Yahoo Stock Predictions: Is CEO Marissa Mayer Turning The Company In A Bullish Direction?

Summary

- CEO confronts reality of stock price fall and proposes plan of action to recover.

- Asian economy affecting Yahoo’s stock performance

- The spin-off an advantage or disadvantage for the business core strategy.

- Innovative Product line introduced for the sake of Yahoo’s 800million monthly users.

- The I Know First Algorithm is bullish on Yahoo in the short term as well as the long term here the focus is on the long term of three-months and one-year time horizons.

Yahoo’s Board decision from three years ago is paying off in the long run. Mayer is on the way to make history with this almost vicennial company. Let’s set the facts straight Yahoo has a stake on Alibaba (BABA) of about 15% and it is greatly significant.

Yahoo’s Board decision from three years ago is paying off in the long run. Mayer is on the way to make history with this almost vicennial company. Let’s set the facts straight Yahoo has a stake on Alibaba (BABA) of about 15% and it is greatly significant.

Alibaba is not meeting market expectations and are greatly affected by the Asian economic crisis. Yahoo is seriously considering to spin-off their shares of Alibaba in order to find some balance within Yahoo Inc. Marissa Mayer from the moment she took the command of Yahoo has implemented new business strategies and products to improve the stock and this has worked so far, now she is implementing new marketing tools and magazines to improve the performance and the YHOO stock.

Figure 1: Marissa Mayer Yahoo’s CEO

A small note on Alibaba: Two big factors of their stock price drop. First the Asian economy crash and Second top and middle management. The main problem in management is the control of a public company. In the past we have seen them privatize and once more IPO, there is a high probability that they will not be able to sustain the company public.

Yahoo (NASDAQ:YHOO) stock this year has fallen about 45% already, this pressures CEO Marissa Mayer to push the company for the last quarter of the year and meet expectations of the shareholders. Many of the events surrounding the company have set the tone for the upcoming and very highly discussed spin-off from Alibaba (BABA) stock as well as Marissa’s strategic plan to regain the company’s core business value. Let us remember that having Alibaba’s share spun-off can potentially bring higher growth prospect.

China’s economic breakdown has a different face today than what we saw two decades ago. For example: Their international fixed exchange rate between currencies gave little to no flexibility when it came to a financial crisis. Today with their new exchange rate reforms it is easier to extend the time period that the economy can keep on going without really having a sharp breakdown with a harsh recovery or a no return pass that would send the Asian economy years back.

Figure 2: Chinese Stock Market

Figure 2: Chinese Stock Market

The new exchange rate reforms include internal debt plans and local loaning. This has allowed many industries in the Asian region to float above waters while this economic crisis passes by and the economy can get back on its feet. It is a big progress and allows the economy to slowly regain economic strength until they start growing exponentially.

Alibaba has been affected by this economic crisis and there is no denying that it might get better soon and things might look a bit different from the picture we see today with Alibaba’s underperformance.

There is a secondary factor that can make a 180 degree change and that is just a speculation, at the moment, the company has the option to privatize again like they did once before. This would solve many issues within the company and might even leave space for growth for Alibaba to be successful and meet the market expectations without the pressure of its shareholders.

Alibaba should reconsider their management skills and investor relationships to better the future of their intrinsic company values. To top it off this scenario of privatizing would put Yahoo in a better place because there would be no need for a spin-off or any IRS taxation.

In the case that the above doesn’t happen the spin-off will be in place and other factors come to place, the IRS and their decision to tax or not the spin-off according to their various policies.

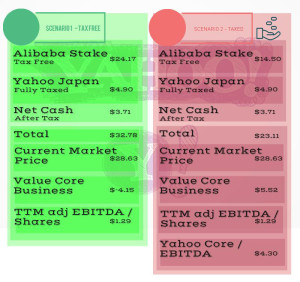

Zachs.com argues that the only two possible scenarios are the spin-off taxed and not taxed. With a small underlying valuation of the core business of Yahoo. Their real sentiment is that Yahoo will not deliver in the last quarter of the year.

In disagreement with their argument, Yahoo has more than one deciding facet of what the future holds for them. To add a positive outcome from their analysis, the already shareholders of Yahoo can see the picture much clearer with this two scenarios and make a decision whether to keep holding on to their shares or selling in the coming quarter.

Figure 3: Different scenarios of Yahoo’ spinoff (with and without IRS taxation); Source: www.Zachs.com

The innovative product line of Yahoo has turned some heads in the world by introducing new artificial intelligence based products from BrightRoll and Flurry. They have consolidated all of their programmatic ad technology under one umbrella with BrightRoll. Flurry being an analytics platform has boosted their advertisement content and performance significantly.

The most recent announcement that Yahoo announced was their live streaming platform of various events ranging from Olympic Games to National Sports and other major events. We will see how this will perform throughout the next quarter of 2015 and the first half of 2016.

