Microsoft Forecast For 2019

This article was written by Vladimir Mazepa, a Financial Analyst at I Know First.

[Source: Wikipedia]

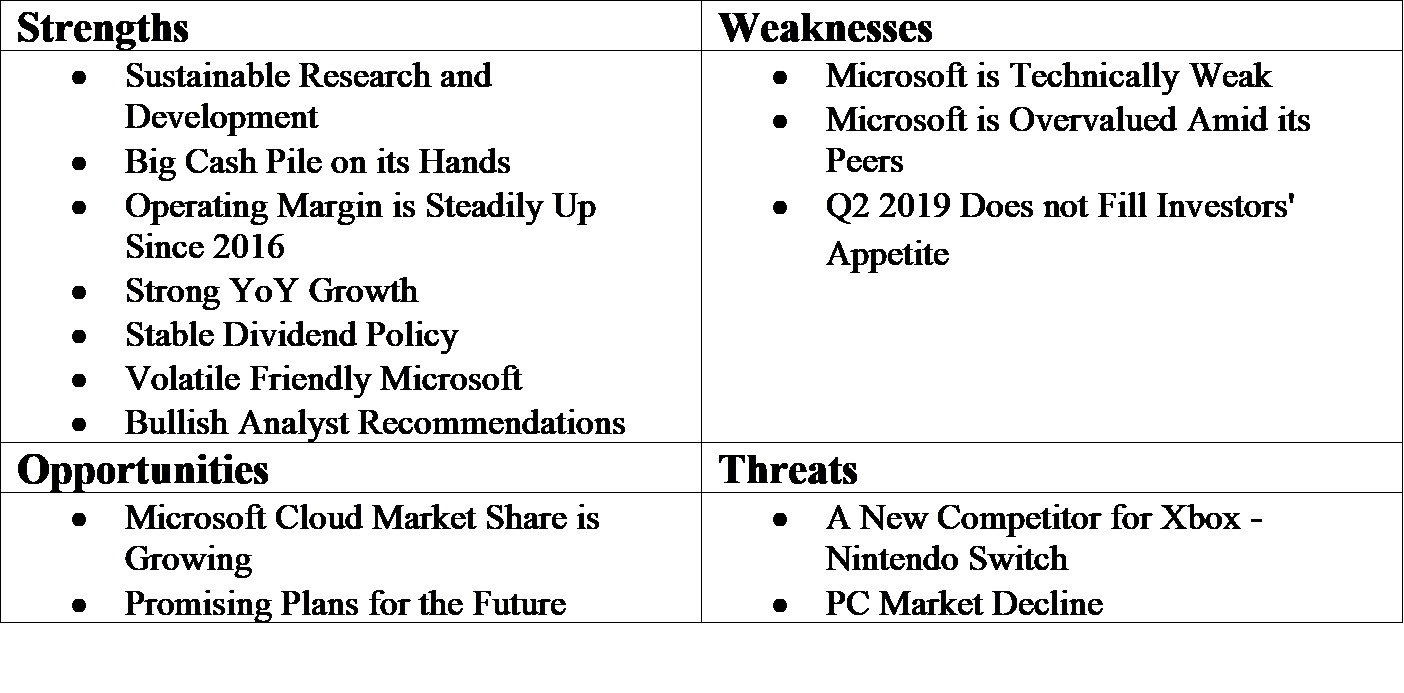

Microsoft Swot Strengths

Strengths

Sustainable Research and Development

Such a company as Microsoft should spend a lot of money on its research and indeed, it does spend. Microsoft increases its spending on R&D every year, because it understands that every tech company should invest in it in order to be competitive in the future.

[Source: YCharts]

