XLNX Stock Prediction: Neutral Times Ahead For Xilinx

This article was written by Julia Masch, a Financial Analyst at I Know First.

“Worldwide hyperscale data center markets implement cloud computing with shared resource and foolproof security systems that protect the integrity of corporate data. Cloud data centers are poised to achieve explosive growth as they replace enterprise web server farms with cloud computing and with cloud 2.0 automated process computing.”

-Nirav Gokani, Exclusive Reportage

Highlights

- Fiscal Year Financials

- Looking Ahead

- Current I Know First Forecast For XLNX

Over the past 6 months, Xilinx, Inc. (NASDAQ:XLNX) has increased in stock price, but only barely. Since closing on December 5 at $67.73, it has only risen to a closing price of $70.66 as of June 6, a modest gain of 4.32%.

So will the stock continue making measly gains? Or will it increase dramatically in the future?

Fiscal Year Financials

Xilinx (NASDAQ: XLNX) had a strong finish to its 2018 fiscal year. The company announced its Q4 earnings on April 23. Xilinx increased revenue 8% YoY to a record $2.54 billion, leading to GAAP earnings per share (EPS) of $1.99. Revenue was negatively affected by tax reform and executive transition costs, but excluding these costs, EPS would have been around $2.72 which would have been a 17% increase YoY. These costs also affected operating margin which was 29.3%. Xilinx ended the year with $3.4 billion in gross cash and $1.7 billion in net cash.

Quarterly Revenue and Earnings for XLNX (Source: Yahoo Finance)

For the March quarter, sales exceeded the top end of the previously estimated guidance range to and came in at a new record $673 million. This was an increase of 7% from the quarter before and 10% YoY. Operating expense was $286 million which included a one time expense of $33 million related to CEO transition. Net income was $166 million with EPS of $0.64. Q4 was a strong quarter and end to the fiscal year for Xilinx.

Looking Ahead: A New CEO and ACAP

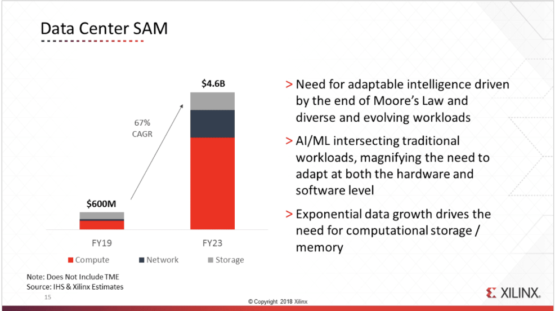

Xilinx plans to capitalize on the fact that silicon for AI will be a $15 billion market sometime within the next 5 years. Next quarter, XLNX expects returns of ~40% to reach quarterly sales between $660 million and $690 million. The company is investing heavily in R&D so that it can continue to innovate and produce top of the line products. The market for chips in the data center is also growing rapidly and will rise to $4.6 billion by 2023. Xilinx is a contributor in both of these markets and the growth will positively impact the company and currently the company expects revenue to accelerate to over 10%.

Additionally, the new CEO Victor Peng has a new vision for the company which focuses on utilizing Xilinx chips to propel artificial intelligence. Peng believes the data center market has the potential to produce $1 billion for the company by 2023. That being said, Xilinx’s competitors are also expecting the growth of the data center market and will also be trying to capitalize on it.

(Source: Xilinx investor Relations)

Peng wants to maximize Xilinx’s share of that market and thinks there are multiple ways to achieve this. The first path to success is focusing on plug-in circuit boards in combination with the chips themselves which will allow them to become a “platform” company. Other chip companies have already begun integrating platform use into their product and have a slight edge on Xilinx. Another viable option is focusing on a new line of chips that differs from traditional Xilinx chips known as “Adaption Computation Acceleration Platform” (ACAP). These chips have advanced features such as embedded memory circuitry which allows greater flexibility for customization and even features a digital-signal-processor. ACAP is fully software programmable and will allow is to be utilized in a variety of different situations. Unlike Nvidia, Xilinx does not only focus on computing, but also serves many markets such as networking and storage. Xilinx plans on delivering their first ACAP product later this year which will be the industry’s first 7-nanometer ACAP product. The roll-out of ACAP will allow Xilinx to capitalize on its platform, not just its chips. This being said, other companies are also working towards similar technology and will be competitive with Xilinx.

Additionally, Peng wants to emphasize R&D and wants to continue working on innovative new products. One of the forthcoming technologies he has mentioned being in the works is a new technology he calls “computational memory” which will change the process of fetching memory and will instead opt to move the memory “nearer” to the processor. These upcoming technologies provide a promising future for the company in the long run, but until the company begins rolling out these new products, it will not see major improvements in stock price.

Confidence in the Company

Xilinx is in the midst of a billion dollar buyback program for its stocks. Since 2010, the company has spent over $2 billion on repurchasing stocks. Currently, the company is in the midst of fulfilling a $1 billion buyback program. Since inception of this program, Xilinx has bought 12.9 million shares averaging $61.50 per share for a total of $793 million worth of shares. Over the past 10 years, the company has invested over $2 billion in itself by buying these stocks. The “repurchase authorization signals a high level of confidence in Xilinx’s growth prospects” and increases shareholder value.

Technical Analysis

The technical analysis for Xilinx is not ideal.

(Source: Yahoo Finance)

Over the past 6 months, the stock price has fluctuated with the 50 day (purple) and 200 day (orange) Simple moving Averages (SMA). Recently, the stock price overcame both of these averages, however, appears to have come together again in after hours trading on June 7. Therefore, it appears there is neither a bullish or bearish momentum for the stock. Additionally, recently, there was a “death cross” in which the 200 day SMA surpassed the 50 day SMA which is not ideal for a company. I expect Xilinx to stay in the general price range it has been in.

Analyst Recommendations

(Source: Yahoo Finance)

The current consensus for analysts is to hold the stock. 7 of the 25 analysts polled by Yahoo Finance are more optimistic about the stock, choosing either a “buy” or “strong buy.”

Current I Know First Forecast for Xilinx

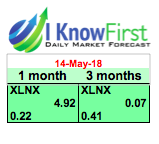

The Current I Know First forecast for Xilinx, is slightly bullish in the short term 1 month and 3 month time horizons, but not with a significantly strong signal. The respective signals of 4.92 and .07 do not indicate strong movement for the stock in the next few months. These signals also have relatively strong predictability signals of .22 and .41.

How to read the I Know First Forecast and Heatmap

Conclusion

While Xilinx does have promising products in its future, we are still waiting for release dates on its new platforms and chips such as ACAP. Additionally, with strong competitors with major market shares, Xilinx will need to begin gaining ground in order to become a better stock option. Additionally, the technical analysis for XLNX does not indicate a bullish momentum for the stock, leading me to agree with the current I Know First bullish forecast. Xilinx is not a strong buy over the next few months and it will likely stay in its current range, but if you already own the stock, it is logical to hold it.

Past I Know First Success With XLNX

In this bullish forecast sent to subscribers on July 9, 2017, the I Know First machine-learning algorithm gave Xilinx a signal of 3.27 with a predictability of .08 over the upcoming 3 days. In accordance with the algorithm, the stock gained 4.48% over this time period.

Subscribe to I Know First’s Daily Market Forecast

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.