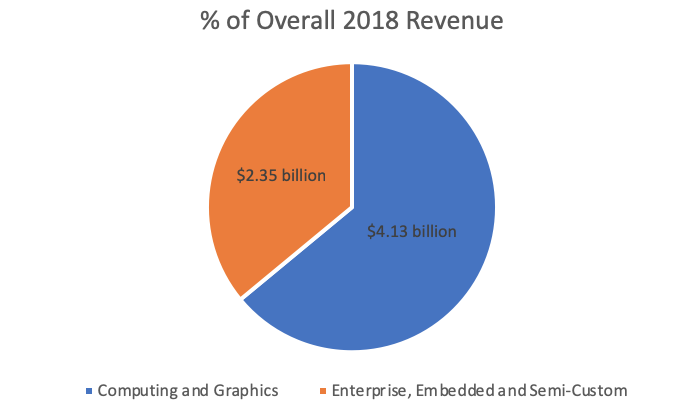

Founded in 1969 as a small Silicon Valley start-up with only a couple dozen employees under its wing, Advanced Micro Devices (NASDAQ: AMD) has grown into the only company in the world that has the leverage of both high-performance graphics and high-performance computing technology. Now with over 10,000 people under its payroll, AMD looks poised to lead the charge in the next era of technology and computing. AMD conducts their business under two primary segments, Computing and Graphics as well as Enterprise, Embedded, and Semi-Custom. Their Computing and Graphics business includes their microprocessors, chipsets, and graphics processing units (GPUs), which are used primarily for desktops, notebooks (laptops), and data centers. On the Enterprise, Embedded, and Semi-Custom side, their product mix contains server and embedded processors, System-on-Chip (SoC) products, and development services, all of which are used predominantly for gaming consoles. In both segments, AMD also gains revenue by licensing portions of its intellectual property portfolio. Despite the Computing and Graphics segment being the larger and higher revenue producing of the two, AMD has done a terrific job of simultaneously bringing up both divisions, and looks poised to increase its market share in each sector.

Ties To China Not As Strong As They Seem

Although AMD itself operates out of the US, its joint venture, Tianjin Haiguang Advanced Technology Investment Company (THATIC), is based in the growing market of China. As the trade war between the US and China continues, AMD has kept an eye on THATIC in hopes of avoiding a similar fate to Huawei, which was added to the Security Entity list on May 15. The list effectively bans US companies from conducting business with said companies for national security and intellectual property reasons. Unfortunately for AMD, THATIC could not avoid that designation any longer, as, on Monday, June 18th, it was added to the Security Entity list along with four other establishments. While the effects of the ban are yet to play out, the addition to the list highlights a greater impact that the ongoing trade war will continue to have on many semiconductor companies. Yet, as shown in the chart below, AMD is well-positioned to withstand the inevitable revenue loss expected to hit all major semiconductor companies. Although AMD has the least exposure to China compared to its competitors, its stock price felt the harshest impact of the heightened trade tensions early Monday, in large part due to AMD’s direct connection to the updated entity list. But the fact that AMD has the most independence from China limits the negative impact that the seemingly endless trade war has on its short-term outlook.

Higher Margins In Q1 Earnings Show Reason For Optimism

At the surface, AMD’s Q1 was not one to remember, as its revenue of $1.27 billion was down 23% YoY due chiefly to lessened revenue in the Computing and Graphics segment. More specifically, slumping client processor and graphics channel sales lead the decline, which also included a 68% YoY decline in operating income down to $38 million. Yet, AMD’s gross margin grew 5% YoY up to 41%, driven mainly by sales growth of processor and datacenter GPUs. This sales growth in processor and datacenter GPUs, which corresponds to Desktop and Notebook (laptop) products respectively, shows up in AMD’s increased market share in both areas.

Meet Rome, The Chip That Will Bring AMD To New Heights

Moving ahead, supporters of AMD have a lot to lean on for further growth. First, AMD’s new 7-nanometer products, which include graphics cards and server processors for PC gamers, should allow AMD to take hold of an even greater market share by year’s end. What sets these products apart is their promise to act as smaller chips, have more power efficiency, and produce faster process speeds than the rest of the field. Many predict AMD to gain a double-digit share of the server market within the next year and a half. AMD bulls do not have to wait long as AMD has already begun shipping its signature ‘Rome’ chip, with the product being expected to contribute to revenue growth in the final two quarters of 2019.

AMD Puts Itself On The Map By Partnering With Major Tech Players

AMD has positioned itself as a go-to company for both the console and cloud markets by announcing partnerships with premier technology companies. To start, Microsoft recently displayed its next-generation Xbox console, “Project Scarlett”, which is projected to be 4x as powerful as the Xbox One X due to an AMD chip acting as the catalyst. AMD’s advantage over competitors, namely Nvidia and Intel, comes from its rollout of APUs (accelerated processing units), which merges the processing power of a CPU and GPU onto a single device. Finally, AMD has struck a chord with Alphabet’s Google, who agreed to use AMD’s graphics technology for its forthcoming Stadia cloud-gaming service. Specifically, AMD will be tasked with creating custom GPUs that will be held in Google’s data centers in order to power the ‘Stadia’ experience. Overall, both relationships are just beginning to blossom, and, assuming the products are successful, could lead to greater AMD recognition as we head into the next-generation of gaming and cloud capabilities.