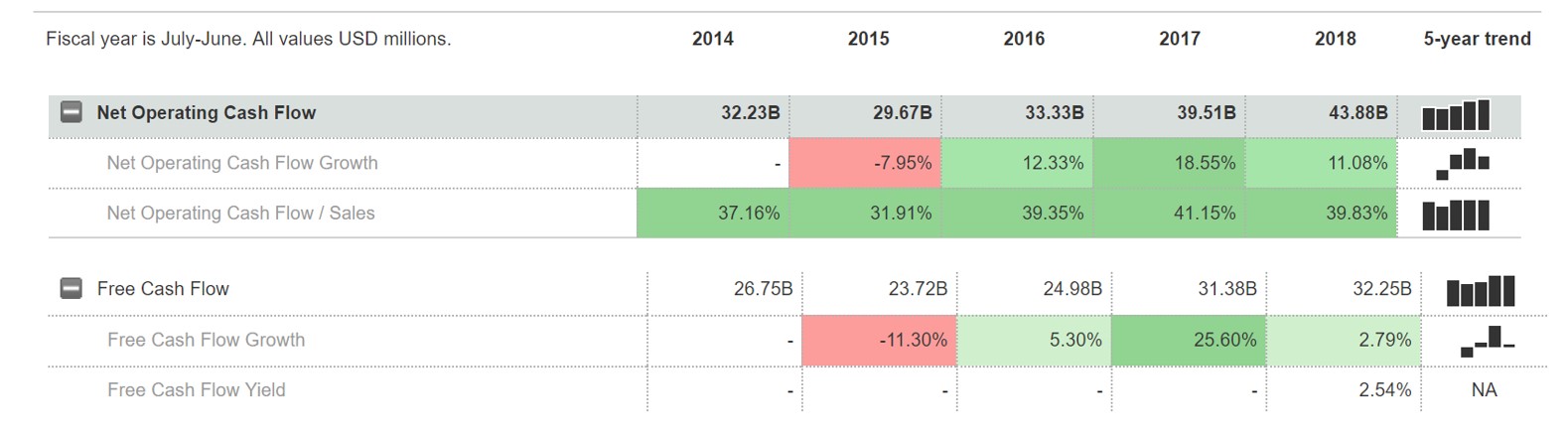

Big Cash Pile on its Hands

Microsoft generates cash every year and showing a stable growth. Moreover, I like the situation with Cash on its Hands, Microsoft has $133 billion. It can go through any problems and cover all the debt in any situation, while other companies would go bankrupt when a crisis happens. Debt is very well covered by short term assets, when short term assets exceed 1.9x debt.

[Source: Marketwatch]

