Amazon Stock Forecast: Amazon Will Continue Muscling In On The $170 Billion Video Games Industry

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- Amazon Game Studios recently cancelled its in-development Breakaway fantasy sports video game. It doesn’t mean Amazon is quitting the $170 billion video games industry.

- Breakaway was likely only a showcase/demo title to demonstrate the all-in-one package capability of its Lumberyard game engine.

- Amazon Game Studios will continue developing its other two games, Next World and Crucible. Crucible is currently a Battle Royale game that’s testing a 12-player limit.

- Amazon has invested more than a billion dollars buying Twitch, Double Helix Games, and CryEngine license. Making its own Twitch-optimized games helps improve Amazon’s advertising business.

- I Know First has negative market trend scores for AMZN. Wait for a cheaper entry-point before you take a long-term position on this stock.

The $170 billion/year video games industry is too big an opportunity for Amazon (AMZN) to leave. The recent news that Amazon Game Studios has cancelled development of its Breakaway video game is nothing to worry about. My guess is Breakaway was a showcase game meant only to demonstrate the power of its Twitch-optimized Lumberyard game engine.

Lumberyard and Twitch are Amazon’s biggest bets toward becoming a serious player in the $170 billion/year video games business. Amazon is offering Lumberyard completely free to game developers so that more Twitch-optimized video games are created. The more video games streamed on Twitch, the more targeted advertisements can be delivered to Twitch’s huge audience.

Below is a screenshot of Lumberyard. It is as complex and powerful as Epic Games’ Unreal 4 game engine.

(Source: Amazon/RealtimeUK.com)

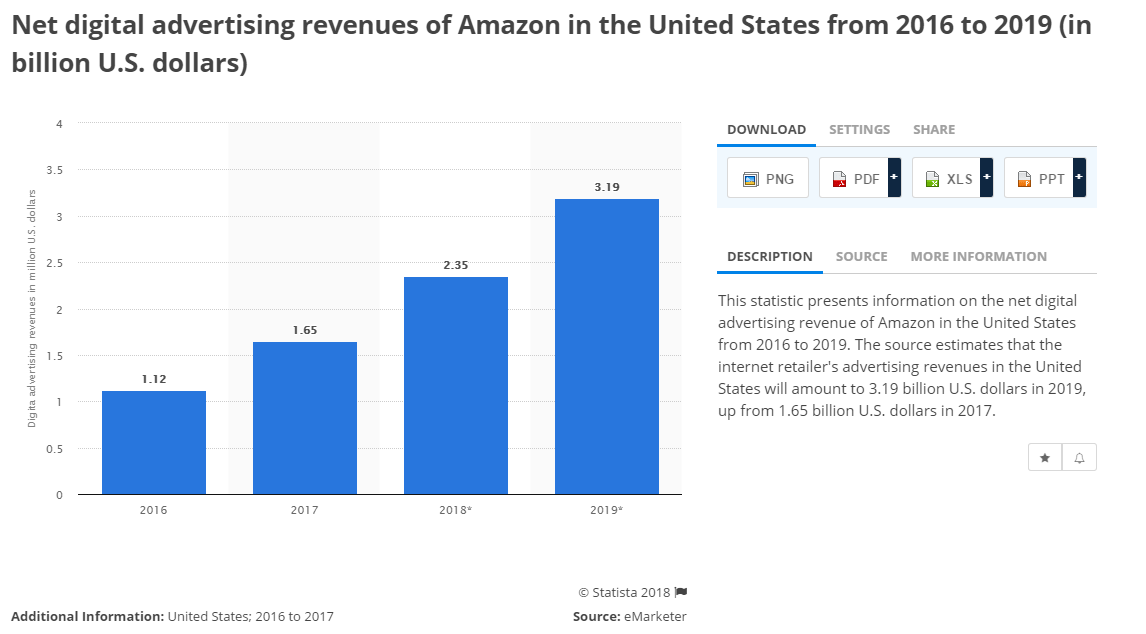

Twitch is a fertile ground for Amazon’s advertising business. Twitch touts more than 100 million monthly active users and 15 million daily active users. Further, 55% of Twitch’s audience is aged between 18-34 years old. Twitch’s young daily/monthly audience contributed to Amazon’s estimated $1.65 billion net U.S. digital advertising revenue last year.

(Source: Statista)

The premium Twitch Turbo membership program also helps Amazon recruit more Prime members to its online marketplace. Aside from Steam, Amazon is also one of the leading online retailer of video games.