Valuation

Currently, AMD is trading at a trailing P/E of 115.90, EV/EBITDA of 54.26, and PEG ratio of 1.39. In order to improve these figures, it is crucial that AMD capitalizes on its partnerships with established technology companies and successfully rolls out its next-generation of processing chips. AMD is well positioned to grow its already increasing market share in all three major GPU divisions as well as boost its profit margins through a shift towards its server sector, typically a very cost-efficient area. AMD’s strong PEG ratio, especially when compared to Micron’s value of -0.19, suggests that it has the potential to be trading at a market cap similar to Micron. If AMD’s earnings grow at the rate that analysts predict, a market cap of $36.8 billion, MU’s current level, is well within reach. If we assume AMD also retains its 1.08 billion shares outstanding, we arrive at a target price for AMD of approximately $34 per share.

Current Upward Movement Showing No Signs Of Slowing Down

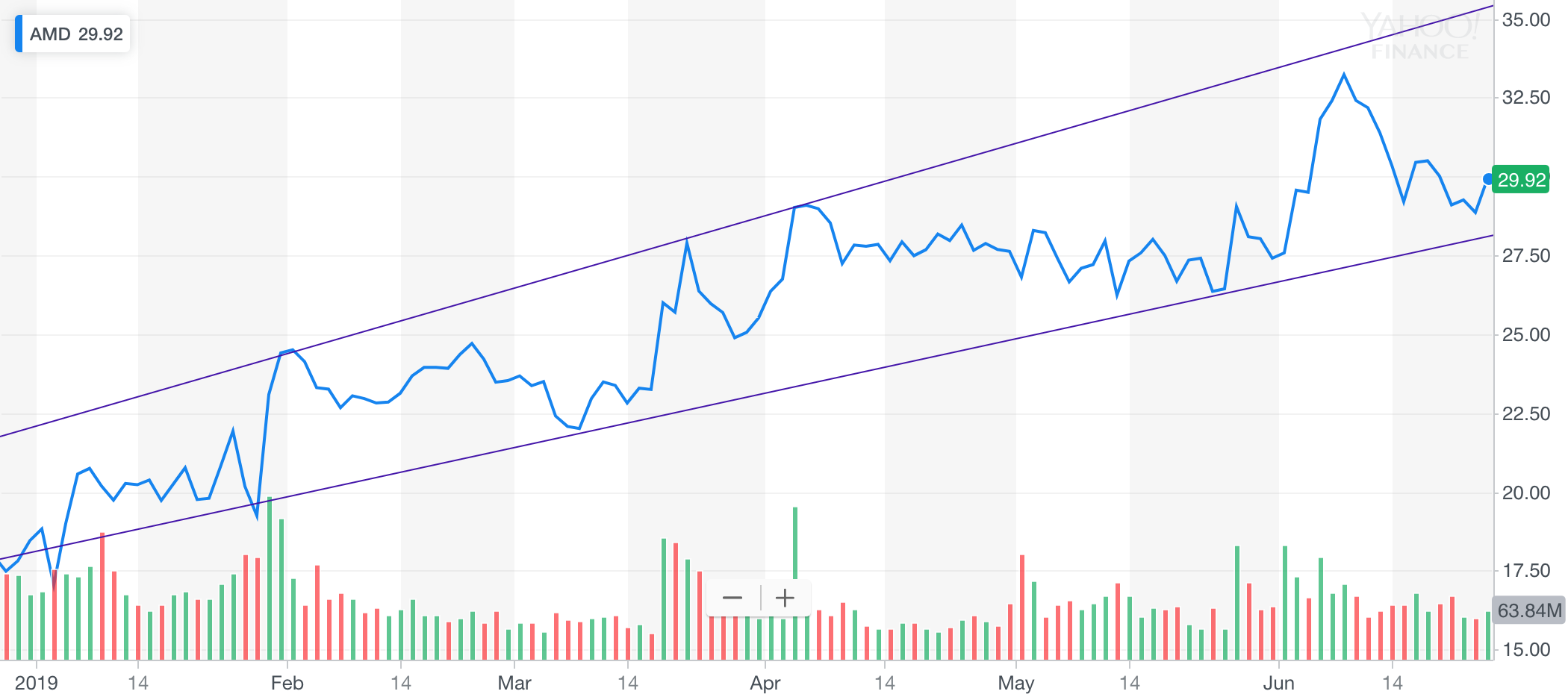

AMD has been steadily improving its share price this year since it bottomed out at $17.05 per share on January 3rd, 2019. Despite a slight dip from its $34.30 per share high on June 10, to its current level of $28.86, AMD is trending upward as its 50-day moving average of more than $28 per share is roughly 17% higher than its 200-day moving average of some $24 a share. As AMD is currently trading right at its 50-day moving average, a potential swing in either direction seems imminent. Thus, my first bullish price target to watch is $30 per share as that is an important psychological barrier to cross and a strong barometer for the short-term price direction of the stock.

Conclusion

AMD’s partnerships with predominant companies, including Google and Microsoft, will help in establishing itself as a legitimate player in the GPU market, and a real competitor to the likes of Intel and Nvidia. As AMD continues to roll out chips similar to Rome that are able to go toe-to-toe with the industry’s top processing chips in price and processing speed, its revenue, earnings, and share price will improve alongside it. All in all, as their competitors are scrambling to adapt to a reality where the trade war has a considerable impact on their sources of revenue, AMD will look towards the future by continuing to roll out new products and secure significant partnerships.

I Know First Bullish Long-term AMD Forecast

Below is the I Know First AMD stock prediction for the next year. It currently has a positive outlook with a signal strength of 34.84 and predictability indicator of 0.72 for the next year.

I Know First Past Success With AMD Stock Prediction

On December, 30, 2018, the I Know First Algorithm issued a bullish forecast for AMD, with 3-months signal of 0.59 and predictability of .57. Advanced Micro Devices gained over 43% during that 3-months following the forecast.

To subscribe today click here.

Please note – for trading decisions use the most recent forecast