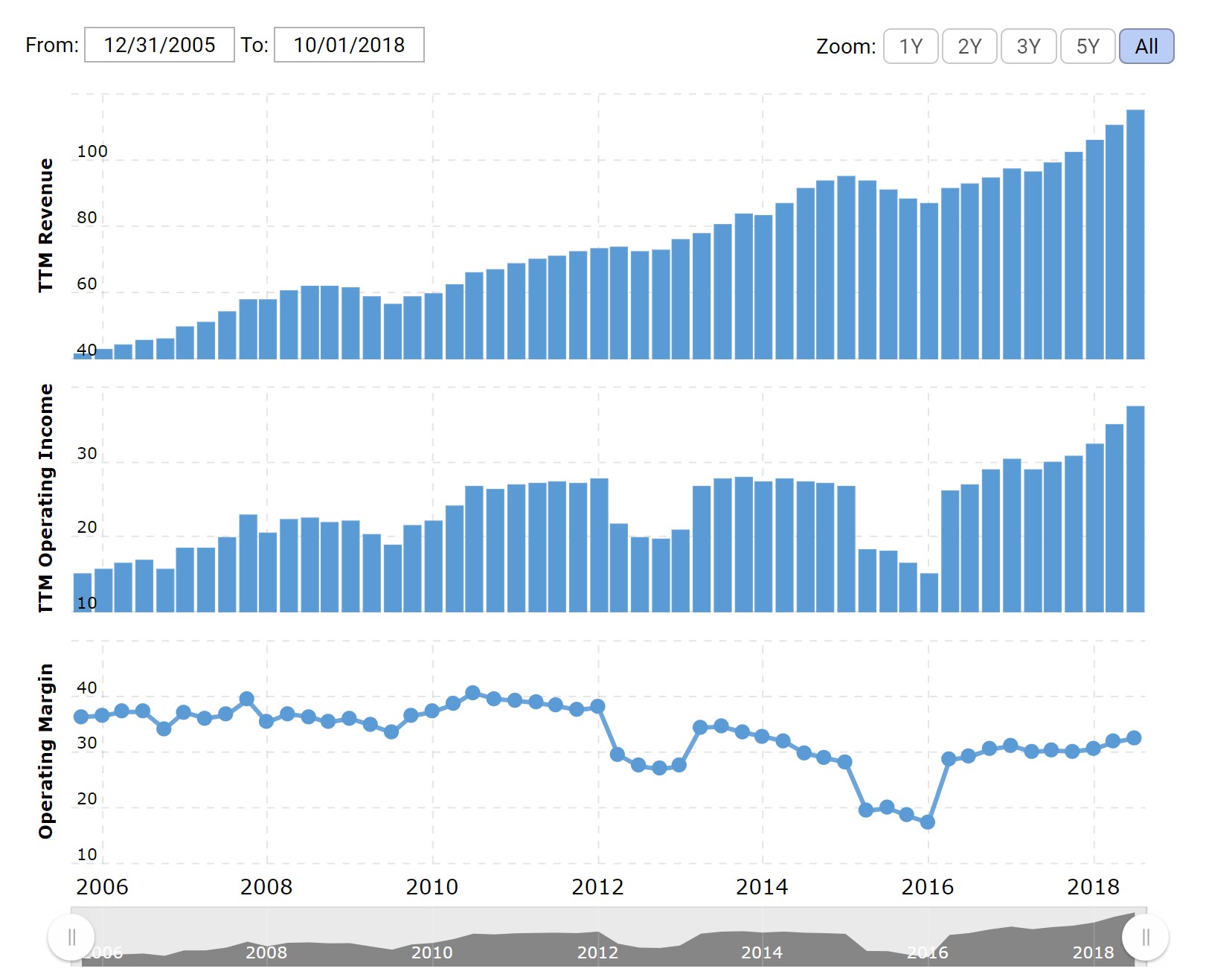

Operating Margin is Steadily Up Since 2016

Operating Margin and Revenues has been steadily growing since 2016. Not only is it growing, but also Operating Margin is above 30%, which shows that Microsoft can create very high income compared to its revenue, which indicates the company is doing really well.

[Source: Macrotrends]

Strong YoY Growth

Microsoft has crushed all the expectations among analysts. It shows perfect growth numbers and exceeds the estimations. It finished 2018 fiscal year with strong revenue growth year over year (YoY) in all the main segments. Productivity and business process grew 13%, personal computing grew 17% and intelligent cloud, which we will talk about later grew 23%.

Year over year net income rose from $6.6 billion ($0.84 per share) in the same period last year to $8.8 billion (1.14$ per share) with 35.7% increase. Wall Street expectations were $0.96 EPS, but MSFT delivered $1.14. Revenue rose to $29.1 billion from $24.5 billion (18.5% increase).

Moreover, Microsoft is showing revenue growth over all the segments: +18.6% in Productivity and Business Processes, Intelligent Cloud increased 23.7%, More Personal Computing (includes gaming, Windows, devices and search ads) rose 14.6%.

Gaming revenue, which is represented by Xbox is 44.4% higher. LinkedIn has shown 33% growth. “Xbox has the key gaming community and monetization capability,” said Nadella.

Dividends paid and Repurchases programs represent together returns to shareholders of $6.1 billion. Moreover, dividend payout ratio is stable and increasing year over year.

[Source: Alphastreet]

[Source: Yahoo Finance]

Stable Dividend Policy

Tech companies can attract investor for their growth potential, but if the company is already a giant like Microsoft, shareholders want to have a stable return on their investments and I like Microsoft for that strategy, because most giants do not pay any dividends (Take for example Google or Amazon).

If you look at the chart, you can see that Microsoft is increasing its dividend payout ratio year over year and is likely to increase in the future. In addition, Microsoft is consistently engaging in buyback programs. Together Dividends paid and Repurchases programs in Q1 2019 showed a return to shareholders of $6.1 billion, this is a 27% growth compared to the last year.

This company policy gives a huge advantage compared to its peers, who underestimate the importance of stable dividend and repurchase programs.

Volatile Friendly Microsoft

Like many tech giants, Microsoft tend to go in accordance with the overall market. Microsoft beta is 1.24. This means, when the market goes up, Microsoft stock price also rises, when the market goes down, Microsoft is likely to decrease. Moreover, volatility of Microsoft is not big, which is good in difficult times on the market.

But What makes Microsoft different is that it tends to perform well while there is an uptrend on the market and tends to decrease less when market is down. Microsoft has outperformed indices over time. On a year period Microsoft rose 16.21%, while S&P 500 decreased 6.63%.

[Source:Yahoo Finance]

[Source:Yahoo Finance]

[Source: YCharts]

Bullish Analyst Recommendations

The majority of analysts have a bullish outlook for Microsoft. Of the 35 analysts 25 recommend buying, 12 of these 25 rate Microsoft as a strong buy. Only 9 analysts give Microsoft a neutral rating.

[Source: Yahoo Finance]

Weaknesses

Microsoft is Technically Weak

If RSI is above 50, momentum is considered up and traders can look for opportunities to buy the market. A drop below 50 would indicate the development of a new bearish market trend.

From the technical perspective, we can almost see a death cross pattern (When simple moving average with a 50-day period crosses simple moving average with a 200-day period), it is clearly a bearish signal. RSI is above 50 and it indicates a continuous uptrend.

Technically, I see the next possible scenario. Price may go up to the nearest resistance level 112-112.50 and create what is called “12345” pattern, according to which the stock may then reverse into a downtrend.