Algorithmic Analysis

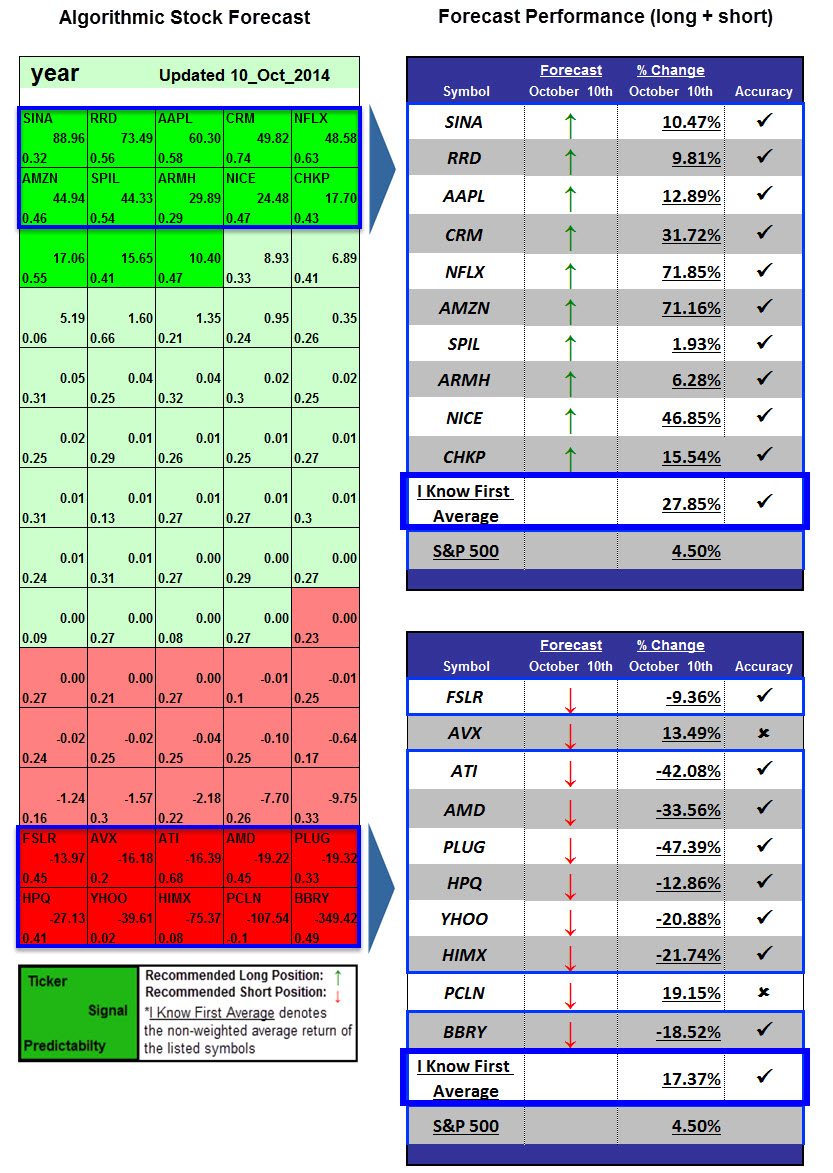

Figure 4: Algorithmic Stock Forecast For 1-Year Period From October 10th 2014 to October 10th 2015

Figure 4: Algorithmic Stock Forecast For 1-Year Period From October 10th 2014 to October 10th 2015

In the past year we correctly predicted the Asian economy’s crisis as well as the downfall of the Yahoo stock at the time which had a strong signal strength of -39.61 and predictability ratings of 0.02, eventually we saw that their stock price dropped by 20.88% in the period of 1-year as the algorithm predicted. To see the full analysis. The current position of the asset is defined and promptly we will see how it will start turning as the prediction for the next 3-month and 1-year period come to light.

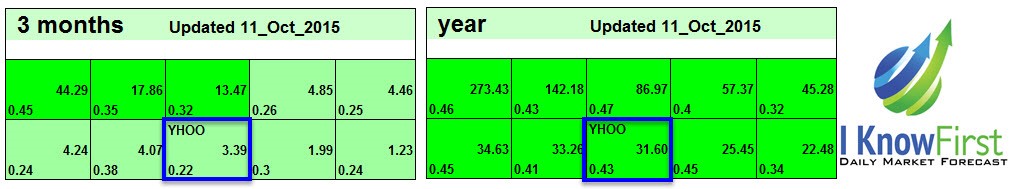

Figure 5: Algorithmic Stock Forecast For 3-Months and 1-Year Period From October 11th 2015

Figure 5: Algorithmic Stock Forecast For 3-Months and 1-Year Period From October 11th 2015

The above forecast is the most recent one from October 11st 2015 indicates that the algorithm believes that the stock price is in currently undervalued, which makes sense considering the company’s stakes in both Alibaba and the Asian economy. With the potential further return of value to shareholders through the spin-off of Alibaba, the introduction of two new online magazines, the use of advertising revolutionary programs and strong approach in their core business, Yahoo is a good stock to invest in at the current price.

The algorithmic analysis above is the most recent forecast from October 11st 2015 and are for the long-term periods of three months and one year. Yahoo Inc. is among the top stock picks for both time horizons. The forecasts are highly bullish, with strong signal strengths of 3.39 and 31.60 respectively with predictability ratings of 0.22 and 0.43. Over the predicted time horizons, the stock price will increase considerably. Yahoo is also working to integrate itself into the Artificial Intelligence in the near future by acquiring new technology based companies that have developed this successfully, which represents an important source of income for the coming years and to be one of the leading technological companies in the world.

Positive signal strength does not mean investors should automatically buy the stock. Dr. Roitman, who created the algorithm, created rules for entry for a stock such as Yahoo. Using this trading strategy, an investor should buy a stock if the last 5 signal strength’s average is positive and if the last closing price is above the 5-day moving average price. When both of these conditions are met, it is a good time to initiate a position in the stock.

Conclusion

As an innovator in the marketing and online service field, Yahoo makes profits from their core business of PC advertisement and search engine space. The current holding of Alibaba stock is hurting their present and potential revenues. Spinning-off Alibaba will alleviate the financial burden they represent after falling for 4Q’s in a row. Mayer’s new ideas to bring the company back up to their feet will be the remedy they need to recover from this bumpy ride.

Yahoo will thrive throughout the next 3-month to 1–year period and we will see it reflected on their new technological advances. For these reasons, the I Know First algorithm is highly bullish on this stock in the long term, with a bullish algorithmic forecast to support this fundamental analysis of Yahoo stock.