Amazon Cannot Fold Its Billion-Dollar Bet On Video Games

Amazon spent $970 billion dollars to buy Twitch 2014, and $70 million to buy a license for Crytek’s CryEngine in 2015. Amazon also spent tens of millions of dollars to acquire full ownership of video games developer Double Helix in 2014. Helix also had its own proprietary game engine called Hex. Curse, a game content hub operator and maker of Skype-like chat for gamers was also purchased by Twitch in 2016.

Amazon used Hex and CryEngine technologies to build its own open-source (and completely-free-to-use) Lumberyard game engine. Like CryEngine and Hex, Lumberyard can do AAA video games for the PC, console, web, and Android/iOS platforms. The only difference is Amazon modified Lumberyard to integrate with Twitch and its various Amazon Web Services platforms.

To better appreciate how powerful Lumberyard is, I urge you to watch this YouTube video of Breakaway at full HD 1080p resolution. The gorgeous 3D graphics of Breakaway made it the best-looking MOBA (Multiplayer Online Battle Arena) video game. Yes, Breakaway has far better graphics than Epic Games’ Paragon MOBA game. Another great showcase of Lumberyard’s capabilities is the recent 2018 YouTube videos of Star Citizen. The developer of Star Citizen replaced CryEngine with Lumberyard late last year.

Amazon has added new features to make Lumberyard as easy to use as Unity and Unreal. Unity is now valued $2.8 billion because its game engine is now very popular. Unity’s success is due to it being easier to use than Crytek’s CryEngine and Unreal. Amazon made many updates to Lumberyard to make it as user-friendly as Unity.

Two examples of Amazon’s excellent user-friendly updates to Lumberyard are EMotion FX animation system and Script Canvas visual scripting toolset. Like Unity, Lumberyard can now be used to make games without people having to learn complex animation software or C++ programming.

I am very interested with Lumberyard’s free Script Canvas tool. It could be better than Unity’s $75 NodeCanvas Visual Scripting add-on. Going forward, Lumberyard could eventually become as popular as Godot. Godot is not as powerful as Lumberyard but it also offers free visual scripting feature. Non-programmers can create complex game logic in Lumberyard via a visual node-based system.

(Source: Amazon)

Together, EMotion FX and Script Canvas accelerate the production and lower the cost of making video games. Unique to Lumberyard too are the AI and deep learning features that Amazon has implemented. Only Lumberyard can be used with Lex and Polly. Lex is an AI tool to create conversational interface powered by Amazon’s cloud AI platform, Alexa. Polly is a text-to-speech service to synthesize human voice in software applications.

Amazon will only make money from Lumberyard if developers used it chose Amazon GameLift. GameLift is the specialized commercial platform for deploying and managing online games at AWS. For many years now Amazon Web Services [AWS] host many online multiplayer games. Ubisoft (UBSFY) is just one of several Tier-1 game publishers who rent scalable cloud AWS servers for their video games. Supercell, Zynga (ZNGA), and Nexon are also using AWS for their global servers and real-time analytics.

Conclusion

Amazon has multiple fronts where it can take a bigger share in the $170 billion/year video games industry. We can count on video games as a valuable expansion strategy for Amazon. The reason for Amazon’s decision to shut down its MOBA game Breakaway is also similar to Epic Games’ closing its Paragon MOBA game. They are both years too late in the MOBA game genre which is dominated by Tencent’s (TCEHY) League of Legends and Valve’s DOTA 2.

Amazon Game Studios will likely focus more trying to imitate the massive success of hit Battle Royale games like Epic’s Fortnite and PUBG Corporation’s Player UnKnown’s Battlegrounds. Amazon Game Studios is still working on Crucible and New World. Crucible is an Alien-themed mini-Battle Royale game that is currently being tested for a 12-player limit last-man-standing third-person shooter. It can be expanded to a full-pledged Battle Royale game by increasing the player limit to 100. New World is a supernatural online multiplayer role-playing game similar to World of Warcraft. Both games are being developed using Amazon’s Lumberyard game engine.

I did some profit taking earlier this year but I remain long AMZN. However, I Know First has negative market trend scores for Amazon’s stock. It is best for new investors to wait for a cheaper entry-point if they want to invest in Amazon.

Past I Know First Forecast Success with AMZN

I Know First has made accurate predictions on AMZN in the past, such as its 3 months bearish article published on July 25, 2017. In the article, Amazon had an uphill battle against Lazada in Southeast Asia with opening of its services in Singapore being still a small tailwind for AMZN. Since the article’s release, AMZN shares have decreased by 7.59% in line with the I Know First algorithm’s forecast. See chart below.

(Source: Yahoo Finance)

This bearish forecast for AMZN was sent to I Know First subscribers on July 25, 2017.

To subscribe today click here.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.