[Source: YCharts]

[Source: YCharts]

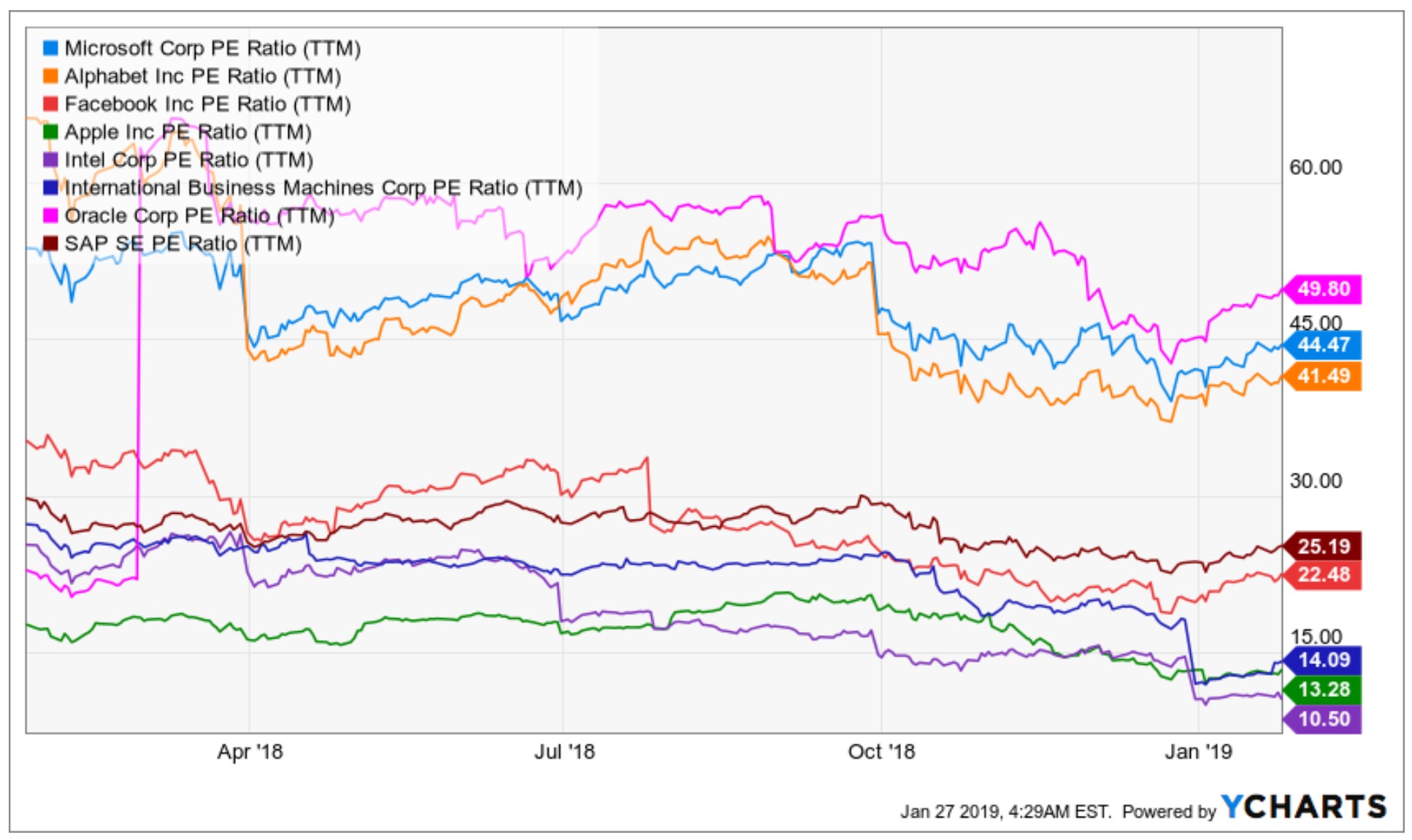

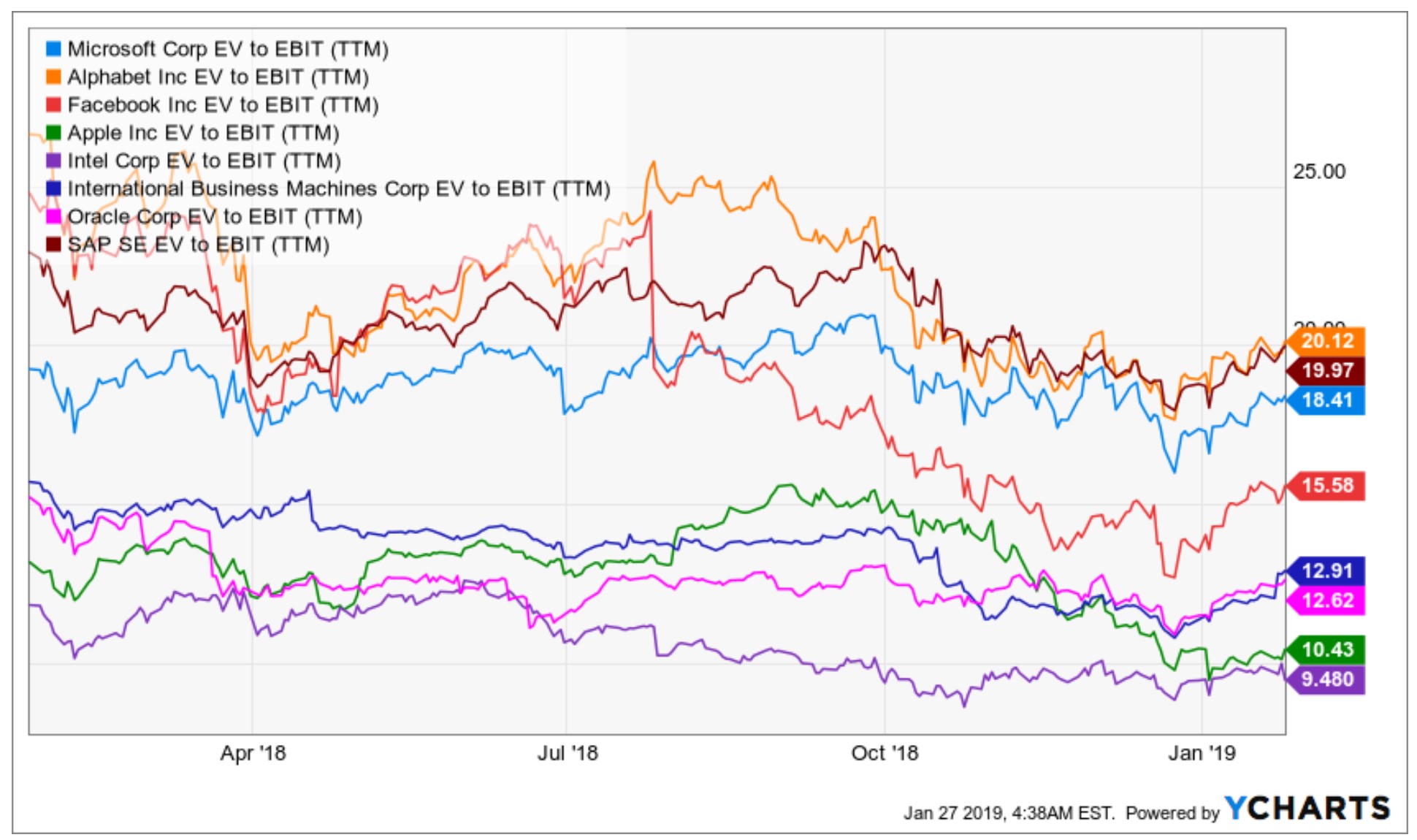

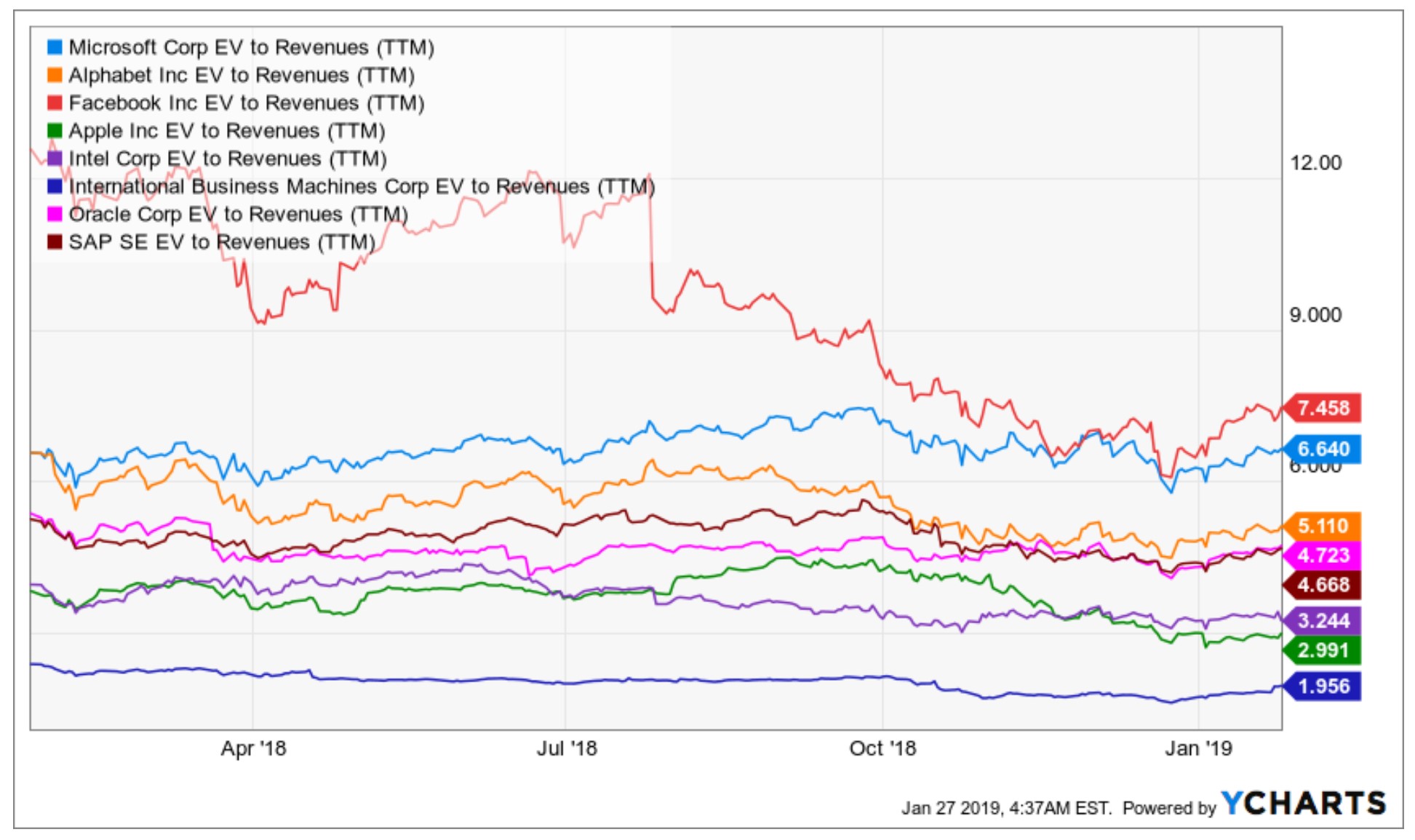

Microsoft is Overvalued Amid its Peers

At first, let’s look at Price to Earnings ratio. We can see on the graph. It can be seen that Microsoft is the second overvalued company among its competitors. P/E ratio of MSFT is 44.47

As the companies have different valuation or tax systems, P/E can often mislead an investor with numbers. That is why it is better to have a look at EV/EBIT and EV/EBITDA, which are hard to manipulate with. However, the situation is the same. MSFT is the third most overvalued company after Alphabet and SAP SE with EV/EBIT (Enterprise Value to Earnings before Interests and Taxes) – 18.41 and EV/EBITDA (Enterprise Value before Interests, Taxes, Depreciation and Amortization) – 14.66, and second with EV/REVENUES (Enterprise Value to Revenues) – 6.64. This pushes me to the answer – Microsoft is overvalued.

[Source: YCharts]

[Source: YCharts]

[Source: YCharts]

Q2 2019 Does not Fill Investors’ Appetite

Microsoft has just recently released 2019 Q2 Earnings Report. All in all, Microsoft grew, but investors anticipated another scenario. Microsoft has claimed revenue $32.47 billion, earnings $8.4 billion, eps $1.08, while Wall Street estimated of $1.09 earnings per share and $32.52 billion.

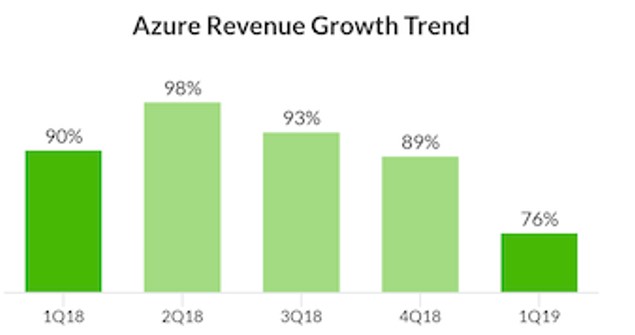

As it can be seen, Microsoft met the expectations, but did not beat them. In my opinion, Satya Nadella bets everything on Cloud, but cannot reach the main goal – become a leader in the industry and beat Amazon’s AWS. Azure growth is flattening now. It grew 76% for the second time, which shows an upcoming slowdown in Azure’s revenue, because previous quarter reports were much higher before.

Opportunities

Microsoft Cloud Market Share is Growing

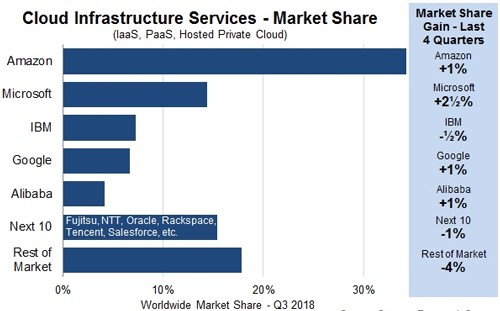

When Satya Nadella became CEO changed the main strategy for building data center software and services and with a focus on clouds. In addition to that, Microsoft had Cash on Hands, so it had huge power for quick and stable growth. Since then, Microsoft has been investing into the cloud system and now Azure has more than 50 data centers worldwide, which is more than any of its competitors. Now we can see, that Azure (Microsoft cloud system) is growing with a much faster pace than Amazon Cloud Systems and will conquer soon the first place.

Clouds bring lots of cash to tech currently and that is why everyone wants to capture this market. Microsoft is the second player on the market after Amazon (AWS).

As you can see on the chart below, Microsoft is eating Amazon cloud market share. Moreover, Microsoft Azure (cloud platform) revenue has shown 76% growth over the year, while Amazon grew just 46 percent year over year. Amazon in a second-quarter market share of over 30 percent, according to market research firm Canalys, but Microsoft’s share rose to 18 percent from 16 percent in the previous quarter.

On the other hand, the gap between AWS and Azure is quite big. Microsoft has big potential in Cloud Service, but it has to continues to show such decent growth in order to replace AWS, because what I see for now is that Azure’s revenue growth is falling and falling rapidly and that makes me nervous. 2Q 2018 we had impressive 98%, then 93% in 3Q, 89% 4Q and then 76% in 1Q 2019. Yes, it is still a growth, and much higher than Amazon’s cloud growth, but dynamic shows that we then can see a big slowdown in that growth. In my opinion, according to the figures, Microsoft has little chances to replace AWS.

[Source: Synergy Research Group]

[Source: Alphastreet]

Promising Plans For the Future

Microsoft is planning to develop and improve algorithms, then they want to link language to the world through speech recognition, language modeling, language understanding, spoken language systems, and dialog systems, to make computers and devices understand what they see, by examining this impact they want to create best practices for their design, integrate intelligent technologies, create chatbots and systems that learn from data and experience.

Microsoft CTO Kevin Scott has just recently told that he believes understanding AI in the future will help people become better citizens. Scott believes “that AI can and should be a beneficial thing for rural America.” A Microsoft spokesperson declined to share the book title or scheduled release date details.

Threats

A New Competitor For Xbox – Nintendo Switch

Analysts Estimate that growing Nintendo Switch could eat market share of Xbox PlayStation in 2019. It is true and real that Nintendo community is growing, but Nintendo cannot replace Xbox and PlayStation, the reason is obvious. Analysts do not take into account that games, which is provided by Nintendo Switch is far different from Xbox and PS. For instance, while Nintendo provides Super Mario, Xbox has Forza Horizon. And still there is no Twitch, YouTube, you cannot listen to music, while playing the games, many people are complaining now that there are almost no choice and good qualitative games on Nintendo Switch. Almost all the games on Nintendo switch are targeted on special audience, who like nostalgia when they see Super Mario, or some other special kinds of games.

Thus, in my opinion, it is not correct to compare Nintendo to Xbox or PlayStation. It is the same as comparing PC to consoles.

PC Market Decline

With rising sales of new phones and tablets, PC sales are declining every year. This is the main threat for Microsoft, because Windows covers about 80% of PC users and that decline in PC sales could directly harm Windows sales and Microsoft profits.

Conclusion

I rate Microsoft as Hold.

Microsoft is a good company with strong growth figures and potential cloud infrastructure. It is one of the biggest companies, which still pays dividends and is profitable, operating margin is more than 30%, it also has cash on its hands and can repay its debt or invest in different projects. Moreover, it has a good leader Satya Nadella, whom has boosted the company since he has come.

However, that is not enough for me, because the company is financially overvalued among its peers, it is consequently not the right time to buy it. Moreover, its stock price is almost at an all-time high ($107), exceedingly close to the support level of $112. Technically it is weak and could show a reversal trend. It is good to buy companies at the bottom levels with a decent discount rate, but Microsoft currently is trading without any discount. In addition, there is new player on the console market – Nintendo Switch, which can eat the market share of Microsoft’s Xbox. Tablets and Phones are replacing PC now, this can consequently lead to decrease in Window’s revenues. Cloud Market Share is a good trump of Microsoft, but I see that growth of Azure’s cloud is slowing down and Microsoft has little chances to beat Amazon’s AWS. It is better to look at the situation, when MSFT will be traded with a good discount rate.

I Know First Long-Term Bullish Forecast For 2019

The I Know First machine learning algorithm currently has a positive outlook for Microsoft. While the stock is bullish over all time horizons, it is most bullish for the 1-year period with a signal of 114.60 and predictability indicator of 0.61.

How to interpret this diagram

Past I Know First Success with Microsoft Stock Forecasts

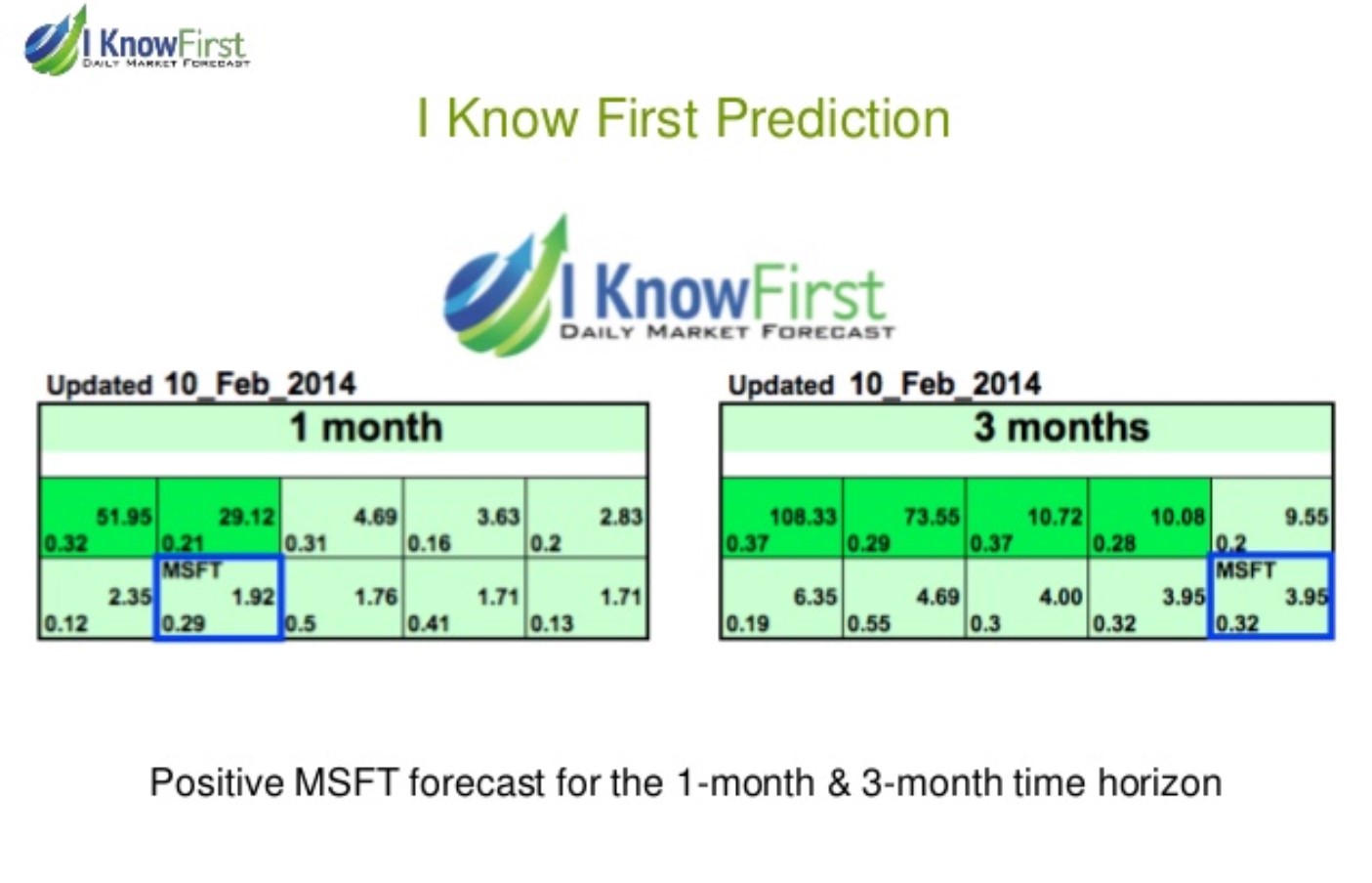

On February 10, 2014 I Know First has made an accurate bullish Microsoft stock forecast for one and 3 months.

It was discussed in the article that Satya Nadella is a perfect leader with about 20 years of experience. He worked on some of Microsoft’s most profitable and growing businesses, including Office. Served as the executive vice-president of Microsoft’s cloud computing, plus he has held many other leadership positions.

Since Satya Nadella was chosen as a CEO many things has changed. He set the main focus of the company – cloud infrastructure. Since that time Microsoft has risen tremendously – more than 180%.

[Source: Finance Yahoo]

This bullish forecast for MSFT was sent to I Know First subscribers on February 10th, 2014. To subscribe today click here.

Please note – for trading decisions use the most recent forecast.